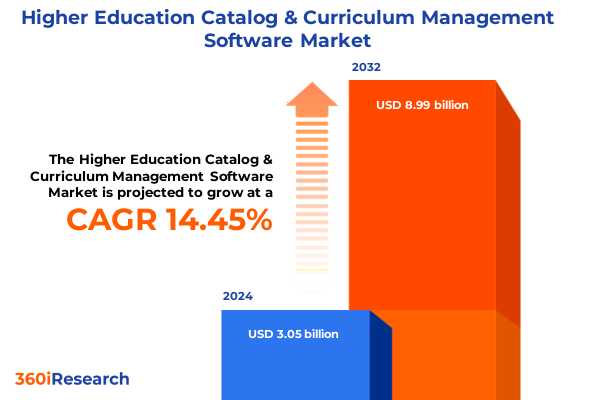

The Higher Education Catalog & Curriculum Management Software Market size was estimated at USD 3.48 billion in 2025 and expected to reach USD 3.98 billion in 2026, at a CAGR of 14.49% to reach USD 8.99 billion by 2032.

Shaping the Future of Academic Excellence Through Advanced Catalog and Curriculum Management Software Solutions That Empower Institutions in the Digital Age

In an era defined by rapid technological progress and evolving pedagogical models, higher education institutions face mounting pressure to modernize their administrative frameworks. Catalog and curriculum management software has emerged as a pivotal solution, enabling colleges and universities to streamline course offerings, ensure accreditation compliance, and facilitate seamless student experiences. The convergence of cloud computing, mobile learning, and data analytics has elevated expectations for intuitive, flexible platforms that integrate across institutional systems and adapt to shifting academic requirements.

Against this backdrop of accelerating digital transformation, the need for a unified approach to catalog and curriculum processes becomes ever more critical. Institutions must balance the imperative for robust governance of academic programs with the drive to innovate teaching modalities and support diverse learner pathways. Consequently, stakeholders ranging from administrators to faculty members are seeking centralized tools that not only reduce administrative overhead but also foster collaboration in designing, reviewing, and publishing curricula. As the backbone of strategic academic planning, an advanced management solution serves as the foundation for institutional agility and pedagogical excellence, setting the stage for sustained growth and competitive differentiation.

Navigating Transformative Technological and Pedagogical Shifts Redefining Higher Education Catalog and Curriculum Management in a Rapidly Evolving Landscape

The landscape of higher education catalog and curriculum management is undergoing substantive transformation driven by both technological breakthroughs and shifts in instructional paradigms. Cloud-native platforms are rapidly displacing legacy on-premises applications, enabling institutions to benefit from scalable infrastructure and continuous feature updates without the constraints of complex IT maintenance cycles. Meanwhile, the integration of artificial intelligence and machine learning capabilities is automating routine tasks-such as prerequisite validation, course alignment checks, and accreditation mapping-freeing up academic leaders to focus on strategic curriculum innovation.

Equally significant is the growing emphasis on competency-based education, micro-credentials, and cross-disciplinary degree pathways. These pedagogical shifts require dynamic frameworks that can support modular course design, real-time reporting on learning outcomes, and flexible program configurations. In response, software providers are embedding advanced analytics dashboards and customizable workflows into their offerings, empowering institutions to iterate rapidly on curriculum design and respond proactively to student performance metrics and employer feedback. These transformative shifts underscore the necessity of adopting platforms that not only manage existing catalogs but also anticipate future academic models.

Assessing the Far Reaching Cumulative Impact of United States Tariff Policies Enacted in 2025 on Technology Procurement and Institutional Budgets Across Campuses

United States tariff policies enacted in 2025 have introduced nuanced challenges for technology procurement across higher education campuses. While software itself often escapes direct duty assessments, the hardware components-servers, networking equipment, and data center infrastructure-are subject to import levies under Section 301 measures. As institutions consider on-premises deployments, the added cost of high-performance computing gear and data storage systems has prompted many to reassess capital expenditure strategies and shift toward subscription-based cloud services to mitigate tariff-driven price fluctuations.

Moreover, the broader trade tensions underscore the importance of vendor diversification and supply chain resilience within the academic technology ecosystem. Institutions are placing greater emphasis on strategic sourcing agreements and exploring domestic hardware options where feasible, even as they weigh the benefits of hybrid deployments that balance data sovereignty concerns with cost control. These cumulative impacts of 2025 tariff adjustments have, in turn, accelerated cloud transitions and reinforced the demand for modular software architectures that decouple mission-critical applications from localized infrastructure dependencies.

Uncovering Key Segmentation Dynamics Driving Adoption Patterns and Deployment Strategies Across Institutions of Varying Types Sizes and Functional Requirements

A nuanced understanding of market segmentation reveals how deployment modes, institution types, organizational sizes, licensing models, solution components, and user profiles collectively inform adoption patterns. Institutions evaluating cloud and on-premises options are making decisions based on workload criticality, data governance policies, and IT resource capacities. Public universities, private nonprofit colleges, and for-profit institutions each bring distinct priorities, such as compliance stringency for public entities or agility imperatives for smaller for-profit schools. Furthermore, organizational scale-whether large research universities, medium-sized regional institutions, or small community colleges-influences both the complexity of catalog structures and budgetary flexibility.

Licensing preferences also diverge, with some institutions opting for perpetual licenses to maintain long-term cost predictability while others embrace subscription models-on an annual or monthly cadence-to access continuous feature enhancements. Within the core software suite, modules ranging from accreditation and assessment management to course catalog and comprehensive curriculum design enable universities to tailor implementations to their priorities. From the administrator orchestrating approval workflows to faculty engaging in content curation and students navigating degree requirements, the software must support varied user journeys and institutional objectives.

This comprehensive research report categorizes the Higher Education Catalog & Curriculum Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Institution Type

- Organization Size

- Licensing Model

- Component

- Deployment Mode

- User Type

Highlighting Regional Market Trajectories and Strategic Adoption Trends Spanning the Americas Europe Middle East Africa and the High Growth Asia Pacific Corridor

Regional dynamics are playing an instrumental role in shaping the higher education catalog and curriculum management market. In the Americas, especially across North America, the convergence of federal funding incentives and state-level mandates for digital transformation has fueled rapid cloud adoption, while Latin American institutions are increasingly prioritizing modular platforms to extend degree offerings to remote student populations. Regulatory frameworks demanding comprehensive reporting on student outcomes and accreditation compliance further underscore the need for integrated management solutions.

Across Europe, the Middle East, and Africa, varying regulatory environments and language considerations necessitate highly configurable platforms capable of supporting multiple academic calendars, frameworks, and localization requirements. In the Middle East, substantial investments in higher education infrastructure are driving demand for next-generation systems, whereas EU member states emphasize data privacy and interoperability standards. Asia-Pacific institutions, spanning early adopters in Australia to emerging markets in Southeast Asia, are balancing rapid enrollment growth with stringent quality-assurance criteria, resulting in a surge of interest in analytics-driven curriculum planning tools that can scale across campuses and streamline accreditation processes.

This comprehensive research report examines key regions that drive the evolution of the Higher Education Catalog & Curriculum Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Solution Providers and Emerging Competitors Shaping the Competitive Landscape in Catalog and Curriculum Management Technology Within Higher Education

A competitive landscape analysis uncovers several leading vendors distinguished by their robust product portfolios, deep industry expertise, and expansive customer success frameworks. Established solution providers have invested heavily in research and development to enhance interoperability with enterprise resource planning systems, learning management platforms, and student information systems. These incumbents leverage decades of client case studies to demonstrate measurable improvements in academic governance, operational efficiency, and learner engagement.

Concurrently, nimble challengers are differentiating themselves through targeted innovation in artificial intelligence-powered recommendation engines, low-code workflow customization, and intuitive user interfaces that reduce onboarding times. Partnerships with third-party integrators and consortia initiatives further expand their market reach and enrich their feature sets. Emerging players are focusing on niche segments-from competency-based education accelerators to advanced analytics for program outcome prediction-thereby compelling established vendors to accelerate their own roadmaps and strategic alliances in response.

This comprehensive research report delivers an in-depth overview of the principal market players in the Higher Education Catalog & Curriculum Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akari Software, Inc.

- Anthology Inc.

- CollegeSource, Inc.

- Coursedog Inc.

- CourseLeaf, Inc.

- Decision Academic, Inc.

- EAB Global, Inc.

- Ellucian Inc.

- Entrada Inc.

- Jenzabar, Inc.

- Kuali Inc.

- Kuali Inc.

- Leepfrog Technologies, Inc.

- Oracle Corporation

- SAP SE

- SmartCatalog IQ

- Unit4 N.V.

- Watermark, Inc.

- Workday, Inc.

Actionable Strategic Recommendations for Institutional Decision Makers to Optimize Catalog and Curriculum Management Investments and Drive Sustainable Academic Innovations

Institutional leaders are encouraged to develop a comprehensive integration roadmap that aligns catalog and curriculum management investments with broader academic transformation initiatives. Starting with an in-depth requirements assessment that encompasses accreditation mandates, pedagogical objectives, and IT infrastructure constraints, decision-makers should engage stakeholders across departments to ensure cross-functional buy-in and minimize change resistance.

Subsequently, a phased implementation strategy-beginning with pilot deployments in key faculties-enables early validation of system performance, data integrity, and user satisfaction. Continuous training programs tailored to distinct user personas foster adoption and unlock advanced feature utilization, while regular feedback loops guide iterative refinements. Finally, institutions should explore strategic alliances with vendor partners to co-innovate on emerging use cases, such as AI-augmented curriculum design and real-time competency mapping, maximizing return on technology investments and positioning their academic offerings at the forefront of student-centric learning models.

Detailing Comprehensive Research Methodology Integrating Qualitative and Quantitative Insights to Ensure Robust Analysis and Reliable Findings in Higher Education Technology Markets

This research combines a robust mixed-methods approach to ensure comprehensive market coverage and data credibility. Primary research comprised structured interviews with senior higher education administrators, IT leads, faculty governance committees, and C-level executives from institutions across North America, EMEA, and APAC. These qualitative insights were supplemented by detailed surveys capturing functional requirements, project timelines, and vendor evaluation criteria from more than 200 respondents.

Secondary research entailed an exhaustive review of academic publications, government white papers, industry consortium reports, and vendor documentation to contextualize technology trends and regulatory drivers. Vendor benchmarking protocols were applied to evaluate solution features, integration capabilities, customer support frameworks, and pricing structures. Finally, data triangulation techniques validated findings by cross-referencing primary feedback, publicly available case studies, and domain expert panels, ensuring the report’s conclusions rest on rigorous, multi-source evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Higher Education Catalog & Curriculum Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Higher Education Catalog & Curriculum Management Software Market, by Institution Type

- Higher Education Catalog & Curriculum Management Software Market, by Organization Size

- Higher Education Catalog & Curriculum Management Software Market, by Licensing Model

- Higher Education Catalog & Curriculum Management Software Market, by Component

- Higher Education Catalog & Curriculum Management Software Market, by Deployment Mode

- Higher Education Catalog & Curriculum Management Software Market, by User Type

- Higher Education Catalog & Curriculum Management Software Market, by Region

- Higher Education Catalog & Curriculum Management Software Market, by Group

- Higher Education Catalog & Curriculum Management Software Market, by Country

- United States Higher Education Catalog & Curriculum Management Software Market

- China Higher Education Catalog & Curriculum Management Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Reflections on Market Evolution and Strategic Imperatives Highlighting the Critical Role of Effective Catalog and Curriculum Management in Institutional Success

As institutions navigate an increasingly complex academic environment, the strategic imperative for effective catalog and curriculum management cannot be overstated. Advanced software platforms are not merely administrative tools; they serve as enablers of educational innovation, facilitating the design of dynamic learning pathways, rigorous accreditation compliance, and data-informed decision making. By aligning technological capabilities with evolving pedagogical models and regulatory requirements, academic leaders can elevate institutional agility and reinforce their competitive positioning.

Looking ahead, the fusion of intelligent automation, adaptive learning frameworks, and interoperability standards will continue to redefine the value proposition of catalog and curriculum solutions. Institutions that proactively embrace these trends-grounded in a clear implementation strategy and supported by continuous stakeholder engagement-will be best positioned to deliver transformative educational experiences and drive sustainable growth in an increasingly digital academic landscape.

Take the Next Step to Elevate Institutional Capabilities by Securing Exclusive Insights Through a Personalized Consultation With Associate Director Sales and Marketing

To access the in-depth market research report that offers unparalleled insights into catalog and curriculum management trends, institutions are invited to arrange a personalized consultation with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). During this dedicated session, decision-makers will explore tailored solutions, clarify strategic objectives, and gain exclusive previews of data-driven recommendations designed to maximize operational efficiency and support sustainable academic innovation. Engage directly with our expert to secure full report access, leverage actionable intelligence, and position your institution at the forefront of digital transformation initiatives by following the link to schedule a meeting today

- How big is the Higher Education Catalog & Curriculum Management Software Market?

- What is the Higher Education Catalog & Curriculum Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?