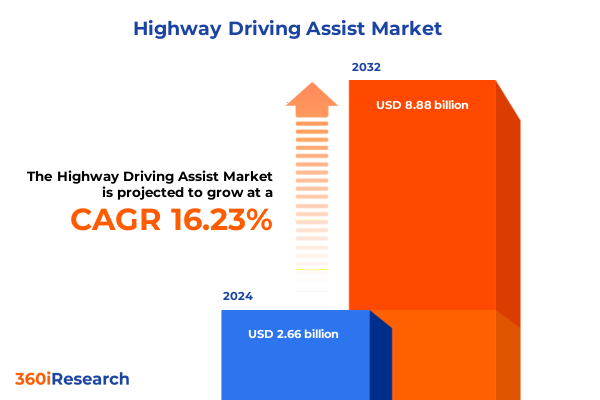

The Highway Driving Assist Market size was estimated at USD 3.07 billion in 2025 and expected to reach USD 3.54 billion in 2026, at a CAGR of 16.38% to reach USD 8.88 billion by 2032.

Unveiling the Core Principles Driving Highway Driving Assist Technology Advancements That Prioritize Safety, Reliability, and Seamless Integration

In an era defined by rapid technological progress and evolving mobility demands, highway driving assist systems have emerged as a cornerstone for the next generation of road safety and efficiency solutions. These advanced driver assistance technologies integrate seamlessly into modern vehicles, offering real-time data processing, proactive risk mitigation, and intuitive driver support. By harnessing the synergies of environmental sensing, automated controls, and intelligent algorithms, these systems are poised to redefine how drivers interact with high-speed road networks.

The introduction of highway driving assist reflects a strategic response to mounting pressures on transportation infrastructure, including rising traffic volumes and heightened regulatory expectations around crash avoidance. This suite of features encompasses adaptive speed management, lane centering interventions, and dynamic traffic flow adjustments, all orchestrated to mitigate human error and reduce roadway fatalities. Moreover, by embedding these capabilities into vehicles across diverse classes-from passenger cars to commercial fleets-industry stakeholders can unlock uniform safety benefits and operational efficiencies.

As stakeholders navigate the complexities of large-scale deployment, this report offers an authoritative foundation for understanding the core principles, technological enablers, and stakeholder considerations that underpin highway driving assist solutions. It establishes a comprehensive framework for examining the underlying components and performance metrics, setting the stage for deeper analysis of transformative industry trends and strategic imperatives.

Analyzing the dramatic shifts reshaping highway driving assist capabilities through innovations in sensors, connectivity, and artificial intelligence ecosystems fueling road safety evolution

The landscape of highway driving assist has evolved dramatically through a convergence of sensor innovation, advanced connectivity, and machine learning. In recent years, sensor modalities have diversified beyond traditional camera and radar configurations, incorporating infrared detection and high-resolution LiDAR point clouds. This expansion of the sensing toolkit has elevated object recognition accuracy and environmental adaptability, enabling systems to perform reliably under diverse weather and lighting conditions.

Furthermore, the proliferation of cellular vehicle-to-everything communication has served as a critical catalyst for real-time data exchange between vehicles and infrastructure. By leveraging edge computing and over-the-air software updates, automakers and suppliers can refine predictive models and deliver incremental feature enhancements without necessitating hardware retrofits. Consequently, manufacturers are positioned to offer continuous improvement cycles that deepen system intelligence and operational resilience.

Artificial intelligence frameworks have also matured, shifting from rule-based constructs toward deep learning engines capable of nuanced decision-making. These algorithms reconcile multi-sensor inputs and historical driving patterns to anticipate potential hazards and optimize driving trajectories. This evolution fosters more fluid human-machine collaboration, wherein drivers receive timely alerts and gentle corrective nudges that preserve autonomy while bolstering confidence and situational awareness.

Exploring the far-reaching effects of newly implemented United States tariff measures in 2025 on component sourcing, supply chain resilience, and cost dynamics for driving assist systems

In 2025, a new wave of United States tariff measures targeted critical components used in highway driving assist systems, including semiconductor chips, LiDAR modules, and advanced radar assemblies. These levies have imparted upward pressure on import costs, compelling original equipment manufacturers and tier one suppliers to reassess sourcing strategies. As a result, many stakeholders have pursued deeper engagements with domestic suppliers to fortify supply chain resilience and mitigate exposure to import-driven price volatility.

The ripple effects of these tariffs have spurred innovation across the value chain. Domestic foundries have scaled capacity to support sensor manufacturing, offering enhanced throughput and reduced lead times. At the same time, design teams have optimized hardware architecture, favoring modular platforms that accommodate alternative sensor configurations without extensive redesigns. This dual focus on supply diversification and platform agility has reinforced the sector’s capacity to weather ongoing trade uncertainties.

Moreover, the tariff environment has accelerated collaborative initiatives between automotive OEMs and technology providers. Joint ventures and cross-licensing agreements have proliferated, allowing partners to co-develop localized component fabrication and streamline certification pathways. These partnerships not only lower unit costs over time but also enable a more responsive ecosystem, wherein design improvements and regulatory adaptations can be implemented in concert, preserving competitive momentum despite external trade constraints.

Revealing critical segmentation insights based on sensor types, automation levels, vehicle categories, applications, and sales channels driving strategic decision-making

A detailed segmentation analysis illuminates how highway driving assist architectures diverge according to sensor type, automation level, vehicle category, application profile, and sales channel strategy. Sensor-based differentiation features camera systems-ranging from monocular lenses to stereoscopic and surround-view arrays-alongside infrared sensing, LiDAR scanning, radar modules classified into long, medium, and short-range segments, and ultrasonic proximity detection. Each sensor modality contributes distinct performance attributes, from high-definition vision to precise spatial mapping, shaping system capabilities and cost considerations.

Automation level further stratifies the ecosystem into conditional automation frameworks, high automation configurations spanning level 4 and level 5 autonomy, and partial automation solutions targeting level 1 and level 2 interventions. Conditional automation handles predefined tasks under limited scenarios, while high automation aspires to hands-off control in varied highway conditions. Partial automation, by contrast, delivers incremental driver assistance for speed regulation and lane positioning, laying groundwork for more advanced systems.

Vehicle classification plays a critical role as well, with heavy commercial vehicles demanding robust long-range sensing and predictive adaptive controls for freight logistics, light commercial vehicles seeking a balance between cost-effective hardware and medium-range detection, and passenger cars emphasizing ergonomic integration and surround awareness. Application differentiation spans adaptive cruise control in its basic, predictive, and stop-and-go iterations; automated parking for parallel and perpendicular scenarios; lane keeping assist features supporting both centering and departure warning; and traffic jam assist systems tailored to high-speed flow and low-speed congestion contexts. Sales channel considerations cut across aftermarket solutions serviced through independent workshops and online retailers and OEM offerings distributed via traditional dealerships and direct sales channels.

This comprehensive research report categorizes the Highway Driving Assist market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Level Of Automation

- Vehicle Type

- Application

- Sales Channel

Comparing how highway driving assist deployment and adoption trends vary across the Americas, Europe Middle East Africa, and Asia Pacific regions under diverse regulatory landscapes

Regional dynamics in highway driving assist reveal pronounced variations in adoption rates, regulatory frameworks, and infrastructure readiness. In the Americas, the United States leads with broad policy support, incentivizing advanced driver assistance features through safety mandates and fleet safety programs. Canada’s highway network has similarly embraced these systems within commercial transport corridors, while Latin American markets are in earlier stages of adoption, focusing on foundational sensor-based upgrades to existing vehicle fleets.

Turning to Europe, the Middle East, and Africa, European Union directives on lane departure warnings and speed assistance have catalyzed integration across passenger vehicle lines, with Germany and France spearheading collaborative testbeds for vehicle-to-infrastructure interoperability. The Middle East has pursued ambitious pilot zones equipped with smart highways that provide real-time traffic data and enhanced lane guidance, whereas Africa’s deployment remains concentrated in key urban centers, balancing cost constraints with safety imperatives.

Asia-Pacific presents a diverse tapestry of market maturity and strategic focus. Japan has prioritized lane centering and radar-based collision avoidance in luxury sedans, supported by strong domestic suppliers. China has witnessed rapid roll-out of predictive adaptive cruise control across domestic brands, tied to government-backed smart road initiatives. India and Southeast Asian nations are investing in foundational connectivity and phased hardware upgrades to extend basic automated parking and lane keeping features to commercial fleets and ride-sharing services.

This comprehensive research report examines key regions that drive the evolution of the Highway Driving Assist market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the competitive landscape by profiling key players, strategic collaborations, and technology leadership shaping the future of highway driving assist innovation

A review of prominent industry participants underscores a competitive landscape characterized by strategic alliances, technology specialization, and vertical integration. Legacy automotive suppliers have expanded R&D investment in sensor fusion platforms, driving enhancements in reliability and environmental robustness. At the same time, semiconductor and software specialists are establishing integrative partnerships, embedding deep learning kernels and high-performance compute architectures into next-generation control units.

In parallel, leading OEMs are leveraging in-house expertise to advance bespoke driving assist features tailored to premium segments, while forging alliances with mapping and connectivity providers to enrich situational awareness. Partnerships between Tier 1 suppliers and mobility startups are also emerging, combining agile software development practices with scale manufacturing capabilities to accelerate time to market. These collaborative models foster shared risk and pooled innovation, enabling participants to address regulatory compliance, data security, and user experience in concert.

Competitive differentiation increasingly hinges on end-to-end solution portfolios that encompass sensor hardware, perception algorithms, and system validation services. Companies investing in flexible software platforms and over-the-air update mechanisms gain a decisive edge, as they can respond rapidly to emerging challenges such as new traffic regulations, cross-border interoperability, and evolving cybersecurity threats. Ultimately, the convergence of hardware excellence and software agility will determine which players capture leadership in the highway driving assist arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Highway Driving Assist market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Aptiv PLC

- Autoliv Inc.

- AVL List GmbH

- Continental AG

- Denso Corporation

- Hella GmbH & Co. KGaA

- Hitachi Ltd.

- Honda Motor Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Intel Corporation

- Magna International Inc.

- Mobileye Global Inc.

- NVIDIA Corporation

- ON Semiconductor Corporation

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Tesla, Inc.

- Texas Instruments Incorporated

- Toyota Motor Corporation

- Valeo SA

- Veoneer, Inc.

- Visteon Corporation

- ZF Friedrichshafen AG

Delivering actionable recommendations to industry leaders focused on strategic partnerships, technology investments, and operational optimization in highway driving assist development

Industry leaders seeking to capitalize on highway driving assist opportunities should prioritize forging strategic alliances with specialized sensor manufacturers and software integrators. By aligning investments toward multi-sensor fusion and edge computing capabilities, organizations can build robust, scalable architectures that adapt rapidly to diverse driving scenarios. In doing so, they cultivate core competencies in both hardware development and machine learning model training, ensuring differentiated performance and reduced system lifecycle costs.

Investing in localized component fabrication and agile supply chain frameworks is equally critical. Companies can harness onshore foundry partnerships and modular platform design to mitigate tariff impacts and shorten lead times. This approach complements iterative product roadmaps, enabling incremental feature roll-outs and smoother regulatory certification across multiple jurisdictions.

Operational excellence initiatives should extend beyond production to encompass comprehensive validation regimes. Establishing dedicated test facilities that replicate varied climate and traffic conditions supports rigorous scenario-based evaluation. Coupled with robust quality management systems, these efforts reinforce safety credentials and build stakeholder confidence, fostering market acceptance and facilitating broader deployment.

Finally, leaders must engage proactively with policymakers and standards bodies to shape emerging regulatory frameworks. By contributing data-driven insights and participating in cross-industry consortia, organizations can influence safety guidelines, interoperability protocols, and data privacy measures. This collaborative posture helps secure favorable policy environments while reinforcing corporate reputation as a responsible innovation partner.

Outlining the comprehensive research methodology employed, incorporating primary interviews, secondary data analysis, and rigorous validation processes enhancing report credibility

This analysis rests on a dual-pronged research methodology combining primary stakeholder engagement with comprehensive secondary source synthesis. In the primary phase, the research team conducted in-depth interviews with senior automotive engineers, supplier executives, transportation policymakers, and technology entrepreneurs. These discussions provided firsthand perspectives on development timelines, integration challenges, and strategic priorities shaping highway driving assist programs worldwide.

Concurrently, the secondary research phase entailed a systematic review of industry publications, technical whitepapers, regulatory filings, and conference proceedings. Proprietary data repositories and peer-reviewed journals were scrutinized to extract performance metrics, failure mode analyses, and validation protocols. This rigorous data triangulation ensures that key findings reflect both theoretical constructs and real-world performance outcomes.

To bolster validity, the research incorporated cross-referencing with controlled pilot studies and public test track trials. Quantitative observations were aligned with qualitative insights to confirm consistency and identify emergent trends. The result is a robust analytical foundation that underpins the recommendations, segment analyses, and regional insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Highway Driving Assist market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Highway Driving Assist Market, by Sensor Type

- Highway Driving Assist Market, by Level Of Automation

- Highway Driving Assist Market, by Vehicle Type

- Highway Driving Assist Market, by Application

- Highway Driving Assist Market, by Sales Channel

- Highway Driving Assist Market, by Region

- Highway Driving Assist Market, by Group

- Highway Driving Assist Market, by Country

- United States Highway Driving Assist Market

- China Highway Driving Assist Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing the executive insights and drawing meaningful conclusions that highlight the evolving opportunities and challenges in the highway driving assist domain

The progressive maturation of highway driving assist technologies heralds a pivotal juncture in automotive evolution. Stakeholders who understand the interplay of advanced sensors, layered automation frameworks, and regional policy dynamics will be best positioned to drive strategic advantage. From the resilience cultivated through localized supply chains to the competitive edge derived from software-centric platforms, this domain offers a spectrum of opportunities for innovators and incumbents alike.

Nevertheless, realizing the full potential of these systems demands careful navigation of regulatory landscapes, rigorous validation processes, and sustained investment in interoperability. Challenges persist in harmonizing international standards, ensuring cybersecurity robustness, and delivering seamless driver experiences across diverse vehicle architectures. Yet, as collaborative ecosystems strengthen and artificial intelligence models grow more capable, the prospects for scalable, reliable highway driving assist deployments intensify.

In concluding this executive summary, it is clear that highway driving assist represents more than an incremental upgrade; it signals a transformative shift toward more autonomous, data-driven mobility. Organizations that integrate the insights contained herein into their strategic planning will be equipped to lead in shaping safer, more efficient roadways for the years to come.

Driving your strategic advantage with expert insights and personalized consultation to secure the definitive highway driving assist market research report today

Driving your strategic advantage begins with tailored insights that resonate with your specific operational context and growth objectives. By engaging directly with Ketan Rohom, you unlock personalized guidance on how best to harness the intelligence within this report to accelerate innovation, bolster competitive positioning, and drive sustainable performance. He will work closely with you to align the research findings with your strategic roadmap, refine project scope to meet your unique requirements, and provide hands-on support throughout your decision-making process.

Seize the opportunity to transform your approach to highway driving assist technologies. Take the first step toward securing the comprehensive analysis and expert recommendations that can inform your next phase of growth. Contact Ketan Rohom, Associate Director of Sales & Marketing, to purchase the definitive highway driving assist market research report and to start shaping a safer, more efficient future on the open road today

- How big is the Highway Driving Assist Market?

- What is the Highway Driving Assist Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?