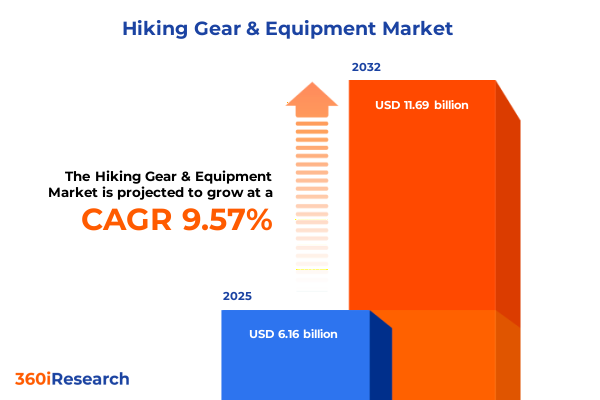

The Hiking Gear & Equipment Market size was estimated at USD 6.16 billion in 2025 and expected to reach USD 6.68 billion in 2026, at a CAGR of 9.57% to reach USD 11.69 billion by 2032.

Discover the New Frontier of Hiking Gear Where Evolving Consumer Demands and Cutting-Edge Innovations Are Redrawing the Map for Adventure Enthusiasts Everywhere

The hiking gear market sits at a pivotal crossroads, shaped by evolving consumer behaviors, technological breakthroughs, and shifting economic forces. Over the past few years, outdoor participation has reached record levels, with 175.8 million Americans engaging in hiking and related activities, underscoring the sector’s critical role in national recreation and commerce. In parallel, global manufacturers have leveraged advanced materials and design philosophies to deliver equipment that meets the demands of both novice adventurers and seasoned professionals.

Concurrently, the industry has seen unprecedented convergence between performance-driven innovation and consumer-centric experiences. Lightweight composite materials have redefined packability and durability, while digital integration through sensors and augmented reality navigation tools has elevated trail safety and personalization. Yet these advancements unfold against a backdrop of complex geopolitical dynamics and regulatory shifts, including recent U.S. tariffs on critical components and finished goods, which are reshaping supply chain strategies.

This executive summary provides a strategic lens on the competitive landscape, regulatory influences, and technological pivots reshaping hiking gear. It illuminates how brands can navigate tariff-induced cost pressures, harness emerging segmentation opportunities, and capitalize on regional market variations. By synthesizing transformative shifts and offering actionable recommendations, this analysis equips decision-makers with the foresight needed to thrive in a rapidly evolving marketplace.

Sustainability, Smart Technologies, and a Circular Economy Are Revolutionizing Hiking Gear Design Distribution and Consumer Engagement

The hiking gear industry is undergoing a fundamental metamorphosis driven by a triad of sustainability imperatives, digital advancements, and circular economy models. Leading brands have committed to reduce carbon footprints through material innovations: for instance, one leading manufacturer has integrated 30% recycled aluminum into its trekking poles, targeting annual carbon savings of 88 tons as part of a broader ambition to halve emissions by 2030. Simultaneously, heritage apparel brands are weaving natural fibers like hemp and Merino wool into performance clothing, exemplifying a rigorous approach to ethical sourcing and waste reduction.

Alongside these eco-driven breakthroughs, the integration of smart technologies is elevating every aspect of the hiker’s journey. Innovative navigation tools now employ augmented reality overlays to project trail data directly into the user’s field of view, transforming traditional compasses into real-time guideposts that enhance safety and trail confidence. Similarly, biometric sensors embedded within footwear and apparel are delivering actionable feedback on terrain adaptation, stride efficiency, and physiological metrics, fostering a deeper synergy between the user and their equipment.

Moreover, the rise of a circular economy ethos is redefining how consumers value and access gear. As tariffs and economic uncertainty tighten spending, re-commerce platforms and resale programs are experiencing surges in popularity, with resale revenues spiking by 70% in recent months as brands and retailers diversify their offerings. This transition underscores an industry-wide recognition that prolonging product life cycles and facilitating secondary markets is not only environmentally responsible but strategically essential in a period of extreme market volatility.

A Comprehensive Overview of How Recent U.S. Trade Tariffs Have Reshaped Supply Chains Pricing Strategies and Industry Viability in 2025

Over the course of 2025, U.S. tariffs have cumulatively exerted profound effects on outdoor equipment, compelling brands to reassess sourcing strategies and pricing frameworks. One major gear producer announced a uniform 10–25% price increase effective May 5, 2025, attributing the move to elevated duties-including a baseline 10% on all imports, 25% on steel and aluminum components, and up to 125% surcharges on select Chinese-made goods. This announcement echoes broader concerns within the Outdoor Industry Association, which cautions that the new trade measures will inflate production and retail costs, jeopardizing job growth and stifling innovation across the sector.

Faced with uneven tariff schedules and extended negotiation timelines, companies have scrambled to mitigate exposure. Some have accelerated bulk imports to build protective inventory buffers, only to find those stockpiles dwindling as uncertainty lingers beyond projected implementation dates. Others, particularly small and mid-sized ultralight brands, have adopted a lean, direct-to-consumer model to absorb incremental costs, although many concede that sustained tariff rates exceeding 10% to 70% would inevitably force consumer price adjustments or diminish margins.

These pressures have also catalyzed exploratory shifts in production geographies. Brands are weighing the potential advantages of diversifying assembly operations across Vietnam, Indonesia, and other lower-cost regions, while simultaneously investigating domestic manufacturing options to insulate critical product lines from future trade volatility. Yet, scaling localized factories to meet technical performance standards remains a formidable challenge, underscoring the need for adaptive strategies that balance cost efficiencies with uncompromising quality.

Unveiling Critical Market Segmentation Insights Across Product Categories Distribution Channels End User Profiles and Material Innovations in Hiking Gear

Insight into the hiking gear market’s segmentation landscape unveils nuanced opportunities and strategic inflection points. From a product type perspective, accessories-encompassing camp cookware, headlamps, navigation tools, trekking poles, and water bottles-are experiencing robust demand as consumers prioritize modular and multi-functional solutions. Apparel segments, ranging from gloves and hats to jackets, pants, and shirts, are witnessing rapid innovation cycles fueled by the integration of sustainable fibers and performance textiles. Meanwhile, backpacks across daypacks, hydration packs, multi-day packs, and overnight packs continue to evolve with ergonomic enhancements and advanced chassis systems. The footwear spectrum-including approach shoes, hiking boots, hiking sandals, and trail runners-reflects a growing appetite for lightweight composites, while sleep systems featuring pillows, sleeping bags, and sleeping pads are adapting to ultralight and temperature-regulating technologies. Tents, subdivided into backpacking, family, mountaineering, and ultralight categories, are likewise benefitting from materials science breakthroughs that deliver enhanced weather resistance without weight penalties.

Distribution channel analysis reveals a complex interplay between traditional and digital pathways. Direct sales via company outlets and trade shows afford brands bespoke consumer engagement and margin control, even as mass merchants-encompassing club stores, hypermarkets, and supermarkets-offer unparalleled reach for entry-level product lines. Online retailers, including brand websites, e-commerce platforms, and online marketplaces, are capitalizing on sophisticated digital marketing and streamlined fulfillment models, while specialty stores-both chain and independent-maintain relevance through curated assortments and expert-led customer service. Sporting goods chains at national and regional levels strike a balance between breadth and targeted promotional activities, underscoring the importance of hybrid omnichannel approaches.

End user differentiation further refines strategic priorities. Professional segments-including mountain guides and rescue teams-demand unwavering reliability, technical precision, and comprehensive warranty support. Conversely, recreational consumers, from casual hikers to dedicated enthusiasts, exhibit diverse price sensitivities and brand loyalty drivers, with many gravitating toward value-added ecosystem offerings. Tour operators, meanwhile, require scalable gear bundles and turnkey solutions that harmonize safety compliance with guest satisfaction.

Material type segmentation-spanning composite, natural, and synthetic categories-highlights an industry in material transition. While synthetic polymers remain the mainstay for performance-critical applications, natural fibers and biodegradable blends are gaining traction amid escalating environmental scrutiny. Composite configurations are unlocking new possibilities in strength-to-weight optimization, compelling brands to adopt a material-agnostic innovation ethos.

This comprehensive research report categorizes the Hiking Gear & Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Distribution Channel

- End User

Examining Regional Dynamics Influencing Hiking Gear Demand From the Americas Through Europe Middle East Africa to the Fast-Growing Asia-Pacific Markets

Regional market dynamics present a rich tapestry of growth drivers and operational challenges. In the Americas, the hiking gear sector continues to harness strong consumer participation and robust retail ecosystems, although recent tariff escalations have introduced cost headwinds that necessitate agile supply chain recalibrations. Brands operating across North and South America must navigate varying regulatory frameworks and leverage regional manufacturing hubs to optimize lead times and control import duties.

Turning to Europe, Middle East, and Africa, the market is characterized by premiumization and stringent environmental regulations. Luxury fashion’s embrace of gorpcore-where high-end labels infuse outdoor aesthetics with couture sensibilities-illustrates rising consumer willingness to invest in aspirational gear that merges style with functionality. Simultaneously, EMEA markets are witnessing accelerated adoption of sustainability standards, compelling brands to secure certifications such as bluesign® and adhere to PFC-free waterproofing mandates.

In the Asia-Pacific region, demand trajectories are among the fastest globally, driven by expanding middle-class discretionary incomes and a burgeoning outdoor tourism sector. E-commerce platforms in China, Japan, and Southeast Asia serve as critical growth vectors, while local manufacturing capabilities offer cost-effective production potentials. Yet, brands must remain vigilant of regional tariff differentials and logistical complexities, particularly when coordinating multi-country supply chains that span key manufacturing nodes.

This comprehensive research report examines key regions that drive the evolution of the Hiking Gear & Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Outdoor Brands and Emerging Innovators Driving the Competitive Landscape of Hiking Gear Through Strategic Initiatives and Partnerships

Leading industry participants are solidifying their competitive positions through differentiated product innovation and strategic partnerships. A prominent mountaineering equipment maker has publicly announced 10–25% price revisions in direct response to tariff surcharges, signaling a willingness to maintain margin integrity rather than compromise performance standards. Meanwhile, Patagonia’s emphasis on recycled fishing net fabrics for technical hiking pants exemplifies a benchmark for circular material utilization. The North Face continues to push smart integration boundaries with its Vectiv footwear series, embedding motion and terrain-sensing capabilities that deliver real-time analytics to the wearer.

Local pioneers and niche innovators alike are redefining market niches. One heritage clothing brand leverages eco-friendly insect-repellent technologies woven into adventure apparel, blending functional performance with environmental stewardship. In wearable technology, Garmin’s solar-powered adventure watch marries recycled ocean plastics with advanced energy-harvesting algorithms, reinforcing its reputation as a leader in device resilience and sustainability. Augmented reality navigation tools from specialized outdoors research firms are gaining traction among serious mountaineers seeking enhanced situational awareness, demonstrating how digital augmentation can elevate core product propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hiking Gear & Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- adidas AG

- Amer Sports Europe Oy

- Columbia Sportswear Company

- Deckers Outdoor Corporation

- Fjällräven Retail USA LLC

- Hyperlite Mountain Gear

- KEEN, Inc.

- L.L. Bean, Inc.

- La Sportiva N.A. Inc.

- Marmot Mountain LLC

- Mont-bell Co., Ltd.

- Patagonia, Inc.

- Puma SE

- VF Corporation

- Wolverine World Wide, Inc.

Strategic Imperatives for Industry Leaders to Navigate Tariff Pressures Embrace Sustainability Enhance Customer Experience and Optimize Supply Chain Resilience

In the face of mounting cost pressures and an increasingly discerning consumer base, industry leaders must adopt a multifaceted strategic playbook. First, brands should proactively establish flexible sourcing networks by diversifying manufacturing geographies and integrating domestic assembly where feasible. This approach mitigates exposure to unilateral tariff escalations and reinforces supply chain resilience.

Second, embedding sustainability as a central pillar of product and corporate strategy will drive competitive differentiation. Companies that accelerate investment in recycled and biodegradable materials, secure transparent ethical certifications, and champion circular economy models stand to attract an eco-conscious consumer cohort-particularly as resale and re-commerce channels solidify their mainstream appeal.

Third, elevating digital experiences through smart gear integration and data-driven service platforms can deepen end-user engagement. By harnessing augmented reality navigation, embedded biometric analytics, and AI-powered adventure assistants, brands can cultivate value-added ecosystems that command premium pricing and foster loyalty.

Finally, a refined go-to-market framework that oscillates seamlessly between direct sales, mass merchant partnerships, e-commerce, and specialist retailers will maximize market reach. Tailoring channel strategies to reflect regional regulatory landscapes and consumer purchasing behaviors ensures brands remain both accessible and aspirational.

Outline of Rigorous Research Methodology Integrating Primary Interviews Secondary Data Analysis and Quantitative Models to Ensure Report Credibility and Accuracy

This report’s findings are grounded in a robust research process that combined comprehensive secondary data analysis with targeted primary investigations. Initially, a thorough review of public policy announcements, trade association publications, and industry periodicals established the macroeconomic and regulatory context. This was complemented by quantitative modeling of segment performance metrics and cross-referencing of corporate financial disclosures to validate pricing and sourcing hypotheses.

Subsequently, in-depth interviews were conducted with senior executives, product development leads, and supply chain managers representing a cross-section of global hiking gear manufacturers, specialty retailers, and trade bodies. These dialogues provided nuanced insights into strategic responses to tariffs, material innovation roadmaps, and channel optimization tactics. Additionally, a consumer survey spanning over 1,200 outdoor enthusiasts in key markets informed behavioral and preference trends, ensuring the segmentation analysis resonates with real-world purchasing drivers.

To reinforce methodological rigor, all qualitative inputs were triangulated with supplier databases and third-party logistics datasets, offering visibility into inventory flows and production shifts. Quality control protocols, including source verification and data integrity checks, were applied throughout to uphold analytical precision and ensure the credibility of the report’s strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hiking Gear & Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hiking Gear & Equipment Market, by Product Type

- Hiking Gear & Equipment Market, by Material Type

- Hiking Gear & Equipment Market, by Distribution Channel

- Hiking Gear & Equipment Market, by End User

- Hiking Gear & Equipment Market, by Region

- Hiking Gear & Equipment Market, by Group

- Hiking Gear & Equipment Market, by Country

- United States Hiking Gear & Equipment Market

- China Hiking Gear & Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing the Key Takeaways From This Analysis and Highlighting the Critical Imperatives Shaping the Future of the Global Hiking Gear Market

The hiking gear sector’s trajectory is defined by an inflection point where disruptive technologies, sustainability imperatives, and geopolitical forces converge. As tariffs recalibrate cost structures, brands that excel in adaptive sourcing and transparent pricing will secure market resilience. Equally, those that champion eco-conscious product lifecycles and smart integration will capture the loyalty of a more informed and values-driven consumer base.

Segmentation insights underscore the importance of a diversified product portfolio, omnichannel distribution strategies, and a material-agnostic approach to innovation. Regional variations-from Americas cost headwinds to EMEA premiumization and Asia-Pacific growth pathways-demand tailored market entry and expansion tactics. Meanwhile, leading companies have demonstrated that strategic clarity, when paired with operational agility, is the key differentiator in a landscape marked by rapid change.

Ultimately, the future of hiking gear rests on the ability of industry participants to harmonize performance demands with evolving expectations around ethics and digital engagement. By embedding these principles into their core strategies, organizations can not only navigate current challenges but also pioneer the next era of outdoor exploration.

Take Immediate Action to Access Premier Hiking Gear Market Intelligence and Customized Strategic Guidance from Associate Director Ketan Rohom

Elevate your strategic decision-making by accessing the comprehensive market intelligence and in-depth analysis contained within this report. Whether you are seeking to refine your product development roadmaps, optimize supply chain resilience, or understand the nuanced interplay of regional dynamics and tariff impacts, this report offers actionable insights tailored to your needs. To secure a customized briefing and explore how these findings can drive your organization’s competitive edge, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, and take the first step toward harnessing the full potential of the hiking gear market.

- How big is the Hiking Gear & Equipment Market?

- What is the Hiking Gear & Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?