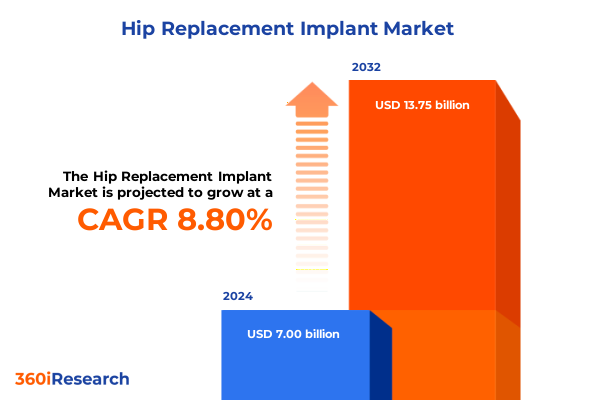

The Hip Replacement Implant Market size was estimated at USD 7.56 billion in 2025 and expected to reach USD 8.16 billion in 2026, at a CAGR of 8.92% to reach USD 13.75 billion by 2032.

Exploring the evolving dynamics driving innovation and patient-centric care in the hip replacement implant sphere to set the stage for strategic insights

The hip replacement implant arena is experiencing a profound metamorphosis driven by demographic trends, technological breakthroughs, and an intensified focus on patient outcomes. An aging global population, coupled with rising incidences of osteoarthritis and obesity, has elevated the demand for durable and minimally invasive joint replacement solutions. At the same time, healthcare providers and payers are under mounting pressure to balance cost containment with the need for high-quality care, prompting a shift toward outpatient settings and value-based reimbursement models. Consequently, the stage is set for implant manufacturers to innovate across product design, surgical techniques, and integrated digital platforms to meet both clinical and economic imperatives.

Amid these dynamics, key advancements in biomaterials-such as next-generation ceramics, highly cross-linked polyethylene, and porous metal surfaces-have extended implant longevity while reducing wear and complication rates. Simultaneously, the diffusion of robotic-assisted systems and computer navigated surgeries has enhanced implant positioning accuracy, translating into faster recoveries and lower revision rates. These converging factors underscore the importance of a holistic market assessment that captures evolving surgeon preferences, shifting reimbursement landscapes, and the competitive interplay between established industry titans and emergent disruptors.

This executive summary provides a structured overview of the latest trends, regulatory developments, and strategic considerations shaping the hip replacement implant market. By synthesizing insights across transformative shifts, tariff impacts, segmentation frameworks, regional dynamics, and leading corporate strategies, decision-makers will gain a cohesive understanding of current opportunities and potential challenges. Ultimately, this foundational perspective serves as a compass for executives seeking to align R&D priorities, optimize supply chains, and secure sustainable growth in a rapidly evolving therapeutic field.

Unveiling the pivotal technological and procedural breakthroughs reshaping surgical approaches and implant materials in hip replacement therapy delivery

Over the past several years, the hip replacement landscape has been fundamentally reshaped by technological breakthroughs and process innovations. Transitioning from traditional open procedures to minimally invasive approaches has reduced postoperative pain, shortened hospital stays, and enabled a growing number of outpatient procedures. Robotic-assisted platforms and augmented reality visualization tools have further refined surgical precision, enabling surgeons to customize implant alignment based on patient-specific anatomy and dynamic gait analysis. As a result, hospitals and ambulatory surgical centers are increasingly investing in these digital systems to differentiate their orthopedic service lines and enhance clinical outcomes.

Parallel to these procedural advances, material science is enjoying a renaissance driven by surface engineering and novel biomaterial pairings. The emergence of ceramic-on-ceramic bearings with optimized alumina and zirconia composites has demonstrated superior wear resistance, while hybrid metal-polyethylene combinations leverage the toughness of cobalt-chromium and titanium alloys to promote osseointegration. Surface coatings such as titanium plasma spray and hydroxyapatite have also improved biological fixation for cementless implants, thereby addressing concerns about long-term stability. Taken together, these developments are fostering a new generation of implant systems that balance durability with biological compatibility.

Furthermore, supply chain digitization and additive manufacturing are enabling rapid prototyping and shorter product development cycles. By incorporating 3D-printed trial implants and patient-matched instruments, manufacturers can reduce lead times and refine designs through iterative surgeon feedback. Consequently, industry participants that embrace open data standards and collaborative innovation ecosystems are poised to capture early-mover advantages, setting the trajectory for sustained growth and differentiation in the competitive hip arthroplasty market.

Analyzing how recent United States tariff adjustments in 2025 are influencing supply chains, cost structures, and competitive positioning within the hip replacement implant

In 2025, revisions to United States tariff schedules have introduced significant headwinds for hip implant manufacturers and their component suppliers. Adjustments to Section 301 duties on imported orthopedic materials, including high-grade stainless steel, cobalt-chromium alloys, and specialized ceramics, have led to an uptick in landed costs. This has prompted procurement teams to revisit supplier contracts, negotiate volume rebates, and explore alternative sourcing from tariff-exempt jurisdictions. Many companies have initiated dual-sourcing strategies to mitigate concentration risk, while some have accelerated reshoring initiatives to domestic production facilities despite the higher labor costs involved.

The ripple effects extend beyond raw materials to encompass packaging, instrumentation, and modular implant components. Logistics providers have faced increased customs clearance complexities, leading to delayed shipments and variability in lead-times. In response, several tier-one manufacturers have invested in advanced supply chain control towers that consolidate real-time visibility across ports, warehouses, and final-mile delivery. By leveraging predictive analytics, organizations can proactively adjust reorder points and buffer inventories, thereby reducing stock-out risks and maintaining surgical throughput.

Although some cost pressures are being passed through to payers and hospitals, market participants are concurrently emphasizing operational efficiencies to preserve profitability. Internal lean programs focused on value stream mapping, surgical tray rationalization, and process standardization have delivered modest cost savings. Overall, the 2025 tariff changes have underscored the importance of agility, cross-functional collaboration, and sophisticated procurement strategies in safeguarding margins and sustaining competitive positioning within the hip implant sector.

Highlighting the market segments defined by surgical techniques, fixation strategies, material combinations, procedure variations, and end-user environments

A comprehensive segmentation framework illuminates the diverse pathways through which patients access hip replacement implants and how manufacturers tailor offerings to distinct clinical needs. Based on surgical approach, the market is studied across minimally invasive techniques, which encompass anterior minimal and posterolateral minimal methods, and traditional procedures, which comprise anterior approach and posterior approach surgeries. In the realm of fixation, implants are categorized as cemented devices providing immediate stability, cementless systems that encourage bone ingrowth over time, and hybrid constructs combining both modalities to optimize early fixation and long-term integration. Material pairing further differentiates products into ceramic on ceramic configurations-such as alumina on alumina and zirconia on zirconia pairings-ceramic on polyethylene options including alumina on polyethylene and zirconia on polyethylene, metal on metal assemblies like cobalt chrome on cobalt chrome and titanium on titanium, and metal on polyethylene solutions featuring cobalt chrome on polyethylene and titanium on polyethylene.

Procedure type segmentation distinguishes between primary surgeries, which are bifurcated into bilateral and unilateral replacements, and revision interventions covering acetabular revision, dual revision, and femoral revision operations. Finally, end-user classification captures the settings in which hip arthroplasty is performed, spanning ambulatory surgical centers that prioritize streamlined pathways for lower-complexity cases and hospitals that deliver comprehensive perioperative capabilities for complex procedures. By understanding these overlapping dimensions, stakeholders can identify high-growth niches, tailor product development roadmaps, and align go-to-market strategies with evolving clinical preferences and reimbursement schemes.

This comprehensive research report categorizes the Hip Replacement Implant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Surgical Approach

- Fixation Method

- Material Pairing

- Procedure Type

- End User

Uncovering how geographical conditions across the Americas, Europe Middle East & Africa, and Asia-Pacific regions are shaping hip implant adoption and innovation

Geographic diversity plays a pivotal role in dictating the pace of adoption, regulatory requirements, and competitive dynamics within the hip implant market. In the Americas, the United States leads with a mature value-based care infrastructure and a well-established outpatient surgery ecosystem, while Canada and Latin America display varied reimbursement frameworks that influence hospital purchasing cycles and surgeon training programs. The emphasis on bundled payment models and patient satisfaction metrics in the U.S. drives manufacturers to demonstrate long-term safety and cost-effectiveness of advanced implant technologies.

Across Europe, Middle East & Africa, heterogeneous healthcare systems present both challenges and opportunities. Western Europe relies on rigorous clinical guidelines and health technology assessments, necessitating robust real-world evidence for market entry. In contrast, several Middle Eastern nations are investing heavily in medical tourism and orthopedic center of excellence development, offering entry points for premium implant solutions. Africa, though still nascent in joint replacement adoption, is experiencing pilot programs and capacity-building initiatives aimed at addressing an emerging burden of musculoskeletal disorders.

In the Asia-Pacific region, rapid urbanization, improving insurance penetration, and a growing geriatric population underpin a surge in hip arthroplasty volumes. Countries such as Japan, South Korea, and Australia exhibit sophisticated reimbursement pathways and high procedure volumes, whereas emerging markets in Southeast Asia and India focus on building surgical capabilities and local manufacturing partnerships. Consequently, localized product customization, tiered pricing strategies, and collaborative training programs are essential for capturing market share in this diverse region.

This comprehensive research report examines key regions that drive the evolution of the Hip Replacement Implant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading implant manufacturers’ strategic alliances, R&D endeavors, and competitive differentiators that are driving growth in hip replacement

Leading manufacturers are deploying multifaceted strategies to sustain differentiation and capture incremental value in the hip replacement arena. Zimmer Biomet has bolstered its portfolio through targeted acquisitions of robotics specialists and surface coating innovators, integrating these capabilities to offer surgeon-centric platforms that combine implant design with digital planning tools. Stryker continues to focus on modularity and patient-matched technologies, leveraging 3D-printed titanium trial components and proprietary navigation software to enhance intraoperative decision-making. DePuy Synthes maintains a robust R&D pipeline, investing in next-generation bearing surfaces and smart implant sensor technologies that monitor load distribution and early signs of wear.

Smith & Nephew, in parallel, has emphasized clinical evidence generation and key account partnerships with leading orthopedic centers, establishing center-of-excellence affiliations that accelerate surgeon adoption and collect real-world outcome data. Meanwhile, specialized challengers such as the Corin Group and DJO have capitalized on nimble innovation cycles, introducing hybrid fixation systems and biologically active coatings designed to reduce aseptic loosening. Collectively, these companies are forging alliances with software providers, robotic equipment manufacturers, and academic institutions to create integrated ecosystems that extend beyond standalone implant sales, fostering recurring revenue streams through service agreements and digital subscription models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hip Replacement Implant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AK Medical Holdings Limited

- Arthrex, Inc.

- B. Braun Melsungen AG

- ConMed Corporation

- Corin Group Ltd

- DJO Global, Inc.

- Exactech, Inc.

- Globus Medical, Inc.

- Johnson & Johnson

- Kyocera Corporation

- LimaCorporate S.p.A.

- Mathys Ltd Bettlach

- Medacta International S.A.

- MicroPort Scientific Corporation

- Smith & Nephew plc

- Stryker Corporation

- Waldemar Link GmbH & Co. KG

- Zimmer Biomet Holdings, Inc.

Delivering pragmatic strategic directives and initiatives for industry executives to optimize innovation and elevate patient outcomes in hip arthroplasty

Industry leaders should prioritize the development of collaborative innovation networks that bridge product design, digital surgery solutions, and postoperative care pathways. By forging partnerships with robotics and imaging firms, implant providers can deliver end-to-end platforms that facilitate precision surgery and longitudinal patient monitoring. Concurrently, procurement and supply chain teams must implement agile sourcing strategies, blending domestic capacity with low-tariff imports to shield margins from geopolitical fluctuations.

In parallel, organizations should intensify investment in biomaterial research targeting next-generation bearing couples and bioactive surface treatments to extend implant lifespan and reduce revision rates. By leveraging digital twin simulations and computational biomechanics, R&D teams can accelerate preclinical testing and refine implant geometries for personalized anatomy. Equally important is the cultivation of value-based contracting expertise, enabling sales and marketing functions to articulate clear health economic benefits to payers and hospital administrators.

Finally, a relentless focus on surgeon education and training through modular curricula, simulated labs, and proctoring programs will be essential to drive uptake of advanced procedural approaches. By combining clinical evidence publication with outcome registries, companies can build trust, demonstrate real-world efficacy, and pursue market access pathways that align with evolving reimbursement models. These integrated recommendations will help secure long-term growth and reinforce leadership positions within the dynamic hip arthroplasty market.

Detailing the rigorous mixed-method research framework integrating primary interviews, secondary data validation, and expert panel consultations

This analysis is grounded in a mixed-method research framework that combines in-depth primary interviews, extensive secondary data validation, and expert panel consultations. Over 40 orthopedic surgeons, hospital administrators, and procurement specialists across key regions were interviewed to capture first-hand insights into clinical preferences, purchasing drivers, and procedural challenges. These qualitative findings were triangulated with regulatory filings, peer-reviewed publications, and publicly available corporate disclosures to ensure the integrity and relevance of the data.

Secondary research encompassed analysis of implant registries, patent landscapes, and clinical trial outcomes to map technology trajectories and benchmark competitor performance. A dedicated team of market analysts validated these sources, applying cross-verification techniques to mitigate bias and confirm emerging trends. In addition, a convened panel of thought leaders and industry veterans reviewed preliminary findings, offering critical feedback and refining strategic interpretations. This iterative approach to expert validation has produced robust conclusions and actionable insights that are both grounded in empirical evidence and informed by real-world practice.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hip Replacement Implant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hip Replacement Implant Market, by Surgical Approach

- Hip Replacement Implant Market, by Fixation Method

- Hip Replacement Implant Market, by Material Pairing

- Hip Replacement Implant Market, by Procedure Type

- Hip Replacement Implant Market, by End User

- Hip Replacement Implant Market, by Region

- Hip Replacement Implant Market, by Group

- Hip Replacement Implant Market, by Country

- United States Hip Replacement Implant Market

- China Hip Replacement Implant Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing key takeaways and strategic imperatives that underscore the future trajectory and enduring opportunities within the hip replacement implant domain

In summary, the hip replacement implant market is at an inflection point defined by demographic imperatives, regulatory shifts, and technological innovation. The push toward minimally invasive procedures, digital surgery integration, and advanced biomaterials has elevated clinical standards while reshaping supply chain and cost structures. Concurrently, tariff adjustments in 2025 have underscored the need for agile procurement strategies and supply chain diversification to maintain competitive margins.

Segmentation analysis reveals a multifaceted landscape spanning surgical approach, fixation method, material pairing, procedural type, and end-user setting, each representing a unique nexus of growth and specialization. Regional insights further illustrate how the Americas, Europe Middle East & Africa, and Asia-Pacific regions present distinct regulatory, reimbursement, and infrastructure environments that require tailored market entry and commercialization strategies. Meanwhile, leading companies are forging synergistic alliances, prioritizing R&D in bearing surfaces and digital platforms, and leveraging evidence-based value propositions to secure preferential hospital formulary placement.

As the industry evolves, sustained success will hinge on the ability to integrate cross-functional expertise, harness data-driven decision-making, and cultivate robust surgeon partnerships. By synthesizing these key takeaways and strategic imperatives, stakeholders can chart a clear path forward and capitalize on enduring opportunities within the dynamic hip replacement domain.

Engage with Ketan Rohom to unlock comprehensive market intelligence and strategic guidance tailored to drive sales growth in hip replacement implants

To secure unparalleled insights and a competitive edge in the hip replacement implant sector, reach out today to Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly, you will gain access to a comprehensive market research report that translates complex data into clear strategic recommendations tailored to your organization’s goals. Ketan’s expertise in articulating technical findings into actionable business intelligence ensures you receive personalized guidance on product positioning, pricing strategies, and channel optimization. This collaboration will empower your team to anticipate industry shifts, refine your value proposition, and accelerate growth in a rapidly evolving marketplace. Contact Ketan Rohom to request a sample, discuss customizable research add-ons, or schedule a consultation that will transform insights into impact and drive your hip replacement implant initiatives forward with confidence.

- How big is the Hip Replacement Implant Market?

- What is the Hip Replacement Implant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?