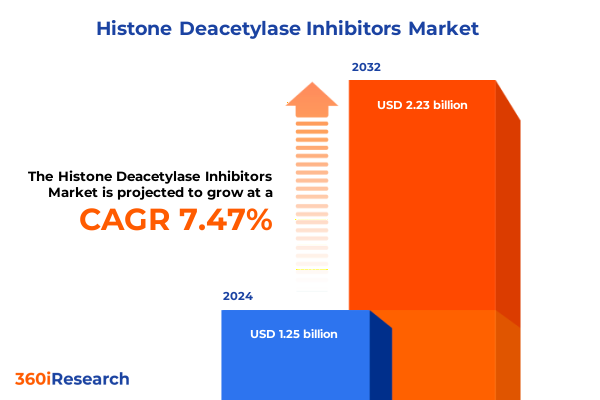

The Histone Deacetylase Inhibitors Market size was estimated at USD 1.34 billion in 2025 and expected to reach USD 1.44 billion in 2026, at a CAGR of 7.53% to reach USD 2.23 billion by 2032.

Emerging Dynamics and Unmet Needs in the Global Histone Deacetylase Inhibitor Ecosystem Offering New Opportunities for Therapeutic Advances

The landscape of histone deacetylase inhibitors has evolved into a cornerstone of epigenetic therapy, offering new modalities for treating oncology, inflammatory disorders, and a spectrum of non-oncological conditions. This class of compounds, by modifying chromatin architecture and gene expression, has demonstrated significant potential in addressing diseases that have long eluded conventional treatments. Stakeholders across the pharmaceutical and biotechnology sectors are increasingly focused on understanding the nuanced mechanisms of action, optimizing clinical protocols, and identifying strategic investment opportunities within this ever-expanding ecosystem.

Against this backdrop, the need for a succinct yet comprehensive executive summary becomes critical. Decision-makers must navigate a complex interplay of scientific innovation, regulatory shifts, and economic variables to position their organizations for sustainable growth. This introduction outlines the purpose of this executive summary: to provide a clear overview of current trends, transformative shifts, policy impacts, segmentation insights, regional dynamics, company strategies, actionable recommendations, and the methodological rigor underpinning the analysis. Collectively, these elements form the foundation for informed decisions that advance the development and commercialization of histone deacetylase inhibitors.

Rapid Technological Progress and Clinical Breakthroughs Redefining the Future Landscape of Histone Deacetylase Inhibitor Research and Application Worldwide

In recent years, advances in medicinal chemistry and structural biology have driven the design of more potent and selective histone deacetylase inhibitors. Breakthroughs in cryo-electron microscopy and high-resolution crystallography have unveiled distinct isoform structures, enabling researchers to craft molecules that engage specific active sites with unprecedented precision. This technological progress is reshaping early discovery efforts, as scientists now harness computational modeling and machine learning algorithms to predict binding affinities and optimize lead compounds before entering traditional wet-lab cycles.

Concurrently, the clinical frontier has witnessed a series of milestone studies demonstrating improved safety and efficacy profiles. Isoform-selective inhibitors targeting Class I and Class II HDACs have shown promise in reducing off-target toxicities, thereby extending therapeutic windows. At the same time, next-generation pan-HDAC inhibitors are achieving broader epigenetic modulation that may be beneficial in refractory hematological malignancies. These clinical breakthroughs, underpinned by adaptive trial designs and biomarker-driven patient selection, underscore the shift toward precision epigenetic therapeutics.

Moreover, regulatory agencies have introduced new frameworks to accelerate the development of epigenetic therapies, reflecting a broader commitment to fostering innovation. Initiatives such as priority review vouchers and accelerated approval pathways are incentivizing early-stage projects, expediting the transition from bench to bedside. These supportive policies, combined with expanding public–private partnerships, are fueling a dynamic environment in which both established pharmaceutical leaders and emerging biotech innovators can collaborate to explore uncharted therapeutic indications and expand the clinical utility of HDAC inhibitors.

Evaluating the Far-Reaching Consequences of Recent United States Tariff Implementations on Histone Deacetylase Inhibitor Supply Chains and Investment Flows

In 2025, a series of updated tariffs implemented by the United States government introduced additional duties on key raw materials, active pharmaceutical ingredients, and specialized laboratory reagents used in histone deacetylase inhibitor research and manufacturing. These measures have had a cascading effect on global supply chains, prompting manufacturers to reassess their sourcing strategies and logistics infrastructures. Costs have increased for high-purity chemicals sourced from overseas suppliers, leading to longer lead times and elevated operational budgets, which in turn have strained R&D pipelines focused on early discovery and preclinical stages.

The tariff-induced cost pressures have compelled organizations to diversify their supplier bases, exploring domestic production options and nearshoring alternatives to mitigate exposure to sudden policy shifts. While these adjustments enhance supply chain resilience, they also necessitate significant capital investments in local manufacturing capabilities and quality controls. Startups and smaller biotech players, in particular, face the challenge of balancing the affordability of reagents with the rigorous standards required for GMP-compliant operations, potentially slowing down critical timelines for investigational new drug filings and clinical trial commencements.

Beyond procurement, the tariffs have influenced investor sentiment and funding landscapes. Venture capital firms and strategic investors are increasingly scrutinizing the geographic distribution of manufacturing assets and the potential volatility of cost structures in HDAC inhibitor programs. Consequently, capital allocation is shifting toward projects that demonstrate robust mitigation strategies, such as multi-sourcing agreements, advanced inventory management systems, and partnerships with contract development and manufacturing organizations located within tariff-free zones. This strategic realignment underscores the broader impact of trade policy on the financial viability of epigenetic therapy development.

In-depth Exploration of Mechanism Variations Clinical Stages Administration Routes Distribution Channels and Indications Shaping Strategic Segmentation Insights

A nuanced segmentation of the histone deacetylase inhibitor market reveals fundamental distinctions based on mechanism of action and isoform selectivity. The dichotomy between isoform-selective and pan-HDAC inhibitors informs therapeutic specificity and safety profiles. Within the isoform-selective category, detailed analysis across Class I, Class II, Class III and Class IV inhibitors highlights unique biological roles and clinical prospects. Class I inhibitors such as HDAC1, HDAC2, HDAC3 and HDAC8 modulators are being optimized for hematological malignancies, whereas Class II compounds targeting HDAC4, HDAC5, HDAC6 and HDAC7 offer promise in inflammatory and neurological disorders. Meanwhile, Class III sirtuin inhibitors and Class IV HDAC11 compounds are emerging as innovative modalities with potential applications in metabolic and viral infection contexts.

Another critical axis of differentiation lies in clinical development stage. Phase I programs are predominantly focused on first-in-human safety assessments and dose-finding studies, often led by small biotech firms. In Phase II and Phase III trials, the emphasis shifts to comparative efficacy and combination regimens, with larger pharmaceutical organizations leveraging their oncology and immunology portfolios to validate therapeutic benefits. Preclinical and discovery efforts remain a vibrant source of novel scaffolds and epigenetic targeting strategies, where advanced screening platforms and in vitro disease models accelerate the identification of next-generation candidates.

Route of administration and distribution channel segmentation also shape market dynamics and patient access. Intravenous formulations dominate early clinical assessments due to stringent control over dosing and bioavailability, while oral and subcutaneous options are gaining traction for their convenience and potential for outpatient use. Topical delivery systems are under investigation for cutaneous T-cell lymphoma and dermatological conditions. Distribution channels ranging from hospital and specialty pharmacies to online and retail networks determine the breadth of access and influence reimbursement pathways, especially in regions where patient-centric models and home care services are being prioritized.

Clinical indication segmentation underscores the dual oncology and non-oncology drivers within this sector. Hematological malignancies, including cutaneous T-cell lymphoma, multiple myeloma, and peripheral T-cell lymphoma, are the primary commercial focus for pan-HDAC inhibitors. Solid tumors such as breast, lung, and prostate cancers represent expanding frontiers for selective epigenetic modulation. In the non-oncology domain, fibrosis, autoimmune disorders, neurological conditions, and emerging antiviral applications highlight the transformative potential of HDAC targeting beyond cancer therapy.

This comprehensive research report categorizes the Histone Deacetylase Inhibitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route of Administration

- Distribution Channel

- Therapeutic Indication

- End User

Comparative Regional Dynamics and Emerging Growth Patterns across the Americas Europe Middle East and Africa and Asia Pacific for HDAC Inhibitor Adoption

The Americas continue to lead in histone deacetylase inhibitor innovation, driven by robust research infrastructure and significant venture capital investment. The United States hosts the majority of active clinical trials, with academic and community cancer centers advancing both mono-therapies and combination regimens. Canada’s supportive regulatory environment and growing biotech hubs are attracting partnerships that bolster local development pipelines. This region’s strong intellectual property protections and streamlined approval processes reinforce its central role in shaping global HDAC inhibitor strategies.

Europe, the Middle East and Africa present a heterogeneous landscape characterized by regulatory diversity and emerging market opportunities. In Western Europe, established pharmaceutical clusters in Germany, the United Kingdom and Switzerland are spearheading late-stage clinical trials and collaborative consortia. Meanwhile, the Middle East is witnessing nascent initiatives to develop regional centers of excellence, often in collaboration with European academic institutions. Africa, though still in the earliest phases of development, shows promise through pilot programs focused on capacity building in pharmacovigilance and clinical trial infrastructure, setting the stage for future growth in epigenetic therapy access.

Asia-Pacific is experiencing accelerated momentum, with China and Japan prioritizing domestic HDAC inhibitor research as part of national innovation agendas. Japanese regulatory reforms are expediting pathways for regenerative and epigenetic medicines, and an expanding patient base supports both oral and injectable formulations. India’s increasing manufacturing capabilities in active pharmaceutical ingredients underline its potential as a cost-competitive supplier, even as local biotech startups explore unique epigenetic targets. Australia and South Korea are developing specialized research consortia, signaling a maturing ecosystem for clinical and translational epigenetics across the Asia-Pacific region.

This comprehensive research report examines key regions that drive the evolution of the Histone Deacetylase Inhibitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Partnership Landscapes Highlighting Major Innovations and Collaborative Trends Shaping the HDAC Inhibitor Sector

Leading pharmaceutical organizations and agile biotech firms are forging distinctive paths within the histone deacetylase inhibitor sector. Major legacy players leverage extensive oncology franchises to integrate HDAC inhibitors into combination regimens, utilizing global trial networks and established commercial infrastructures. In contrast, innovative biotech companies focus on first-in-class isoform-selective candidates, often emphasizing niche indications such as cutaneous T-cell lymphoma or fibrotic diseases to rapidly demonstrate clinical proof of concept.

Collaborative partnerships and licensing agreements are shaping the competitive landscape. Strategic alliances between small research-driven ventures and international contract development and manufacturing organizations enable scalable production and distribution. Partnerships with diagnostic companies are also becoming more prevalent, as companion biomarker assays enhance patient stratification and optimize therapeutic outcomes. This trend highlights the importance of integrating precision medicine tools early in the development lifecycle, thus reinforcing the value proposition of epigenetic therapies.

Beyond R&D, companies are exploring diversified business models, including shared-risk collaboration platforms and outcome-based contracting. Technology-driven service providers offering advanced screening, data analytics, and AI-enabled compound optimization are gaining prominence. These specialized partners augment internal capabilities of both established pharmaceutical houses and emerging biotech entities, promoting a fluid ecosystem in which core competencies are leveraged through cross-sector collaboration to drive the next wave of HDAC inhibitor innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Histone Deacetylase Inhibitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca plc

- Bayer AG

- Bio-Techne Corporation

- Biocon Limited

- Blueprint Medicines Corporation

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb Company

- Cadila Healthcare Limited

- Celltrion, Inc.

- Curis Inc.

- Dr. Reddy's Laboratories Limited

- Eisai Co. Ltd.

- Eli Lilly and Company

- Exelixis, Inc.

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Huya Bioscience International LLC

- Italfarmaco S.p.A.

- Karyopharm Therapeutics Inc.

- Karyopharm Therapeutics Inc.

- Medivir AB

- MEI Pharma Inc.

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Sandoz International GmbH

- Shenzhen Chipscreen Biosciences Co., Ltd.

- Shuttle Pharma

- STADA Arzneimittel AG

- Sun Pharmaceutical Industries Limited

- Syndax Pharmaceuticals Inc.

- Teva Pharmaceutical Industries Limited

- Thermo Fisher Scientific, Inc.

- Tokyo Chemical Industry Pvt. Ltd.

- Xynomic Pharmaceuticals

Actionable Strategic Roadmap Recommendations for Industry Stakeholders to Drive Sustainable Growth and Innovation in the Evolving HDAC Inhibitor Landscape

Industry leaders should proactively diversify their supply chains by integrating multi-sourcing strategies and establishing partnerships with manufacturers located in tariff-exempt jurisdictions. Implementing comprehensive supplier auditing and advanced inventory management systems will not only mitigate the risk of sudden policy changes but also ensure continuity in critical reagent availability and production timelines.

Further, directing R&D investments toward isoform-selective histone deacetylase inhibitors can yield differentiated therapeutic profiles and enhanced safety margins. By prioritizing molecular targets with clear mechanistic rationale and leveraging adaptive trial designs, organizations can accelerate proof-of-concept milestones and attract strategic investors interested in precision epigenetic solutions.

Finally, fostering strategic alliances across the value chain-from diagnostic developers to contract research organizations-will enhance the robustness of development programs and facilitate market access. Collaborative frameworks that align incentives around patient outcomes, combined with integrated biomarker strategies, will optimize clinical trial efficiency and strengthen reimbursement dialogues, ultimately driving sustainable growth in the HDAC inhibitor landscape.

Comprehensive Methodological Framework Detailing Data Collection Analysis Techniques and Validation Processes Underpinning the Rigorous HDAC Inhibitor Research

The research methodology underpinning this analysis integrates both qualitative and quantitative approaches to ensure a comprehensive understanding of the histone deacetylase inhibitor domain. Primary research consisted of in-depth interviews with scientific thought leaders, clinical investigators, regulatory experts, and commercial strategists, capturing firsthand insights into therapeutic pipelines, trial design considerations, adherence to safety standards, and market entry challenges.

Secondary research included rigorous examination of peer-reviewed journals, patent filings, clinical trial registries, regulatory guidance documents, and financial disclosures. This extensive review allowed for cross-validation of technical data, identification of emerging trends in mechanism-of-action studies, and mapping of competitive landscapes. Key data points were triangulated across multiple sources to mitigate bias and confirm the reliability of strategic inferences.

Data analysis employed advanced statistical techniques and thematic content analysis, leveraging specialized databases for clinical trial outcomes and epigenetic marker expression patterns. Validity checks, including peer reviews of draft findings and iterative feedback loops with domain experts, ensured the accuracy and credibility of conclusions. This robust methodological framework guarantees that the insights presented are grounded in empirical evidence and reflect best practices for market research in the biotechnology sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Histone Deacetylase Inhibitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Histone Deacetylase Inhibitors Market, by Drug Class

- Histone Deacetylase Inhibitors Market, by Route of Administration

- Histone Deacetylase Inhibitors Market, by Distribution Channel

- Histone Deacetylase Inhibitors Market, by Therapeutic Indication

- Histone Deacetylase Inhibitors Market, by End User

- Histone Deacetylase Inhibitors Market, by Region

- Histone Deacetylase Inhibitors Market, by Group

- Histone Deacetylase Inhibitors Market, by Country

- United States Histone Deacetylase Inhibitors Market

- China Histone Deacetylase Inhibitors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Perspectives on the Strategic Imperatives and Future Directions Driving Progress in Histone Deacetylase Inhibitor Development and Commercialization

The convergence of technological innovation, regulatory facilitation, and strategic collaboration continues to redefine the histone deacetylase inhibitor landscape. As isoform-selective and pan-HDAC compounds advance through clinical stages, organizations equipped with diversified supply chain strategies and targeted R&D portfolios will be best positioned to capture emerging opportunities. The evolving tariff environment underscores the necessity for resilient operational models that safeguard against policy-induced disruptions.

In conclusion, stakeholders across established pharmaceutical enterprises, nimble biotech ventures, and contract service providers must align around a shared vision of precision epigenetic therapy. By leveraging robust segmentation analyses, understanding regional nuances, and fostering synergistic partnerships, the industry can accelerate the translation of HDAC inhibitors into transformative treatments that address unmet medical needs. The future of epigenetic modulation rests on a foundation of scientific rigor, strategic foresight, and collaborative innovation.

Engage with Associate Director of Sales Marketing to Unlock the Full Scope of the HDAC Inhibitor Market Research Insights Tailored for Your Strategic Objectives

To access the full suite of in-depth analyses, data tables, and expert insights that will empower your organization’s strategic planning and execution in the histone deacetylase inhibitor domain, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through the distinctive features of the report and tailor a solution that aligns with your unique research requirements.

Engaging with Ketan Rohom ensures a customized experience, from understanding critical market dynamics to leveraging advanced segmentation and regional breakdowns. Secure your copy of the comprehensive market research report today and position your organization at the forefront of innovation in HDAC inhibitor development and commercialization.

- How big is the Histone Deacetylase Inhibitors Market?

- What is the Histone Deacetylase Inhibitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?