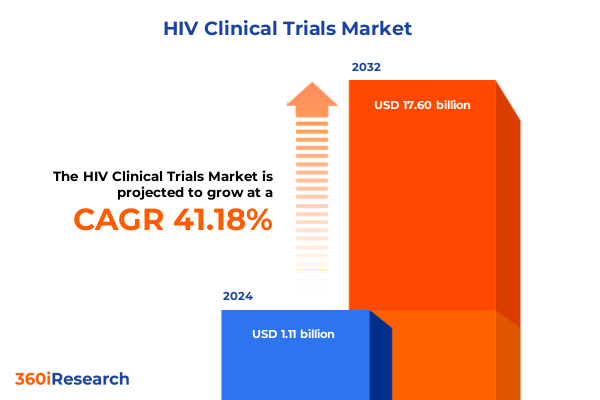

The HIV Clinical Trials Market size was estimated at USD 1.55 billion in 2025 and expected to reach USD 2.16 billion in 2026, at a CAGR of 41.45% to reach USD 17.60 billion by 2032.

Understanding the Evolving Terrain of HIV Clinical Trials and the Imperative for Comprehensive Insights to Guide Strategic Decision-Making

The global fight against HIV continues to unfold against a backdrop of unprecedented scientific progress and enduring challenges, underscoring the critical role of clinical trials in driving new treatment and prevention strategies. Today, more than 39 million people live with HIV worldwide, a figure that highlights both the scale of the epidemic and the urgency of advancing therapeutic options to improve patient outcomes and curb transmission rates. Since 2018, the biopharma industry has launched over 1,000 HIV clinical trials, reflecting robust investment in novel drug classes, innovative delivery mechanisms, and collaborative research models across regions. These trials are the backbone of efforts to bring long-acting injectables, novel oral agents, and gene-based therapies from concept to clinic, offering renewed hope for simplified regimens, enhanced adherence, and durable viral suppression.

Yet, the landscape remains complex. Recent foreign aid reductions have led to the suspension of key vaccine trials, as seen in South Africa where a promising HIV vaccine program was abruptly halted following the withdrawal of $46 million in U.S. funding. Concurrently, regulatory shifts and evolving patient needs demand adaptive trial designs that can respond to emerging variants, resistances, and socioeconomic barriers. In this context, a comprehensive, data-driven understanding of clinical trial dynamics-from drug class performance to regional execution nuances-is essential for stakeholders seeking to navigate risks, capitalize on breakthroughs, and shape the future of HIV care.

Identifying the Revolutionary Advances and Paradigm-Shifting Innovations Reshaping the HIV Clinical Trial Landscape in Recent Years

The HIV clinical trial landscape is experiencing a wave of transformative innovation driven by next-generation therapeutics and patient-centric approaches. The recent FDA approval of lenacapavir for twice-yearly pre-exposure prophylaxis represents a pivotal advancement, offering sustained protection with a single injection every six months and demonstrating near-perfect efficacy in large-scale African trials. This breakthrough exemplifies the shift toward long-acting formulations that address adherence challenges inherent in daily regimens.

Equally significant is the emergence of gene editing and novel mechanism-based therapies that promise to alter the course of treatment. Weekly oral combinations leveraging Merck’s islatravir and Gilead’s lenacapavir have shown viral suppression rates above 94% at 24 weeks, heralding the potential for an oral weekly regimen that balances efficacy with convenience. Moreover, ViiV Healthcare’s growing real-world evidence for long-acting cabotegravir-based injectables underscores the maturation of implementation science, with zero HIV acquisitions reported in U.S. and Brazilian cohorts using Apretude and high uptake of Cabenuva for treatment.

Beyond pharmacology, decentralized trial designs and digital health integration are redefining patient engagement. Post-pandemic models enable remote monitoring, home-based sample collection, and telehealth visits, expanding trial access to rural and underserved populations. Meanwhile, venture capital investments have surged in Asia-Pacific, with China attracting over $1.53 billion between 2019 and 2022, compared to $540.5 million in the U.S., signaling a shift in innovation epicenters and collaborative funding structures. These converging trends are reshaping trial efficiency, data richness, and global collaboration, marking a new era in HIV research.

Analyzing the Far-Reaching Consequences of the 2025 United States Trade Tariff Measures on HIV Clinical Trial Operations and Costs

The implementation of sweeping U.S. tariff measures in early 2025 has introduced new complexities into the HIV clinical trial supply chain, directly influencing project costs and timelines. A blanket 10% tariff on nearly all imported goods, including active pharmaceutical ingredients, lab equipment, and diagnostics, was enacted on April 5, 2025, with the stated intent of strengthening domestic manufacturing. Concurrently, import duties of up to 245% on Chinese APIs and 20% on Indian counterparts, alongside 25% tariffs on medical devices from Canada and Mexico, have substantially elevated the cost base for trial sponsors and contract research organizations operating in the United States.

These tariffs have triggered acute increases in procurement expenses, prompting many companies to reassess their sourcing strategies. For instance, the 25% levy on key drug intermediates from China and India has driven up API prices, resulting in the reallocation of R&D budgets and the postponement of some government-funded initiatives due to constrained funding envelopes. The heightened cost pressure has also been linked to a projected slowdown in trial site readiness, as laboratories contend with more expensive analytical instruments and packaging materials subject to a 15% tariff.

In response, sponsors are increasingly shifting portions of their supply chain to tariff-free jurisdictions or exploring decentralized models that allow for remote monitoring and local sourcing within regions unaffected by U.S. duties. This strategic pivot, while mitigating immediate financial burdens, risks fragmenting trial oversight and elongating logistical pathways, potentially delaying trial outcomes. Moreover, the cumulative impact on long-term clinical research funding may lead to fewer government-backed studies and a reorientation toward markets with stable trade policies and robust local manufacturing capabilities.

Unlocking Strategic Opportunities with an In-Depth Segmentation of Drug Classes, Trial Phases, End Users, Administration Routes, Distribution Channels, and Patient Demographics

A nuanced segmentation framework reveals critical insights into the drivers of HIV clinical trial performance and decision-making. Drug class analysis highlights the evolution of therapeutic strategies: entry inhibitors such as enfuvirtide and maraviroc continue to be explored for patients with resistant virus profiles, while integrase inhibitors-bictegravir, dolutegravir, elvitegravir, and raltegravir-dominate early-phase combination studies due to their potent viral suppression and tolerability profiles. Non-nucleoside reverse transcriptase inhibitors, including efavirenz, etravirine, nevirapine, and rilpivirine, remain integral to backbone regimens, complemented by nucleoside analogs like emtricitabine, lamivudine, tenofovir, and zidovudine, which serve as foundational elements in both treatment and prevention protocols. Protease inhibitors-atazanavir, darunavir, fosamprenavir, and lopinavir-are now primarily evaluated in salvage therapy trials or specialized patient subsets.

Trial phase segmentation underscores the need for targeted resource allocation. Early Phase I studies focus on safety and pharmacokinetics of novel agents, whereas Phase II trials, divided into Phase IIa and IIb, assess initial efficacy signals and dose optimization. Phase III expansion studies validate clinical endpoints in larger, more diverse populations, and Phase IV post-marketing investigations monitor long-term safety and real-world effectiveness. Understanding the distinct objectives of each phase enables sponsors to align clinical milestones with regulatory interactions and commercialization strategies.

End user segmentation influences trial site selection and service models. Clinics and hospitals provide critical sites for patient recruitment and data collection, while academic institutes and contract research organizations form the backbone of complex protocol execution and regulatory compliance. The route of administration-injectable, oral, or transdermal-further shapes trial logistics, impacting site infrastructure needs and patient adherence support. Distribution channels, spanning hospital pharmacies, online pharmacies, and retail outlets that include both chain and independent pharmacies, determine the post-trial access pathways for successful therapies. Finally, patient age cohort considerations-adult, geriatric, and pediatric-drive protocol design adjustments, including dosing regimens and safety monitoring, ensuring that clinical evidence reflects the full spectrum of those affected by HIV.

This comprehensive research report categorizes the HIV Clinical Trials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Trial Phase

- End User

- Route Of Administration

- Distribution Channel

- Patient Age Group

Harnessing Regional Dynamics and Market Nuances Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Drive HIV Clinical Trial Success

Regional dynamics play a pivotal role in shaping the trajectory of HIV clinical trials. In the Americas, the United States leads in trial volume, infrastructure sophistication, and funding availability, while Latin American countries offer diverse patient populations and cost-effective operational environments that support large-scale efficacy studies. The robust regulatory framework and established contract research network in North America foster rapid protocol approvals, but escalating costs and tariff-induced supply chain constraints are prompting sponsors to explore strategic partnerships and localized sourcing models to maintain trial momentum.

Within Europe, Middle East & Africa, heterogeneous regulatory landscapes present both opportunities and challenges. Western European nations consistently contribute to late-stage Phase III studies, leveraging strong healthcare systems and high patient awareness. In contrast, select EMEA regions in Africa deliver vital patient cohorts for early-phase and combination therapy trials, driven by high disease prevalence and supportive local research centers. Harmonizing regulatory requirements across these markets and navigating import-export regulations remain key imperatives for successful cross-border trial execution.

Asia-Pacific is emerging as a frontier of accelerated HIV research, with Mainland China accounting for nearly half of all regional trials and showcasing rapid recruitment capabilities and streamlined regulatory pathways. Governments across the Asia-Pacific have invested in biotechnology innovation and public-private partnerships, catalyzing growth in trial volumes and attracting global sponsors. This expansion is balanced by efforts to ensure data quality, patient safety, and ethical standards, which are essential to translating regional successes into global therapeutic advances.

This comprehensive research report examines key regions that drive the evolution of the HIV Clinical Trials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Competitive Landscape: Key Company Strategies, Collaborations, and Innovations Steering HIV Clinical Trial Excellence

Leading pharmaceutical and biotechnology companies are advancing HIV clinical trials through differentiated pipelines, strategic collaborations, and real-world evidence generation. Gilead Sciences has pioneered long-acting prevention with lenacapavir, recently approved for six-month dosing, supported by robust efficacy data in thousands of participants and partnerships to enable affordable access in low-income countries. Merck’s innovative two-drug oral regimen combining doravirine and islatravir has achieved non-inferiority to established therapies in Phase III trials and is advancing multiple formulations, including once-weekly and monthly oral candidates, reflecting a commitment to regimen simplification and patient preference. ViiV Healthcare continues to lead in long-acting injectables, with implementation studies demonstrating zero HIV acquisitions with Apretude and high uptake of Cabenuva for treatment, underpinned by expansive real-world datasets presented at CROI and IAS meetings.

Beyond these innovators, emerging players are injecting fresh momentum into the trial ecosystem. Academic and contract research organizations are forming consortia to explore cutting-edge modalities such as therapeutic vaccines and CRISPR-based gene editing, while strategic alliances between Big Pharma and biotechnology start-ups are accelerating the translation of early-stage discoveries into clinical proof of concept. These partnerships leverage complementary strengths-global commercialization reach alongside nimble scientific agility-to address unmet needs and shorten development timelines. Such diversified approaches underscore the competitive intensity of the HIV research sector and highlight the importance of adaptive strategies to sustain innovation leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the HIV Clinical Trials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Gilead Sciences, Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Moderna, Inc.

- Pfizer Inc.

- Roche Holding AG

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- ViiV Healthcare Limited

Implementing Forward-Looking Recommendations to Optimize HIV Clinical Trial Design, Execution, and Strategic Investment for Industry Leaders

To navigate the complex HIV clinical trial environment and capitalize on emerging opportunities, industry leaders should adopt a multi-faceted strategy. First, diversifying supply chains by establishing secondary sourcing agreements in tariff-free jurisdictions can mitigate the impact of U.S. import duties and stabilize cost structures. Investing in local manufacturing partnerships in regions such as Europe and Asia-Pacific will further enhance supply resilience. Second, expanding the adoption of decentralized trial models-leveraging telehealth, home-based sampling, and mobile health technologies-will improve patient recruitment and retention, particularly among underserved populations, while reducing reliance on traditional site infrastructure.

Third, prioritizing long-acting therapies and regimen simplification remains imperative. Sponsors should accelerate real-world evidence generation for injectables and novel oral formats to support regulatory submissions and payer negotiations, thereby facilitating broader market access. Fourth, strategic collaborations between Big Pharma, biotech innovators, and academic centers of excellence can unlock synergies in gene-based therapies, therapeutic vaccines, and next-generation drug delivery technologies. Finally, proactive engagement with regulatory authorities to harmonize requirements across phases and regions will expedite trial approvals and ensure consistent data quality, positioning sponsors to respond swiftly to evolving public health priorities.

Detailing the Rigorous Research Methodology Employed to Ensure Accuracy, Reliability, and Comprehensive Coverage of HIV Clinical Trial Insights

This report synthesizes data from extensive secondary research and primary expert consultations to deliver a robust and reliable analysis of the HIV clinical trial landscape. Secondary sources include peer-reviewed journals, regulatory agency databases, and global trial registries, providing comprehensive coverage of drug approvals, pipeline activities, and policy developments. Primary research involved structured interviews with leading clinical investigators, regulatory affairs specialists, and supply chain managers, yielding qualitative insights into operational challenges and emerging best practices.

Data triangulation was employed to validate findings across multiple datasets, ensuring consistency in trial counts, geographic distributions, and therapeutic segmentation. Quantitative analyses leveraged proprietary databases tracking trial initiation dates, enrollment metrics, and phase progression, while thematic synthesis distilled key trends and strategic implications. Expert review panels comprising representatives from academia, industry, and patient advocacy groups assessed the report’s interpretations and recommendations, enhancing its applicability for decision-makers seeking to optimize trial portfolios and anticipate market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HIV Clinical Trials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HIV Clinical Trials Market, by Drug Class

- HIV Clinical Trials Market, by Trial Phase

- HIV Clinical Trials Market, by End User

- HIV Clinical Trials Market, by Route Of Administration

- HIV Clinical Trials Market, by Distribution Channel

- HIV Clinical Trials Market, by Patient Age Group

- HIV Clinical Trials Market, by Region

- HIV Clinical Trials Market, by Group

- HIV Clinical Trials Market, by Country

- United States HIV Clinical Trials Market

- China HIV Clinical Trials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Critical Findings to Deliver a Cohesive Conclusion on the Future Trajectory of HIV Clinical Trials and Strategic Imperatives

In conclusion, the HIV clinical trial ecosystem stands at a transformative juncture, propelled by technological breakthroughs, innovative trial designs, and shifting geopolitical forces. Long-acting therapies, weekly and monthly oral regimens, and gene-based modalities promise to enhance patient adherence and expand treatment possibilities. However, emerging challenges-ranging from tariff-induced cost pressures to funding fluctuations-require agile supply chain strategies and diversified funding models to sustain progress.

By integrating granular segmentation analysis, regional insights, and competitive intelligence, stakeholders can align clinical development efforts with patient needs, regulatory expectations, and market access imperatives. Proactive adoption of decentralized models, strategic partnerships, and real-world evidence generation will be critical to maintaining momentum and ensuring that novel HIV therapies reach those who need them most. As the landscape evolves, a data-driven, collaborative approach will be essential to transform clinical innovation into tangible public health impact.

Engage with Ketan Rohom to Acquire the Definitive HIV Clinical Trial Report and Empower Your Strategic Decisions with Expert Insights

To secure a definitive competitive edge in the dynamic HIV clinical trial arena, reach out to Ketan Rohom, whose expertise bridges scientific rigor with market-driven insights. As Associate Director of Sales & Marketing, he stands ready to guide you through the comprehensive HIV clinical trial report, ensuring you harness actionable intelligence to inform your strategic investments, optimize trial design, and navigate regulatory challenges. Engage with his tailored consultation to elevate your decision-making, accelerate product development timelines, and position your organization at the forefront of the next wave of HIV treatment innovations.

- How big is the HIV Clinical Trials Market?

- What is the HIV Clinical Trials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?