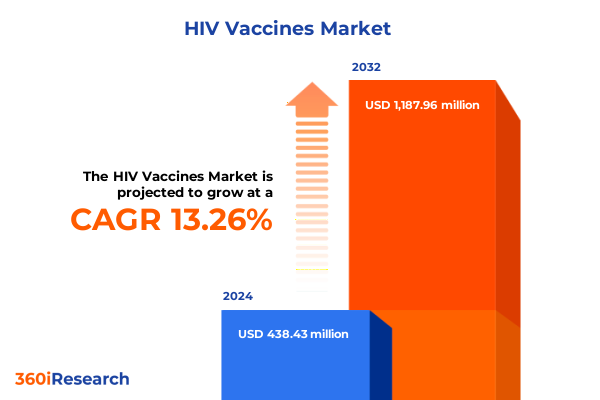

The HIV Vaccines Market size was estimated at USD 438.52 million in 2024 and expected to reach USD 494.38 million in 2025, at a CAGR of 13.27% to reach USD 1,188.44 million by 2032.

Revealing the Crucial Imperatives and Underlying Drivers Shaping the Future Trajectory of HIV Vaccine Research and Development

The global effort to develop effective vaccines against HIV has reached a pivotal juncture, driven by decades of scientific inquiry, clinical innovation, and unprecedented collaboration across sectors. As we stand at the forefront of a potential breakthrough, this report seeks to illuminate the critical drivers shaping vaccine research and chart a path for stakeholders to navigate the intricate landscape ahead. From the earliest inactivated virus attempts through the revolutionary advent of mRNA technologies, each phase of development has contributed to the collective knowledge base, setting the stage for transformative impact.

This executive summary distills the essential insights necessary for decision-makers, researchers, and investors to align their strategies with emerging trends. By examining the shifts in scientific paradigms, regulatory shifts, and market dynamics, we provide a concise yet comprehensive foundation that underscores the urgency and promise of advancing HIV vaccines. The introduction serves as both a roadmap and a catalyst for action, ensuring readers can swiftly grasp the landscape’s complexity and seize opportunities to drive meaningful progress.

How Cutting-Edge Vaccine Platforms and Adaptive Regulatory Pathways Are Revolutionizing HIV Vaccine Development and Collaborative Research

In recent years, landmark advances in vaccine platforms have redefined possibilities within HIV research. Innovations such as self-amplifying mRNA constructs and virus-like particle formulations have demonstrated not only enhanced immunogenicity but also the potential for scalable manufacturing. Meanwhile, the refinement of viral vector approaches, leveraging chimpanzee adenovirus backbones, has addressed long-standing concerns related to preexisting immunity, ultimately broadening the toolkit available to investigators.

Regulatory landscapes have also shifted toward adaptive frameworks, enabling accelerated clinical trial pathways without compromising safety thresholds. Collaborative consortia between public agencies, academic institutions, and industry leaders have further facilitated data sharing and harmonized trial protocols across geographies. These collaborative models, coupled with advancements in biomarker identification and correlates of protection, are catalyzing a new era in HIV vaccine development-one defined by agility, robust pipeline diversification, and an integrated approach to clinical validation.

Assessing the Multifaceted Influence of New U.S. Trade Measures on Procurement, Supply Chains, and R&D Strategies in HIV Vaccine Development

The introduction of new U.S. tariff measures in early 2025, targeting biotechnological imports including specialized reagents, sequencing equipment, and critical lab consumables, has imparted a multifaceted impact on HIV vaccine research. Procurement costs for raw materials have experienced upward pressure, compelling research institutions and manufacturers to reassess sourcing strategies. In response, organizations have intensified efforts to develop domestic supply chains and secure tariff-exempt classifications through strategic partnerships and technology transfers to alleviate financial strain.

Beyond procurement, these tariff adjustments have spurred a reevaluation of global R&D footprints. Major vaccine developers are recalibrating their collaboration models to capitalize on regions with favorable trade agreements and streamlined customs regulations. Simultaneously, the increased lead times for imported equipment have prompted a surge in pre-award negotiations and long-term supplier contracts, ensuring continuity of critical research activities. While short-term operational costs have risen, these shifts are fostering greater resilience and strategic diversification in the HIV vaccine ecosystem.

Uncovering Deep Insights Into HIV Vaccine Dynamics Through Comprehensive Segmentation of Platforms, Technologies, and End User Channels

Insights from the latest market segmentation reveal nuanced dynamics across various dimensions of the HIV vaccine landscape. When examining vaccine classification, preventive offerings dominate investor attention, particularly platforms leveraging virus-like particles and recombinant protein constructs that combine robust safety profiles with scalable manufacturing. In contrast, therapeutic approaches, while representing a smaller share of early-stage pipelines, are gaining traction through targeted peptide formulations designed to elicit potent T-cell responses.

Technological segmentation further delineates emerging priorities. Within the nucleic acid space, mRNA technologies remain at the forefront, with self-amplifying RNA constructs demonstrating promising immunogenicity metrics in late preclinical studies. DNA-based platforms continue to evolve, integrating advanced delivery modalities to enhance cellular uptake. Viral vector developments are focused on next-generation serotypes to circumvent neutralizing antibodies, while peptide candidates are being tailored for epitope specificity.

Route of administration plays a pivotal role in candidate differentiation. Intramuscular injections retain their status as the primary delivery method, yet intranasal formulations are under investigation for their potential to induce mucosal immunity. Subcutaneous injections offer an alternative niche for certain adjuvant-enhanced constructs, broadening the clinical toolkit. End users span clinical trial sites within hospital-affiliated clinics and standalone research centers, while private and public hospitals alike serve as pivotal hubs for larger Phase II and III studies. Pharmaceutical companies and specialized research institutes collaborate closely to pilot novel platforms, bridging early-stage discovery with large-scale testing.

Distribution dynamics underscore the importance of direct engagement. Direct sales channels facilitate partnerships and licensing agreements, while growing online sales platforms enable rapid dissemination of ancillary supplies to trial sites. Retail pharmacies, although not primary distributors of investigational vaccines, play a critical role in post-approval delivery, establishing familiar patient touchpoints and supporting immunization campaigns once regulatory clearance is obtained.

This comprehensive research report categorizes the HIV Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Route Of Administration

- Target Antigen

- End User

Evaluating Regional Ecosystems and Collaborative Frameworks That Are Defining the Future of HIV Vaccine Development Across Global Markets

Regional analysis underscores the heterogeneous nature of the global HIV vaccine environment. In the Americas, robust funding ecosystems and advanced clinical trial infrastructure have positioned the region at the vanguard of pipeline progression. North American research hubs benefit from collaborative networks spanning biotechnology firms, academic centers, and government agencies, enabling streamlined trial initiation and patient recruitment. Meanwhile, Latin American countries are enhancing their regulatory alignment with international standards, opening new populations for efficacy studies.

Across Europe, the Middle East, and Africa, regulatory harmonization initiatives have reduced administrative barriers, fostering cross-border trials that leverage diverse epidemiological profiles. European Union frameworks, supported by substantial Horizon research grants, continue to underpin early-phase pipeline activity. In the Middle East, strategic partnerships between sovereign wealth funds and global pharmaceutical companies are catalyzing local manufacturing capabilities, while African nations are increasingly participating in consortium-driven vaccine efficacy studies, providing invaluable real-world data on variant prevalence.

Asia-Pacific markets are marked by expansive manufacturing capacities in countries such as India and China, which are undertaking technology transfers to scale production of leading vaccine candidates. Government incentives and public-private funding vehicles are expediting late-stage clinical trials across the region. Moreover, emerging economies in Southeast Asia and Oceania are leveraging regional cooperation agreements to streamline regulatory reviews and support multi-site immunogenicity studies, further diversifying the global development footprint.

This comprehensive research report examines key regions that drive the evolution of the HIV Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Collaborations, Platform Innovations, and Emerging Leaders Revolutionizing HIV Vaccine Pipelines Globally

Leading global innovators are actively shaping the trajectory of HIV vaccine progress through differentiated strategies. Major biotechnology firms specializing in mRNA delivery platforms continue to expand their pipeline portfolios, integrating novel lipid nanoparticle formulations to optimize antigen presentation. At the same time, pharmaceutical incumbents with viral vector expertise are reinforcing their positions through targeted acquisitions and strategic alliances, enhancing vector libraries and manufacturing scale.

Smaller biotech ventures are carving out specialized niches by focusing on peptide-based therapeutics and self-amplifying RNA constructs, often in collaboration with academic spin-outs and research institutes. These partnerships not only accelerate early-stage discovery but also facilitate independent validation of immunological correlates. Contract development and manufacturing organizations have simultaneously scaled their end-to-end services to meet the surging demand for GMP-compliant reagents and fill-finish operations, underpinning the rapid translation of benchside breakthroughs into clinical candidates.

In parallel, multinational consortiums-comprising non-profit foundations, government research arms, and private enterprises-have formalized governance structures to streamline resource allocation and data sharing. This collaborative ecosystem is instrumental in reducing duplication of efforts and ensuring that promising vaccine candidates advance efficiently through the clinical continuum. As competition intensifies, agility in platform innovation and strategic partnership formation remain critical determinants of success.

This comprehensive research report delivers an in-depth overview of the principal market players in the HIV Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afrigen Biologics

- AlphaVax, Inc.

- Bavarian Nordic A/S

- BioNTech SE

- Celldex Therapeutics, Inc.

- Cipla Limited

- Excision BioTherapeutics, Inc.

- F. Hoffmann-La Roche, Ltd

- GeneCure Biotechnologies

- Genetic Immunity, Inc. by Power of the Dream Ventures, Inc.

- GeoVax Labs, Inc.

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- ImmunityBio, Inc.

- Immuno Cure BioTech Limited

- Immunocore Holdings plc

- Immunor AS

- Inovio Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Moderna, Inc.

- Oncolys BioPharma Inc.

- Pfizer Inc.

- ReiThera Srl

- Sanofi S.A.

- Sumagen Co. Ltd. by CreoSG Co., Ltd.

- TheraVectys SA

- TVAX Biomedical, Inc.

- Uvax Bio, LLC

- Vir Biotechnology, Inc

Actionable Strategic Initiatives for Stakeholders to Maximize Agility, Regulatory Alignment, and Collaborative Innovation in HIV Vaccine Development

Industry leaders seeking to capitalize on the next wave of HIV vaccine breakthroughs should prioritize investment in flexible platform technologies that enable rapid antigen optimization and scalable production. Allocating resources to self-amplifying mRNA and virus-like particle constructs can position organizations at the cutting edge of immunogenicity and safety. Simultaneously, cultivating diversified supply chains-through domestic manufacturing partnerships and tariff-mitigating alliances-will safeguard against geopolitical volatility and procurement bottlenecks.

Engagement with regulatory stakeholders early in the development cycle is equally essential. Proactive dialogues to align on adaptive trial designs and biomarker endpoints can accelerate approval timelines without compromising data integrity. Organizations should also harness digital clinical trial tools to enhance patient monitoring and data collection, improving the robustness of safety and efficacy assessments. Finally, forging cross-sector consortia that integrate academic expertise, non-profit funding, and private investment will reinforce collaborative frameworks, streamline resource sharing, and ultimately drive the field closer to a licensed HIV vaccine.

Methodical Integration of Primary Expert Interviews and Secondary Literature to Generate a Robust and Actionable Overview of HIV Vaccine Development

Our comprehensive research methodology integrates both primary and secondary data streams to ensure robustness and validity. Primary insights were garnered through in-depth interviews with thought leaders, including senior executives at biotechnology firms, clinical trial investigators, and regulatory experts. These discussions provided nuanced perspectives on emerging platform capabilities, tariff impacts, and regional trial complexities. Concurrently, secondary research leveraged peer-reviewed journals, white papers, and publicly available regulatory filings to contextualize findings within the broader scientific and policy landscape.

Data triangulation was employed to reconcile divergent viewpoints, enhancing the reliability of our analysis. We applied a rigorous segmentation framework-encompassing vaccine type, technology, route of administration, end user, and distribution channel-to structure market dynamics and identify pivotal trends. Regional insights were validated through cross-referencing government publications, clinical trial registries, and trade data. Finally, all conclusions were reviewed by an expert advisory panel to ensure accuracy and actionability, culminating in an authoritative overview of the global HIV vaccine ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HIV Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HIV Vaccines Market, by Vaccine Type

- HIV Vaccines Market, by Route Of Administration

- HIV Vaccines Market, by Target Antigen

- HIV Vaccines Market, by End User

- HIV Vaccines Market, by Region

- HIV Vaccines Market, by Group

- HIV Vaccines Market, by Country

- United States HIV Vaccines Market

- China HIV Vaccines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Critical Developments and Strategic Considerations to Illuminate the Pathway Toward a Licensed HIV Vaccine

This executive summary encapsulates the pivotal shifts redefining HIV vaccine research, from platform innovations to regulatory evolution and supply chain realignment. By systematically exploring segmentation insights, regional ecosystems, and corporate strategies, readers gain a holistic understanding of the factors propelling the field forward. The nuanced impact of U.S. trade measures, alongside the resilience fostered through diversified alliances, underscores the dynamic interplay between policy and scientific progress.

As the global community approaches the threshold of an approved HIV vaccine, the imperative for strategic foresight has never been greater. Stakeholders equipped with deep insights into emerging technologies, regulatory pathways, and collaborative frameworks will be best positioned to accelerate development timelines and deliver transformative public health solutions. This report serves as a strategic compass, guiding industry leaders through complexity toward the shared goal of ending the HIV epidemic.

Unlock Comprehensive HIV Vaccine Market Intelligence Directly from Associate Director Ketan Rohom to Propel Your Strategic Decisions and Investment Plans

To gain unparalleled access to granular insights, cutting-edge analysis, and strategic guidance on the HIV vaccine landscape, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at our firm. With his extensive expertise in guiding life sciences decision-makers through critical research investments, Ketan can provide tailored advice on how this report aligns with your organizational objectives and accelerates your initiatives in HIV vaccine development.

Engaging with Ketan ensures you receive a personalized walkthrough of the report’s most impactful findings, along with exclusive perspectives on emerging opportunities and potential challenges. Don’t miss this opportunity to partner with a seasoned industry professional who can bridge the gap between data and actionable strategy. Reach out today to schedule a consultation and take the first step toward strengthening your strategic position in the rapidly evolving HIV vaccine market.

- How big is the HIV Vaccines Market?

- What is the HIV Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?