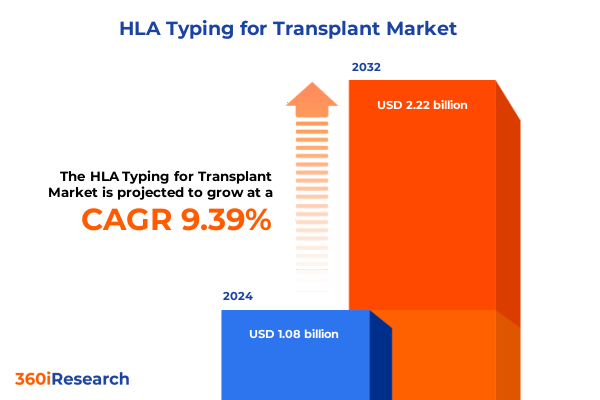

The HLA Typing for Transplant Market size was estimated at USD 1.18 billion in 2025 and expected to reach USD 1.29 billion in 2026, at a CAGR of 9.37% to reach USD 2.22 billion by 2032.

Unveiling the Critical Foundations of HLA Typing Evolution and Its Pivotal Role in Shaping Successful Transplant Outcomes Around the Globe

The world of transplant immunology hinges on the intricate biology of human leukocyte antigens, a system that has challenged and inspired clinicians and researchers for decades. HLA typing, which deciphers these molecular markers, stands at the intersection of cutting-edge genomics, practical laboratory workflows, and life-saving clinical decisions. As transplantation moves into an era of precision medicine, understanding the genomic diversity and compatibility profiles of donors and recipients has never been more critical. This foundational technique not only underpins organ and stem cell transplantation success, but also informs pharmacogenomic research and immune-related disease studies.

Over recent years, the field has advanced from serological assays toward high-resolution molecular methods, rapidly accelerating the ability to predict immunogenic mismatches and tailor immunosuppressive regimens. These developments have fostered a paradigm shift through which clinicians and laboratory directors can make data-driven decisions in near real time. While technological maturation continues to lower barriers to entry, the increasing complexity of HLA alleles and emerging regulatory requirements underscore the need for a comprehensive understanding of market drivers and constraints. This introduction sets the stage for an in-depth examination of the forces transforming HLA typing, from policy and tariffs to regional dynamics and segmentation insights that will guide industry leaders toward strategic innovation.

Revolutionary Technological and Clinical Milestones Redefining the HLA Typing Landscape and Driving Unprecedented Precision in Transplant Medicine

Over the last decade, transformative breakthroughs in sequencing technology, bioinformatics, and laboratory automation have fundamentally altered the HLA typing landscape. Next-generation sequencing platforms now provide the depth of resolution once reserved for research laboratories, enabling the disambiguation of thousands of allele variants in a single workflow. This leap in capability has allowed transplant centers and diagnostic laboratories to refine donor-recipient matching algorithms, significantly reducing the incidence of graft versus host disease and organ rejection. In parallel, improvements in real-time PCR systems and flow cytometry assays have streamlined workflows, decreased turnaround times, and broadened accessibility for midsize diagnostic laboratories that manage high volumes of test requests.

Concurrently, the integration of cloud-based bioinformatics and software solutions has facilitated the standardization and scalability of data analysis. By leveraging robust analytical pipelines, laboratory directors can now implement standardized allele calling and reporting practices across multiple sites, ensuring consistency and regulatory compliance. Moreover, the shift towards modular instrumentation fosters flexible laboratory footprints, allowing organizations to adapt rapidly to evolving clinical demands and emerging supply chain constraints. As a result, the industry is witnessing unprecedented precision in immunogenetics, heralding a new era in which personalized treatment strategies and adaptive laboratory networks become the norm.

Assessing How 2025 United States Tariff Adjustments Have Reshaped the Import Dynamics, Cost Structures, and Accessibility of HLA Typing Solutions

Beginning early in 2025, the United States government enacted a series of tariff adjustments targeting imported diagnostic instruments, reagents, and consumables, which have had a cumulative effect on the HLA typing marketplace. These measures, intended to incentivize domestic manufacturing, resulted in elevated landed costs for electrophoresis equipment, next-generation sequencers, and specialized flow cytometers. As import duties climbed, laboratories faced pressure on capital budgets, leading many to re-evaluate procurement schedules and prioritize instrument service agreements over new acquisitions.

The ripple effects extended to reagent and consumable suppliers, whose cost structures intensified in response to higher duties on imported chemicals and plasticware. In reaction, several key manufacturers accelerated investments in U.S.-based production facilities and formed strategic alliances with local partners to mitigate tariff burdens. Simultaneously, diagnostic laboratories and transplant centers began diversifying their supply chains, adopting dual-source strategies to maintain continuity of critical assays. These cumulative shifts, while initially disruptive, have fostered a trend toward regional self-sufficiency, driving collaborations between instrument vendors and reagent suppliers to optimize bundled offerings. Consequently, the tariff environment of 2025 has redefined cost management practices, compelling stakeholders to innovate around procurement, logistics, and local manufacturing partnerships.

Illuminating Market Segmentation Dynamics Across Product Type, Technology Platforms, Transplant Modalities, Critical Applications, and End User Perspectives

A nuanced examination of market segmentation reveals how stakeholders tailor their strategies across product, technology, transplant type, application, and end-user dimensions. Within product portfolios, manufacturers balance the offering of core instruments such as electrophoresis equipment and PCR systems alongside ancillary consumables and comprehensive software modules. By aligning electrophoresis, flow cytometry, and sequencing platforms under unified service models, organizations can ensure interoperability and streamlined training across diverse laboratory environments.

Looking at technological frameworks, the ascendancy of molecular assays-particularly next-generation sequencing and PCR-based approaches-has been matched by continued reliance on mixed lymphocyte culture and serological methods where cost constraints and legacy workflows persist. This dual-track ecosystem demands that suppliers optimize reagent kits for both high-resolution sequencing and traditional assays, while also ensuring software compatibility for multi-modal data integration.

Transplant modality segmentation underscores distinct needs between hematopoietic stem cell programs, which require high-throughput typing of bone marrow and peripheral blood samples, and solid organ transplant centers focusing on heart, kidney, liver, and lung graft compatibility. Each modality drives unique reagent volumes and instrument uptime requirements. Parallel to this, application-based insights-from donor-recipient matching through pharmacogenomics research and transplant diagnostics-demonstrate the versatility of HLA typing platforms to support both clinical and research laboratories.

Finally, the end-user landscape-spanning blood banks, diagnostic laboratories, hospitals, and specialized research institutions-reflects varied purchasing behaviors and service expectations. Blood banks and organ procurement organizations prioritize rapid turnaround and traceability, whereas research laboratories emphasize customizable protocols and assay flexibility.

This comprehensive research report categorizes the HLA Typing for Transplant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Transplant Type

- Application

- End user

Exploring Regional Variations in HLA Typing Adoption, Infrastructure Readiness, Regulatory Environments, and Clinical Practices Across Major Global Markets

Geographical considerations play a pivotal role in shaping adoption rates, regulatory compliance, and infrastructure readiness. In the Americas, robust reimbursement frameworks in the United States and Canada support rapid uptake of high-resolution sequencing and automated workflows. Major metropolitan transplant centers drive demand for integrated software suites and standardized reporting, while Latin American markets navigate variable regulation and emerging public–private partnerships to expand diagnostic coverage.

Across Europe, the Middle East, and Africa, heterogeneous regulatory landscapes and funding models result in distinct patterns of instrumentation investment. Western Europe, with its centralized healthcare budgets, emphasizes validated workflows and vendor partnerships for instrument maintenance, whereas emerging markets in Eastern Europe and Sub-Saharan Africa lean on cost-effective hybrid solutions, often combining legacy serological assays with PCR-based kits to maximize resource utilization. Simultaneously, Middle Eastern transplant programs, benefitting from recent public health initiatives, are forging collaborations to establish regional reference laboratories and advanced biorepositories.

In the Asia-Pacific region, governments in China, Japan, and Australia are investing in domestic manufacturing capacity, driving local innovation in reagent development and sequencing platforms. Regulatory harmonization efforts aim to streamline cross-border kit approvals, enabling multinational vendors to deploy integrated solutions more rapidly. Furthermore, Southeast Asian transplant networks are forging consortiums to share best practices, optimize training programs, and create joint centers of excellence that leverage high-throughput HLA typing for both clinical and research applications.

This comprehensive research report examines key regions that drive the evolution of the HLA Typing for Transplant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Emphasizing Strategic Collaborations, Diverse Innovation Portfolios, and Competitive Positioning in the HLA Typing Sector

Leading stakeholders have refined their competitive positioning by pursuing strategic collaborations, innovation in assay development, and comprehensive service offerings. Prominent life science companies have expanded their footprints through joint ventures with specialized reagent manufacturers and contract research organizations, securing priority access to raw materials and cutting-edge enzymology. This collaborative model accelerates time to market for next-generation sequencing reagents and enables co-development of proprietary software tailored for immunogenetics workflows.

Others differentiate by establishing centers of excellence that provide end-to-end support-from initial assay validation through clinical application training-thereby deepening customer relationships and reinforcing brand loyalty. These centers often host on-site workshops and remote learning platforms, addressing the evolving needs of transplant immunology laboratories. Companies further augment their portfolios by integrating artificial intelligence and machine learning algorithms into allele calling and compatibility assessment, delivering predictive insights that inform clinical decision making.

Finally, the pursuit of regulatory harmonization has led several players to engage with governmental agencies and industry consortia, working to define standardized allele nomenclature and electronic reporting formats. By advocating for interoperable data schemas, they aim to reduce time and cost barriers to global adoption of high-resolution typing technologies, positioning themselves as thought leaders in the convergence of genomics and clinical diagnostics.

This comprehensive research report delivers an in-depth overview of the principal market players in the HLA Typing for Transplant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Biofortuna Limited

- bioMérieux SA

- Bruker Corporation

- CareDx, Inc.

- Creative Biolabs

- Diasorin S.p.A.

- F. Hoffmann-La Roche Ltd

- Fujirebio Inc.

- GenDx B.V.

- HistoGenetics LLC

- Hologic, Inc.

- Illumina, Inc.

- Immucor, Inc. by WERFEN

- Omixon Biocomputing Ltd.

- PacBio

- QIAGEN N.V.

- Siemens Healthineers AG

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Defining Actionable Strategies for Stakeholders to Foster Cross-Functional Integration, Accelerate Technological Adoption, and Navigate Regulatory Landscapes

To maintain market leadership, stakeholders should prioritize the development of integrated platforms that unify instrumentation, reagents, and software under single-vendor frameworks. Encouraging cross-functional integration between R&D, regulatory affairs, and commercial teams will expedite the translation of assay innovations into validated products. Investing in modular, scalable laboratory automation can further enhance operational agility, enabling rapid adaptation as new HLA allele discoveries emerge and regulatory requirements evolve.

Industry leaders must also foster strategic alliances with local manufacturers and contract development organizations to diversify supply chains and alleviate the impact of trade policy fluctuations. Collaborative partnerships with academic research centers can accelerate assay validation timelines and expand the clinical use cases for HLA typing, such as pharmacogenomic biomarkers. Additionally, engaging with regional healthcare networks to deliver training programs and co-developed reference standards will strengthen market penetration and build trust among end users.

Finally, embracing advanced data analytics and AI-driven reporting will create differentiated value propositions. Deploying predictive compatibility models based on aggregated typing data can offer transplant centers actionable insights, moving beyond static genotype reports toward dynamic risk stratification tools. By implementing these actionable strategies, organizations can solidify their market positioning and drive broader access to precision transplant immunology.

Detailing a Robust Mixed Methodology Combining Primary Interviews, Secondary Intelligence Sources, and Advanced Analytical Techniques for Comprehensive Insights

This research leverages a mixed-methodological framework to ensure rigor and relevance. Primary data collection comprised in-depth interviews with laboratory directors, transplant surgeons, and procurement officers, alongside structured surveys of instrument procurement managers and reagent specialists. These efforts provided firsthand perspectives on operational challenges, purchasing criteria, and emerging technology preferences.

Secondary intelligence involved exhaustive reviews of regulatory filings, reimbursement guidelines, and import/export documentation, supplemented by analysis of scientific publications and patent databases. Proprietary databases were queried to identify recent collaborations, funding announcements, and product registrations worldwide. Quantitative validation applied statistical analyses to corroborate qualitative findings, ensuring internal consistency and external validity.

An advanced analytical framework integrated SWOT and value chain assessments to map competitive landscapes and identify key drivers and constraints. Scenario modeling explored the implications of tariff changes, supply chain disruptions, and technological breakthroughs. Together, these approaches produced a comprehensive, multidimensional understanding of the HLA typing sector, equipping decision makers with actionable insights and practical recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HLA Typing for Transplant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HLA Typing for Transplant Market, by Product Type

- HLA Typing for Transplant Market, by Technology

- HLA Typing for Transplant Market, by Transplant Type

- HLA Typing for Transplant Market, by Application

- HLA Typing for Transplant Market, by End user

- HLA Typing for Transplant Market, by Region

- HLA Typing for Transplant Market, by Group

- HLA Typing for Transplant Market, by Country

- United States HLA Typing for Transplant Market

- China HLA Typing for Transplant Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Integrating Pivotal Findings and Defining Next Steps to Reinforce the Essential Role of High-Resolution HLA Typing in Optimizing Transplant Outcomes

The body of evidence presented underscores the transformative impact of technological innovation, policy shifts, and regional dynamics on the HLA typing industry. High-resolution molecular assays, especially next-generation sequencing, have raised the bar for accuracy and clinical utility, while modular automation and cloud-based analytics are enhancing laboratory efficiency and consistency across geographies. Simultaneously, evolving trade policies and regional infrastructure investments are reshaping cost structures and access pathways, prompting stakeholders to diversify partnerships and localize production.

Market segmentation analysis has revealed the interconnectedness of product offerings, technological platforms, transplantation modalities, and end-user requirements, highlighting the need for holistic strategies that address end-to-end workflows. Regional insights emphasize how reimbursement frameworks, regulatory harmonization, and capacity building influence adoption patterns, pointing to opportunities for targeted market entry and service expansion. Leading companies have demonstrated that strategic collaborations and innovation portfolios, bolstered by regulatory engagement, can establish competitive moats in this high-stakes environment.

In conclusion, delivering precision transplant outcomes demands a comprehensive approach that aligns technological capabilities with operational realities and policy contexts. By synthesizing these pivotal findings, stakeholders can chart a path forward to harness the full potential of HLA typing, ultimately improving patient outcomes and advancing the practice of personalized transplant medicine.

Engage with Ketan Rohom to Unlock Tailored HLA Typing Market Intelligence and Propel Informed Strategic Decisions with Expert Sales and Marketing Guidance

For organizations aiming to stay ahead in the rapidly evolving field of histocompatibility testing, securing in-depth market intelligence is critical. Engaging directly with Ketan Rohom, an experienced Associate Director in Sales and Marketing, will enable stakeholders to access customized insights tailored to specific strategic priorities and operational challenges. Through a personalized consultation, decision makers can explore detailed modeling of supply chain scenarios, receive comparative analyses of emerging technological platforms, and benchmark their development pipelines against industry best practices. This direct engagement also offers the opportunity to discuss tailored service packages, ensuring that every report component-from regulatory overviews to competitive landscapes-aligns precisely with organizational goals. By taking this proactive step, life science leaders, clinical laboratory managers, and transplant program directors can accelerate their strategic planning processes, mitigate risks associated with shifting trade policies, and capitalize on the latest advancements in high-resolution HLA typing. Reach out to Ketan Rohom to transform abstract data into concrete action plans and elevate your program’s transplantation success rates.

- How big is the HLA Typing for Transplant Market?

- What is the HLA Typing for Transplant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?