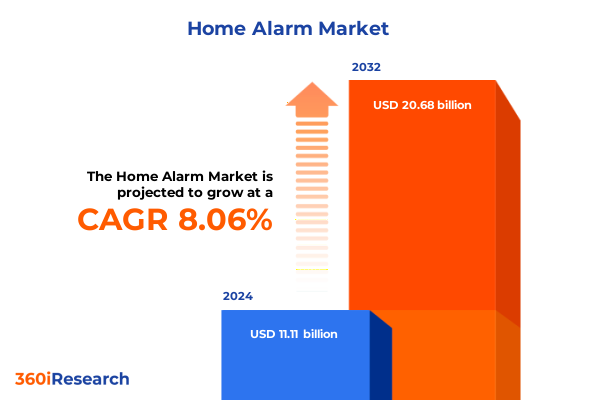

The Home Alarm Market size was estimated at USD 12.01 billion in 2025 and expected to reach USD 12.99 billion in 2026, at a CAGR of 8.79% to reach USD 21.68 billion by 2032.

Navigating the Accelerating Evolution of Home Alarm Systems Driven by Technological Innovation and Heightened Consumer Security Demands

The home alarm industry has entered a transformative era fueled by rapid digitalization, heightened security concerns, and the ubiquity of connected devices. In the wake of unprecedented global events and evolving crime patterns, homeowners and enterprises alike increasingly demand intelligent, integrated security ecosystems rather than standalone intrusion alarms. This shift toward proactive risk management has raised expectations for seamless remote monitoring, real-time alerts, and data-driven analytics delivered through intuitive platforms.

Against this backdrop, the convergence of telecommunications, cloud computing, and artificial intelligence has redefined how security systems detect, deter, and respond to threats. Vendors that once competed solely on the basis of sensor count and alarm thresholds now prioritize interoperable ecosystems capable of orchestrating cameras, access control, environmental sensors, and mobile applications. Consequently, new entrants and technology giants alike have intensified competition, challenging traditional providers to innovate or risk obsolescence.

Moreover, the democratization of home automation and the proliferation of smart devices have emboldened consumers to adopt do-it-yourself security solutions, further fragmenting the market. Simultaneously, commercial enterprises continue to invest in advanced professional monitoring and centralized command platforms to safeguard assets and critical infrastructures. By understanding these converging dynamics-where convenience, connectivity, and security intersect-stakeholders can anticipate the next wave of innovation in home alarm solutions.

Unpacking the Transformational Shifts Reshaping the Home Security Landscape Through IoT Convergence Intelligent Automation and Evolving Consumer Behavior

The home security landscape has experienced seismic shifts in recent years as emerging technologies recalibrate what it means to protect residential and commercial environments. Internet of Things convergence now enables every sensor, camera, and control panel to communicate through unified protocols, creating holistic situational awareness rather than isolated alert streams. Building on this foundation, intelligent automation leverages edge computing and AI-powered analytics to filter false alarms, predict atypical behavior patterns, and initiate automated response workflows.

In parallel, voice assistant integration and seamless mobile app control have redefined user experience, transforming alarm systems into multifunctional hubs that extend well beyond intrusion detection. This evolution has sparked fierce competition between device manufacturers and platform providers vying to deliver the most intuitive interface, whether through augmented reality-enabled diagnostics or frictionless onboarding experiences that eliminate technical barriers for end users.

As security ecosystems grow in complexity, however, they also introduce new vulnerabilities, prompting an intensified focus on cybersecurity hardening and firmware resilience. Consequently, providers are forging partnerships with data security specialists to embed encryption, threat-detection algorithms, and secure key management into every layer of the solution. Together, these transformative shifts underscore a broader industry metamorphosis: from reactive alarm triggers to predictive, integrated security frameworks that adapt in real time to evolving risks.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Home Alarm Supply Chains Cost Structures and Operational Adaptations

The introduction of new tariff measures by the United States in 2025 has compounded existing supply chain complexities for home alarm manufacturers. With duties increasing on components such as printed circuit boards, optical sensors, and microprocessors imported from key overseas production hubs, vendors have encountered elevated procurement costs that cascade through their value chains. In response, many organizations have reevaluated their sourcing strategies to mitigate margin erosion and maintain competitive pricing.

During this period of heightened trade barriers, several market participants accelerated efforts to diversify manufacturing footprints, exploring nearshoring options in Mexico and Southeast Asia while repatriating critical assembly operations to domestic facilities. Simultaneously, design teams have prioritized modular architectures, enabling rapid substitution of high-tariff parts without extensive reengineering. This approach not only moderates input cost volatility but also enhances resilience against future policy fluctuations.

Moreover, the increased overhead has prompted strategic dialogues between suppliers and distribution partners to rebalance inventory commitments, optimize order volumes, and renegotiate contractual terms. Forward-looking companies have also invested in advanced demand-planning tools that incorporate tariff scenarios, currency fluctuations, and logistical constraints to safeguard continuity. Through these adaptations, industry leaders are weathering the cumulative impact of trade measures and emerging with supply chains that combine cost sensitivity with operational adaptability.

Drawing Actionable Insights from Multi-Dimensional Segmentation to Illuminate Growth Dynamics Across Home Alarm Product Functionality and Service Models

Analyzing the market through multiple segmentation lenses reveals nuanced growth drivers and adoption patterns that shape product development and go-to-market strategies. The product spectrum encompasses access control devices, cameras, control panels, sensors, and sirens & alarms, with camera applications further differentiated between indoor and outdoor environments and sensor technologies spanning door/window sensors, glass break sensors, motion sensors, and smoke/CO detectors. This granularity guides innovation priorities by highlighting the rising demand for outdoor-ready cameras with weatherproof housings and advanced motion analytics alongside specialized sensors that address life-safety requirements.

Moving to service segmentation, a clear bifurcation emerges between professional monitoring and self-monitoring models. Professionals continue securing large commercial deployments and high-value residential properties, whereas tech-savvy homeowners increasingly gravitate toward self-monitoring solutions that offer control over notification settings and subscription costs. Installation typologies also diverge along a similar axis: do-it-yourself adoption is surging in suburban housing markets, driven by simplified wireless kits and comprehensive mobile setup guides, while complex multi-device ecosystems in metropolitan and enterprise contexts still rely heavily on professional installers.

The system divide between wired and wireless architectures further influences deployment choices. Wireless networks dominate retrofit and greenfield residential projects seeking minimal construction impact, yet wired backbones retain relevance in industrial and legacy commercial builds where uninterrupted connectivity is non-negotiable. Distribution channels amplify these distinctions: direct sales channels maintain premium pricing and customization, online retail via company websites and e-commerce platforms drives volume adoption among DIY enthusiasts, and specialty stores reinforce brand credibility, all while telecom operators bundle security offerings within broader home connectivity packages. Lastly, end users split between commercial and residential segments, with commercial clients prioritizing integrated access control and video analytics, while residential adopters emphasize user-friendly sensors and camera solutions that blend seamlessly into daily life.

This comprehensive research report categorizes the Home Alarm market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Monitoring Type

- Installation Type

- System Type

- End User

- Distribution Channel

Unveiling Distinct Regional Nuances in Home Alarm Adoption Highlighting Divergent Regulatory Landscapes and Consumer Preferences Across Global Markets

Regional market trends underscore the importance of tailoring security offerings to local regulatory frameworks, infrastructure maturity, and consumer behaviors. In the Americas, the United States leads with high penetration of professional monitoring services and an established dealer network, while Canada and select Latin American markets demonstrate rapid uptake of wireless and cloud-based systems. These markets exhibit strong preference for integrated solutions that pair video surveillance with mobile app alerts and in-app emergency dispatch.

Across Europe, Middle East & Africa, Western Europe showcases steady adoption of smart home security features, tempered by stringent data privacy regulations that shape camera usage and cloud storage policies. In the Middle East, demand centers on sophisticated commercial installations that blend access control, perimeter detection, and centralized command stations. African markets, while nascent, display pronounced interest in mobile-first alarm notifications and cost-effective sensor kits designed for off-grid applications.

The Asia-Pacific region features diverse dynamics, driven by manufacturing hubs in China that supply components at scale, and burgeoning consumer markets in India and Southeast Asia embracing self-installation kits. Tier-one cities in mainland China and South Korea emphasize high-resolution imaging and AI-driven analytics, whereas Australia and New Zealand show growing demand for remote monitoring services and seamless integration with home automation platforms. These regional nuances highlight the necessity for differentiated product roadmaps and distribution strategies to capture distinct market opportunities.

This comprehensive research report examines key regions that drive the evolution of the Home Alarm market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Leadership and Innovation Trajectories of Leading Home Alarm Companies Shaping the Competitive Security Ecosystem

A cadre of established and emerging companies is actively shaping the home alarm market through targeted investments, strategic partnerships, and continuous product innovation. Legacy security providers have broadened their portfolios to include smart cameras, environmental sensors, and access control modules, while technology enterprises have introduced subscription-free self-monitoring solutions designed to capture do-it-yourself enthusiasts.

Key players differentiate through their service models: some prioritize managed monitoring services with tiered response protocols, while others leverage cloud-native platforms that seamlessly connect disparate devices under unified mobile and web dashboards. Partnerships with telecommunications operators are becoming increasingly prevalent, enabling providers to integrate alarm offerings into bundled internet and voice contracts, thereby expanding distribution reach and reducing customer acquisition costs.

Innovation remains a cornerstone of competitive advantage, with leading firms investing heavily in AI-enhanced analytics, edge processing capabilities, and cybersecurity certifications. This focus extends to enterprise alliances, where security specialists collaborate with building management system providers to deliver converged solutions for commercial clients. Simultaneously, nimble new entrants capitalize on niche sensor technologies, energy-harvesting devices, and white-label distribution models to challenge incumbents and accelerate feature deployment. Together, these strategic maneuvers define the evolving competitive tapestry and guide future market leadership trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Alarm market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Abode Systems, Inc.

- ADT LLC

- Allegion PLC

- Aqara by Lumi United Technology Co., Ltd.

- Arlo Technologies, Inc.

- Assa Abloy AB

- Brinks Home by Monitronics International, LLC

- China Security & Fire IoT Sensing Co., Ltd.

- Cisco Systems, Inc.

- Control4 Corporation

- ELK Products Inc.

- General Electric Company

- Honeywell International Inc.

- Johnson Controls International PLC

- Lorex Corporation

- Milesight

- Napco Security Technologies, Inc.

- Nortek Security & Control LLC

- Ring LLC

- Robert Bosch GmbH

- Schneider Electric SE

- Shenzhen Professional Security Technology Co., Ltd.

- Siemens AG

- SimpliSafe, Inc.

- SZ PGST Co., Ltd.

- Titan Alarm

- Universal Electronics Inc.

- Vivint Smart Home, Inc.

- Wyze Labs, Inc.

- X10 Home Security

Implementing Forward-Looking Strategies for Home Alarm Providers to Accelerate Technology Adoption Mitigate Risks and Enhance Customer Engagement

To thrive amid intensifying competition and regulatory complexity, industry leaders must adopt forward-looking strategies that balance technological advancement with operational resilience. Prioritizing investments in artificial intelligence and edge computing will empower providers to reduce false alarms and enhance proactive threat detection through behavioral analytics. At the same time, expanding wireless mesh network capabilities and modular hardware designs can streamline installations and accelerate time-to-value for end users.

Diversifying sourcing footprints and near-shoring critical assembly operations mitigates tariff exposure and fosters greater supply-chain agility. Additionally, companies should refine subscription offerings to include flexible self-monitoring tiers alongside premium professional monitoring plans, catering to both budget-conscious homeowners and mission-critical commercial clients. By integrating subscription management platforms with customer relationship management systems, providers can optimize retention and up-sell opportunities based on usage patterns.

Further, strengthening partnerships with telecom operators, home automation vendors, and cybersecurity specialists will expand distribution channels while enhancing product credibility. Tailoring solutions for industry verticals such as healthcare, retail, and multifamily residential properties can unlock new revenue streams and deepen client relationships. Finally, embedding robust data privacy and compliance protocols will reassure stakeholders and differentiate brands in a market where trust is paramount.

Detailing the Rigorous Research Framework Combining Qualitative Expertise Quantitative Analysis and Stakeholder Perspectives for Comprehensive Market Insight

This research employs a rigorous mixed-methodology framework combining qualitative and quantitative approaches to deliver comprehensive market insight. Primary data collection involved in-depth interviews with security integrators, technology vendors, distribution partners, and end-user stakeholders to capture firsthand perspectives on emerging trends, operational challenges, and customer requirements. These interviews were complemented by online surveys spanning residential and commercial segments to validate hypotheses and quantify adoption drivers.

Secondary research drew from authoritative industry publications, government trade and customs databases, regulatory filings, and white-papers from technology consortiums. This layer of data provided macroeconomic context, tariff schedules, and competitive intelligence that underpinned segmentation analysis. The study’s multi-dimensional segmentation covers product types, monitoring services, installation typologies, system architectures, distribution channels, and end-user verticals, ensuring granular interpretation of market dynamics.

Regional assessments for the Americas, Europe, Middle East & Africa, and Asia-Pacific were conducted by synthesizing local regulatory frameworks, distribution infrastructures, and consumer preferences. Competitive benchmarking evaluated leading and emerging players across dimensions such as product portfolio depth, technology integration, partnership networks, and service models. Throughout the process, data triangulation and validation protocols ensured the integrity and reliability of insights, equipping decision-makers with actionable, evidence-based recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Alarm market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Alarm Market, by Product Type

- Home Alarm Market, by Monitoring Type

- Home Alarm Market, by Installation Type

- Home Alarm Market, by System Type

- Home Alarm Market, by End User

- Home Alarm Market, by Distribution Channel

- Home Alarm Market, by Region

- Home Alarm Market, by Group

- Home Alarm Market, by Country

- United States Home Alarm Market

- China Home Alarm Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Consolidating Key Findings and Anticipating the Next Phase of Innovation and Integration in Home Alarm Security Solutions for Stakeholder Decision-Making

The analysis underscores a home alarm industry in flux, where technological innovation, shifting consumer behaviors, and regulatory pressures converge to reshape market trajectories. Key findings reveal that the integration of AI-powered analytics and IoT connectivity is driving a new paradigm focused on predictive threat detection and seamless user experiences. Tariff measures enacted in 2025 have prompted strategic supply-chain realignments, catalyzing near-shoring and modular design approaches that enhance affordability and agility.

Segmentation insights illuminate the diverse demands across product types, monitoring services, installation preferences, and distribution channels, reinforcing the necessity for tailored offerings that resonate with distinct user cohorts. Regional nuances further highlight how data privacy considerations in Europe, telecom bundling in the Americas, and manufacturing scale in Asia-Pacific influence adoption patterns. Competitive analysis showcases how legacy providers and agile startups alike are leveraging partnerships, platform development, and cybersecurity enhancements to secure market leadership.

Looking ahead, stakeholders who proactively embrace flexible business models, invest in interoperable technology architectures, and foster collaborative ecosystems will be best positioned to capture the next wave of growth. By synthesizing these insights, decision-makers can navigate the complexities of the evolving home alarm sector and chart a course toward sustainable competitive advantage.

Engage with Ketan Rohom to Secure Advanced Home Alarm Market Intelligence and Propel Strategic Business Decisions with Comprehensive Research Insights

Securing unparalleled insights into the evolving home alarm market requires access to comprehensive, expertly curated research. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the definitive market intelligence that empowers your organization to navigate changing security technologies, shifting regulatory environments, and emerging consumer preferences. Engage directly with Ketan to explore custom licensing options, receive detailed data extracts, or arrange a personalized briefing that aligns precisely with your strategic requirements. Don’t miss the opportunity to elevate your decision-making with this in-depth report tailored for business leaders, product strategists, and investment professionals seeking actionable insights into the next generation of home alarm solutions.

- How big is the Home Alarm Market?

- What is the Home Alarm Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?