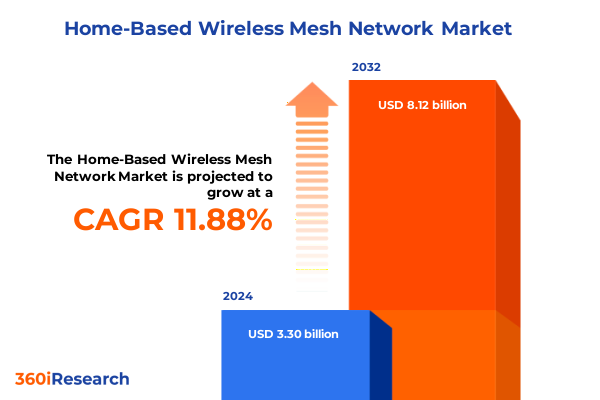

The Home-Based Wireless Mesh Network Market size was estimated at USD 3.69 billion in 2025 and expected to reach USD 4.08 billion in 2026, at a CAGR of 11.91% to reach USD 8.12 billion by 2032.

Setting the Stage for the Future of Home-Based Wireless Mesh Networks with an Overview of Industry Fundamentals and Emerging Drivers

As the proliferation of connected devices continues to reshape residential environments, home-based wireless mesh networks have emerged as a cornerstone technology for delivering seamless connectivity. Driven by an unprecedented surge in Internet of Things deployments, elevated expectations for in-home streaming and gaming experiences, and the shift toward remote work and learning, mesh networks offer a resilient, scalable alternative to traditional Wi-Fi extenders. This executive summary unpacks the critical industry fundamentals, underscoring the significance of mesh architectures in addressing coverage dead zones, latency bottlenecks, and the growing demand for consistent throughput across multiple floors and large dwellings.

Against this fast-evolving backdrop, the analysis delves into the drivers and constraints shaping supplier strategies and end-user adoption patterns. From chipset development cycles accelerating next-generation standards to consumer appetite for plug-and-play solutions, myriad factors converge to influence market dynamics. This introduction establishes the foundational context for the subsequent sections, setting the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation nuances, regional trends, competitive positioning, and strategic imperatives that industry stakeholders must heed to maintain a competitive edge.

Identifying Pivotal Transformations Driving Home Wireless Mesh Network Adoption Through Technological Advancements and Consumer Behavior Dynamics

Over the past two years, home-based wireless mesh networks have benefitted from a confluence of technological breakthroughs and shifting consumer behaviors. Advances in semiconductor integration, particularly in Wi-Fi 6 and its extension into Wi-Fi 6E, have elevated network speeds while optimizing power consumption for battery-constrained devices. Simultaneously, the standardization of low-power, low-latency protocols like Thread and enhancements in Bluetooth Mesh connectivity have unlocked new possibilities for smart home interoperability and device-to-device communication without overreliance on central routers.

Furthermore, evolving consumer expectations are compelling suppliers to rethink user experience design. End users now demand not only raw throughput but also intelligent traffic management, automated network self-healing, and advanced security features to safeguard against emerging threats. This shift has spurred the integration of AI-driven analytics and cloud orchestration into mesh system firmware, enabling proactive diagnostics and dynamic bandwidth allocation. As a result, contemporary mesh offerings are as much about software-driven service enhancement as they are about hardware capabilities, marking a departure from legacy networking solutions toward fully integrated, intelligent ecosystems.

Assessing the Rippling Effects of the 2025 United States Tariffs on the Supply Chain Cost Structures and Strategic Sourcing Decisions

In 2025, changes to U.S. trade policy introduced higher tariff rates on specific classes of electronic components originating from key manufacturing hubs, directly impacting cost structures for home-based wireless mesh network suppliers. Import duties levied on semiconductor chipsets, RF front-end modules, and power management integrated circuits have elevated procurement costs, prompting device manufacturers to reevaluate their global sourcing strategies. In particular, suppliers reliant on high-performance Wi-Fi 6E chipsets experienced compressions in margin profiles as the timing and scope of tariff exemptions remained uncertain.

To mitigate these pressures, industry players have accelerated efforts to diversify component sourcing, exploring alternative assembly partners in Southeast Asia, Mexico, and Eastern Europe. Concurrently, strategic stockpiling of critical components and renegotiation of long-term supply agreements have emerged as tactical responses to potential supply chain disruptions. Although tariff-driven cost increases have yet to significantly slow consumer adoption, they have catalyzed an industry-wide recalibration of procurement practices, with greater emphasis on nearshoring, vertical integration, and collaborative R&D initiatives aimed at developing tariff-exempt or domestically produced chipset solutions.

Unveiling Strategic Segmentation Insights Across Technology Standards Connectivity Types Node Counts Application Use Cases End User Profiles and Deployment Approaches

Understanding the multifaceted nature of the home-based wireless mesh network market requires a granular examination of technology standards, connectivity types, node counts, applications, end users, and deployment models. When segmenting by technology standard, Bluetooth Mesh offers robust device-to-device communication suitable for sensor and actuator networks, while Thread provides secure, IPv6-based connectivity optimized for low-power smart home devices. Wi-Fi stands out for bandwidth-intensive use cases and is further differentiated by generation: Wi-Fi 5 remains prevalent in cost-sensitive installations, whereas Wi-Fi 6 and its extension into the 6E spectrum deliver enhanced throughput, reduced latency, and expanded channel availability. Additionally, Z-Wave’s proprietary sub-GHz band technology caters to long-range, interference-resistant links, and ZigBee’s iterations-ZigBee 3.0 and ZigBee Pro-continue to power legacy lighting and industrial-grade automation deployments.

From the perspective of backhaul infrastructure, hybrid backhaul solutions combining wired Ethernet and wireless links strike a balance between reliability and flexibility, whereas wired backhaul configurations deliver predictable performance for high-density node architectures. Pure wireless backhaul systems, in turn, facilitate rapid installation and scalability in retrofit scenarios. The number of nodes within a mesh network influences both cost and performance: networks comprising two to four nodes suit compact apartments, five to eight nodes align with mid-sized homes seeking edge coverage, and deployments with more than eight nodes address sprawling residences or multi-dwelling units requiring advanced routing capabilities.

Application-driven segmentation reveals that energy management systems leverage mesh networking to optimize load balancing for smart thermostats and meter readings, entertainment-focused setups prioritize seamless UHD video streaming and low-latency gaming sessions, home security installations integrate cameras, sensors, and alarms over secure mesh channels, and residential automation scenarios encompass comprehensive device orchestration from lighting to climate controls. Finally, end user profiles range from individual homeowners seeking turnkey solutions to multi-dwelling complexes that demand centralized network management, as well as small home offices emphasizing both performance and ease of use. Deployment modes vary accordingly: hybrid systems blend professional installation with consumer customization, ISP-provided mesh systems are bundled into managed service contracts, and standalone consumer-purchased units empower do-it-yourself enthusiasts to configure mesh networks independently.

This comprehensive research report categorizes the Home-Based Wireless Mesh Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Standard

- Connectivity Type

- Number Of Nodes

- Application

- End User

- Deployment Mode

Illuminating Regional Dynamics and Growth Drivers Shaping Home-Based Wireless Mesh Network Trends Across the Americas Europe Middle East Africa and Asia-Pacific

Regionally, the Americas maintain leadership in both market maturity and adoption rates for home-based wireless mesh networks. North America in particular has seen rapid integration of advanced mesh solutions within both urban and suburban residential environments, fueled by high broadband penetration, strong disposable income, and robust competition among internet service providers offering managed mesh services as part of differentiated broadband packages. Latin American markets, while still developing, show promising growth trajectories driven by government-backed smart city initiatives and increasing consumer awareness of reliable Wi-Fi as a gateway to digital services.

In Europe, the Middle East, and Africa, regulatory frameworks around spectrum allocation and data privacy exert significant influence on mesh network deployments. Western Europe has embraced mesh architectures in high-density apartment complexes and renovated historical buildings where conventional wiring is impractical, whereas Eastern European markets are gradually adopting mesh solutions, spurred by rising internet adoption and public–private partnerships in urban infrastructure upgrades. The Middle East’s luxury property sector integrates mesh networks into smart building blueprints, and Africa’s tech hubs leverage mesh technology to address last-mile connectivity gaps in both residential and small business segments.

Across the Asia-Pacific region, countries such as China, Japan, and South Korea continue to lead in early adoption of cutting-edge mesh hardware, benefiting from domestic chipset manufacturing and aggressive rural connectivity initiatives. Southeast Asian markets display strong demand for cost-effective, DIY mesh units to overcome inconsistent broadband infrastructure, while India’s expanding smart home ecosystem presents both opportunities and challenges around network security and interoperability. Overall, regional dynamics underscore the importance of localized go-to-market strategies, regulatory compliance, and partnerships with telecommunications operators to navigate diverse market conditions.

This comprehensive research report examines key regions that drive the evolution of the Home-Based Wireless Mesh Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Their Strategic Initiatives Shaping Competitive Trajectories in the Home Wireless Mesh Network Ecosystem

The competitive landscape for home-based wireless mesh networks is defined by a blend of established networking incumbents and agile challengers introducing differentiated offerings. Global consumer electronics brands have leveraged extensive R&D budgets and marketing channels to drive awareness and mainstream adoption. Their product roadmaps emphasize seamless cloud management, frequent firmware updates, and integration with broader smart home ecosystems through strategic alliances with leading voice assistant platforms.

At the same time, specialized networking firms and emerging startups are carving out niches by focusing on high-performance mesh solutions, enterprise-grade security protocols, or tailored deployments for multi-dwelling units and small home offices. These companies often adopt a direct-to-consumer sales model, leveraging e-commerce platforms and firmware customization to meet specific customer requirements. Partnerships between chipset designers and module integrators have also intensified, facilitating accelerated time-to-market for next-generation mesh nodes. In parallel, collaborations with internet service providers have led to co-branded managed mesh services, enabling subscription-based revenue models and tighter customer lock-in.

Collectively, these competitive dynamics illustrate a market in which innovation cycles are accelerating, and established players must continuously refine their value propositions, while challengers must demonstrate scale and reliability to capture broader market share. The interplay of strategic alliances, technology differentiation, and service-based offerings will determine the hierarchical positions of companies in the coming 12 to 18 months.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home-Based Wireless Mesh Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com Inc.

- AmpliFi Inc.

- Apple Inc.

- ASUS TeK Computer Inc.

- AVM GmbH

- D-Link Corporation

- Devolo AG

- Eero LLC

- Google LLC

- Gryphon Online Safety Inc.

- Huawei Technologies Co. Ltd.

- Ignition Design Labs Inc.

- Linksys Holdings Inc.

- Luma Home Inc.

- Meshforce Technology Co. Ltd.

- Netgear Inc.

- Nokia Corporation

- Plume Design Inc.

- Samsung Electronics Co. Ltd.

- Securifi LLC

- Tenda Technology Co. Ltd.

- TP-Link Technologies Co. Ltd.

- Xiaomi Corporation

- Zyxel Communications Corp.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Home Mesh Network Deployments

To capitalize on the momentum within the home-based wireless mesh network market, industry leaders should diversify component sourcing by forging alliances with suppliers across multiple geographies, thereby reducing exposure to tariff-induced cost fluctuations. Embracing modular hardware architectures will enable rapid integration of emerging Wi-Fi standards and low-power wireless protocols, while cloud-native network management platforms can support automated diagnostics and seamless over-the-air updates. By investing in AI-driven analytics, vendors can offer predictive maintenance services and personalized user experiences, differentiating their solutions in a crowded marketplace.

Moreover, cultivating partnerships with internet service providers and energy utilities can expand distribution channels and unlock new revenue streams through managed service contracts. Stakeholders should also prioritize robust security frameworks that address both network-level vulnerabilities and IoT device authentication, thereby strengthening consumer trust and complying with tightening data protection regulations. For deployments in multi-dwelling units and small home offices, vendors can develop tiered solution bundles that address diverse performance and budget profiles, enhancing market penetration without diluting brand prestige.

Finally, proactive engagement with standards bodies and participation in interoperability alliances will position companies at the forefront of cross-platform compatibility, simplifying integration for end users and accelerating overall adoption. By executing these recommendations in tandem, industry leaders can navigate a complex landscape of supply chain shifts, regulatory changes, and evolving consumer demands to secure long-term growth.

Detailing the Research Methodology Employed to Ensure Robust Data Collection Rigorous Analysis and Comprehensive Coverage of Home Mesh Network Innovations

This research leverages a multi-pronged approach to ensure the accuracy, reliability, and comprehensiveness of its findings. Primary research included in-depth interviews with senior executives from device manufacturers, chipset vendors, service providers, and channel partners, complemented by surveys of residential end users to gauge adoption drivers and pain points. Secondary research sources encompassed regulatory filings, patent databases, industry whitepapers, and publicly available corporate disclosures from technology companies.

Data triangulation techniques were employed to reconcile discrepancies across sources, ensuring that insights are corroborated by multiple data points. Qualitative inputs were systematically coded and analyzed to identify recurring themes and validate emerging trends, while quantitative data on network deployments and protocol adoption rates were normalized against industry benchmarks. Peer review sessions with external domain experts provided additional validation, and findings were stress-tested against alternative market scenarios to evaluate sensitivity to key variables such as tariff changes and standard evolution.

Throughout the research process, adherence to rigorous quality control protocols and ethical standards was maintained, guaranteeing that the resulting analysis delivers a balanced perspective on the competitive landscape, technological trajectories, and strategic imperatives shaping the home-based wireless mesh network industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home-Based Wireless Mesh Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home-Based Wireless Mesh Network Market, by Technology Standard

- Home-Based Wireless Mesh Network Market, by Connectivity Type

- Home-Based Wireless Mesh Network Market, by Number Of Nodes

- Home-Based Wireless Mesh Network Market, by Application

- Home-Based Wireless Mesh Network Market, by End User

- Home-Based Wireless Mesh Network Market, by Deployment Mode

- Home-Based Wireless Mesh Network Market, by Region

- Home-Based Wireless Mesh Network Market, by Group

- Home-Based Wireless Mesh Network Market, by Country

- United States Home-Based Wireless Mesh Network Market

- China Home-Based Wireless Mesh Network Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Key Takeaways Emphasizing Strategic Imperatives and the Path Forward for Stakeholders in Home-Based Wireless Mesh Network Solutions

In closing, the home-based wireless mesh network sector stands at a critical inflection point where technological innovation, shifting regulatory landscapes, and evolving consumer expectations intersect. Strategic imperatives such as supply chain diversification, standards participation, and sophisticated service offerings will define market leaders. As mesh networking transitions from a niche enhancement to a foundational element of digital living spaces, stakeholders must align product development, partnerships, and go-to-market strategies to deliver seamless, secure, and scalable connectivity experiences.

By synthesizing the key insights presented-from tariff-driven sourcing shifts to granular segmentation and regional dynamics-decision-makers are equipped with a clear roadmap for optimizing investment and product strategies. The time to act is now, as the pace of innovation and market expansion accelerates, shaping the next chapter in connected home networking solutions.

Leveraging Expert Engagement to Secure Comprehensive Market Insights and Drive Decision-Making Through a Direct Partnership with Associate Director Sales Marketing

To gain unfettered access to the comprehensive analysis and actionable intelligence contained within the full market research report, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with Ketan, you can secure a tailored briefing that aligns the report’s insights with your organization’s strategic priorities, ensuring that you have the detailed data and expert context needed to make informed decisions. Reach out today to explore licensing options, custom add-on services, and enterprise data integration, and position your organization at the forefront of home-based wireless mesh network innovation.

- How big is the Home-Based Wireless Mesh Network Market?

- What is the Home-Based Wireless Mesh Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?