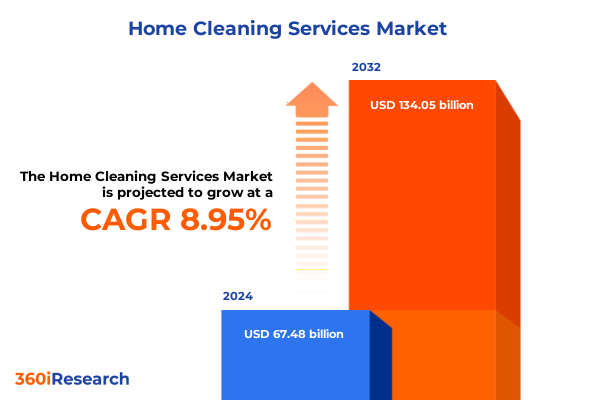

The Home Cleaning Services Market size was estimated at USD 73.04 billion in 2025 and expected to reach USD 79.06 billion in 2026, at a CAGR of 9.06% to reach USD 134.05 billion by 2032.

Exploring How Rising Consumer Demands Innovative Technologies and Operational Challenges Are Shaping the Future Trajectory of Home Cleaning Services

The home cleaning services market has entered a pivotal phase marked by rapidly evolving customer expectations, heightened regulatory scrutiny, and an unprecedented pace of technological innovation. Consumers today demand higher standards of cleanliness, eco-friendly solutions, and seamless booking experiences that integrate effortlessly into their daily routines. In response, providers are reimagining service delivery models, balancing on-demand flexibility with subscription conveniences, and leveraging data-driven insights to tailor offerings that resonate with diverse household needs.

Against this backdrop, industry players face mounting pressure to optimize operational efficiency while maintaining service quality. Workforce challenges-including labor shortages, fluctuating contractor availability, and compliance with emerging labor regulations-add complexity to scheduling and cost management. Simultaneously, the proliferation of digital platforms has democratized access to professional cleaning, lowering barriers for new entrants but raising the bar for differentiation. As environmental sustainability becomes a central consideration for both end users and policy makers, companies must adopt greener chemistries and transparent waste management practices to uphold brand reputation and mitigate regulatory risks.

Navigating these converging forces requires a clear understanding of underlying trends, market drivers, and competitive dynamics. This introduction sets the stage for a thorough examination of how transformative shifts, tariff impacts, strategic segmentations, and regional nuances collectively shape the future trajectory of home cleaning services. By contextualizing the current landscape, stakeholders can better identify value-creation opportunities, anticipate disruptive challenges, and craft strategies that ensure long-term resilience and growth.

Revealing Key Technological Sustainability and Consumer Behavior Transformations Reshaping Competitive Dynamics in the Home Cleaning Services Landscape

In recent years, the home cleaning services landscape has undergone transformative shifts driven largely by technological advancements and changing consumer priorities. Digital booking platforms and mobile applications now represent primary touchpoints for customer engagement, enabling on-demand scheduling, real-time updates, and seamless payment processing. This digital transformation not only enhances user convenience but also provides providers with rich data streams to optimize route planning, forecast demand peaks, and measure service quality against key performance indicators.

Moreover, sustainability has emerged as a powerful force reshaping market dynamics. Consumers increasingly select eco-certified cleaning agents, biodegradable packaging, and carbon-neutral service options. Forward-thinking companies are responding by integrating green chemistries and deploying reusable equipment, thereby aligning operational practices with broader environmental objectives. Concurrently, artificial intelligence and machine learning tools are streamlining administrative workflows-from dynamic pricing algorithms that adjust rates based on demand patterns to predictive maintenance systems for equipment reliability.

At the same time, evolving labor market conditions and regulatory frameworks are redefining workforce strategies. Companies are experimenting with contractor-based, employee-based, and platform-mediated models to balance flexibility with accountability. As a result, competitive differentiation now hinges on the ability to deliver consistent, high-quality service while ensuring compliance, safeguarding worker well-being, and fostering customer trust. Through this section, we unveil the key technological, sustainability, and labor transformations that are recalibrating competitive dynamics across the home cleaning services domain.

Examining the Comprehensive Impacts and Ripple Effects of 2025 United States Tariff Policies on Operational Costs Supply Chains and Pricing Structures

The introduction of new United States tariffs in early 2025 has exerted a material influence on the home cleaning services supply chain, with repercussions felt across equipment procurement, chemical sourcing, and pricing strategies. Tariffs imposed on imported cleaning machinery and specialized tools have driven up capital expenditures for service providers, compelling many to reconfigure procurement plans or seek alternative domestic suppliers. Consequently, companies have reevaluated supplier relationships, giving rise to partnerships focused on local manufacturing and just-in-time inventory models to mitigate cost volatility.

Similarly, levies on chemical imports have contributed to upward pressure on unit costs for detergents, disinfectants, and specialty cleaning agents. In response, some organizations have accelerated investments in formulation research, collaborating with domestic chemical producers to develop in-house or white-label products that circumvent tariff constraints. Meanwhile, price adjustments have necessitated careful communication with end customers to preserve satisfaction and loyalty, often by bundling value-added services or introducing tiered service packages that cushion the impact of incremental cost increases.

Beyond direct cost implications, tariff-driven shifts have introduced strategic considerations around geographic sourcing and risk management. Service providers are increasingly diversifying supply networks to include regional distribution centers, reducing lead times and enhancing supply chain resilience. These adaptive strategies not only mitigate the financial burden of tariffs but also bolster service continuity in the face of future trade policy uncertainties. Through a detailed examination of these tariff effects, this section illuminates the multifaceted operational and strategic ramifications for home cleaning service companies in 2025 and beyond.

Decoding Actionable Market Segmentation Patterns Based on Service Type Booking Frequency Workforce Model Payment Methods and Channel Preferences

Decoding market segmentation reveals nuanced pathways for growth and differentiation in the home cleaning services sector. When categorizing by service type, the market includes deep cleaning, move in out cleaning, post construction cleaning, specialty cleaning-which itself encompasses carpet cleaning, upholstery cleaning, and window cleaning-alongside standard cleaning offerings. This diversity of service categories enables providers to tailor solutions that address specific customer needs, whether preparing a newly constructed property for handover or delivering regular maintenance cleanings that preserve indoor air quality.

From the perspective of booking frequency, the dichotomy between one-time engagements and recurring service arrangements highlights distinct revenue and retention profiles. While one-time appointments capture immediate demand spikes, recurring schedules such as biweekly, monthly, quarterly, and weekly engagements build a predictable revenue stream and foster stronger customer relationships. Providers that successfully convert first-time users into long-term subscribers often invest in loyalty incentives, automated reminders, and flexible rescheduling policies to enhance stickiness.

Workforce model segmentation further underscores strategic differentiation. Contractor-based frameworks offer scalability during peak seasons but may present quality control challenges, whereas employee-based structures deliver standardized performance at the expense of higher fixed costs. Platform-mediated approaches merge the two by leveraging technology to match vetted cleaning professionals with customer requests in real time, optimizing utilization and service consistency. Meanwhile, payment mode segmentation distinguishes pay-as-you-go clients from subscription plan participants, the latter benefiting from either annual or monthly prepaid arrangements that drive upfront revenue and customer commitment.

Finally, channel preferences shape how customers discover and engage cleaning services, spanning from traditional offline referrals and in-person bookings to sophisticated online marketplaces and mobile apps. Providers adept at integrating omnichannel touchpoints gain competitive advantage by capturing consumer mindshare across digital and real-world interactions. This intricate segmentation landscape offers a roadmap for companies seeking to align their offerings with evolving customer expectations and operational imperatives.

This comprehensive research report categorizes the Home Cleaning Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Booking Frequency

- Workforce Model

- Payment Mode

- Booking Channel

Illuminating Regional Market Dynamics and Key Growth Drivers Shaping Home Cleaning Service Landscapes Across Americas Europe Middle East and Africa AsiaPacific

Regional variations in demand, regulatory frameworks, and consumer preferences shape distinct home cleaning services landscapes across the Americas, Europe Middle East and Africa, and AsiaPacific. In the Americas, robust consumer spending power and high urbanization rates drive significant uptake of both on-demand and subscription cleaning services. North American markets, in particular, exhibit a strong propensity for digital booking platforms and eco-friendly service packages, while Latin American regions demonstrate growing interest in premium offerings as household incomes rise and middle-class populations expand.

Turning to Europe, Middle East and Africa, regulatory emphasis on labor protections and chemical safety standards has elevated the importance of compliance and credential verification. In Western Europe, stringent environmental regulations and consumer awareness fuel demand for green cleaning solutions and use of certified agents, whereas emerging economies across the Middle East and Africa present opportunity pockets for first-mover providers to establish brand recognition. In these markets, partnerships with local distributors and franchise models often accelerate entry and expand service networks efficiently.

Across AsiaPacific, rapid urban migration and limited residential domestic help traditions have converged to create fertile ground for professional home cleaning services. Technological adoption is particularly high in metropolitan hubs, with app-based bookings, digital wallets, and AI-driven scheduling becoming standard consumer expectations. Simultaneously, varying economic development levels within the region necessitate adaptable pricing structures and modular service bundles that cater to both high-end urban dwellers and cost-sensitive suburban households. These regional dynamics underscore the importance of localized strategies that balance global best practices with cultural and regulatory nuances.

This comprehensive research report examines key regions that drive the evolution of the Home Cleaning Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Service Providers Driving Competitive Advantage and Technological Integration in the Home Cleaning Sector

Within this competitive arena, a cohort of established and emerging companies are setting benchmarks for innovation, quality, and operational excellence. Traditional leaders with deep brand heritage continue to invest in workforce training and green product lines to reinforce customer trust, while platform-focused entrants leverage data analytics and dynamic matching algorithms to streamline service delivery. The competitive mix also includes regional specialists who differentiate through hyperlocal expertise and community partnerships, as well as global technology firms exploring adjacent services to broaden their value propositions.

Notable service brands have launched proprietary mobile applications that aggregate customer feedback, enable real-time technician tracking, and facilitate seamless payment reconciliation. Simultaneously, digital marketplaces have forged alliances with cleaning franchises and independent providers, offering dual-branded experiences that combine national reliability with local flexibility. Innovation is further evident in integrated home-maintenance ecosystems, where cleaning services are bundled with on-demand handyman, laundry, and appliance servicing, creating end-to-end solutions that drive wallet share and customer loyalty.

As competitive intensity rises, companies that prioritize differentiated service quality, transparent pricing, and robust customer engagement will secure leading positions. Those embracing strategic partnerships-whether through chemical suppliers, equipment manufacturers, or technology integrators-will further elevate their competitive edge. This section provides clear insight into the companies that are redefining standards and capturing value across the home cleaning services market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Cleaning Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Doormaid Services Pvt. Ltd.

- Eunike Living Pte. Ltd.

- Helpling GmbH

- Henkel AG & Co. KGaA

- HiCare Services Pvt. Ltd.

- HomeTriangle Pvt. Ltd.

- Housejoy Services Pvt. Ltd.

- Kao Corporation

- KMAC International Pte. Ltd.

- Maid in Singapore Pte. Ltd.

- MaidPro, Inc.

- Nimbus Homes Pte. Ltd.

- Reckitt Benckiser Group plc

- SC Johnson & Son, Inc.

- ServisHero Pte. Ltd.

- Singapore Cleaning Service Pte. Ltd.

- Superb Cleaning Services

- The Clorox Company

- The Procter & Gamble Company

- Timesaverz Services Pvt. Ltd.

- Unilever Plc

- Urban Company Pvt. Ltd.

Delivering Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends Enhance Operational Resilience and Strengthen Customer Satisfaction

Industry leaders must adopt a multi-pronged strategy to harness emerging trends and fortify market positioning. First, investing in digital platforms that offer intuitive booking experiences and real-time service tracking will not only meet evolving consumer expectations but also generate valuable data for predictive analytics. Building on this foundation, companies should expand sustainable service options, including eco-certified products and carbon offset programs, to resonate with environmentally conscious customer segments and comply with tightening regulations.

Moreover, cultivating a resilient workforce through blended models can optimize cost structures while safeguarding service consistency. Strategic alliances with contractor networks, supplemented by in-house training academies for direct employees, ensure scalability during demand spikes and reinforce quality control. Simultaneously, flexible subscription packages, tailored through automated preference engines, will deepen customer engagement and smooth revenue volatility.

On the supply chain front, diversifying sourcing channels and forging local partnerships can mitigate tariff-driven cost pressures and minimize lead times. Implementing integrated inventory management systems further strengthens responsiveness to fluctuating demand. Lastly, prioritizing data security and customer privacy will build trust and differentiate brands in an increasingly scrutinized digital environment. By operationalizing these recommendations, home cleaning service providers can drive sustainable growth, enhance operational resilience, and deliver superior customer satisfaction.

Detailing Rigorous Research Approaches Combining Primary Interviews Secondary Data Analysis Quantitative Surveys and Stakeholder Validation Processes

This research leverages a comprehensive, multi-stage methodology designed to ensure rigor, relevance, and reliability of findings. Secondary research formed the foundation through analysis of industry reports, regulatory filings, company press releases, and scholarly articles. These sources provided context on market drivers, regulatory landscapes, and competitive positioning. Building on this desk research, primary interviews were conducted with executives from leading service providers, equipment manufacturers, and chemical suppliers, yielding insights into operational practices, strategic priorities, and emerging challenges.

To quantify market dynamics, a structured survey was administered to a statistically significant sample of consumers and B2B clients, capturing preferences around service types, booking channels, and willingness to pay for premium and sustainable offerings. Survey findings were further validated through workshops with subject-matter experts and cross-checked against provider data to ensure consistency. Additionally, triangulation methods were applied by comparing supplier shipment volumes, tariff schedules, and pricing trends to model the tariff impact scenarios described in this report.

Qualitative thematic analysis of open-ended responses complemented quantitative metrics, uncovering nuanced consumer motivations and pain points. The research process adhered to strict data governance protocols, ensuring confidentiality and data integrity. This blended approach guarantees that the insights presented are both representative of current market realities and actionable for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Cleaning Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Cleaning Services Market, by Service Type

- Home Cleaning Services Market, by Booking Frequency

- Home Cleaning Services Market, by Workforce Model

- Home Cleaning Services Market, by Payment Mode

- Home Cleaning Services Market, by Booking Channel

- Home Cleaning Services Market, by Region

- Home Cleaning Services Market, by Group

- Home Cleaning Services Market, by Country

- United States Home Cleaning Services Market

- China Home Cleaning Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights Highlighting Core Findings Strategic Imperatives and Future Considerations Shaping the Next Phase of Home Cleaning Services Evolution

This executive summary distills the essence of the home cleaning services market, highlighting critical trends, regulatory impacts, segmentation insights, regional dynamics, and competitive benchmarks. Core findings reveal that digital transformation and sustainability are no longer optional but mandatory components of any successful service proposition. The 2025 tariffs underscore the fragility of global supply chains, accelerating the shift toward local sourcing and strategic alliances.

Segmentation analysis underscores the importance of aligning service portfolios with customer behavior, from deep cleaning and specialty care to subscription-driven recurring engagements. Regional insights emphasize that tailored approaches-whether prioritizing eco-friendly solutions in Europe or leveraging mobile wallets in AsiaPacific-are essential for market penetration. Competitive profiling showcases that winners will be those brands that seamlessly marry technology with human touch, maintaining quality standards while optimizing operational agility.

Looking ahead, stakeholders should remain vigilant toward evolving regulatory requirements, labor market changes, and potential trade policy developments. By embracing the actionable recommendations in this report, industry leaders can strengthen resilience, elevate customer satisfaction, and capture growth opportunities. This conclusion serves as a strategic compass, guiding decision makers through the complexities of a market poised for further innovation and expansion.

Empowering Decision Makers to Connect with Associate Director of Sales and Marketing for Exclusive Access to Home Cleaning Market Research Insights Report

To gain immediate access to in-depth analysis and actionable insights tailored to your strategic priorities in the home cleaning services industry, connect directly with Ketan Rohom, Associate Director of Sales and Marketing. His expertise in guiding decision makers through the complexities of market dynamics ensures you receive personalized support in evaluating the report’s findings and understanding their implications for your organization. Reach out today to secure your copy of the comprehensive home cleaning services market research report and position your business to capitalize on emerging opportunities from day one

- How big is the Home Cleaning Services Market?

- What is the Home Cleaning Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?