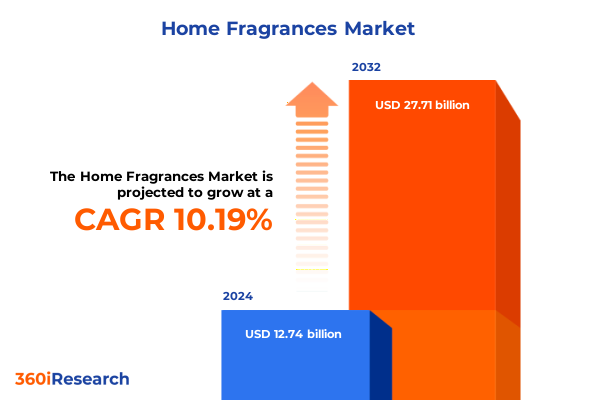

The Home Fragrances Market size was estimated at USD 13.94 billion in 2025 and expected to reach USD 15.25 billion in 2026, at a CAGR of 10.30% to reach USD 27.71 billion by 2032.

Laying the Foundation for Scented Innovation in Home Fragrances by Exploring Evolving Consumer Tastes and Industry Dynamics

The home fragrance sector occupies a dynamic intersection of lifestyle, wellness, and experiential consumer engagement, making it one of the most vibrant corners of the broader consumer goods market. Rooted in centuries-old traditions of scenting interiors with botanical extracts, modern home fragrances have evolved into a sophisticated ecosystem where consumers seek products that resonate with personal identity, memory, and well-being. This evolution is reflected in the rise of functional aromatherapy blends, clean-ingredient formulations, and digitally enabled purchasing experiences that cater to an audience increasingly focused on self-care rituals. The emphasis on natural and organic ingredients has gained traction as environmentally conscious consumers demand transparency in sourcing and eco-friendly packaging solutions-an imperative underscored by leading industry analyses that highlight the growing significance of green formulations and sustainable operations in home fragrance portfolios.

Unveiling the Transformative Shifts Reshaping the Home Fragrance Market Through Innovation, Sustainability, and Digital Engagement Strategies

In recent years, sustainability has crystallized as a core pillar in home fragrance development, compelling brands to pivot toward bio-based waxes, plant-derived fragrance oils, and refillable packaging models. This shift is not merely aesthetic: consumers are rewarding products that demonstrate a measurable reduction in carbon footprint and plastic waste, prompting manufacturers to invest in closed-loop recycling partnerships and cradle-to-cradle design principles. Consequently, the sector is witnessing an uptick in the adoption of soy-based and beeswax candles, as well as innovations in polymer gel diffusers engineered for biodegradability.

Examining How 2025 Tariffs on Imported Home Fragrance Components Are Reshaping Supply Chains, Production Costs, and Competitive Strategies in the U.S.

The introduction of elevated U.S. tariffs in early 2025 on imported raw materials and finished components has prompted home fragrance companies to reexamine their supply chains and cost structures. Tariff rates ranging up to 125 percent on select candle waxes, jars, and packaging supplies sourced from China have led many manufacturers to consider reshoring production or diversifying suppliers into tariff-exempt regions to protect margins. At the same time, the specter of cumulative duties under overlapping trade measures has compelled executives to engage directly with policymakers and the Fragrance Creators Association to seek clarifications and potential exemptions. The importance of this dialogue was highlighted by Washington Post reporting that U.S. import duties surged from an average of just above 2 percent to nearly 15 percent by mid-2025, disrupting cross-border logistics and driving some ingredient prices upward by an estimated 2 percent overall in 2025.

Illuminating Segmentation Insights Across Product Types, Distribution Channels, Scent Profiles, and Packaging Formats to Inform Strategic Positioning and Innovation

A nuanced understanding of product segmentation reveals the distinct growth drivers and margin profiles within the home fragrances market. Candles-differentiated by wax type such as beeswax, paraffin, and soy-continue to command consumer attention through artisanal formulations and premium packaging, while electric diffusers leveraging nebulizing and ultrasonic technologies offer a flameless option favored by tech-savvy households. Gel diffusers, whether using polymer or silica gel matrices, maintain appeal for their long-lasting scent release, whereas reed diffusers formulated with dipropylene glycol or fractionated coconut oil resonate with minimalists seeking a steady aroma without active energy consumption. Sprays, delivered either via aerosol or pump mechanisms, deliver immediate impact and are often the go-to format for time-pressed consumers seeking quick freshness upgrades.

This comprehensive research report categorizes the Home Fragrances market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Scent Type

- Packaging Format

Revealing Regional Dynamics in the Home Fragrance Market Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Guide Strategic Expansion

Regional market dynamics underscore the importance of tailoring strategies to distinct consumer priorities across the globe. In the Americas, North America’s mature retail landscape and well-established department stores coexist with a robust e-commerce ecosystem, driving opportunities for exclusive in-store collections alongside digital subscription services. Conversely, Europe, the Middle East & Africa exhibit a rising appetite for luxury artisanal fragrances, with consumers in Western Europe favoring niche perfumery collaborations and refillable glass packaging, while markets in the Middle East display a preference for woody and oriental scent profiles that align with cultural traditions. Meanwhile, Asia-Pacific’s rapid urbanization and growing middle class have catalyzed demand for accessible fresh and fruity scent formats, as online retail platforms expand into Tier-2 and Tier-3 cities to capture a new cohort of aspirational buyers.

This comprehensive research report examines key regions that drive the evolution of the Home Fragrances market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Initiatives Driving Leading Home Fragrance Companies Toward Sustainable Growth and Market Leadership

Leading companies within home fragrances demonstrate varied approaches to innovation and market leadership. Procter & Gamble’s Febreze brand has leveraged its expertise in odor-eliminating technology to introduce multi-format scent solutions that target specific household zones, while SC Johnson’s Glade has bolstered its mass-market presence through high-visibility promotions and strategic partnerships with lifestyle retailers. Unilever’s Air Wick continues to test smart-home diffuser formats that integrate motion sensors and app-based scent scheduling, reflecting a broader trend toward connected home devices. Newell Brands’ Yankee Candle remains synonymous with premium scented candles, differentiating itself through seasonal limited-edition collections and collaborations with renowned designers. At the high end, Jo Malone and NEST Fragrances underscore the luxury segment’s focus on artistic packaging and bespoke scent experiences, while emerging indie brands harness direct-to-consumer platforms to cultivate intimate community-driven narratives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Fragrances market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aera Home LLC

- Amway

- Bath & Body Works Inc

- Chanel SA

- Coty Inc

- Diptyque Paris

- DSM-Firmenich AG

- Godrej and Boyce Mfg Co Ltd

- Henkel AG & Co KGaA

- International Flavors & Fragrances Inc

- L'Occitane Groupe SA

- L'Oréal SA

- LVMH Moët Hennessy Louis Vuitton

- Mane SA

- MINISO Co Ltd

- Newell Brands Inc

- Now Health Group Inc

- Procter & Gamble Company

- Reckitt Benckiser Group plc

- Robertet Group

- Ryohin Keikaku Co Ltd

- S C Johnson & Son Inc

- Symrise AG

- Takasago International Corporation

Crafting Actionable Recommendations for Industry Leaders to Leverage Innovation, Sustainability, and Consumer Insights in the Home Fragrance Sector

Industry leaders should prioritize a multifaceted approach that addresses both cost pressures and shifting consumer expectations. First, companies can mitigate tariff-induced cost fluctuations by establishing alternative sourcing channels in regions outside of high-tariff jurisdictions, complemented by long-term supplier contracts that provide price stability and ensure quality consistency. Next, accelerating investments in refillable and recyclable packaging platforms will resonate with eco-conscious audiences and help maintain compliance with evolving environmental regulations. Embracing direct-to-consumer channels-particularly subscription models and virtual scent-profiling tools-will enhance customer loyalty by delivering personalized fragrance journeys that evolve with individual tastes. Finally, forging strategic partnerships with smart home technology providers can unlock new use cases for app-controlled diffusers and integrate aromatherapy benefits into holistic wellness ecosystems, further differentiating offerings in a crowded marketplace.

Detailing the Methodological Framework, Data Collection Techniques, and Analytical Approaches Underpinning This Comprehensive Home Fragrance Market Study

This analysis integrates a robust methodological framework designed to ensure comprehensive market coverage and rigorous data validation. Secondary research entailed a thorough review of public filings, industry journals, and regulatory announcements, including trade orders and executive proclamations, to assess policy impacts. Primary insights were gathered through structured interviews with supply chain executives, fragrance formulators, and retail buyers to capture firsthand perspectives on production challenges and evolving consumer behaviors. Quantitative data was triangulated against proprietary shipment statistics and point-of-sale data to verify channel performance. All findings were subjected to multi-stage quality checks and stakeholder reviews, ensuring that recommendations reflect the latest market realities and anticipate future inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Fragrances market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Fragrances Market, by Product Type

- Home Fragrances Market, by Distribution Channel

- Home Fragrances Market, by Scent Type

- Home Fragrances Market, by Packaging Format

- Home Fragrances Market, by Region

- Home Fragrances Market, by Group

- Home Fragrances Market, by Country

- United States Home Fragrances Market

- China Home Fragrances Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Insights, Strategic Implications, and Future Considerations for Stakeholders in the Evolving Home Fragrance Market Ecosystem

Collectively, the insights presented underscore a market at a crossroads of tradition and transformation. Consumer demand for authentic, wellness-oriented products will continue to spur innovations in natural formulations and sustainable packaging, while digital engagement and personalization tools will redefine the purchase journey. At the same time, evolving trade policies and tariff landscapes necessitate agile supply chain strategies to preserve competitiveness. By synthesizing segmentation nuances, regional preferences, and competitive positioning, stakeholders can chart a path toward resilient growth and lasting brand equity. As the home fragrance ecosystem evolves, success will favor those who combine strategic foresight with operational agility to meet consumer demands in an increasingly interconnected global marketplace.

Encourage Targeted Engagement with Ketan Rohom to Secure Comprehensive Market Research Insights and Drive Strategic Decision-Making in Home Fragrances

To obtain a comprehensive home fragrances market research report and gain access to in-depth strategic insights, readers are invited to engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By contacting Ketan, you can secure tailored guidance on how the analysis applies to your organization’s goals, explore custom data requests, and ensure your team benefits from expert consultancy to drive informed decision-making in the evolving home fragrance landscape. Reach out to Ketan to accelerate your understanding of consumer preferences, navigate complex regulatory environments, and stay ahead of emerging product and channel innovations.

- How big is the Home Fragrances Market?

- What is the Home Fragrances Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?