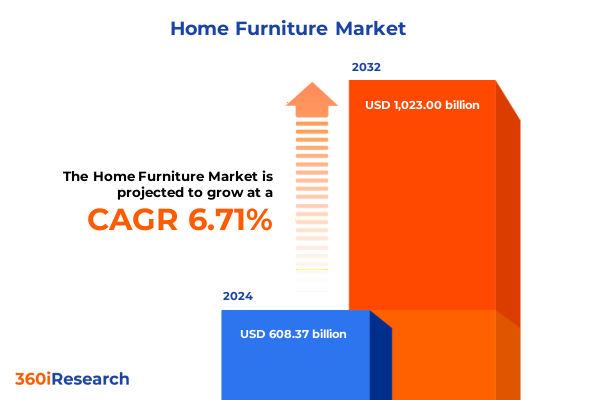

The Home Furniture Market size was estimated at USD 646.16 billion in 2025 and expected to reach USD 686.28 billion in 2026, at a CAGR of 6.78% to reach USD 1,023.00 billion by 2032.

Setting the Stage for a Rapidly Evolving Home Furniture Landscape Driven by Consumer Preferences, Design Innovation, and Strategic Market Forces

The home furniture sector stands at the threshold of a transformative era, shaped by evolving consumer lifestyles, emerging technologies, and shifting economic conditions. As households prioritize comfort, functionality, and aesthetics, industry players must adapt to an increasingly complex set of market drivers. In recent years, digitalization has accelerated consumer access to products, while heightened environmental awareness is reshaping material choices and production methods.

Moreover, supply chain dynamics have become more intricate as global trade tensions and logistical constraints impact sourcing strategies and cost structures. In this context, businesses must navigate a delicate balance between innovation and resilience. By understanding the foundational trends and market forces at play, stakeholders can position themselves to seize opportunities, mitigate risks, and foster sustainable growth in the home furniture landscape.

Unveiling Game-Changing Shifts Reshaping Home Furniture Through Digitalization, Sustainability, and Emerging Consumer Behaviors

Digital transformation is redefining how furniture is designed, marketed, and sold, with manufacturers and retailers investing heavily in omnichannel platforms. E-commerce has emerged as a critical distribution channel, connecting consumers to a wider array of products and enabling customized experiences powered by augmented reality and artificial intelligence. These technologies not only streamline purchasing processes but also allow shoppers to visualize furniture in their own spaces before making commitments, reducing return rates and enhancing satisfaction. Moreover, according to a recent CSIL survey, global e-commerce sales now represent more than ten percent of total furniture revenue, underscoring the growing importance of digital channels in driving industry expansion.

In parallel, sustainability has risen to the forefront of industry priorities as eco-conscious consumers demand responsible sourcing and circular economy solutions. Companies are responding by adopting recyclable materials, reclaiming wood, and offering take-back programs to reduce environmental impact. At the same time, a burgeoning second-hand market has attracted investments in refurbishment and resale initiatives, further illustrating the sector’s shift toward more sustainable business models. This emphasis on environmental stewardship not only appeals to socially responsible buyers but also strengthens brand reputation and loyalty in a competitive marketplace.

Examining the Cumulative Ramifications of 2025 United States Tariffs on Home Furniture Supply Chains, Costs, and Market Dynamics

The 2025 tariff environment has introduced substantial pressures across the home furniture value chain, amplifying costs for raw materials, components, and finished products. A 25 percent levy on steel and aluminum enacted on March 12 has increased hardware expenses for cabinetry and metal furnishings, forcing manufacturers to explore alternative suppliers and renegotiate long-term contracts. Simultaneously, additional duties ranging from ten to 145 percent on imports from key markets such as China have further strained pricing structures, compelling many businesses to absorb a significant portion of the burden rather than immediately passing costs to consumers. For example, despite the average U.S. tariff rate surging to seventeen percent, evidence indicates that American companies have absorbed most increases to remain competitive, resulting in compressed margins across major product categories including sofas, bedroom sets, and dining furniture.

Furthermore, the accumulation of multiple tariff measures throughout the year has contributed to broader inflationary pressures, with the Consumer Price Index registering a 2.7 percent rise in June as manufacturers and retailers delayed price adjustments until supply chains recalibrated. While the full impact of these levies will evolve over time, industry surveys have already recorded widespread expectations of price increases exceeding ten percent among furniture providers, alongside strategic shifts toward stockpiling, domestic sourcing, and selective product line rationalization. Together, these responses illustrate how the cumulative tariff landscape has both challenged existing business models and spurred innovation in logistics, procurement, and product development.

Distilling Vital Segment-Specific Insights Across Product, Material, Type, Channel, and End-Use to Illuminate Market Opportunities

A nuanced understanding of market segments reveals divergent performance and opportunity profiles across product categories, materials, assembly types, distribution channels, and end-use applications. Within product categories, the living room collection-encompassing sofas and entertainment units-remains a cornerstone of consumer demand, while outdoor furniture gains traction as lifestyles prioritize open-air living. In contrast, storage and organization offerings benefit from the rise of multifunctional living spaces, highlighting the need for adaptable designs.

Material preferences continue to evolve, with wood sustaining its status as a premium choice, glass and metal attracting modern aesthetics, and upholstery varieties meeting comfort and style criteria. Prefabricated and ready-to-assemble formats cater to distinct customer segments, from convenience seekers to value-driven consumers. On the distribution front, traditional brick-and-mortar retailers maintain relevance for high-touch experiences, even as digital channels expand their reach through branded websites and partnerships with e-commerce giants. Finally, end-use demarcations between apartments and bungalows underscore spatial considerations, influencing design dimensions, feature integration, and customization levels. Together, these layered segmentation insights empower stakeholders to tailor strategies for each unique market niche.

This comprehensive research report categorizes the Home Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Type

- Distribution Channel

- End Use

Harnessing Regional Variances and Growth Drivers Across Americas, EMEA, and Asia-Pacific to Inform Strategic Market Positioning

Regional markets exhibit distinct growth catalysts and consumer preferences that warrant tailored strategies. In the Americas, the proliferation of home remodeling projects and the enduring adoption of remote work have fueled sustained demand for ergonomic home office solutions. In 2025, U.S. home office furniture revenue reached 18.34 billion dollars, underscoring the segment’s leading position and highlighting opportunities for specialized seating and adjustable desks tailored to hybrid-work environments. Additionally, Latin American markets are experiencing steady urbanization and rising disposable incomes, creating fertile ground for mid-range and premium product lines.

Europe, the Middle East, and Africa (EMEA) display a nuanced blend of sustainability mandates, luxury demand, and digital adoption. In the Gulf Cooperation Council, online furniture sales grew by over twenty-five percent in 2023, fueled by enhanced logistics and virtual visualization tools, while government initiatives such as Saudi Vision 2030 are catalyzing large-scale residential development that elevates furniture spending patterns. Meanwhile, sub-Saharan markets are embracing eco-friendly options, and Europe’s build-to-rent and micro-housing trends drive interest in compact, transformable furnishings certified by environmental standards like FSC and Blue Angel.

Asia-Pacific emerges as a powerhouse underpinned by rapid urbanization and dynamic e-commerce ecosystems. Approximately fifty percent of the region’s population now resides in urban areas, a figure projected to reach sixty percent by 2040, which has directly propelled housing construction and furniture consumption patterns. Leading digital markets such as South Korea and Singapore have seen online furniture sales contribute over thirty percent of total retail revenue, supported by immersive AR and VR tools that enhance online shopping experiences. Altogether, these regional insights clarify where to concentrate product development, distribution investments, and marketing initiatives to align with local demand drivers.

This comprehensive research report examines key regions that drive the evolution of the Home Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Furniture Manufacturers and Retailers to Reveal Strategic Initiatives, Competitive Advantages, and Innovation Priorities

Leading furniture manufacturers and retailers are deploying diverse strategies to consolidate positions and capture emerging demand. Global giants leverage scale and integrated supply chains to secure cost advantages for raw materials and logistics, while also investing in design centers that rapidly translate consumer insights into fresh collections. Regional specialists often differentiate through niche product propositions-offering bespoke customization, sustainable materials, or culturally resonant aesthetics that resonate with local markets.

Technology integration constitutes a shared priority, with top firms adopting advanced data analytics, CRM platforms, and AI-driven personalization engines to refine product assortments and marketing outreach. Simultaneously, partnerships between manufacturers and logistics providers optimize inventory management and fulfilment speed, catering to consumer expectations for rapid delivery and flexible return policies. Through these coordinated initiatives, leading companies are deepening customer engagement, streamlining operations, and defending market share against both established competitors and direct-to-consumer disruptors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARHAUS, LLC

- Ashley Furniture Industries, Inc.

- Bassett Furniture Industries, Inc.

- Bernhardt Furniture Company

- Chateau d'Ax S.p.A.

- Dorel Industries Inc.

- Ethan Allen Interiors Inc.

- Flexsteel Industries, Inc.

- Man Wah Holdings Limited

- Natuzzi S.p.A.

- Wayfair Inc.

- Williams-Sonoma, Inc.

Actionable Strategic Recommendations for Furniture Industry Leaders to Capitalize on Emerging Trends, Optimize Operations, and Drive Growth

To navigate the evolving home furniture ecosystem, industry leaders should prioritize the development of digital capabilities that seamlessly integrate online and offline channels. Investing in immersive visualization technologies and data-driven personalization can enhance the shopping journey, reduce returns, and foster loyalty. Concurrently, establishing resilient, regionally diversified supply networks will mitigate disruptions and optimize cost structures in the face of shifting trade policies and material price volatility.

Moreover, embracing circular economy models-such as product take-back schemes, refurbishment services, and upcycled materials-can differentiate brands while addressing environmental concerns. Collaborations with technology partners and startups can accelerate innovation in smart furniture and IoT integrations, unlocking new revenue streams and value propositions. Finally, organizations should refine their customer segmentation frameworks to tailor product offerings and marketing messages for distinct demographic and geographic cohorts, ensuring strategic alignment with local preferences and macro-economic conditions.

Outlining a Robust Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Quality Assurance Protocols

The foundation of this research encompasses a multifaceted approach combining extensive secondary research, primary data collection, and rigorous validation protocols. Initially, industry intelligence was gathered from reputable publications, trade associations, government databases, and company reports to establish a comprehensive baseline of market dynamics. This phase encompassed tariff schedules, trade statistics, macroeconomic indicators, and consumer behaviour studies.

Subsequently, targeted interviews with senior executives, supply chain experts, and channel partners were conducted to capture qualitative insights and context. Responses were cross-validated against quantitative data points to ensure consistency and accuracy. Finally, data triangulation techniques were employed, reconciling inputs from different sources and methodologies. Throughout, strict quality control measures-including peer reviews, logic checks, and revision cycles-upheld the research’s integrity and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Furniture Market, by Product Type

- Home Furniture Market, by Material Type

- Home Furniture Market, by Type

- Home Furniture Market, by Distribution Channel

- Home Furniture Market, by End Use

- Home Furniture Market, by Region

- Home Furniture Market, by Group

- Home Furniture Market, by Country

- United States Home Furniture Market

- China Home Furniture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights Synthesizing Core Findings, Strategic Implications, and Forward-Looking Perspectives for Home Furniture Stakeholders

This executive summary has distilled the critical forces reshaping the home furniture industry-highlighting digital transformation, sustainability imperatives, tariff impacts, detailed segmentation profiles, and differentiated regional strategies. By synthesizing learned insights, stakeholders are equipped with a clear understanding of where and how to allocate resources, innovate product lines, and optimize market approaches.

Looking ahead, the accelerating convergence of consumer expectations, technological advances, and regulatory shifts will continue to redefine competitive landscapes. Organizations that proactively embrace agility, invest in data-driven decision-making, and cultivate strategic partnerships will be best positioned to capture emerging opportunities and navigate potential challenges. Ultimately, the path forward demands a balanced emphasis on growth, resilience, and responsible practices.

Take the Next Step Toward Market Leadership by Connecting with Ketan Rohom to Secure Your Detailed Home Furniture Market Report

Don’t miss the opportunity to gain a critical competitive edge by securing direct access to in-depth market intelligence designed for decision-makers. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this comprehensive home furniture market research report can be tailored to address your organization’s unique strategic priorities and growth objectives. Discover how granular insights, trend analyses, and expert recommendations can support your next phase of expansion.

Act now to schedule a consultation, learn about customized research options, and take advantage of early-access benefits. Connect with Ketan to unlock the data-driven insights essential for shaping product roadmaps, refining go-to-market strategies, and staying ahead of evolving consumer demands in the dynamic home furniture arena.

- How big is the Home Furniture Market?

- What is the Home Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?