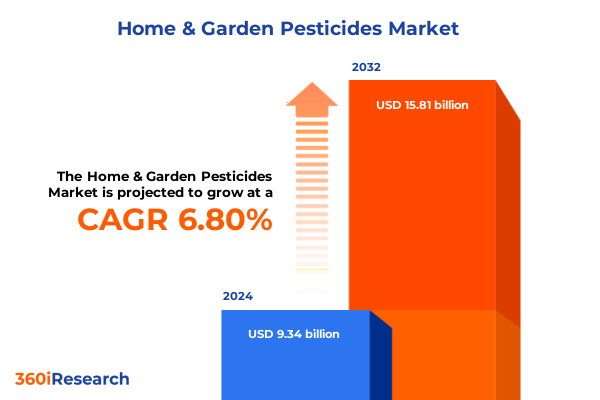

The Home & Garden Pesticides Market size was estimated at USD 9.98 billion in 2025 and expected to reach USD 10.70 billion in 2026, at a CAGR of 6.78% to reach USD 15.81 billion by 2032.

Explore the dynamic Home & Garden Pesticides ecosystem, unveiling core drivers, consumer motivations, and key contextual factors that define the market today

The home and garden pesticide market has evolved into a complex ecosystem driven by shifting consumer behaviors, environmental awareness, and innovations in pest control. Homeowners are no longer content with traditional over-the-counter solutions; they demand products that align with their health concerns, sustainability goals, and gardening aspirations. As urban gardening and boutique landscape projects flourish, pest management has become integral to preserving both aesthetic appeal and plant health. The interplay of climatic variability and emerging pest species further underscores the need for adaptive, reliable solutions, positioning pest control at the forefront of home and garden maintenance narratives.

Moreover, the rise of digital platforms and e-commerce channels has democratized access to specialized pest control formulations and delivery systems. Consumers are now researching and purchasing advanced tools-from precision spray nozzles to smart monitoring devices-directly from manufacturer websites and marketplaces. Regulatory scrutiny on chemical usage has intensified, prompting brands to enhance transparency in labeling and invest in bio-based innovations. Collectively, these factors underscore the critical importance of understanding core market drivers, laying a solid foundation for this comprehensive look at the home and garden pesticide landscape.

Reveal the transformative shifts revolutionizing home and garden pest control, highlighting sustainability, technological innovation, and evolving regulatory pressures

The home and garden pesticide sector is undergoing transformative shifts that are redefining how products are developed, marketed, and applied. A pivotal movement toward organic and natural alternatives reflects heightened consumer concern over the long-term effects of synthetic chemicals on human health and ecosystems. Bio-based solutions derived from botanical extracts and microbial agents are gaining traction, reshaping product pipelines and prompting incumbent manufacturers to diversify their portfolios.

In parallel, technological innovation is catalyzing smarter pest management approaches. Internet-enabled sensors, automated detection systems, and precision application devices enable targeted treatments that minimize chemical usage while maximizing efficacy. These advancements support Integrated Pest Management frameworks, which blend biological, cultural, and chemical methods into holistic strategies. Consequently, the sector is transitioning from broad-spectrum sprays to data-driven targeting, enhancing both environmental stewardship and consumer confidence in product performance.

Regulatory landscapes are also evolving in response to environmental imperatives and public health priorities. Stricter labeling requirements and approvals for new active ingredients are accelerating the displacement of high-risk chemicals, fostering a climate of continuous innovation. Collectively, these sustainability, technology, and regulatory forces are converging to transform the home and garden pesticide arena into a more efficient, transparent, and environmentally conscious domain.

Examine the cumulative impact of the United States’ 2025 tariff measures on home and garden pesticide supply chains, costs, and sourcing strategies

In 2025, U.S. trade policy introduced a 10% across-the-board tariff on chemical imports from key trade partners, including China. This measure encompassed many active ingredients used in household and garden pesticide formulations, leading to a reassessment of global sourcing strategies and pricing models. While the administration granted exemptions for certain herbicides such as diquat and paraquat, the broader crop protection sector has nonetheless experienced upward pressure on procurement costs and extended lead times for critical inputs.

Industry leaders who had weathered earlier tariff cycles under prior administrations applied those mitigation frameworks to ease the immediate financial impact. By leveraging long-term supplier agreements and shifting incremental volumes to alternative manufacturing bases, some organizations effectively insulated their formulations business from steep cost escalations. Nevertheless, the cumulative effect of tariff measures has spurred a strategic pivot toward regional sourcing within North America and Latin America, as companies seek to bolster supply chain resilience and reduce dependency on distant production hubs.

Looking ahead, the persistence of reciprocal duties on both formulated products and raw materials is reshaping the economics of home and garden pest control. Manufacturers and distributors are increasingly evaluating tariff pass-through strategies and exploring local formulation partnerships to safeguard margins and ensure consistent product availability for end users.

Unlock segmentation insights spanning product types, formulations, sales channels, application areas, methods, active ingredients, and end users to guide strategic decisions

In dissecting market segmentation, it becomes clear that product type differentiation-spanning fungicides, herbicides, insecticides, and rodenticides-drives portfolio decisions. Within herbicides, the distinction between pre-emergent and post-emergent formulations informs both application timing and product messaging, while rodenticide options bifurcate into anticoagulant and non-anticoagulant chemistries. Formulation diversity further shapes market access, as aerosol, gel, granular, liquid, and powder presentations each fulfill specific use-case requirements, with liquid concentrates and ready-to-use solutions catering to professional applicators and DIY gardeners alike.

Sales channel analysis reveals a balance of traditional brick-and-mortar outlets-DIY stores, garden centers, and specialty shops-and digitally enabled routes to market. Online distribution channels encompass both brand-owned websites and broader e-commerce marketplaces, expanding geographic reach and fostering direct consumer engagement. Application area segmentation underscores the duality of indoor and outdoor usage scenarios; indoor products target houseplants and structural surfaces, while outdoor solutions are engineered for lawns, ornamental plants, and soil treatment regimens.

Application methods play a pivotal role in user experience and efficacy, with bait, dust, and spray technologies each offering distinct delivery mechanics for pest control. Active ingredient preferences also vary, as bio-based formulations rooted in botanical and microbial science compel a growing segment of the market to pivot away from traditional synthetic chemistries. Finally, end-user segmentation distinguishes between professional landscape services-encompassing both commercial landscapers and institutional clients-and residential consumers managing DIY pest control programs. This multifaceted segmentation framework informs strategic positioning, product innovation, and targeted marketing tactics across the home and garden pesticide landscape.

This comprehensive research report categorizes the Home & Garden Pesticides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Sales Channel

- Application Area

- Application Method

- Active Ingredient

- End User

Delve into key regional dynamics across the Americas, EMEA, and Asia-Pacific territories, illuminating demand drivers, regulatory landscapes, and growth catalysts

Regional dynamics exert a profound influence on market trajectories and strategic priorities. In the Americas, favorable regulatory frameworks and a strong DIY gardening culture underpin sustained demand for both synthetic and bio-based pest control solutions. North American producers and distributors benefit from robust distribution networks and proximity to key ingredient manufacturers, enabling efficient restocking cycles and responsive customer support. Latin America, in contrast, is emerging as both a growth frontier and a creative hub for biological pest management research, driven by public and private sector investments in sustainable agriculture.

The Europe, Middle East & Africa region presents a mosaic of regulatory stringencies and environmental mandates that are accelerating the shift toward low-risk and organic pesticide alternatives. European markets in particular lead in adopting integrated pest management guidelines and stringent residue monitoring, prompting manufacturers to customize formulations for compliance. Meanwhile, Middle Eastern and African markets demonstrate increasing receptivity to durable, water-efficient application methods that address arid climate challenges.

Asia-Pacific markets are characterized by rapid urbanization, evolving consumer purchasing behaviors, and heightened pest pressures driven by climate volatility. In nations such as Australia and Japan, strict chemical registration processes coexist with a growing appetite for eco-friendly, non-toxic options. Southeast Asian and South Asian markets are witnessing accelerated adoption of digital distribution platforms, bridging rural-urban divides and creating new pathways for innovation diffusion.

This comprehensive research report examines key regions that drive the evolution of the Home & Garden Pesticides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain penetrating insights into the strategies, portfolios, and competitive positioning of leading pesticide manufacturers dominating the home and garden market

A cohort of leading companies continues to shape the home and garden pesticide space through robust R&D pipelines, strategic alliances, and targeted acquisitions. Bayer leverages its broad life-science portfolio to introduce novel active ingredients and formulation technologies, while Syngenta applies lessons from prior tariff cycles to optimize its global supply chain and refine its biologicals portfolio for home and garden applications. BASF’s focus on dual-mode insecticides and precision spray solutions underscores its commitment to efficacy and sustainability, and the company’s collaboration with tech providers is advancing data-driven application systems.

The Scotts Miracle-Gro Company and SC Johnson continue to capitalize on brand recognition and extensive retail partnerships, combining consumer insights with integrated pest management offerings to expand their market footprint. DuPont de Nemours and Reckitt Benckiser apply chemical innovation and marketing acumen to sustain product differentiation, while smaller specialty players introduce niche bio-based and formulation enhancements that compel established brands to continuously elevate performance and safety standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home & Garden Pesticides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bayer AG

- Central Garden & Pet Company

- Corteva Agriscience

- FMC Corporation

- Godrej Consumer Products Ltd

- Henkel AG & Co KGaA

- Nufarm Limited

- Organic Laboratories Inc

- Reckitt Benckiser Group plc

- SC Johnson & Son Inc

- Spectrum Brands Holdings Inc

- Sumitomo Chemical Co Ltd

- Syngenta Group

- The Scotts Company LLC

- UPL Limited

- Willert Home Products

- Woodstream Corporation

Discover actionable recommendations enabling industry leaders to capitalize on emerging trends, optimize operations, and drive growth in the home and garden pesticide sector

Industry leaders should prioritize investment in bio-based active ingredients and biological control agents to meet escalating regulatory expectations and consumer demand for natural solutions. By expanding internal R&D programs and forging partnerships with botanical extraction specialists, companies can accelerate time-to-market for next-generation formulations. Concurrently, integrating digital decision-support tools into product offerings will afford end users real-time application guidance, reducing misuse and enhancing satisfaction.

Supply chain resilience must be bolstered through diversified sourcing strategies and regional manufacturing footprints. Cultivating relationships with North American and Latin American ingredient suppliers can mitigate the unpredictability of tariff regimes and geopolitical tensions, ensuring continuity of supply. In marketing, segment-focused communication-tailored to professional landscapers, residential gardeners, and online consumers-will heighten relevance and drive adoption. Finally, embedding sustainability metrics into product development and performance claims will reinforce brand credibility and secure competitive advantage in a market increasingly governed by environmental stewardship __.

Understand the research methodology combining primary interviews, secondary data analysis, and triangulation protocols underpinning this comprehensive analysis

This analysis harnesses a mixed-method research framework to deliver robust and credible insights. Primary data were collected through in-depth interviews with industry executives across leading pesticide manufacturers, distributors, and formulation specialists. These conversations provided nuanced perspectives on product development pipelines, supply chain strategies, and regulatory compliance challenges.

Complementing primary research, secondary data were meticulously aggregated from government and regulatory publications, peer-reviewed journals, trade association reports, and leading industry news sources. Publicly available customs and trade databases were examined to track tariff implementations and exemptions, while e-commerce analytics informed assessments of distribution channel evolution.

Data triangulation protocols were employed to reconcile qualitative findings with quantitative reference points, ensuring consistency and validity. Insights were iteratively validated through cross-check workshops with domain experts and an advisory panel, guaranteeing that this report reflects the latest market developments and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home & Garden Pesticides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home & Garden Pesticides Market, by Product Type

- Home & Garden Pesticides Market, by Formulation

- Home & Garden Pesticides Market, by Sales Channel

- Home & Garden Pesticides Market, by Application Area

- Home & Garden Pesticides Market, by Application Method

- Home & Garden Pesticides Market, by Active Ingredient

- Home & Garden Pesticides Market, by End User

- Home & Garden Pesticides Market, by Region

- Home & Garden Pesticides Market, by Group

- Home & Garden Pesticides Market, by Country

- United States Home & Garden Pesticides Market

- China Home & Garden Pesticides Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesize the findings from this analysis to highlight overarching insights, strategic imperatives, and the future outlook for home and garden pesticide stakeholders

Drawing together the key findings, it is evident that the home and garden pesticide market is transitioning toward greater sustainability, technological sophistication, and regulatory compliance. The shift to bio-based active ingredients and integrated pest management frameworks is reshaping product portfolios, while digital tools and precision application methods are enhancing effectiveness and user experience.

Trade policies and tariff measures have catalyzed a reorientation of supply chains, driving manufacturers to pursue regional production alliances and diversify procurement strategies. Concurrently, the segmentation landscape-encompassing formulation preferences, application areas, and end-user profiles-offers a roadmap for targeted product innovation and channel engagement.

Ultimately, success in this dynamic environment will hinge on the ability to integrate sustainability commitments, leverage data-driven technologies, and adapt to evolving regulatory frameworks. Stakeholders who embrace these imperatives will be best positioned to capture growth opportunities and solidify leadership in the home and garden pesticide sector.

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure the full market research report and discover opportunities in the home and garden pesticide sector

Thank you for exploring this executive summary. To access the complete home and garden pesticides market report and gain deeper intelligence on competitive landscapes, emerging opportunities, and strategic imperatives, engage with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through tailored solutions and demonstrate how these insights can translate into actionable growth plans for your organization. Reach out to secure the full research deliverable and position your business to capitalize on market dynamics in the home and garden pesticide sector.

- How big is the Home & Garden Pesticides Market?

- What is the Home & Garden Pesticides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?