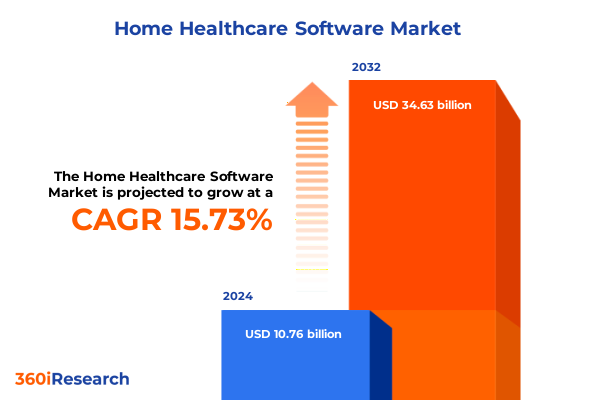

The Home Healthcare Software Market size was estimated at USD 12.42 billion in 2025 and expected to reach USD 14.35 billion in 2026, at a CAGR of 15.77% to reach USD 34.63 billion by 2032.

Pioneering the Future of Home Healthcare Software through Innovative Integration, Patient-Centric Solutions, and Optimized Care Delivery

The landscape of home healthcare is undergoing a profound transformation as providers and technology partners collaborate to deliver care that extends well beyond clinic walls. Innovations in software platforms are redefining how clinical teams coordinate care across distributed settings, optimize financial operations, and engage patients more deeply. This report delves into the current home healthcare software environment, examining the critical drivers of adoption, the evolving expectations of end users, and the competitive dynamics that shape market trajectories.

As regulatory frameworks evolve and consumer demand for personalized, technology-enabled care accelerates, software solutions are becoming indispensable tools for agencies, ambulatory clinics, hospitals, and individual patients alike. The integration of electronic health records with patient engagement portals, financial management systems, and telehealth modules underscores the convergence of clinical excellence with digital efficiency. Throughout this executive summary, we will unpack the key shifts influencing the sector, explore the impact of recent policy measures, and provide actionable insights that empower stakeholders to navigate a rapidly changing market.

Revolutionary Shifts Reshaping Home Healthcare Software: Embracing AI, Telehealth Expansion, and Regulatory Evolution for Enhanced Patient Outcomes

Home healthcare software is being reshaped by a confluence of technological breakthroughs and shifting care paradigms. Artificial intelligence is now instrumental in predictive analytics, enabling providers to identify high-risk patients and proactively intervene to prevent readmissions. Machine learning algorithms embedded within electronic health record systems can analyze vast datasets to recommend personalized care pathways, enhancing clinical outcomes while reducing operational inefficiencies.

At the same time, telehealth modalities have transcended early skepticism to become integral components of care delivery. The rise of asynchronous telehealth allows patients to transmit health data and communications at their convenience, while synchronous video consultations facilitate real-time interactions between clinicians and patients. These telehealth solutions not only expand access in rural and underserved areas but also improve patient satisfaction through greater flexibility.

Regulatory evolution continues to catalyze transformation, as reimbursement policies adapt to recognize virtual care services and cross-state licensure compacts simplify provider mobility. Enhanced interoperability standards and data privacy frameworks are fostering greater collaboration among stakeholders while safeguarding sensitive information. Together, these trends are converging to carve a new frontier in home healthcare, where digital sophistication and patient-centered design drive sustainable growth.

Assessing the Far-Reaching Impact of United States Tariffs in 2025 on Home Healthcare Software Supply Chains, Costs, and Global Collaborations

The implementation of new United States tariffs in 2025 has introduced a layer of complexity to the procurement of hardware components and software licenses integral to home healthcare solutions. Suppliers of clinical monitoring devices and telehealth equipment have faced rising input costs, prompting software vendors to reevaluate their supply chain strategies. Some have responded by localizing certain development and manufacturing processes to mitigate tariff-related expenses, while others have pursued strategic partnerships to diversify their sourcing.

These tariffs have also influenced pricing models, as vendors balance the need to maintain profitability with the imperative to offer competitive subscription rates. The increased cost of imported medical-grade cameras, sensors, and networking equipment has, in some instances, been partially passed through to end users in the form of higher service fees. However, innovative software providers are countering this pressure by accelerating the adoption of cloud-based infrastructures and open-source frameworks, reducing reliance on proprietary hardware and streamlining maintenance.

Ultimately, the cumulative impact of the 2025 tariffs has underscored the importance of resilience and agility. Home healthcare software companies that have anticipated policy shifts and proactively optimized their supply chains are better positioned to sustain margins and deliver uninterrupted service to a diverse clientele.

Deep-Dive into Essential Segmentation Insights: Analyzing Product Types, Deployment Modes, End Users, and Applications Shaping the Home Healthcare Software Ecosystem

Insights into the segmentation of the home healthcare software market reveal a multifaceted ecosystem in which diverse solutions intersect to serve distinct customer needs. Within the product type dimension, clinical solutions have emerged as foundational tools, integrating care coordination, electronic health records, and medication management to facilitate seamless clinical workflows. Financial management solutions complement these capabilities by enabling efficient claims processing and comprehensive revenue cycle oversight, ensuring fiscal sustainability for providers.

Patient management solutions further enrich the landscape by focusing on the end user experience. Robust patient engagement platforms, remote monitoring tools, and scheduling and staffing modules enable agencies to maintain consistent communication, track vital signs in real time, and allocate caregiving resources effectively. Telehealth solutions, encompassing both asynchronous and synchronous interactions, extend the reach of clinical expertise, breaking down geographical barriers and delivering timely interventions.

Deployment mode plays a pivotal role in determining system architecture and operational flexibility. Cloud-based offerings, whether hosted in private cloud environments tailored to stringent security requirements or deployed via public cloud infrastructures for rapid scalability, empower organizations to adapt quickly to changing demand. Conversely, on-premises deployments, which include enterprise-level installations and standalone configurations, appeal to entities with specific compliance mandates or those seeking greater control over their data environments.

End-user segmentation highlights the varied stakeholders adopting home healthcare software. Ambulatory care facilities, from independent clinics to multi-specialty practices, leverage these tools to streamline outpatient services. Home care agencies, whether large national providers or smaller regional operators, rely on integrated platforms to coordinate care teams and manage operations. Hospitals incorporate home healthcare modules to extend continuity of care beyond discharge, while individual patients increasingly engage with consumer-facing applications for remote consultations and self-management.

Application-oriented segmentation underscores the breadth of functionalities at play. Billing and financial management components, inclusive of claims management and revenue cycle modules, ensure that economic considerations are addressed. Electronic health records form the backbone of clinical data aggregation, while scheduling and staffing solutions optimize workforce deployment. Telehealth and remote monitoring applications, featuring remote patient monitoring and virtual consultations, deliver critical touchpoints for ongoing care and clinical decision support.

This comprehensive research report categorizes the Home Healthcare Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Mode

- End User

- Application

Unveiling Key Regional Dynamics across Americas, Europe Middle East Africa, and Asia-Pacific Driving Diverse Home Healthcare Software Adoption Trends

Regional dynamics exert a profound influence on the adoption and adaptation of home healthcare software solutions. In the Americas, a combination of progressive reimbursement policies and a growing emphasis on value-based care has spurred significant investments in integrated platforms. Providers in North America lead in the incorporation of advanced analytics and AI-driven modules, while Latin American markets demonstrate rapid uptake of mobile-enabled telehealth services to address infrastructure challenges.

The Europe, Middle East, and Africa landscape is characterized by regulatory heterogeneity and diverse healthcare delivery models. European nations are advancing interoperability initiatives and incentivizing digital health integration, fostering robust markets for clinical and financial management solutions. In the Middle East, governments are investing in smart health strategies to modernize aging care systems, creating opportunities for telehealth and remote monitoring offerings. Meanwhile, sub-Saharan Africa’s resource-constrained settings are witnessing grassroots innovation in lightweight, cloud-native platforms designed for low-bandwidth environments.

Across Asia-Pacific, the convergence of large aging populations and government-led smart city initiatives is driving demand for scalable home healthcare solutions. East Asian economies are at the forefront of deploying AI-powered predictive care models, while South and Southeast Asian regions are rapidly expanding telehealth networks to improve rural access. Collaborative ventures between local technology firms and multinational vendors are accelerating the customization of applications to meet regional linguistic, cultural, and regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Home Healthcare Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Contenders in Home Healthcare Software: Competitive Landscape and Strategic Positioning Insights

Leading providers in the home healthcare software segment are distinguished by their robust technology portfolios, strategic partnerships, and commitment to interoperability. Market incumbents with comprehensive clinical and patient management suites have solidified their positions through continuous innovation and acquisitions that expand telehealth and financial management capabilities. These companies invest heavily in research and development to integrate artificial intelligence features and advanced analytics, ensuring that their platforms can deliver predictive insights that preempt patient deterioration.

Emerging contenders differentiate themselves by focusing on niche applications or underserved market segments. Startups offering specialized remote monitoring devices or user-centric mobile engagement tools are gaining traction, particularly among small to mid-sized home care agencies seeking cost-effective solutions. These innovators frequently adopt agile development methodologies, enabling rapid feature releases and tailored customization, which resonates with providers seeking flexibility in deployment and pricing.

Strategic alliances between established technology firms and healthcare service organizations are further redefining competitive dynamics. Collaboration agreements facilitate seamless data exchange across electronic health records, telehealth portals, and claims management systems. Such partnerships enhance the end-to-end service proposition for clients, combining clinical best practices with cutting-edge digital infrastructure. As market demands evolve, companies that can forge collaborative ecosystems while retaining agility are likely to secure long-term growth and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Healthcare Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlayaCare Inc.

- Allscripts Healthcare Solutions, Inc.

- AxisCare, LLC

- Axle Health, Inc.

- CareCloud, Inc.

- CareSmartz360, Inc.

- Casamba, Inc.

- ClearCare, LLC

- Delta Health Technologies, Inc.

- GE HealthCare Technologies Inc.

- HealthHero Ltd.

- Homecare Homebase, Inc.

- ISAAC Healthcare Software, Inc.

- KanTime, Inc.

- Koninklijke Philips N.V.

- MatrixCare, LLC

- McKesson Corporation

- Medical Information Technology, Inc.

- Mediware Information Systems, Inc.

- Medtronic plc

- NextGen Healthcare Information Systems, LLC

- Procura, LLC

- ResMed Inc.

- Thornberry Ltd.

- WellSky, Inc.

Actionable Recommendations for Industry Leaders to Capitalize on Technological Advances, Regulatory Shifts, and Market Opportunities in Home Healthcare Software

To capitalize on the accelerating digitization of home healthcare, industry leaders should prioritize the integration of artificial intelligence into clinical and operational workflows. By embedding predictive analytics into electronic health records and remote monitoring platforms, organizations can anticipate care gaps, personalize interventions, and reduce unplanned hospital readmissions. Investing in data literacy initiatives and cross-functional analytics teams will enable more nuanced interpretation of insights, translating raw data into actionable care strategies.

At the same time, embracing hybrid deployment architectures that blend private cloud security with the agility of public cloud services will empower providers to scale rapidly while maintaining compliance. Establishing robust governance frameworks that encompass data privacy, interoperability standards, and vendor management can streamline both initial implementation and long-term updates. This dual approach enhances resilience against supply chain disruptions and evolving regulatory requirements.

Furthermore, forging ecosystem partnerships is essential for delivering a seamless end-to-end experience. Collaboration with device manufacturers, network service providers, and healthcare payers can yield integrated solutions that span clinical monitoring, revenue cycle management, and patient engagement. Proactively engaging with regulatory bodies to stay ahead of policy changes and participating in standards consortia will ensure that product roadmaps align with future healthcare directives. By weaving together advanced technologies, adaptable infrastructures, and strategic alliances, industry leaders can unlock new pathways for growth and deliver superior patient outcomes.

Comprehensive Research Methodology Employed to Ensure Rigorous Data Collection, Validation, and Analytical Precision in Home Healthcare Software Insights

This research leverages a multi-pronged methodology designed to ensure accuracy, relevance, and depth. Primary data collection involved in-depth interviews with senior executives from home healthcare agencies, ambulatory care facilities, and software vendors. These conversations provided firsthand perspectives on deployment challenges, feature requirements, and future investment priorities.

Secondary research complemented these insights through the systematic review of industry publications, regulatory documents, and technical whitepapers. Publicly available financial reports and patent databases were analyzed to gauge vendor innovation trends and competitive positioning. Where applicable, vendor press releases and product roadmaps were examined to validate the introduction of new modules and feature enhancements.

Quantitative modeling techniques were applied to synthesize data on deployment preferences, user adoption rates, and functional demand drivers. Segmentation matrices were constructed to map product capabilities against end-user requirements and regional variances. Rigorous validation processes, including triangulation of data points and peer reviews, were employed to mitigate bias and reinforce the credibility of the findings.

Collectively, this combination of qualitative and quantitative approaches ensures a comprehensive examination of the home healthcare software domain, providing stakeholders with trustworthy insights to inform strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Healthcare Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Healthcare Software Market, by Product Type

- Home Healthcare Software Market, by Deployment Mode

- Home Healthcare Software Market, by End User

- Home Healthcare Software Market, by Application

- Home Healthcare Software Market, by Region

- Home Healthcare Software Market, by Group

- Home Healthcare Software Market, by Country

- United States Home Healthcare Software Market

- China Home Healthcare Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Conclusive Perspectives on the Future Trajectory of Home Healthcare Software, Synthesizing Core Findings and Strategic Imperatives for Stakeholders

The evolution of home healthcare software is marked by the convergence of clinical precision, financial intelligence, and patient-centric design. As providers navigate regulatory complexities and supply chain challenges, the imperative to adopt integrated, scalable, and interoperable solutions has never been stronger. The insights presented in this report underscore the importance of agility, collaboration, and data-driven innovation in shaping the sector’s next phase of growth.

Organizations that embrace advanced analytics, hybrid deployment architectures, and strategic alliances are positioned to deliver superior outcomes, enhance operational efficiency, and secure competitive advantage. Regional nuances-from infrastructure readiness in emerging markets to stringent compliance requirements in developed economies-highlight the need for tailored approaches. Meanwhile, segmentation dynamics reveal that the ability to address specific product, deployment, end-user, and application needs will determine vendor success.

Looking forward, stakeholder engagement with policymakers, technology partners, and end users will drive the development of more holistic care ecosystems. By continuing to refine digital strategies and prioritize evidence-based decision-making, organizations can unlock the full promise of home healthcare software: improving patient experiences, optimizing resource utilization, and contributing to the sustainability of health systems worldwide.

Connect with Ketan Rohom to Secure Your Comprehensive Home Healthcare Software Market Research Report and Unlock Actionable Insights Tailored to Your Business Growth

For personalized guidance on leveraging the latest trends and insights in the home healthcare software market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex market intelligence into actionable strategies will ensure your organization secures a competitive edge. Reach out to explore how this comprehensive research report can address your unique priorities, drive informed decision-making, and accelerate business growth. Engage with an advisor who understands both the technological nuances and operational imperatives of the sector, tailoring recommendations specifically to your objectives to maximize ROI and patient care excellence.

- How big is the Home Healthcare Software Market?

- What is the Home Healthcare Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?