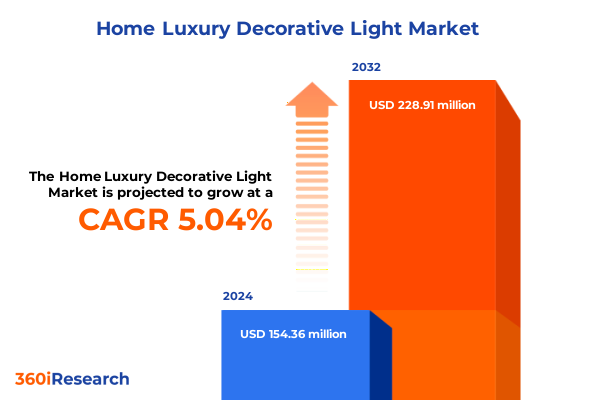

The Home Luxury Decorative Light Market size was estimated at USD 160.84 million in 2025 and expected to reach USD 169.54 million in 2026, at a CAGR of 5.17% to reach USD 228.91 million by 2032.

Exploring the Intricate Dynamics and Emerging Opportunities That Are Shaping the Future Landscape of the Home Luxury Decorative Lighting Market

The home luxury decorative lighting market is undergoing a profound evolution driven by an intersection of design innovation, technological sophistication, and shifting consumer preferences. In recent months, celebrated interior designer Brigette Romanek introduced a collection that seamlessly fuses sculptural artistry with everyday functionality, blending materials such as burnished brass, veined alabaster, and marble with approachable wicker and linen elements to epitomize what industry insiders call "livable luxury". This emphasis on marrying aesthetic boldness with practicality mirrors the broader industry movement toward fixtures that serve as both visual centerpieces and integral components of comfortable living spaces.

Meanwhile, smart technology integration has surged to the forefront of product development, with manufacturers leveraging artificial intelligence to offer adaptive lighting solutions that learn user habits and preferences. Recent analyses highlight AI-driven systems capable of automatically adjusting brightness and color temperature to align with circadian rhythms, reducing energy consumption while enhancing user comfort. Such intelligent features are rapidly becoming hallmarks of premium lighting collections, reinforcing the market’s pivot toward connected, user-centric experiences.

Sustainability considerations further complement these trends, as evidenced by the rising adoption of energy-efficient LEDs and eco-friendly materials like rattan and recycled glass. Reports indicate that an overwhelming majority of luxury buyers-approximately 96%-favor environmentally responsible lighting options when style and budget allow. As a result, design houses are investing in circular manufacturing and long-lasting components to meet both consumer expectations and regulatory demands.

Taken together, these developments underscore a market landscape defined by seamless integration of artistry, intelligence, and environmental stewardship. The convergence of these forces is reshaping product portfolios and creating new avenues for differentiation and value creation across residential and high-end commercial applications.

Identifying the Transformative Technological, Aesthetic, and Consumer Behavior Shifts Redefining the Global Luxury Decorative Lighting Landscape

The luxury decorative lighting industry is experiencing a wave of transformative shifts that extend beyond mere product innovation, encompassing distribution, consumer engagement, and aesthetic philosophies. In design studios around the globe, the concept of "colorful quiet luxury" has gained traction, blending rich yet subdued hues like saffron, aubergine, and moss with minimalist high-quality backdrops to balance emotion and elegance without overpowering the space. This chromatic refinement reflects a broader appetite for personalized, bespoke installations that evoke both serenity and subtle drama.

Simultaneously, biophilic design principles are influencing fixture aesthetics, with sculptural forms inspired by organic shapes and natural materials that evoke dappled sunlight or delicate botanical structures. Such fixtures not only provide illumination but also foster a palpable sense of connection to nature, enhancing occupant well-being and reinforcing the home as a restorative sanctuary.

On the technological front, smart controls have evolved from novelty to necessity, with integrated automation and voice-activated interfaces becoming standard features in ultra-premium product lines. Industry leaders are embedding motion sensors, daylight harvesting algorithms, and intuitive mobile applications into their fixtures, enabling seamless ambiance management and reinforcing the notion of lighting as an experience rather than a mere utility.

Transitioning to distribution models, the online channel has witnessed unprecedented growth, propelled by immersive digital showrooms and augmented reality applications that allow consumers to visualize installations in situ. At the same time, luxury showrooms continue to adapt by offering hyper-personalized in-person consultations, interactive display environments, and exclusive events that solidify brand prestige. This dual-channel approach ensures that discerning buyers can engage with luxury lighting brands in both digital and physical realms, fostering deeper emotional connections and driving premium purchase decisions.

Assessing the Far-Reaching Impacts of the 2025 United States Tariff Landscape on the Supply Chains and Competitive Dynamics of Luxury Lighting Imports

In 2025, the United States imposed several significant tariff measures that have cumulatively reshaped import patterns and cost structures for luxury decorative lighting products. On January 1, the Office of the United States Trade Representative concluded its four-year Section 301 review and increased duties on certain imports from China, notably raising tariffs on metal and crystal components-such as tungsten products-to 25% and on polysilicon used in energy-efficient lighting modules to 50%. These measures, aimed at countering unfair trade practices, have prompted manufacturers and distributors to reevaluate sourcing strategies and explore alternative supply chains.

Moreover, standing Section 232 tariffs instituted in 2018 continue to apply 25% duties on steel and 10% on aluminum, affecting the cost basis for metal frames, fixtures, and alloy elements. The persistence of these duties has driven some brands to accelerate investments in domestic fabrication facilities and foster partnerships with local artisans to mitigate exposure to volatile tariff regimes.

Further compounding the landscape, a sweeping reciprocal tariff framework announced in early April introduced a universal 10% baseline on all imports, with country-specific rates that for China reached 34%, operational from April 5 and April 9 respectively. This regime also eliminated the de minimis exemption for Chinese-origin low-value shipments under $800 starting May 2, subjecting these packages to duty rates of up to 30% or flat fees-dramatically affecting e-commerce platforms selling direct-to-consumer lighting accessories. The removal of this exemption has particularly disrupted small-batch imports and sample shipments, forcing online retailers to absorb increased logistics costs or to adjust pricing structures.

Collectively, these tariff actions have had a profound impact on cost structures, supply chain diversity, and competitive positioning. Brands that have proactively diversified their vendor base and localized critical production steps are better positioned to maintain margin resilience, while those reliant on traditional import channels are navigating tighter profit windows and longer lead times.

Deciphering Critical Market Segmentation Layers to Illuminate Demand Patterns Across Product Types, Channels, Price Tiers, Materials, and Light Sources

An in-depth understanding of the luxury decorative lighting market emerges from a multifaceted segmentation framework that illuminates nuanced demand drivers and purchasing behaviors. Examining product types reveals distinct growth trajectories: ceiling lights command attention in large atrium and foyer applications where expansive impact is paramount, while chandeliers embody opulence in formal dining and entryway settings. Pendant lights and floor lamps offer versatility in both accent and task illumination, catering to design-savvy homeowners seeking statement pieces, whereas table lamps and wall lights address functional needs in intimate or transitional spaces.

Distribution channels also play a pivotal role in shaping market access and brand perception. Offline channels, encompassing department stores, luxury showrooms, and specialty outlets, continue to serve as influential touchpoints for high-net-worth consumers who value personalized, tactile experiences. Conversely, the online segment-comprising both branded e-commerce platforms and third-party marketplaces-extends reach to a digitally native audience, bolstered by immersive visualization tools and streamlined fulfillment models.

From a light-source perspective, LED technology dominates premium offerings, prized for its energy efficiency, longevity, and tunable color spectrum. Yet incandescent and halogen sources retain niche appeal among purists who prioritize the warm glow and color rendering characteristics synonymous with traditional lighting. Additionally, fluorescent fixtures maintain a foothold in certain commercial and hospitality applications where broad-area illumination is prioritized.

Material preferences further segment consumer demand, with crystal and glass components delivering timeless sophistication, metal structures embodying modern minimalism, and wood accents injecting organic warmth. Finally, price-tier segmentation delineates three core strata: High End collections characterized by bespoke designs and artisanal craftsmanship, Premium assortments emphasizing innovative features and select customization options, and Ultra Luxury offerings that cater to exclusive clientele with tailored, one-of-a-kind luminaries. This layered segmentation approach underscores the importance of targeted product development and channel strategies to align with specific buyer personas and purchasing occasions.

This comprehensive research report categorizes the Home Luxury Decorative Light market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Light Source

- Material

- Price Range

- Distribution Channel

Uncovering Regional Nuances and Demand Drivers Shaping the Luxury Decorative Lighting Market Across the Americas, EMEA, and Asia-Pacific

Regional variations in the luxury decorative lighting market underscore the importance of localized design sensibilities, regulatory environments, and consumer behaviors. Across the Americas, the United States and Canada lead demand for bold statement fixtures and integrated smart lighting solutions, buoyed by robust residential renovation activity and rising interest in human-centric lighting that supports wellness and productivity. In Latin America, aspirational buyers gravitate toward artisanal pieces that blend indigenous craftsmanship with contemporary design motifs, reflecting an affinity for cultural heritage and sustainable materials.

Turning to Europe, Middle East & Africa, Western Europe remains a hotbed for artistic expression in lighting, with renowned design houses in Italy, France, and the United Kingdom setting trends in sculptural forms and high-tech integration. The region’s emphasis on energy efficiency and circular economy principles drives adoption of recyclable materials and modular fixtures. In the Middle East, large-scale hospitality and luxury residential projects demand monumental chandeliers and expansive LED installations, often incorporating custom motifs and precious metals to convey status and local identity. Meanwhile, select African markets are emerging as niche hubs for bespoke decorative lighting crafted from reclaimed wood and natural fibers, aligning with sustainability narratives and community-centric production.

Asia-Pacific presents a dynamic landscape marked by divergent growth drivers: in Greater China, the interplay of tariff policies and government incentives has catalyzed domestic manufacturing prowess, enabling local brands to compete on both quality and cost. Southeast Asian markets are witnessing heightened consumer adoption of mid- and high-tier lighting solutions, supported by improving distribution networks and rising urbanization. In Japan and South Korea, design excellence merges with technological innovation, resulting in ultra-refined fixtures that incorporate AI-driven controls and seamless connectivity. These regional insights highlight the imperative for market participants to tailor their value propositions and engagement models in accordance with localized demand drivers and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Home Luxury Decorative Light market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Driving Innovation and Competitive Edge in the Luxury Decorative Lighting Sector

Leading companies in the luxury decorative lighting space are distinguished by their commitment to design leadership, engineering excellence, and holistic customer experiences. At the forefront, European heritage brands have leveraged centuries of artisanal tradition to deliver meticulously crafted fixtures, while simultaneously integrating advanced LED modules and digital controls to meet modern efficiency and connectivity standards. North American players, in turn, have carved out niches by partnering with independent designers to produce limited-edition collections that resonate with design-conscious consumers seeking unique statement pieces.

Innovative start-ups are also disrupting the competitive landscape by focusing on direct-to-consumer models, enabling rapid iteration and personalized customization at scale. These entrants employ data-driven design processes, harnessing customer feedback and usage analytics from smart lighting systems to refine product features and aesthetics. Simultaneously, established corporations with global reach are doubling down on omnichannel distribution strategies and strategic acquisitions to expand their premium portfolios and fortify their positions in emerging markets.

Collaborative alliances between lighting manufacturers and technology firms have materialized as a key differentiator, facilitating the seamless embedding of IoT capabilities and cloud-based controls into fixture designs. Such partnerships empower vendors to offer subscription-based maintenance services and continual feature upgrades, driving recurring revenue streams and cementing long-term customer relationships. Collectively, these company-level strategies underscore the critical role of innovation, agility, and ecosystem thinking in securing competitive advantage in the rapidly evolving luxury decorative lighting sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Luxury Decorative Light market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1stDibs.com, Inc.

- Acuity Brands, Inc.

- Arhaus

- Eaton Corporation plc

- Hubbell Incorporated

- Legrand S.A.

- NVC Lighting Technology Co., Ltd.

- Opple Lighting Co., Ltd.

- OSRAM GmbH

- Panasonic Corporation

- Signify N.V.

- Zumtobel Group AG

Formulating Targeted Strategies and Operational Roadmaps for Industry Leaders to Capitalize on Emerging Trends and Navigate Market Complexities

To thrive amid accelerating technological change and evolving consumer expectations, industry leaders must adopt a dual focus on product innovation and operational resilience. Prioritizing modular, adaptable fixture designs will enable rapid customization and responsive production runs, reducing time to market while accommodating bespoke client requirements. In parallel, brands should invest in advanced manufacturing technologies-such as additive processes and precision robotic assembly-to maintain craftsmanship excellence at scale and buffer against supply chain disruptions.

Strengthening digital engagement capabilities is equally vital; immersive virtual showrooms and augmented reality visualization tools can bridge the gap between physical and digital retail experiences, enabling customers to experiment with configurations in real time. Moreover, integrating AI-driven recommendation engines within e-commerce platforms can personalize the user journey, elevating conversion rates and fostering brand loyalty.

From a supply chain perspective, companies should diversify sourcing networks by establishing partnerships with regional manufacturers and vetted artisanal collectives. This approach not only hedges against geopolitical risks and fluctuating tariffs but also supports local economies and enriches product narratives. Finally, embedding sustainability as a core pillar-through the use of recyclable materials, cradle-to-cradle design, and transparent reporting-will resonate with environmentally conscious luxury consumers and align with tightening regulatory requirements. By implementing these targeted strategies, industry leaders will be well-positioned to capture emerging opportunities and mitigate future uncertainties.

Detailing the Rigorous Methodological Framework Underpinning the Comprehensive Market Study and Ensuring Data Accuracy and Insight Reliability

The insights presented in this report are grounded in a rigorous, multi-source research methodology designed to ensure data validity, comprehensiveness, and analytical depth. Primary research involved in-depth interviews with key stakeholders, including senior executives, product designers, supply chain managers, and distribution partners. These qualitative engagements provided first-hand perspectives on strategic priorities, emerging challenges, and evolving customer preferences.

Complementing primary inputs, secondary research encompassed a systematic review of industry publications, trade journals, regulatory announcements, and patent databases. This phase included analysis of tariff notifications from official government sources and pertinent news outlets to assess policy impacts on supply chains and pricing. Additionally, leading design and architecture platforms were scanned for trend signals to contextualize shifts in aesthetics and functional requirements.

Quantitative data was synthesized from custom surveys targeting high-end residential and commercial end-users, as well as from supplier shipment records to validate consumption patterns across regions and segments. Statistical techniques, such as cross-tabulation and regression analysis, were employed to identify correlation between design features, price tiers, and channel performance. The integrated application of qualitative insights and quantitative evidence underpins the report’s strategic recommendations and ensures actionable intelligence for market participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Luxury Decorative Light market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Luxury Decorative Light Market, by Product Type

- Home Luxury Decorative Light Market, by Light Source

- Home Luxury Decorative Light Market, by Material

- Home Luxury Decorative Light Market, by Price Range

- Home Luxury Decorative Light Market, by Distribution Channel

- Home Luxury Decorative Light Market, by Region

- Home Luxury Decorative Light Market, by Group

- Home Luxury Decorative Light Market, by Country

- United States Home Luxury Decorative Light Market

- China Home Luxury Decorative Light Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings and Strategic Takeaways to Provide a Cohesive Perspective on the Future Trajectory of Luxury Decorative Lighting

The home luxury decorative lighting market stands at a pivotal juncture, shaped by a confluence of design innovation, technological integration, and shifting regulatory dynamics. Through this analysis, we have illuminated how statement lighting, smart automation, and sustainability are converging to redefine consumer expectations and drive product differentiation. Moreover, the marketplace’s segmentation underscores the importance of finely tuned offerings across product types, distribution pathways, light sources, materials, and price tiers.

We have also examined the cumulative impact of recent U.S. tariff policies on supply chain configurations, cost structures, and competitive strategies. The evolving geopolitical landscape underscores the imperative for brands to diversify sourcing, enhance local production capabilities, and fortify digital engagement models. Regionally, the divergent trajectories across the Americas, EMEA, and Asia-Pacific call for nuanced go-to-market approaches that reflect local aesthetics, regulatory standards, and purchasing behaviors.

Finally, profiling leading companies and distilling actionable recommendations provides a roadmap for stakeholders to harness emerging trends and mitigate potential disruptions. As the sector continues to innovate and adapt, those who balance visionary design with operational agility will emerge as the definitive leaders in the next era of luxury decorative lighting.

Unlock Exclusive Access to In-Depth Luxury Decorative Lighting Market Insights by Engaging Directly with Our Associate Director for Sales and Marketing

Ready to transform your strategic approach to the home luxury decorative lighting market and gain unparalleled insights? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive report and elevate your competitive positioning today

- How big is the Home Luxury Decorative Light Market?

- What is the Home Luxury Decorative Light Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?