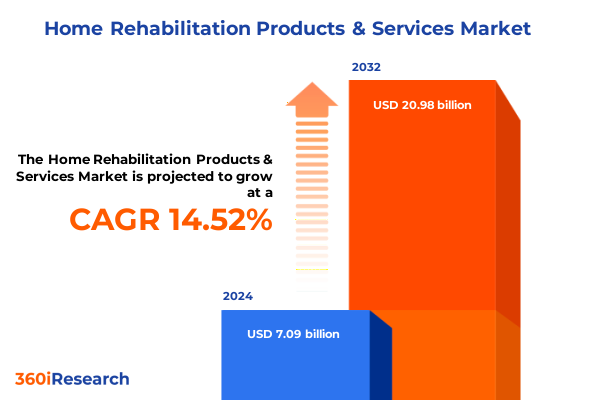

The Home Rehabilitation Products & Services Market size was estimated at USD 8.00 billion in 2025 and expected to reach USD 9.04 billion in 2026, at a CAGR of 14.76% to reach USD 20.98 billion by 2032.

Home rehabilitation solutions ascend as aging demographics drive demand for autonomy cost-effective care and modernized at-home clinical support

The convergence of demographic evolution and rising demand for patient-centered care has driven the home rehabilitation products and services sector into an era of unprecedented transformation. As the U.S. population age 65 and older surged to 61.2 million in 2024, representing 18.0 percent of the total population, the imperative to enable aging in place has never been more pronounced. This shift reflects not only a growing preference for comfort and autonomy but also mounting pressures on traditional institutional care settings as capacity constraints and cost burdens intensify.

Moreover, long-term care affordability challenges are compelling families to explore home-based rehabilitation solutions as a more sustainable alternative. Two-thirds of caregiving in the United States remains informal and unpaid, further underscoring the need for effective assistive products that alleviate the physical and emotional toll on family members. In turn, providers and manufacturers are innovating with purpose, designing equipment that addresses the complex needs of individuals with mobility limitations and functional impairments.

In parallel, service models have evolved to integrate hospital-level care at home, leveraging remote monitoring and multidisciplinary coordination to enhance recovery outcomes. Programs implemented by over 350 U.S. hospitals now deliver clinical interventions, including nurse consultations and digital therapeutics, within the home environment, reducing readmissions and improving patient satisfaction. Together, these forces are redefining the home rehabilitation paradigm, setting the stage for rapid expansion and technological advancement.

Digital therapeutics robotics and telehealth innovations are reshaping home rehabilitation toward personalized data-driven care pathways and outcome-focused models

Advancements in digital therapeutics, data analytics, and connected devices are catalyzing a profound shift in the home rehabilitation sector, enabling more precise, personalized, and scalable interventions. Wearable sensors embedded in mobility aids now capture real-time gait and balance metrics, furnishing clinicians with actionable insights to optimize physical therapy regimens. This integration of biomechanics and cloud-based analytics enhances adherence tracking and outcome measurement, fostering continuous care beyond clinic walls.

Telehealth platforms have concurrently matured, supporting synchronous and asynchronous virtual therapy sessions that bridge geographic barriers and expand access. Home rehabilitation providers increasingly embed tele-rehabilitation modules into service offerings, allowing occupational and speech therapists to conduct interactive assessments and guided exercises remotely. These models align with value-based care incentives, where reimbursement is contingent on demonstrable patient outcomes, driving investments in remote monitoring infrastructure.

Robotic exoskeletons and smart exercise equipment are also entering the home market, delivering assistance and resistance tailored to individual recovery stages. Augmented reality applications further enrich therapeutic engagement by gamifying exercises to improve motivation and adherence. As a result, the home rehabilitation landscape is evolving from reactive support to proactive, data-driven care pathways, underscoring the potential to improve functional independence across diverse patient populations.

Analysis of the 2025 US tariff landscape reveals significant duty hikes on rehabilitation equipment components driving supply chain realignment and cost management imperatives

In April 2025, the U.S. implemented a universal import duty of 10 percent on all medical devices and equipment, eliminating prior duty-free provisions and marking a significant departure from longstanding trade policy. Concurrently, reciprocal tariffs introduced tiered levies on select trading partners, imposing a 20 percent duty on EU exports and a 24 percent tariff on goods from Japan, while China faces a punitive aggregate rate of 54 percent when combining Section 301 measures with the new general duty structure. These policies reflect a strategic effort to bolster domestic manufacturing and address perceived unfair trade practices.

Section 301 of the Trade Act continues to exert profound influence on the rehabilitation equipment supply chain. Chinese-origin mobility aids, lifting devices, and supportive seating systems are now subject to an additional 34 percent punitive tariff, compounding the base 10 percent duty and driving total import costs to approximately 44 percent for many product lines. Likewise, critical components such as lithium-ion battery cells and motors, integral to powered wheelchairs and robotic devices, incurred a 25 percent levy starting January 1, 2025, exacerbating cost pressures for manufacturers and distributors reliant on global sourcing.

As a result, industry stakeholders are reevaluating sourcing strategies, exploring nearshore alternatives in Mexico and Eastern Europe, and pursuing tariff exclusion petitions for specialized rehabilitation machinery. These developments underscore the necessity for supply chain resilience and proactive engagement with trade authorities to mitigate downstream cost impacts and preserve product accessibility for patients.

In-depth segmentation across product type end users therapy modalities and age groups uncovers targeted demand dynamics and design imperatives

The home rehabilitation market exhibits multifaceted demand profiles when viewed through the lens of product, end-user, therapy, and demographic segmentation. Within product categories, bathroom safety solutions encompass grab bars, raised seats, and shower chairs, while living aids range from adaptive utensils to dressing assistance implements. Mobility devices extend from basic canes and walkers to advanced scooters and wheelchairs, and therapeutic furniture includes adjustable rehabilitation beds alongside patient lifts and transfer boards. Each subcategory commands distinct functional and regulatory requirements, shaping development priorities and distribution pathways.

End users of these solutions span ambulatory care centers, home environments, hospitals, long-term care facilities, and specialized rehabilitation clinics. Ambulatory settings emphasize compact, portable aids that support short-term mobility, whereas home users prioritize comfort, ease of installation, and aesthetic integration. Hospitals and care centers demand durable, high-capacity equipment capable of withstanding frequent sanitization and heavy usage, and long-term care providers value modular systems that adapt to evolving patient needs over extended stays.

Therapy type introduces another dimension, as occupational, physical, and speech therapy applications call for tailored support tools. Physical therapists often prescribe resistance-based walkers or gait trainers, whereas occupational interventions leverage daily living aids and ergonomic seating. Speech therapy, while less equipment-intensive, integrates communication devices that complement motor rehabilitation accessories. Age group further refines demand profiles, with pediatric users requiring lightweight, adjustable frames, geriatric patients benefiting from stability-focused designs, and adult populations spanning a spectrum of ergonomic and technological preferences. Understanding these interrelated segmentation layers is essential to align product development with clinical protocols and end-user expectations.

This comprehensive research report categorizes the Home Rehabilitation Products & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Service Category

- Patient Age Group

- Care Delivery Mode

- Technology Intensity

- Distribution Channel

- End User Type

Comprehensive regional overview contrasts market maturation regulatory landscapes and manufacturing hubs across the Americas EMEA and Asia-Pacific

Regional dynamics in the home rehabilitation sector reflect varying demographic trends, regulatory frameworks, and innovation ecosystems across the Americas, EMEA, and Asia-Pacific. In North America, the United States and Canada lead adoption, fueled by robust reimbursement policies and high per-capita healthcare expenditure. Latin American markets, while growing, contend with limited rehabilitation infrastructure and fragmented payer systems that temper large-scale investments, prompting local providers to prioritize cost-effective, durable product lines.

Europe’s diverse regulatory environment, anchored by the Medical Device Regulation (MDR), ensures stringent safety and quality standards, driving manufacturers to pursue CE marking and invest in localized compliance capabilities. Western European countries benefit from integrated healthcare networks that incorporate home rehabilitation into broader care pathways, whereas Central and Eastern European regions are increasingly attractive near-market production hubs due to lower labor costs and improving logistical connectivity.

Asia-Pacific demonstrates a dual narrative of rapid demand expansion and supply-side innovation. Japan, South Korea, and Australia are characterized by advanced aging populations and well-established care protocols, fostering early adoption of smart assistive devices. Meanwhile, emerging economies in Southeast Asia and South Asia present significant growth potential, with expanding middle classes and government initiatives aimed at increasing home care accessibility. The region also serves as a major manufacturing base, with specialized component production for global distribution, underscoring its strategic importance in supply chain networks.

This comprehensive research report examines key regions that drive the evolution of the Home Rehabilitation Products & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive dynamics reveal technology alliances acquisitions and innovation leadership shaping the global home rehabilitation product landscape

Industry participants are navigating an increasingly competitive environment defined by technological differentiation and strategic collaboration. Klika Tech’s partnership with LUCI introduced the first-of-its-kind IoT-enabled smart wheelchair platform, leveraging cloud connectivity and multi-sensor analytics to enhance stability and prevent accidents. Concurrently, Drive DeVilbiss Healthcare expanded its portfolio through the acquisition of De Oro Devices, integrating the NexStride gait-cueing system designed to support neuroambulatory rehabilitation and fall risk reduction.

Meanwhile, 1800Wheelchair’s launch of an advanced power wheelchair scooter underscores the focus on modular, user-centric design that balances comfort with maneuverability. Major global manufacturers such as Sunrise Medical and Ottobock continue to invest in all-terrain mobility solutions and elliptical gait trainers, broadening application scope for diverse therapeutic contexts. Their recent product introductions, including off-road power chairs and pedal-driven MyWay gait trainers, exemplify the drive toward versatility and enhanced functional outcomes.

Strategic alliances and acquisitions remain pivotal, as companies seek to strengthen distribution networks and accelerate innovation cycles. This dynamic landscape rewards entities that combine R&D prowess with market agility, positioning them to capitalize on emerging digital health synergies and evolving reimbursement models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Rehabilitation Products & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apria Healthcare Group, Inc.

- Arjo AB

- DJO Global, Inc.

- Drive DeVilbiss Healthcare, LLC

- Fresenius Medical Care AG & Co. KGaA

- GF Health Products, Inc.

- Hillrom Holdings, Inc.

- Invacare Corporation

- Medline Industries, LP

- Mölnlycke Health Care AB

- Numotion Holdings, LLC

- Ottobock SE & Co. KGaA

- Permobil AB

- Pride Mobility Products Corp.

- ResMed Inc.

- Sunrise Medical LLC

Strategic recommendations emphasize digital integration supply chain resilience and value-based alignment to secure competitive advantage and sustainable growth

To thrive amid evolving trade policies and escalating competition, industry leaders should prioritize the integration of connected health technologies that enable remote monitoring and data-driven therapy optimization. Establishing partnerships with telehealth providers can amplify value propositions by seamlessly incorporating virtual rehabilitation pathways into product ecosystems.

Supply chain diversification emerges as a critical lever to mitigate tariff-induced cost pressures. Firms are advised to secure nearshore manufacturing partners and pursue targeted tariff exclusions for high-value rehabilitation machinery. Engaging proactively with trade authorities and leveraging existing exclusion processes can preserve margin structures and enhance supply resilience.

Aligning product development with value-based care frameworks is equally essential. By collaborating with payers to demonstrate improved functional outcomes and reduced readmissions, manufacturers can position their offerings for prioritized reimbursement. Furthermore, customizing solutions for specific clinical and demographic segments-such as pediatric gait training or senior-focused stability aids-enables precision targeting and heightens clinical adoption rates.

Finally, cultivating geographic agility through regional market intelligence and localized regulatory expertise will empower organizations to navigate varied compliance landscapes and capitalize on growth opportunities across the Americas, EMEA, and Asia-Pacific.

Mixed-method research harnesses primary interviews secondary data review and expert validation to deliver credible home rehabilitation market insights

This analysis employed a mixed-method research design, initiating with an extensive secondary review of trade publications, governmental press releases, and industry news to establish contextual underpinnings. Key federal documents, including the USTR Federal Register notices and U.S. Census Bureau population estimates, were systematically examined to quantify tariff regimes and demographic trends.

Primary research involved structured interviews with senior executives from device manufacturers, rehabilitation service providers, and policy experts. These discussions validated insights on technology adoption, supply chain adaptations, and segmentation drivers. Quantitative data points were triangulated through cross-referencing public filings and reputable news sources, ensuring methodological rigor and reducing bias.

To refine segmentation and regional analyses, expert panels comprising clinicians and market strategists assessed category definitions and end-user requirements. This collaborative vetting ensured that therapeutic, demographic, and geographic clusters accurately reflect real-world demand patterns. Finally, iterative validation with external advisors reinforced the credibility and practical relevance of the findings, producing a robust foundation for stakeholders’ strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Rehabilitation Products & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Rehabilitation Products & Services Market, by Product Category

- Home Rehabilitation Products & Services Market, by Service Category

- Home Rehabilitation Products & Services Market, by Patient Age Group

- Home Rehabilitation Products & Services Market, by Care Delivery Mode

- Home Rehabilitation Products & Services Market, by Technology Intensity

- Home Rehabilitation Products & Services Market, by Distribution Channel

- Home Rehabilitation Products & Services Market, by End User Type

- Home Rehabilitation Products & Services Market, by Region

- Home Rehabilitation Products & Services Market, by Group

- Home Rehabilitation Products & Services Market, by Country

- United States Home Rehabilitation Products & Services Market

- China Home Rehabilitation Products & Services Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 5565 ]

Synthesized insights underscore the critical interplay of demographics technology and policy in driving the evolution of home rehabilitation offerings

The home rehabilitation products and services domain stands at the nexus of demographic imperatives, technological innovation, and policy recalibration. Aging populations are driving an intensified focus on patient autonomy and at-home care solutions, while advancements in digital therapeutics, robotics, and telehealth expand the scope and precision of rehabilitation interventions.

Tariff reforms implemented in 2025 underscore the importance of proactive supply chain strategies and sourcing flexibility to manage cost impacts on critical rehabilitation components. Meanwhile, segmentation insights highlight the need for tailored product development that aligns with specific clinical contexts, end-user preferences, and age-related design considerations. Regional disparities in regulatory landscapes and market maturity further emphasize the value of localized approaches to compliance and distribution.

Against this backdrop, competitive dynamics reveal a sector characterized by strategic collaborations, technology leadership, and targeted acquisitions. Industry leaders who embrace value-based care partnerships, leverage connected health platforms, and diversify manufacturing footprints will be best positioned to navigate evolving market complexities. Collectively, these forces chart a transformative trajectory, reshaping how rehabilitation care is delivered and experienced within the home setting.

Connect directly with Ketan Rohom to access the definitive home rehabilitation report and transform research insights into strategic market advantage

For a deeper dive into the comprehensive insights, detailed analyses, and actionable strategies shaping the home rehabilitation products and services landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to explore tailored research findings, unlock customized market intelligence, and equip your organization with a competitive edge in this dynamic sector. Contact Ketan today to secure your copy of the definitive market research report and transform data into decisive action.

- How big is the Home Rehabilitation Products & Services Market?

- What is the Home Rehabilitation Products & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?