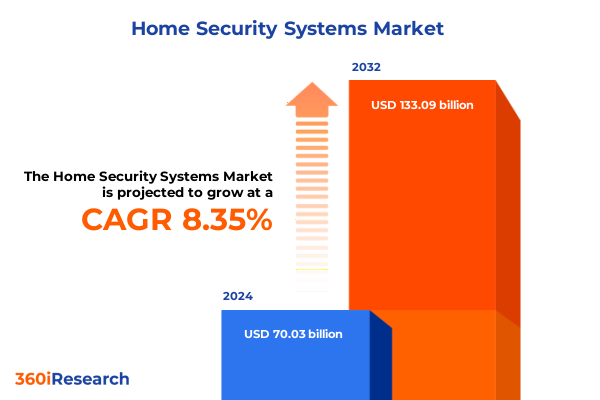

The Home Security Systems Market size was estimated at USD 75.62 billion in 2025 and expected to reach USD 81.71 billion in 2026, at a CAGR of 8.41% to reach USD 133.09 billion by 2032.

Comprehensive Introduction to the Home Security Systems Sector Highlighting Core Trends, Technological Innovations, and Consumer Expectations Driving Growth

The home security systems landscape has undergone a profound transformation as technological advancements, heightened consumer expectations, and evolving threat profiles converge. Once dominated by standalone alarm systems and basic surveillance cameras, the market now embraces an expansive ecosystem of integrated devices that blend hardware, software, and cloud services. As smart sensors, mobile alerts, and artificial intelligence capabilities become ubiquitous, homeowners demand seamless experiences that fuse convenience with robust protection.

Against this backdrop, the industry’s focus has shifted from isolated components to holistic solutions that deliver end-to-end assurance. Customers no longer view security solely as a standalone function; rather, they seek connected environments where access control, environmental monitoring, and video analytics work in harmony. Consequently, providers are compelled to redefine their value propositions by emphasizing interoperability, user-friendly interfaces, and predictive threat detection.

Moreover, the proliferation of wireless connectivity and edge computing has lowered barriers to adoption, enabling a broader demographic of consumers to deploy advanced security measures. As a result, established players and emerging disruptors alike are exploring strategic partnerships and ecosystem alliances to deliver differentiated offerings. In this context, understanding the core market dynamics and aligning with consumer priorities has never been more critical.

Analyzing Transformative Shifts Propelled by IoT Integration, Artificial Intelligence Advancements, and Heightened Cybersecurity Concerns in Home Security

Home security solutions are experiencing a paradigm shift driven by the convergence of Internet of Things frameworks, machine learning innovations, and an intensified focus on cybersecurity resilience. As devices become smarter and more interconnected, providers are embedding artificial intelligence algorithms into cameras and motion detectors to differentiate between benign events and genuine threats. This evolution not only reduces false alarms but also enables real-time risk assessment, empowering homeowners to respond swiftly to anomalies.

Simultaneously, the expansion of mesh networking and low-power wireless technologies has redefined installation models, allowing devices to communicate reliably with minimal infrastructure investment. Service providers and installers can now configure comprehensive systems in a fraction of the time previously required, leading to accelerated deployment and lowered total cost of ownership. In addition, the seamless integration of security platforms with home automation ecosystems ensures that lighting, HVAC, and access control devices operate in concert to deter intruders and enhance occupant comfort.

Furthermore, the industry’s attention to data privacy and encryption has intensified as high-profile breaches underscore the vulnerabilities associated with connected devices. Vendors are adopting secure boot processes, end-to-end encryption, and multi-factor authentication to fortify their offerings against evolving cyberthreats. Consequently, buyers exhibit a growing preference for vendors that can demonstrate robust security protocols, transparent data policies, and continuous firmware updates.

Assessing the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Cost Structures, and Strategic Sourcing Decisions in Home Security Systems

In 2025, a series of new trade measures imposed by the United States government introduced tariffs on key home security components imported from several major trading partners. As a result, manufacturers reliant on overseas production have encountered elevated input costs, prompting many to reassess sourcing strategies and explore alternative manufacturing locations. Consequently, global supply chains are becoming more complex as companies balance tariff mitigation with operational continuity.

Some industry leaders have responded by diversifying their supplier networks, shifting portions of production to regions with more favorable trade terms. Others have accelerated localization efforts, establishing assembly lines closer to end markets to minimize cross-border duties. Meanwhile, a number of vendors have begun adjusting their pricing structures and product portfolios to preserve margin targets, even as consumers weigh affordability against advanced features.

Notably, security integrators and channel partners face new planning uncertainties due to fluctuating lead times and tariff-related cost volatility. To address these challenges, many are forging collaborative forecasting agreements with manufacturers and investing in risk-sharing mechanisms. Ultimately, the cumulative impact of these trade policies has underscored the importance of supply-chain agility and proactive policy engagement, prompting stakeholders across the ecosystem to develop more resilient operating models.

Uncovering Key Segmentation Insights Across System Types, Connectivity Models, Application Environments, Installation Preferences, and Distribution Channels

Deep analysis of the home security market reveals that system diversity now extends from foundational access control and video surveillance solutions to advanced environmental sensors and smart security platforms that incorporate fire and smoke detection capabilities. At the same time, connectivity paradigms have bifurcated, with traditional wired systems still favored in large installations while wireless alternatives leveraging Bluetooth, Wi-Fi, and Zigbee have gained prominence in retrofit scenarios. These connectivity choices affect not only installation complexity but also ongoing maintenance requirements and interoperability with broader smart-home ecosystems.

In terms of application contexts, indoor deployments remain critical for monitoring entry points and living spaces, while outdoor installations provide perimeter protection through weather-resistant cameras and motion-activated lighting. Installation preferences also diverge; some homeowners opt for do-it-yourself setups to maintain control and reduce upfront costs, whereas others rely on professional services that guarantee seamless integration and warranty coverage. Finally, the route to market spans both traditional offline channels-where consumers engage with local installers and retail showrooms-and online platforms that offer direct shipping, subscription-based models, and digital customer support. Collectively, these segmentation insights underscore the need for vendors to tailor product configurations and go-to-market approaches to meet distinct customer requirements and channel dynamics.

This comprehensive research report categorizes the Home Security Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System

- Connectivity

- Applications

- Installation Type

- Distribution Channels

In-Depth Regional Insights Highlighting Market Drivers, Regulatory Dynamics, and Adoption Trends Across Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics in the Americas are shaped by mature markets with high penetration of integrated security platforms alongside emerging economies where basic alarm and CCTV installations continue to expand. Regulatory frameworks in North America encourage interoperability standards and data privacy safeguards, driving demand for solutions that comply with stringent certification requirements. In Latin America, economic growth has spurred interest in comprehensive security systems for residential complexes and small enterprises, although cost sensitivity remains a critical factor.

Across Europe, the Middle East, and Africa, variations in regulatory regimes and infrastructure development create a heterogeneous environment for security providers. Western European markets emphasize advanced analytics, GDPR-compliant data management, and professional installation services, whereas in the Middle East, large-scale construction projects fuel demand for integrated building management and security solutions. In Africa, urbanization trends and rising security concerns in metropolitan centers are catalyzing investments in both traditional and smart security offerings.

In the Asia-Pacific region, rapid technological adoption and government initiatives aimed at smart city deployments have accelerated the uptake of IoT-enabled security devices. Countries with established manufacturing bases are evolving into export hubs, while emerging markets focus on cost-effective wireless systems that deliver immediate value. Moreover, local players often differentiate through value engineering and tiered service models that address diverse consumer segments.

This comprehensive research report examines key regions that drive the evolution of the Home Security Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Home Security Companies and Exploring Their Strategic Initiatives, Partnerships, Product Portfolios, and Innovation Roadmaps

Major players in the home security sector are pursuing distinct strategies to capture value across the evolving landscape. Some global incumbents have expanded their product portfolios through strategic acquisitions of smart-home startups, enabling them to integrate voice control, data analytics, and subscription services into traditional security offerings. Simultaneously, leading technology firms are leveraging existing consumer device ecosystems to cross-sell security cameras, sensors, and automation modules, enhancing stickiness through bundled subscriptions and cloud storage.

Regional specialists and emerging disruptors, by contrast, are focusing on localized innovation and service differentiation. They are investing in user-centric mobile applications, rapid deployment models, and tiered pricing plans that align with specific consumer preferences. Many have also formed alliances with telecommunication providers to embed security services within broader connectivity packages, thereby unlocking new distribution pathways and customer touchpoints.

Across the board, these companies are prioritizing research and development initiatives aimed at improving edge-device intelligence, battery longevity, and cybersecurity resilience. By forging partnerships with chipset manufacturers and software developers, they are positioning themselves to lead in areas such as facial recognition, predictive maintenance, and integrated home automation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Security Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Abode Systems, Inc.

- ADT Inc.

- Ajax Systems

- Allegion PLC

- Assa Abloy

- Bharti Airtel Limited

- Cove Smart, LLC

- Digital Fire and Security Services Pvt Ltd.

- Frontpoint Security Solutions, LLC

- Godrej & Boyce Manufacturing Company Limited

- Hangzhou Hikvision Digital Technology Co., Ltd.

- HomeAutomat

- HomeMate Smart Private Limited

- Honeywell International Inc.

- Johnson Controls International PLC

- NSS Security Systems Pvt. Ltd.

- Optex Pinnacle India Pvt. Ltd.

- Panasonic Holdings Corporation

- Resideo Technologies, Inc.

- Ring LLC

- Robert Bosch GmbH

- Schneider Electric SE

- SECOM PLC

- SimpliSafe, Inc.

- Smartify by AutoDeus Technologies Private Limited

- Snap One, LLC

- Tata Play Services

- Vivint, Inc.

- Wyze Labs, Inc.

- Xfinity by Comcast

Actionable Strategic Recommendations for Industry Leaders to Optimize Supply Chains, Enhance Service Offerings, and Drive Sustainable Competitive Advantages

Industry leaders should prioritize diversification of their supply chains to mitigate the impact of geopolitical uncertainties and ensure continuity of essential components. By identifying alternative manufacturing partners in regions with stable trade relations, companies can reduce exposure to fluctuating tariff regimes and maintain cost competitiveness. In parallel, organizations must invest in scalable cloud-based platforms that support continuous software updates, remote diagnostics, and subscription revenue models.

Furthermore, embedding robust cybersecurity protocols at every layer of the solution stack will differentiate offerings in a market increasingly sensitive to data privacy and system integrity. Leaders should adopt secure development lifecycles, third-party code audits, and zero-trust architectures to build trust with end users. Concurrently, enhancing end-user experiences through intuitive interfaces, voice and mobile integrations, and proactive customer support will foster loyalty and drive higher retention rates.

Finally, forging strategic alliances with home automation and telecommunications providers can unlock bundled service opportunities and create seamless ecosystems. By leveraging cross-industry partnerships, companies can accelerate innovation, expand distribution reach, and deliver compelling value propositions that resonate with both tech-savvy and mainstream consumers.

Detailed Research Methodology Outlining Data Collection, Expert Interviews, Validation Processes, and Analytical Frameworks Underpinning Market Insights

This research employs a multi-phased approach beginning with comprehensive secondary data collection from credible industry publications, regulatory filings, and patent databases to establish a macro-level understanding of market dynamics. Subsequently, the study integrates qualitative insights drawn from in-depth interviews with executives, system integrators, and cybersecurity experts to capture emerging trends and real-world challenges.

To validate these perspectives, a structured primary research phase solicited feedback from a cross-section of stakeholders-manufacturers, distributors, channel partners, and end users-via online surveys and targeted consultations. All data points have been triangulated through multiple sources to ensure consistency and reliability, while conflicting inputs were addressed through follow-up validation rounds and expert workshops.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and technology adoption curves inform the interpretation of findings, enabling the identification of strategic opportunities and potential risks. Rigorous quality control measures, including internal peer reviews and methodological audits, underpin the integrity of the conclusions drawn in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Security Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Security Systems Market, by System

- Home Security Systems Market, by Connectivity

- Home Security Systems Market, by Applications

- Home Security Systems Market, by Installation Type

- Home Security Systems Market, by Distribution Channels

- Home Security Systems Market, by Region

- Home Security Systems Market, by Group

- Home Security Systems Market, by Country

- United States Home Security Systems Market

- China Home Security Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Conclusive Synthesis Emphasizing Critical Insights, Strategic Imperatives, and the Future Outlook for Home Security Systems Stakeholders

This executive summary synthesizes the critical insights gleaned from a thorough exploration of the home security systems landscape, emphasizing the importance of integrating advanced technologies, resilient supply chains, and customer-centric service models. It highlights the transformative role of IoT, AI, and cybersecurity measures in shaping product roadmaps and defines the strategic imperatives for industry participants to thrive amidst trade-related headwinds.

By examining segmentation nuances-from system types and connectivity options to installation preferences and distribution channels-the report reveals the multifaceted nature of consumer requirements and underscores the need for tailored solutions. Regional analyses further elucidate the diverse regulatory, economic, and cultural factors that influence adoption patterns across the Americas, EMEA, and Asia-Pacific.

Ultimately, the insights presented here serve as a foundation for informed decision-making and strategic planning. Organizations that heed these findings, embrace innovation, and foster collaborative ecosystems will be well-positioned to capture growth opportunities and maintain competitive resilience in an increasingly dynamic market environment.

Connect with Ketan Rohom to Access Comprehensive Home Security Systems Market Intelligence and Drive Informed Decisions with a Customized Research Report

To explore how this comprehensive market intelligence can inform your strategic planning and catalyze your growth objectives, connect directly with Ketan Rohom. As Associate Director of Sales & Marketing, he can provide tailored insights and guidance to help you navigate complex supply chain considerations, technology adoption hurdles, and regulatory environments. Engage in a detailed discussion of the research findings and discover actionable next steps to strengthen your competitive positioning. Reach out to schedule a personalized briefing or to obtain your copy of the full home security systems market research report, enabling you to make informed decisions with confidence and drive innovation within your organization.

- How big is the Home Security Systems Market?

- What is the Home Security Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?