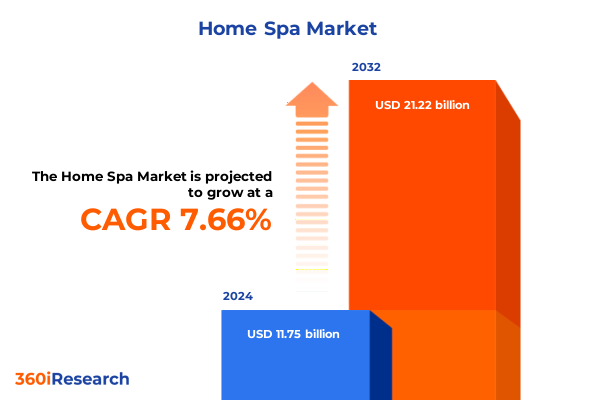

The Home Spa Market size was estimated at USD 12.59 billion in 2025 and expected to reach USD 13.58 billion in 2026, at a CAGR of 7.73% to reach USD 21.22 billion by 2032.

Establishing the Home Spa Market Context Through A Comprehensive Introduction Emphasizing Wellness Trends And Consumer Priorities

The home spa landscape is experiencing an unprecedented convergence of wellness, technology, and personalized self-care that is redefining residential environments. As consumers increasingly view their homes as sanctuaries of rejuvenation, the breadth of products and services designed to satisfy rising expectations has expanded dramatically. From sophisticated hydrotherapy systems to ergonomic relaxation furnishings and premium hybrid formulations, every aspect of the home spa ecosystem is being reimagined.

Against this backdrop, understanding consumer motivations has never been more critical. Homeowners are seeking immersive experiences that integrate seamlessly into daily routines, demanding intuitive interfaces, sustainable materials, and clinically validated benefits. Meanwhile, market participants are challenged to balance cost efficiencies with elevated quality standards, navigating complex supply chains and evolving regulatory landscapes.

This introduction lays the foundation for a deeper exploration of the dynamics transforming the industry. It establishes the report’s scope by highlighting key drivers, emerging categories, and the competitive pressures that define the modern home spa market. Through this lens, stakeholders will gain a clear view of the forces at play and the strategic considerations required to thrive in a rapidly shifting environment.

Examining The Transformative Shifts Reshaping The Home Spa Landscape Through Technology Wellness Integration And Evolving Consumer Expectations

Innovations in digital connectivity and wellness integration are catalyzing a profound transformation in the home spa sector. Traditional hydrotherapy and steam technologies are now augmented by intuitive touchscreen controls, ambient lighting, and app-driven personalization, tailoring each session to individual needs. Furthermore, the rising influence of multi-sensory experiences has prompted manufacturers to embed audio, temperature variation, and even integrative aromatherapy protocols into products previously limited to mechanical functions.

Moreover, sustainability and design convergence have reshaped expectations around materials and form factors. Premium woods, recyclable composites, and biomimetic finishes are becoming the norm, reflecting consumers’ growing environmental consciousness. At the same time, the aesthetic integration of spa systems into home interiors has become a critical differentiator, with seamless cabinetry, compact footprints, and modular configurations enabling spa-like sanctuaries even within urban residences.

Consequently, the competitive landscape now favors agile innovators capable of merging advanced engineering with wellness science and refined design. As health and lifestyle priorities evolve, the home spa industry is poised to redefine luxury living by transforming everyday bathrooms, decks, and dedicated wellness rooms into highly personalized retreats that support holistic well-being and sensory delight.

Analyzing The Cumulative Impact Of United States Tariffs In 2025 On Home Spa Imports Highlighting Cost Pressures And Supply Chain Adaptation

The cumulative impact of updated U.S. tariff measures on home spa components and products has introduced both challenges and strategic imperatives for industry participants. Tariffs under Section 232 continue to impose duties of 25 percent on steel and aluminum inputs, affecting foundational elements such as sauna framing and metal fittings. Simultaneously, Section 301 tariffs remain in force at rates of 7.5 percent or 25 percent, depending on the specific HTS classification, which influences the cost of steam generators, facial devices, and other spa equipment imported from designated countries.

In April 2025, a reciprocal tariff modification lowered certain duties to 10 percent for a limited 90-day period, providing temporary relief on a range of goods. However, this reduction did not extend to all spa-related items, prompting stakeholders to reassess sourcing strategies and inventory planning. The enduring presence of high import duties has incentivized some manufacturers to explore domestic assembly and reclassification options under bonded warehousing protocols. Furthermore, buyers are increasingly negotiating long-term contracts to hedge against duty fluctuations, while suppliers are emphasizing product value through bundled services and extended warranties.

Ultimately, the tariff landscape underscores the necessity of supply chain agility. Firms that proactively engage in customs strategy optimization and cultivate diversified supplier networks are better positioned to mitigate cost pressures. As policy environments continue to evolve, ongoing monitoring and responsive sourcing will be crucial to sustaining competitive pricing and ensuring uninterrupted access to critical spa components.

Uncovering Key Segmentation Insights To Reveal How Product Ingredient Gender Distribution Channel And End User Dynamics Shape The Market

Deep examination of market segmentation reveals distinct pathways for value creation across multiple dimensions. When considering product type, equipment such as body massagers, steam showers, and hot tubs anchor premium offerings, while furnishings like bathtubs and massage beds serve design-driven niches. Complementing these are spa products ranging from exfoliating scrubs to aromatherapy oils that cater to routine self-care rituals. By mapping these sub-categories, industry players can identify where technological integration and material innovation yield the greatest differentiation.

Equally important is the lens of ingredient type, where organic formulations are increasingly prized for their perceived purity, contrasted against synthetic blends that deliver targeted performance. Gender-based analysis further illuminates consumer preferences, with female buyers often gravitating toward multifunctional skincare masks and proprietary facial devices, while male consumers demonstrate rising interest in massage tools and minimalist steam systems. Distribution channel dynamics underscore the continued relevance of brick-and-mortar showrooms for high-touch experiential purchases, even as online platforms gain ground through curated product assortments and subscription models. Finally, segmentation by end user reveals a bifurcation between home-based wellness practitioners-who seek professional-grade equipment-and individual consumers, whose priorities center on ease of use and seamless integration into daily routines.

This comprehensive research report categorizes the Home Spa market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Gender

- Distribution Channel

- End User

Presenting Key Regional Insights Demonstrating How The Americas Europe Middle East Africa And Asia Pacific Drive Distinct Home Spa Strategies

A regional perspective underscores how geographic nuances shape strategy and innovation within the home spa sector. In the Americas, robust consumer spending power and a mature retail infrastructure drive demand for ultra-connected spa systems and premium ingredients. North American adoption of subscription-based service models has further deepened engagement, with consumers trading one-time purchases for ongoing wellness experiences. Cross-border supply chain networks also facilitate access to specialized components from Latin American manufacturers, enhancing product diversity.

Meanwhile, Europe, the Middle East, and Africa present a tapestry of regulatory frameworks and cultural wellness traditions that inform market behavior. European emphasis on sustainability and design heritage encourages the use of locally sourced woods and eco-certified formulations, while the Middle East’s luxury-oriented segment prioritizes large-scale saunas and bespoke installation services. African markets, though nascent, are witnessing rising interest in affordable paraben-free products and compact equipment solutions tailored to emerging middle-class demographics.

Across the Asia-Pacific region, rapid urbanization and digital adoption accelerate uptake of space-efficient spa modules and integrated mobile-app controls. Japanese and South Korean consumers favor high-precision facial steamers and device-led therapies, whereas Australian and New Zealand markets emphasize outdoor sauna innovations. Collectively, regional insights reveal the imperative of localized strategies that marry global best practices with culturally resonant product attributes.

This comprehensive research report examines key regions that drive the evolution of the Home Spa market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Companies Insights Illustrating How Industry Leaders Leverage Innovation Sustainability And Connectivity In The Home Spa Sphere

Leading companies are defining the next generation of home spa through a blend of technological prowess, design leadership, and sustainability commitments. For example, Kohler’s 2025 launch of at-home saunas crafted from premium Scandinavian spruce incorporates ergonomic headrests, ambient lighting, and intuitive touchscreen controls, reflecting an approach that marries heritage aesthetics with modern wellness functionality. This strategy underscores how established brands pivot to capture consumer demand for immersive, customizable experiences.

In the equipment category, Jacuzzi’s SmartTub® System exemplifies how remote monitoring and connectivity can enhance peace of mind and operational efficiency. Through real-time notifications, energy usage tracking, and integration with voice assistants, the platform positions the hot tub itself as an intelligent wellness partner rather than a passive fixture. This digital-first orientation appeals to tech-savvy consumers seeking seamless interaction between their spa systems and broader smart-home environments.

Product innovators are equally active on the sustainability front. L’Oréal’s commitment to eliminate all PFAS from its formulations by the end of 2024 demonstrates a proactive response to environmental and health concerns, aligning with rising consumer demand for clean, transparent ingredient sourcing. Ingredient specialists such as Givaudan are advancing natural and organic extracts, leveraging research into plant-based actives that meet stringent efficacy and eco-certification requirements. Collectively, these companies illustrate diverse pathways to leadership, from smart system integration to ingredient innovation and sustainable design.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Spa market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.G Industries

- Acticon Life Sciences

- Amorepacific Corporation

- Bath & Body Works

- Beurer GmbH

- Bo International

- Caudalie S.A.

- Consern Pharma Limited

- Daxal Cosmetics Private Limited

- Dr Kleenz Laboratories Private Limited

- Elemis Ltd.

- Estée Lauder Companies Inc.

- Farmoganic Health And Beauty

- Harvia Plc

- Jacuzzi Brands, Inc.

- Janki Herbals Private Limited

- L'Oréal S.A.

- Mxofere Diamond Facial Kit

- Reckitt Benckiser Group PLC

- Reviera Overseas

- Shiseido Company, Limited

- Shohan Chemicals Private Limited

- SKCC Personal Care Pvt. Ltd

- Sundãri LLC

- Yaxon Biocare Private Limited

Providing Actionable Recommendations For Industry Leaders To Navigate Emerging Home Spa Challenges And Leverage Growth Opportunities Effectively

Industry leaders can capitalize on evolving market conditions by embracing a multifaceted strategy that prioritizes consumer-centric innovation, operational resilience, and collaborative partnerships. First, integrating advanced digital capabilities into spa systems-such as AI-driven usage personalization and predictive maintenance-will differentiate offerings and foster greater customer loyalty over the long term. By embedding sensors and machine-learning algorithms, brands can transform equipment into adaptive wellness platforms that respond dynamically to user behavior.

Second, developing agile supply chain frameworks will mitigate the impact of fluctuating tariffs and geopolitical shifts. Establishing dual-sourcing arrangements and exploring local assembly hubs can reduce exposure to import duties while shortening lead times. Furthermore, proactive engagement with customs authorities on classification and exclusion processes will ensure tariff mitigation strategies remain current and compliant.

Third, deepening segmentation-driven marketing efforts will unlock niche growth opportunities. By tailoring product portfolios and messaging to specific consumer cohorts-be it organic-seeking wellness practitioners or digitally connected individual buyers-companies can enhance relevance and premium positioning. Collaborative ventures with design studios and wellness influencers can amplify these efforts, creating aspirational narratives that resonate across multiple touchpoints.

Lastly, sustaining momentum in sustainability will remain paramount. Investing in recycled materials, water-efficient technologies, and carbon-neutral manufacturing not only addresses regulatory requirements but also strengthens brand equity. Embracing circularity through take-back programs and refillable packaging can further differentiate products in an increasingly eco-aware marketplace.

Detailing The Research Methodology Underpinning The Home Spa Report Through Rigorous Primary And Secondary Analysis And Expert Validation

This report’s findings derive from a rigorous research methodology combining primary and secondary investigation. Primary research encompassed in-depth interviews with leading executives, wellness practitioners, and distribution channel partners across key regions, capturing firsthand insights into operational challenges and consumer preferences. These qualitative perspectives were complemented by expert roundtables and technical site visits to manufacturing facilities, ensuring a granular understanding of product innovation and supply chain dynamics.

Secondary research involved comprehensive analysis of industry publications, trade association reports, and regulatory filings to map the evolving tariff landscape and competitive positioning. Market registries, patent databases, and corporate disclosures were systematically reviewed to identify strategic investments, partnerships, and sustainability initiatives. In addition, a detailed review of channel-specific data provided clarity on online and offline distribution shifts.

All data sources underwent meticulous cross-validation to ensure consistency and reliability. Triangulation techniques were applied to reconcile quantitative trends with anecdotal evidence, enabling the identification of convergent themes. This integrated approach ensures that both the strategic implications and tactical recommendations presented here rest on a robust and transparent foundation, offering stakeholders actionable intelligence for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Spa market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Spa Market, by Product Type

- Home Spa Market, by Ingredient Type

- Home Spa Market, by Gender

- Home Spa Market, by Distribution Channel

- Home Spa Market, by End User

- Home Spa Market, by Region

- Home Spa Market, by Group

- Home Spa Market, by Country

- United States Home Spa Market

- China Home Spa Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Reflections That Synthesize Core Findings Of The Home Spa Report With A ForwardLooking Perspective On Market Evolution

In synthesizing the core findings, it is evident that the home spa industry stands at the intersection of technological innovation, wellness culture, and sustainability imperatives. The market’s evolution is driven by a sophisticated consumer base seeking seamless integration of spa experiences into their living spaces, prompting manufacturers to embrace connectivity, design excellence, and eco-friendly materials. At the same time, regulatory measures such as U.S. tariff adjustments have underscored the importance of supply chain adaptability and customs strategy optimization.

Segment analysis highlights differentiated growth vectors across equipment, furnishings, and products, with organic formulations and digital interfaces emerging as key differentiators. Regional insights reveal that while the Americas lead in premium smart systems, Europe, the Middle East, and Africa prioritize sustainability and bespoke installations, and Asia-Pacific accelerates adoption through compact, tech-enabled solutions. Industry frontrunners have demonstrated diverse tactics-from remote monitoring platforms to natural ingredient research-that position them for leadership.

Compelling CallToAction To Engage With Ketan Rohom Associate Director Sales Marketing To Secure The Complete Home Spa Market Research Report

To access the comprehensive home spa market research report and gain in-depth insights into the transformative trends shaping the industry, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through the report’s extensive findings and help tailor a package that aligns with your strategic objectives. Whether you are evaluating expansion opportunities, assessing tariff impacts, or exploring emerging segmentation and regional dynamics, Ketan Rohom can ensure you have the actionable intelligence you need. Contact him today to secure your copy and position your organization at the forefront of the home spa evolution.

- How big is the Home Spa Market?

- What is the Home Spa Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?