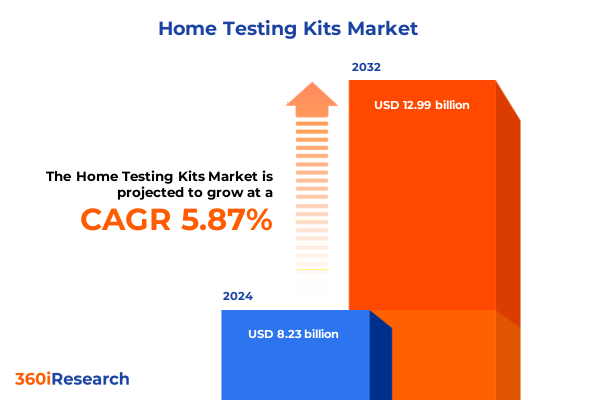

The Home Testing Kits Market size was estimated at USD 10.34 billion in 2025 and expected to reach USD 11.16 billion in 2026, at a CAGR of 8.37% to reach USD 18.17 billion by 2032.

Unveiling the Evolving Home Diagnostics Ecosystem and Its Critical Role in Empowering Consumer-Driven Healthcare Experiences

The home testing kits market has emerged as a pivotal force in modern healthcare, driven by consumers’ growing desire for autonomy and immediacy in managing their well-being. Advances in miniaturized diagnostics, digital connectivity, and user-centric design are converging to create an ecosystem where individuals can reliably monitor key health indicators from the comfort of their homes. This shift reflects a broader democratization of medical insights, empowering people to take proactive control over their health trajectories without the delays inherent in traditional clinical settings.

In recent years, the global health crisis underscored the indispensable value of at-home diagnostics, catalyzing regulatory agility, supply chain innovation, and heightened consumer awareness. Telehealth platforms rapidly incorporated home-based testing into their care pathways, while manufacturers accelerated product development cycles to address urgent needs. As a result, regulatory bodies have introduced streamlined pathways for Emergency Use Authorizations and digital health integrations, establishing a precedent for future product approvals and market entries.

This executive summary synthesizes the transformational trends, regulatory influences, market segmentation, competitive dynamics, and regional variances shaping the home testing kits landscape. By providing an integrated analysis of technological innovations, policy environments, and consumer behaviors, this document equips decision-makers with the clarity and direction needed to navigate a market defined by rapid evolution and high strategic stakes.

Examining the Revolutionary Technological and Behavioral Shifts Accelerating Home Testing Adoption Across the Healthcare Continuum

Home testing solutions are being reshaped by a fusion of cutting-edge technologies and evolving consumer expectations, signaling a departure from conventional diagnostic frameworks toward more patient-centric models. Integration of Internet of Things–enabled sensors with smartphone applications now enables real-time data acquisition and seamless sharing with healthcare providers. Artificial intelligence and machine learning algorithms further enhance diagnostic accuracy, offering personalized risk assessments and tailored health guidance based on individual test results.

Concurrently, behavioral shifts born from widespread telehealth adoption have normalized at-home testing as an essential component of preventive care. Consumers, once hesitant to self-diagnose, now embrace these tools as integral to their health management strategies. Partnerships between diagnostics manufacturers, telemedicine platforms, and pharmacy chains are expanding distribution pathways, ensuring tests are available through both online storefronts and bricks-and-mortar outlets.

Regulatory agencies, having adapted during recent health emergencies, continue to refine guidelines that balance rapid market entry with rigorous safety and performance standards. As reimbursement models evolve to include remote monitoring services, the incentivization of home diagnostics becomes stronger, creating an environment ripe for sustained innovation. These intertwined technological, behavioral, and policy shifts are collectively redefining the parameters of accessible, data-driven healthcare.

Analyzing the Cumulative Financial and Operational Consequences of 2025 U.S. Tariff Regimens on the Home Testing Kit Supply Chain

The introduction of sweeping U.S. tariff measures in early 2025 has imposed layered duties on imported components crucial to home testing kit production. A universal 10 percent tariff now applies to the majority of imports, elevating baseline costs across all product categories. Diagnostic test kit manufacturers sourcing elements from China face additional levies under Section 301, culminating in combined duties that may exceed 50 percent on certain reagents and consumables. Meanwhile, imports from Europe incur supplemental reciprocal tariffs approaching 20 percent, and components from Japan bear tariffs in the mid-20 percent range.

Compounding these measures are long-standing Section 232 duties on steel and aluminum components, which can reach 50 percent for products containing significant metal content. Although Canada and Mexico benefit from USMCA exemptions for many goods, non-USMCA inputs from those markets carry rates of up to 25 percent. Collectively, these layered tariffs are driving manufacturers to reevaluate global sourcing strategies, accelerate near-shoring initiatives, and secure alternative suppliers in India, Southeast Asia, and Latin America.

In response, industry leaders are negotiating with domestic distributors, investing in redundancy across supplier networks, and adopting dual-sourcing frameworks to mitigate delivery delays and margin erosion. While short-term price pressures pose challenges to affordability and accessibility, these policy shifts may ultimately catalyze expanded U.S. production capacity, fostering resilience and innovation in the long term.

Deriving Strategic Insights from Multi-Dimensional Market Segmentation Revealing Customer Preferences and Product Specializations

An in-depth segmentation of the home testing landscape reveals nuanced demand patterns across diverse test modalities and consumer requirements. Diagnostic categories range from basic allergen evaluations to complex genetic analyses, encompassing chronic disease assessments for conditions such as cancer and diabetes, as well as infectious disease panels for COVID-19, hepatitis, HIV, and influenza, and even reproductive health tests like pregnancy kits. Each test type commands specific user profiles and performance expectations, influencing design, regulatory pathways, and marketing strategies.

Beyond modality, sample types further differentiate product offerings: blood remains the gold standard for many markers, while saliva-based assays offer noninvasive convenience and rapid turnaround. Stool tests address gastrointestinal concerns, and urine specimens support both metabolic and reproductive health screens. Usage frequency also plays a crucial role; one-time use panels appeal to episodic needs, whereas recurring subscriptions for chronic condition monitoring facilitate ongoing engagement and data continuity.

Distribution channels and end-use applications layer additional complexity. Traditional pharmacy chains and supermarket outlets cater to impulse and walk-in purchases, while direct-to-consumer company websites and e-commerce platforms enable discreet ordering and subscription renewals. Applications range from disease monitoring to lifestyle tracking-spanning fitness metrics and nutritional assessments-and extend into preventative health screenings. Age demographics further shape demand, with distinct needs and regulatory considerations for adults, pediatric users, and senior populations. A holistic view of these interlocking segments provides the strategic foundation required to tailor products, messaging, and partnerships for maximal market impact.

This comprehensive research report categorizes the Home Testing Kits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Testing Technology

- Usage Frequency

- Application

- Sales Channel

Comparative Regional Analysis Uncovering Distinct Trends and Growth Drivers Across Americas, EMEA, and Asia-Pacific Home Testing Landscapes

In the Americas, established healthcare infrastructure and widespread insurance coverage have fostered robust penetration of home testing technologies. Consumer comfort with telehealth services, coupled with retail pharmacy partnerships, enables seamless distribution across urban and suburban markets. Regulatory environments in the United States and Canada continue refining pathways for test approval, reinforcing consumer trust and facilitating rapid adoption of novel at-home diagnostics.

Across Europe, Middle East & Africa, regulatory frameworks vary widely, from centralized approval processes within the European Union to more fragmented pathways in African and Middle Eastern nations. European markets benefit from cohesive reimbursement schemes that support patient access and drive demand for preventive screening. In contrast, emerging economies in the Middle East and Africa face infrastructure challenges, yet represent high-growth opportunities as digital health initiatives expand and public-private partnerships increase local capacity for distribution and education.

The Asia-Pacific region displays some of the fastest growth trajectories, driven by proactive government support for domestic manufacturing and digital health integration. High smartphone penetration and consumer familiarity with e-commerce have accelerated direct-to-consumer channels, while collaborative ventures between global diagnostics firms and local agencies have streamlined regulatory approvals. Collectively, each region’s distinct regulatory, economic, and consumer landscapes creates a mosaic of opportunities requiring tailored strategies for product launch, pricing, and channel development.

This comprehensive research report examines key regions that drive the evolution of the Home Testing Kits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Market Players Shaping the Competitive Home Testing Kit Ecosystem with Strategic Collaborations

Leading industry participants span a spectrum from legacy diagnostics manufacturers to agile digital health startups. Established players are leveraging broad product portfolios and global distribution networks to maintain market share, while investing heavily in R&D to enhance test sensitivity, reduce turnaround times, and integrate data connectivity for remote monitoring. They are also forming strategic alliances with electronics firms to develop next-generation wearable and smartphone-compatible testing platforms.

Simultaneously, emerging companies are carving out niches with specialized offerings-such as direct-to-consumer genetic tests and personalized chronic disease management subscriptions-capitalizing on consumer demand for tailored health insights. Many are forging partnerships with telehealth providers and pharmacy chains to embed testing across care journeys, enhancing visibility and driving recurring usage models. Through targeted marketing and digital engagement, these newer entrants are disrupting traditional channels and accelerating innovation loops.

Investors and corporate development teams continue to pursue M&A and strategic equity positions, both to acquire proprietary technologies and to secure access to new markets. Joint ventures between diagnostics firms and logistics providers are also emerging, aimed at optimizing cold-chain management and last-mile delivery. By understanding the varied competitive positioning and strategic imperatives of these leading organizations, stakeholders can identify collaboration opportunities and competitive threats in equal measure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Testing Kits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Exact Sciences Corporation

- LifeScan Enterprises LLC

- Becton, Dickinson and Company

- QuidelOrtho Corporation

- Ascensia Diabetes Care Holdings AG

- McKesson Corporation

- Medline Industries, LP

- Sinocare Inc

- Terumo Corporation

- OraSure Technologies Inc.

- Arkray, Inc.

- Eurofins Scientific Limited

- Bionime Corporation

- Biosynex SA

- BTNX Inc.

- TaiDoc Technology Corporation

- VivaChek Biotech (Hangzhou) Co., Ltd.

- BioLytical Laboratories Inc.

- i-SENS, Inc.

- J. Mitra & Co. Pvt. Ltd.

- Prima Lab SA

- AdvaCare Pharma USA

- Atlas Laboratories Ltd

- Atlas Medical GmbH

- Atomo diagnostics

- InTec PRODUCTS, INC.

- Nureca Limited

- SelfDiagnostics OU

- Vitruvian Health

Essential Actionable Strategies for Industry Leaders to Advance Supply Chain Resilience, Innovation, and Consumer Engagement in Home Diagnostics

Industry leaders should prioritize the establishment of resilient, diversified supply chains that blend domestic production capabilities with carefully vetted international partners. By negotiating long-term agreements and adopting dual-sourcing strategies, companies can mitigate the risk of tariff shocks and geopolitical disruptions. Concurrently, investments in modular manufacturing technologies-such as flexible production lines and rapid prototyping facilities-will accelerate time to market and support customization for regional requirements.

Strategic collaborations with telehealth platforms, retail pharmacy chains, and insurance providers can magnify market reach and foster integrated care pathways. Co-developing bundled service offerings-combining testing kits with virtual consultations and post-test coaching-will enhance consumer value and drive higher engagement. Additionally, aligning with regulatory bodies to shape guidelines and demonstrate real-world evidence can smooth approval processes and facilitate reimbursement for novel diagnostics.

Finally, leveraging advanced analytics and user feedback loops to refine test formulations, digital interfaces, and subscription models will ensure offerings remain relevant and user-friendly. By embedding predictive algorithms and personalized recommendations into test reports, companies can shift from reactive diagnostics to proactive health management, fostering long-term loyalty and opening avenues for adjacent services.

Detailed Methodological Framework Outlining the Rigorous Research Approaches Integrating Primary and Secondary Data for Robust Analysis

This analysis harnessed a multi-tiered research framework integrating both primary and secondary data to ensure comprehensive and objective insights. In the primary research phase, structured interviews were conducted with senior executives from diagnostics manufacturers, supply chain specialists, regulatory affairs experts, and telehealth providers to capture nuanced perspectives on emerging trends and strategic responses.

Complementing these interviews, a quantitative survey of end-users across multiple demographics provided real-world feedback on usage patterns, channel preferences, and willingness to pay for various test types. In the secondary research phase, authoritative trade publications, regulatory filings, and government policy documents were systematically reviewed to map tariff structures, approval pathways, and reimbursement schemes. Corporate annual reports and financial disclosures were also analyzed to identify investment trajectories and innovation pipelines.

All data points were triangulated through cross-validation techniques and synthesized using a proprietary analytical model that classifies market influences by technological, regulatory, economic, and behavioral dimensions. This rigorous approach underpins the robust, actionable insights presented herein, ensuring the report reflects current realities and anticipates future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Testing Kits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Testing Kits Market, by Indication

- Home Testing Kits Market, by Testing Technology

- Home Testing Kits Market, by Usage Frequency

- Home Testing Kits Market, by Application

- Home Testing Kits Market, by Sales Channel

- Home Testing Kits Market, by Region

- Home Testing Kits Market, by Group

- Home Testing Kits Market, by Country

- United States Home Testing Kits Market

- China Home Testing Kits Market

- Japan Home Testing Kits Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 7520 ]

Concluding Remarks Synthesizing Core Findings and Highlighting the Strategic Imperatives for Future Developments in Home Testing Diagnostics

The home testing kits sector stands at a pivotal juncture, shaped by accelerated technological advances, shifting consumer expectations, and a rapidly evolving policy landscape. As diagnostic tools become more accessible, connected, and personalized, the industry is transitioning from episodic tests to integrated care pathways that support continuous health monitoring and timely interventions.

Tariff reforms in 2025 have underscored the importance of supply chain agility, prompting companies to reconsider sourcing strategies and invest in domestic production. Meanwhile, nuanced segmentation of test types, sample mediums, usage frequencies, distribution channels, applications, and age groups has highlighted critical opportunities for product differentiation and targeted outreach.

Regional analyses reveal that while mature markets continue to demand incremental innovation and seamless integration with established healthcare systems, emerging economies offer rapid growth potential driven by digital health adoption and supportive government initiatives. Against this backdrop, both established manufacturers and disruptive startups must navigate competitive dynamics through strategic partnerships, robust R&D investments, and consumer-centric business models.

By implementing the actionable recommendations and leveraging the insights delineated in this summary, stakeholders can position themselves to capitalize on the expanding home diagnostics ecosystem, delivering greater value to consumers and reinforcing long-term growth trajectories.

Connect with Ketan Rohom to Secure Your Comprehensive Home Testing Kits Market Report and Drive Strategic Decision-Making for Your Organization

To explore detailed market dynamics, actionable insights, and strategic frameworks tailored to your organization’s needs, connect with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the comprehensive home testing kits report, ensuring you acquire the critical data and recommendations necessary to drive growth, optimize operations, and strengthen your competitive positioning. Reach out today to secure your copy and partner with an expert who can help transform research findings into strategic impact.

- How big is the Home Testing Kits Market?

- What is the Home Testing Kits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?