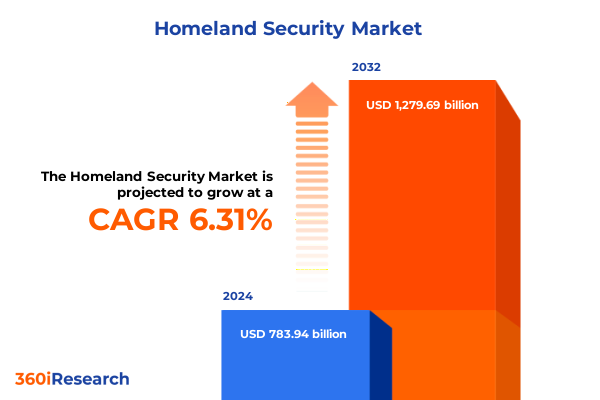

The Homeland Security Market size was estimated at USD 831.59 billion in 2025 and expected to reach USD 882.13 billion in 2026, at a CAGR of 6.35% to reach USD 1,279.69 billion by 2032.

Laying the Foundation for a Comprehensive Exploration of Homeland Security Trends and Challenges Amid Global Technological and Geopolitical Change

In an era defined by technological acceleration, evolving geopolitical tensions, and an expanded range of threats, homeland security remains at the forefront of national priorities. This executive summary sets the stage for an in-depth examination of the forces shaping security policies, procurement decisions, and innovation pathways. By synthesizing market dynamics, regulatory developments, and emerging threat vectors, this overview provides decision-makers with a clear understanding of the environment in which homeland security providers and end users operate.

The analysis within these pages draws upon the latest policy pronouncements, tariff updates, and technology breakthroughs to deliver a cohesive narrative. Through a structured exploration of transformations in threat landscapes, supply chain considerations, segmentation insights, and regional differentiation, readers will gain actionable perspectives. As we navigate through the subsequent sections, the aim is to equip stakeholders with authoritative and timely intelligence that informs strategic direction and investment priorities.

Uncovering the Pivotal Technological, Policy, and Threat Paradigms Reshaping Homeland Security Strategies and Capabilities Worldwide

Over the past few years, homeland security strategies have undergone a paradigm shift driven by converging technological advances and changing threat paradigms. Traditional perimeter protection models have been augmented by data-driven intelligence analytics, enabling predictive threat detection where risks are identified before they materialize. Artificial intelligence and machine learning have empowered cybersecurity solutions to adapt in real time to novel attack patterns, while unmanned aerial systems and smart sensors have enhanced surveillance capabilities both at borders and in critical infrastructure environments.

Simultaneously, policy frameworks and funding priorities have realigned around resilience and interoperability. Cross-agency collaboration has been strengthened through unified data sharing initiatives, reducing operational silos and improving incident response coordination. Public-private partnerships have emerged as a cornerstone for innovation, with government incentives fueling R&D in emerging domains such as quantum encryption and biometric authentication. As threats evolve-from sophisticated cyber espionage to rapidly mobilized transnational crime networks-the homeland security ecosystem is responding with integrated, adaptive, and technology-enabled solutions.

Assessing the Compound Effects of 2025 United States Tariff Measures on Homeland Security Supply Chains and Technology Investments

The cumulative effect of the United States’ 2025 tariff actions has reverberated across homeland security supply chains and technology investment decisions. In early 2025, the restoration of a uniform 25% tariff on steel imports and an equivalent levy on aluminum sought to bolster domestic production, closing exemptions previously granted to key trading partners. However, the subsequent June proclamation escalating steel and aluminum duties to 50% markedly increased the cost base for hardware components integral to security systems, from access control devices to perimeter fencing materials. These shifts have prompted procurement officers to reassess vendor portfolios, favoring suppliers with onshore manufacturing capabilities or tariff mitigation strategies.

Moreover, the initiation of a Section 232 inquiry into semiconductor imports introduced uncertainty for electronics and cybersecurity equipment providers. With semiconductors underpinning advanced surveillance cameras, intrusion detection sensors, and secure communications gear, stakeholders are grappling with potential tariff rates that could start at 25% and escalate over time. This scrutiny reflects a broader administration focus on securing critical technology supply chains, as evidenced by investigations into pharmaceuticals and computing equipment under separate national security reviews. Consequently, industry players are accelerating efforts to diversify sourcing, expand domestic fabrication partnerships, and explore tariff exclusion petitions to preserve competitive pricing in a tightened trade environment.

Unlocking Market Dynamics Through Multi-Dimensional Segmentation in Homeland Security Solutions Spanning Domains and User Scenarios

A multi-dimensional segmentation framework reveals the granularity of demand drivers across homeland security solutions. When considering solution categories, border security encompasses patrol operations and immigration control, the latter further defined by advanced document verification and efficient visa processing workflows. Cybersecurity solutions bifurcate into application, cloud, endpoint, and network domains, each underpinned by specialized sub-capabilities such as dynamic and static analysis for applications or cloud workload protection and identity access management for cloud environments. Meanwhile, intelligence analytics is anchored by predictive analytics and threat intelligence, and physical security integrates access control with biometric and card reader mechanisms, intrusion detection using alarm systems and motion sensors, and surveillance through perimeter security and video monitoring.

Complementing solution segmentation, the component perspective delineates hardware elements like cameras and sensors, services that span consulting, integration, and managed offerings, and software platforms categorized into analytics and management suites. Deployment modes oscillate between cloud-based architectures-whether private or public-and on-premises models tailored to enterprise or small business footprints. End user segmentation captures the breadth of application across defense branches including air, land, and sea forces; federal civilian agencies such as homeland security and justice departments; state and local emergency services and police; and transportation hubs including airports and seaports. Lastly, application-driven segmentation underscores specialized use cases from logical and physical access control to incident forensics and remediation workflows, host- and network-based intrusion detection, and thermal and video surveillance. This nuanced segmentation underscores where investments are concentrated and highlights tailored value propositions needed to address specific operational requirements.

This comprehensive research report categorizes the Homeland Security market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution

- Component

- Deployment

- End User

- Application

Analyzing Regional Nuances and Opportunities in Homeland Security Markets Across the Americas, EMEA, and Asia-Pacific Geographies

Geographic variances in homeland security priorities and procurement cycles underscore the importance of tailored regional strategies. In the Americas, shifting political administrations and evolving cross-border cooperation measures influence border security investments, while significant urban infrastructure expansion drives demand for advanced physical surveillance and cybersecurity fortifications. The region’s emphasis on modernization has spurred collaborative R&D initiatives and digital transformation programs within federal and state agencies.

Across Europe, the Middle East, and Africa, the security landscape is shaped by heterogeneous threat environments and varied regulatory regimes. European Union member states place high value on integrated intelligence analytics platforms and interoperable emergency response systems, whereas Middle Eastern nations prioritize counterterrorism capabilities and critical infrastructure protection. African governments are increasingly coupling capacity-building efforts with managed services partnerships to address resource constraints.

In the Asia-Pacific, rapid urbanization, critical trade routes, and emerging cybersecurity threats drive robust adoption of cloud-based security services and advanced network protection solutions. Nations are focusing on strengthening maritime surveillance, upgrading immigration control systems, and integrating artificial intelligence into threat detection frameworks. Collectively, these regional insights highlight the necessity of adaptable go-to-market approaches aligned with local policies, budgetary cycles, and operational imperatives.

This comprehensive research report examines key regions that drive the evolution of the Homeland Security market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Positioning and Strategic Initiatives of Leading Enterprises Driving Innovation in Homeland Security

Leading organizations within the homeland security ecosystem are differentiating through a combination of technological innovation, strategic partnerships, and service excellence. Legacy defense contractors have expanded their portfolios to include cybersecurity and intelligence analytics capabilities, leveraging their deep understanding of federal procurement processes to secure long-term contracts. At the same time, technology firms specializing in cloud security and AI-driven threat detection have partnered with traditional integrators to provide end-to-end solutions that address both cyber and physical vulnerabilities.

Software vendors continue to invest in next-generation management platforms that unify disparate data streams from sensors, access control systems, and threat intelligence feeds. This aggregation enables real-time situational awareness and rapid response orchestration. In parallel, managed service providers are capitalizing on demand for fully outsourced security operations centers, combining remote monitoring with on-site support for seamless 24/7 coverage. These strategic initiatives underscore how companies are aligning product roadmaps, M&A activity, and alliance networks to capture value across high-growth segments and differentiated procedural requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Homeland Security market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- AeroVironment Inc.

- ASELSAN A.Ş.

- AVEVA Group PLC

- BAE Systems

- Booz Allen Hamilton Holding Corporation

- Bruker Corporation

- Chemring Group PLC

- Cobham Limited

- Elbit Systems Ltd.

- FLIR Systems

- General Atomics

- General Dynamics Corporation

- Honeywell International Inc.

- IDEMIA

- InSource Solutions

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Evolving Threat Landscapes and Market Pressures

Industry leaders must embrace a proactive posture that integrates strategic foresight with operational adaptability. First, investing in modular and scalable architectures enables rapid adaptation to evolving threat scenarios and regulatory changes, ensuring that upgrades and expansions can be implemented with minimal disruption. Second, fostering collaborative ecosystems through technology partnerships and public-private alliances accelerates innovation cycles and enhances collective resilience against sophisticated adversaries.

In parallel, organizations should prioritize workforce transformation by equipping personnel with specialized digital skills in areas such as AI-enhanced analytics, cloud security operations, and unmanned systems management. This capability building is critical for leveraging advanced technologies effectively. Lastly, embedding risk management frameworks into procurement and development processes ensures that supply chain dependencies and geopolitical uncertainties are factored into strategic decisions. By adopting these imperatives, leaders can navigate the complex intersection of policy, technology, and threat evolution to maintain robust security postures.

Detailing Rigorous Research Methodology and Analytical Frameworks Employed to Illuminate Homeland Security Market Insights with Precision

This analysis is built upon a rigorous research methodology that combines primary and secondary sources to ensure accuracy and depth. Secondary research included a comprehensive review of publicly available policy documents, trade fact sheets, executive orders, and industry thought leadership pieces. Primary data was collected through interviews with subject matter experts, procurement officials, and technology providers, offering direct insights into procurement rationales and technology adoption challenges.

Quantitative and qualitative data points were triangulated to validate trends and projections. Technology adoption curves, budget allocation patterns, and tariff impacts were cross-referenced against multiple data sets to mitigate biases. Analytical frameworks such as SWOT and PESTEL were applied to assess the strategic environment, and segmentation models were iteratively refined to reflect end user requirements and solution interdependencies. This methodological approach ensures that the findings presented herein are robust, actionable, and reflective of the dynamic homeland security landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Homeland Security market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Homeland Security Market, by Solution

- Homeland Security Market, by Component

- Homeland Security Market, by Deployment

- Homeland Security Market, by End User

- Homeland Security Market, by Application

- Homeland Security Market, by Region

- Homeland Security Market, by Group

- Homeland Security Market, by Country

- United States Homeland Security Market

- China Homeland Security Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4929 ]

Synthesizing Critical Findings and Future Outlook for Homeland Security Stakeholders in an Era of Unprecedented Change

Throughout this summary, we have traced the major shifts influencing homeland security-from tariff-driven supply chain realignments to the integration of AI-powered analytics and regional procurement divergences. The interplay of policy measures, technological advancements, and evolving threat vectors underscores the sector’s complexity and the imperative for agile, informed decision-making.

As homeland security stakeholders confront new challenges and opportunities, the insights highlighted here serve as a strategic compass. Whether refining procurement strategies, optimizing solution portfolios, or forging collaborative partnerships, the findings offer a foundation for action. By synthesizing market forces, segmentation nuances, and company strategies, this report equips leaders to navigate uncertainty, seize emerging prospects, and maintain robust security postures in an era defined by change.

Take the Next Step in Strengthening Organizational Security Posture by Securing the Complete Homeland Security Market Research Report Today

If you are ready to elevate your organization’s security posture and capitalize on the insights uncovered in this comprehensive analysis, now is the time to take action. You can secure the full-depth market research report by reaching out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through the report’s extensive data and customizable deliverables to ensure you receive the precise strategic guidance and competitive intelligence you need. By engaging directly with our sales and marketing leadership, you will access tailored support for integrating our findings into your roadmap and unlocking opportunities across the evolving homeland security landscape. Contact Ketan Rohom today to transform these insights into strategic advantage and drive your organization’s long-term resilience and growth

- How big is the Homeland Security Market?

- What is the Homeland Security Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?