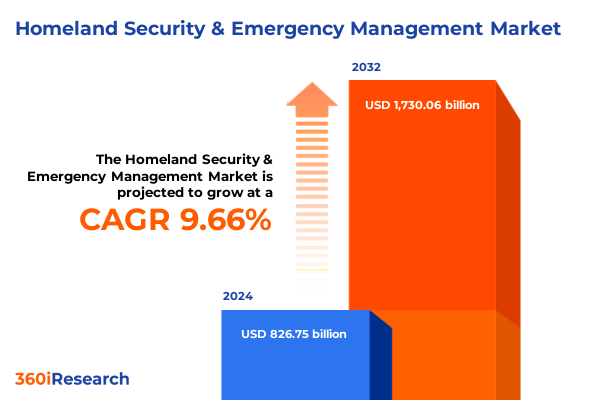

The Homeland Security & Emergency Management Market size was estimated at USD 894.33 billion in 2025 and expected to reach USD 967.43 billion in 2026, at a CAGR of 9.88% to reach USD 1,730.06 billion by 2032.

Unveiling the Strategic Imperatives Guiding Homeland Security and Emergency Management Amid Rapid Technological and Geopolitical Transformations

In an era defined by rapid technological advancements, evolving threat landscapes, and shifting geopolitical dynamics, Homeland Security and Emergency Management have emerged as critical pillars of national resilience. This executive summary introduces the strategic imperatives that government agencies, defense contractors, first responders, and private security firms must internalize to safeguard lives, protect infrastructure, and maintain continuity under complex conditions. By synthesizing cutting-edge developments in communications, cybersecurity, detection, robotics, and emerging software platforms, this report sets the stage for informed decision-making that transcends traditional paradigms.

The following sections unpack transformative shifts that are reshaping the landscape, analyze the cumulative impacts of the United States’ 2025 tariff regime on vital security equipment supply chains, and distill key segmentation insights across product, application, end user, deployment, and technology dimensions. The summary further provides regional perspectives across the Americas, EMEA, and Asia-Pacific, profiles market leadership trends, and delivers actionable recommendations that will empower industry leaders to remain agile, collaborative, and future-focused. As agencies and organizations seek to counter both state-sponsored and non-state threats-from sophisticated cyberattacks to natural disasters-this introduction underscores the necessity of a holistic, integrated, and data-driven approach to resilience and operational readiness.

Navigating the Technological and Geopolitical Shifts That Are Redefining Homeland Security and Emergency Management in the Digital Age

The Homeland Security and Emergency Management sector is undergoing a profound transformation driven by the convergence of advanced technologies, heightened cyber threats, and evolving geopolitical pressures. Artificial intelligence and machine learning are rapidly maturing, enabling predictive threat detection, automated incident response, and real-time behavioral analytics across both physical and digital domains. Leading cybersecurity firms report surging investments in AI-enabled automation to counter increasingly sophisticated attacks, with platform integration emerging as a competitive differentiator amid talent shortages and scaling challenges.

Simultaneously, the proliferation of unmanned aerial vehicles and autonomous robotics is revolutionizing surveillance, border security, and search-and-rescue operations. Governments and private operators are integrating UAVs, UGVs, and autonomous platforms with sensor networks-spanning radar, optical, thermal, and acoustic modalities-to achieve layered situational awareness that was previously unattainable. This trend is further accelerated by 5G and edge computing deployments, which support ultra-low-latency data transmission essential for real-time analytics and remote operations.

Geopolitical tensions and trade uncertainties are prompting reshaped procurement strategies. National security investigations into drone imports and critical materials underscore heightened scrutiny of foreign dependencies and supply chain vulnerabilities. At the same time, climate-driven challenges-from intensifying hurricanes to wildfires-are fueling investments in resilient infrastructure, early warning systems, and integrated incident management solutions that blend analytics platforms with on-ground detection capabilities.

Assessing the Far-Reaching Effects of 2025 U.S. Tariff Policies on Homeland Security Equipment Supply Chains and Industry Innovation

By early 2025, cumulative U.S. tariff measures have reshaped both procurement costs and innovation pathways within the Homeland Security and Emergency Management market. Sector-specific tariffs on drones, sensors, and electronic components-implemented under Section 301 and Section 232 authorities-have driven import rates as high as 170% on key unmanned systems, radically altering price dynamics for critical aerial surveillance assets. The impact extends to detection systems, where electronics sourced from China and Southeast Asia now face substantial markups, compelling suppliers to reassess global sourcing strategies and negotiate exemptions to mitigate budget overruns.

These cost pressures have spurred a dual response: established defense contractors and large-scale integrators have leveraged scale to absorb tariffs and secure supply chain continuity, while smaller innovators have accelerated domestic manufacturing initiatives to align with America First sourcing mandates. In particular, the anti-drone and detection segments have witnessed a surge of modular, open-architecture solutions that prioritize software-driven threat identification over hardware-intensive models, reducing reliance on tariff-impacted components. This has led to a split in R&D priorities, with U.S. firms emphasizing radar-based detection and AI-powered visual recognition, even as rival ecosystems maintain multi-sensor fusion approaches optimized for different operational contexts.

While these tariffs introduced short-term volatility and project delays, they have also catalyzed strategic realignment toward self-sufficiency and innovation. Government-backed R&D grants and private equity flows are now prioritizing domestic chip fabrication, advanced sensor development, and resilient supply networks-initiatives that promise to enhance long-term interoperability and reduce vulnerability to future trade disruptions.

Deriving Actionable Insights from Multi-Dimensional Segmentation Across Products Applications End Users Deployment and Technology

Disaggregating the Homeland Security and Emergency Management market along multiple dimensions reveals nuanced opportunities and competitive dynamics. When examined by product type, Communications Equipment spans hardware components, networking infrastructure, and satellite communications; Cybersecurity Solutions are segmented into cloud security, endpoint security, identity and access management, and network defense; Detection Systems encompass biological, chemical, explosive, fire and gas, and radiological sensors; Drones and Robotics include autonomous robots, unmanned aerial vehicles, and ground vehicles; Protective Gear ranges from ballistic protection to CBRN and firefighting suits; Sensors extend across acoustic, biological, chemical, optical, and thermal modalities; while Software Platforms integrate analytics engines, command and control interfaces, and incident management suites.

From an application standpoint, the market addresses border security through air, land, and maritime vectors; command and control via communication systems, decision support, and resource allocation tools; emergency response in fire control, medical services, and search-and-rescue; evacuation management covering crowd flow modeling, route optimization, and shelter coordination; infrastructure protection of communication networks, power grids, transportation corridors, and water treatment facilities; and surveillance and monitoring through perimeter defenses, sensor mesh networks, UAV patrols, and video analytics.

End-user segmentation underscores differentiated procurement pathways. Defense contractors-from large primes to specialized SMEs-drive high-complexity system integration, while emergency services agencies such as EMS, fire departments, and law enforcement prioritize rapid-deployment, user-centric solutions. Government agencies at federal, state, and municipal levels emphasize regulatory compliance and interoperability. Infrastructure operators in power, telecommunications, transportation, and water utilities seek resilient, scalable platforms. Private security firms-including dedicated cybersecurity houses, executive protection teams, and risk management consultancies-require adaptive solutions balancing risk mitigation with commercial viability.

Deployment type also shapes delivery models, with cloud-native architectures offering elastic scalability, on-premise installations delivering localized control, and hybrid frameworks enabling balanced performance and data sovereignty. Finally, technology segmentation highlights investment fronts in artificial intelligence (computer vision, machine learning, natural language processing), big data analytics (predictive, real-time, visualization), blockchain (ledger security, smart contracts), cloud computing (IaaS, PaaS, SaaS), Internet of Things (asset tracking, remote monitoring, wireless sensing), and robotics (aerial and ground platforms), each driving distinctive R&D and partnership strategies.

This comprehensive research report categorizes the Homeland Security & Emergency Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Deployment Type

Comparative Regional Dynamics Shaping Homeland Security Investments and Operational Priorities Across the Americas EMEA and Asia-Pacific

Regional dynamics profoundly influence procurement priorities, threat profiles, and partnership models in the Homeland Security and Emergency Management market. In the Americas, North America leads global spending, buoyed by robust fiscal commitments such as the Fiscal Year 2025 discretionary allocation of $64.81 billion for DHS programs. This funding surge supports advanced acquisition of radar systems, cybersecurity frameworks, and next-generation detection platforms, while fostering public-private collaboration through federal grants and inducement prize contests.

Europe, Middle East, and Africa present a mosaic of strategic imperatives driven by counterterrorism, critical infrastructure resilience, and cross-border crisis management. EU regulations on data privacy and digital sovereignty shape cybersecurity solutions, while collaborative initiatives within NATO and the European Defence Fund accelerate joint R&D in biometrics, AI-driven analytics, and secure communication networks. In the Middle East, maritime security and border surveillance investments are spurred by geopolitical flashpoints and energy corridor protections, whereas African nations focus on humanitarian response, disease detection, and community-based resilience programs.

Asia-Pacific is characterized by escalating investments in maritime and coastal security, driven by territorial disputes, port protection mandates, and disaster preparedness for cyclones, earthquakes, and tsunamis. Governments are deploying integrated sensor networks, autonomous maritime drones, and cloud-based incident management platforms, often in partnership with domestic tech champions. This region’s emphasis on scalable, cost-effective solutions is fostering innovation in modular robotics, real-time analytics, and hybrid deployment architectures suited to archipelagic states and densely populated urban centers.

This comprehensive research report examines key regions that drive the evolution of the Homeland Security & Emergency Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leadership and Competitive Strategies of Leading Homeland Security Technology and Service Providers Globally

Market leadership within Homeland Security and Emergency Management is marked by strategic alliances between traditional defense primes and emerging technology specialists. The likes of Lockheed Martin, Northrop Grumman, Raytheon Technologies, General Dynamics, and L3Harris continue to command large-scale programs in integrated air and missile defense, layered detection systems, and advanced communication networks. European majors such as BAE Systems, Thales, and Leonardo complement these offerings with sophisticated command and control suites and secure satellite communications. Meanwhile, global integrators like FLIR Systems and Leidos excel in sensor fusion and real-time analytics, bridging physical and digital security domains.

Concurrently, pure-play cybersecurity and software firms are carving out high-margin niches. Companies including Palantir, ZeroEyes, Evolv Technology, and Aptima are pioneering AI-driven threat intelligence, incident management platforms, and behavioral analytics that augment traditional detection systems. Joint ventures are proliferating, with tech startups collaborating with defense giants to integrate cloud-native architectures, blockchain-based data integrity solutions, and next-generation biometrics into holistic security ecosystems.

Funding patterns reflect this duality: large primes invest heavily in hardware-centric R&D and sustainment programs, while VC-backed innovators secure growth capital to scale SaaS-based models, subscription services, and analytics-as-a-service, fostering recurring revenue streams and continuous innovation loops.

This comprehensive research report delivers an in-depth overview of the principal market players in the Homeland Security & Emergency Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Booz Allen Hamilton Holding Corporation

- CACI International Inc

- Elbit Systems Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- IBM Corporation

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Motorola Solutions, Inc.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Science Applications International Corporation

- Siemens AG

- Thales S.A

- The Boeing Company

- Unisys Corporation

Strategic Recommendations for Homeland Security Leaders to Drive Innovation Resilience and Collaborative Preparedness in a Complex Threat Environment

Industry leaders should prioritize the integration of advanced analytics and AI across operational workflows to enhance predictive capabilities and streamline decision-making. By adopting agentic AI that autonomously identifies and prioritizes emerging threats, organizations can allocate human expertise to complex scenarios and optimize resource deployment. Concurrently, forging symbiotic public-private partnerships will accelerate the translation of academic and startup innovations into field-ready solutions, while de-risking R&D investments through co-funding and collaborative testbeds.

Resilient supply chains demand a balanced approach: diversifying component sourcing across trusted allies and domestic manufacturers can mitigate tariff-driven volatility, while strategic stockpiling and long-term purchase agreements safeguard continuity for critical detection and communication hardware. Embracing hybrid deployment models will accommodate stringent data sovereignty regulations without sacrificing the scalability of cloud-native platforms-ensuring mission-critical systems remain responsive under high throughput and contested network environments.

Finally, holistic training and workforce development programs must evolve in parallel. Upskilling personnel on AI-enabled tools, cross-domain Analytics, and integrated incident management techniques will fortify institutional readiness. By embedding adaptive learning platforms and immersive simulations, organizations can refine protocols preemptively, fostering a culture of continuous improvement and anticipatory resilience in the face of both conventional and non-traditional threats.

Transparent Methodological Framework Combining Primary Intelligence Secondary Research and Multi-Layered Validation Techniques for Market Analysis

This analysis is grounded in a rigorous methodological framework combining primary and secondary research. Primary inputs include in-depth interviews with senior executives across defense integrators, cybersecurity vendors, emergency response agencies, and regulatory bodies, providing firsthand perspectives on operational challenges, procurement cycles, and technology roadmaps. These interviews were supplemented by proprietary executive workshops that validated emerging trends and triangulated competitor positioning.

Secondary research encompassed a comprehensive review of policy directives, budgetary appropriations, trade regulations, and technology forecasts from government archives, industry white papers, and open-source intelligence. Company annual reports, patent filings, and press releases were systematically analyzed to map R&D investments and strategic alliances. Market segmentation structures were defined through a process of iterative validation with domain experts, ensuring alignment with real-world procurement categories and application scenarios.

Quantitative analysis leveraged custom-built databases to identify deal flow trends, funding patterns, and cross-segment revenue streams, while thematic coding distilled insights from hundreds of qualitative data points. The resulting multi-layered validation approach ensures that the findings and recommendations presented herein are both robust and actionable for decision makers in government and industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Homeland Security & Emergency Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Homeland Security & Emergency Management Market, by Product Type

- Homeland Security & Emergency Management Market, by Technology

- Homeland Security & Emergency Management Market, by Application

- Homeland Security & Emergency Management Market, by End User

- Homeland Security & Emergency Management Market, by Deployment Type

- Homeland Security & Emergency Management Market, by Region

- Homeland Security & Emergency Management Market, by Group

- Homeland Security & Emergency Management Market, by Country

- United States Homeland Security & Emergency Management Market

- China Homeland Security & Emergency Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4770 ]

Synthesizing Critical Executive Takeaways to Empower Decision Makers Steering Homeland Security and Emergency Management Strategies Forward

The Homeland Security and Emergency Management market in 2025 is defined by its accelerating digital transformation, complex trade dynamics, and the imperative for integrated resilience. As AI-driven analytics and autonomous systems mature, organizations face a pivotal opportunity to transition from reactive to anticipatory postures, leveraging predictive capabilities to forestall emerging threats. Concurrently, the realignment of supply chains and the emergence of hybrid procurement models underscore a renewed focus on strategic self-reliance and allied collaboration.

Segmentation insights reveal that holistic approaches-spanning communications equipment, cybersecurity platforms, detection systems, robotics, protective gear, and software suites-are central to addressing diverse application scenarios, from border security to infrastructure protection and emergency response. Regional variations in budgetary allocations and threat portfolios demand tailored strategies, while competitive dynamics between defense primes and agile technology firms drive continuous innovation.

By embracing the recommendations outlined herein-integrating AI, diversifying supply networks, enhancing workforce competencies, and fostering cross-sector partnerships-decision makers can architect a more secure, resilient future. This synopsis crystallizes the critical factors shaping procurement decisions and technology roadmaps, empowering stakeholders to act with confidence in an ever-evolving security environment.

Secure Your Competitive Advantage Today by Partnering with Ketan Rohom to Access the Comprehensive Homeland Security Market Research Report and Insights

To explore how these insights translate into strategic advantage, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan stands ready to guide you through the full report, ensuring you secure critical intelligence, detailed analyses, and tailored recommendations that will empower your organization to navigate emerging challenges and capitalize on growth opportunities in the Homeland Security and Emergency Management market.

- How big is the Homeland Security & Emergency Management Market?

- What is the Homeland Security & Emergency Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?