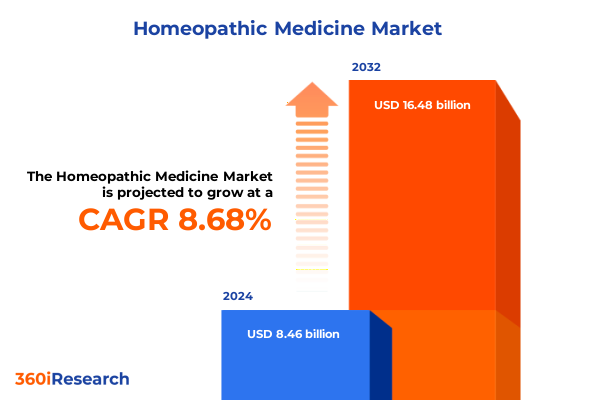

The Homeopathic Medicine Market size was estimated at USD 9.13 billion in 2025 and expected to reach USD 9.86 billion in 2026, at a CAGR of 8.79% to reach USD 16.48 billion by 2032.

Unveiling the Complex Landscape of the United States Homeopathic Medicine Industry to Provide Strategic Insights for Stakeholder Decision-Making

The homeopathic medicine sector has emerged as a prominent component of the broader wellness ecosystem, driven by a convergence of consumer demand for natural remedies and a growing emphasis on holistic health paradigms. As conventional healthcare models evolve under pressure from chronic disease burdens and rising treatment costs, homeopathy offers an alternative grounded in personalized symptom management and minimal side effects. This introductory analysis frames the underlying principles of homeopathic practice, which rely on the doctrine of "like cures like" and the utilization of highly diluted natural substances to stimulate the body's intrinsic healing processes.

Against this philosophical backdrop, the United States market has witnessed a resurgence in interest, fueled by wellness influencers, integrative clinicians, and direct-to-consumer channels. Investors and product developers are responding to these shifts by diversifying portfolios to include a broader range of homeopathic formulations, from traditional tinctures to advanced delivery systems. Moreover, regulatory advancements have contributed to greater standardization and credibility, establishing a more structured path for product registration and quality assurance. By setting the stage with these foundational themes, stakeholders can appreciate the strategic relevance of homeopathy in an era defined by consumer empowerment and a preference for preventive care.

Examining the Key Transformative Shifts Reshaping Homeopathic Medicine from Market Disruptions to Consumer-Driven Innovations

The homeopathic medicine arena is being reshaped by a series of transformative shifts that extend far beyond incremental product innovation. Digital commerce platforms now serve as primary conduits for consumer acquisition, enabling brands to reach niche patient segments through personalized marketing and subscription-based delivery models. This evolution toward omnichannel engagement reflects a broader healthcare trend in which patient experience and convenience are paramount, ushering homeopathic offerings into mainstream retail pharmacies and health-tech ecosystems.

Concurrently, the integration of homeopathic practitioners into multidisciplinary care teams has bolstered clinical legitimacy. Integrative health centers and wellness clinics are prescribing homeopathic remedies in conjunction with nutrition, physical therapy, and mindfulness practices, underscoring a collaborative approach to patient outcomes. Technological advancements in formulation science are further enhancing product efficacy and consistency, as companies deploy nanotechnology and advanced excipients to optimize bioavailability. These converging trends point to an industry in the midst of rapid maturation, where strategic agility and cross-sector partnerships will define market leadership.

Assessing the Cumulative Impact of Recent United States Tariffs in 2025 on the Homeopathic Medicine Industry’s Supply Chain Dynamics and Cost Structures

In 2025, new trade policies have introduced fresh complexities to the homeopathic supply chain, as tariff measures target both active pharmaceutical ingredients and finished products. A proposed 25% levy on pharmaceutical imports, if enacted, could translate into significantly higher manufacturing and procurement costs, impacting margin structures across the value chain. Simultaneously, a global tariff of 10% on goods entering the United States has come into force, prompting raw material suppliers and ingredient manufacturers to reassess sourcing strategies and logistics networks.

These policy shifts have triggered a wave of supply chain realignments, with some service providers accelerating capacity expansions in domestic API production and others pursuing exemption petitions under trade-law frameworks. However, the legal landscape remains unsettled, as recent litigation has challenged the executive authority underpinning these tariff orders, injecting an element of regulatory uncertainty into long-term planning processes. Although the full ramifications on end-consumer pricing and market penetration remain to be seen, it is evident that bowed yet resilient supply chains and proactive stakeholder engagement will be essential to maintaining product accessibility and competitive positioning.

Delving into Market Segmentation of Homeopathic Medicines by Product Types, Dosage Forms, End Users, Distribution Channels, and Therapeutic Applications

A nuanced segmentation framework reveals the multifaceted nature of the homeopathic medicine market and underscores the importance of tailored strategies for each category. When examining product type, the spectrum spans both combination remedies, which integrate multiple active ingredients to address complex symptom presentations, and single remedies, favored for their purity and diagnostic specificity. In terms of dosage form, companies have diversified offerings from gels and liquids to pellets and tablets. Within gels, sachet-based single-serve formats and traditional tube applications cater to both on-the-go consumers and those seeking sustained topical relief. Liquid formulations split between dropper-dispensed concentrates and syrup-based preparations to accommodate preference variability, while small spherical pellets-available as classic or custom-blended options-are paired with sugar-coated or uncoated tablet forms for oral administration.

Further, end-user segmentation delineates clear demographic distinctions: adults pursuing self-care regimens often leverage over-the-counter solutions, geriatric patients gravitate toward age-friendly dosage formats and multi-ingredient complexes, and pediatric users benefit from palatable presentations and precise dosing. Distribution pathways have likewise bifurcated into offline retail channels, where pharmacists and store associates provide personalized guidance, and online portals that offer discreet ordering and doorstep delivery. Finally, application-based segmentation highlights therapeutic focus areas, with dedicated product lines for allergy relief, cold and flu mitigation, dermatological support, and pain management, each supported by targeted clinical communication and marketing initiatives.

This comprehensive research report categorizes the Homeopathic Medicine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Distribution Channel

- Application

- End User

Uncovering Regional Variations in Homeopathic Medicine Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics inject additional layers of complexity and opportunity into the homeopathic medicine landscape. In the Americas, established distribution networks and strong consumer awareness have fostered robust retail penetration, complemented by growing integration of homeopathy into wellness resorts, spas, and integrative medical practices. North American manufacturers are increasingly investing in domestic trial studies to validate efficacy and secure formulary listings, while Latin American markets demonstrate rising adoption thanks to culturally ingrained traditional medicine practices.

Across Europe, Middle East, and Africa, regulatory frameworks vary widely yet collectively contribute to an environment of cautious optimism. Western Europe’s well-defined guidelines support high-quality product registration and consumer confidence, whereas emerging markets in the Middle East and Africa are witnessing a nascent expansion driven by improving healthcare infrastructure and rising disposable income. Regulatory harmonization efforts, such as the EU’s simplified registration pathways for homeopathic preparations, are reducing time-to-market and encouraging cross-border commerce. Meanwhile, partnerships with local clinical research institutions are underpinning greater scientific dialogue.

Asia-Pacific stands out for its dynamic growth potential, anchored by India’s long-standing AYUSH system and China’s accelerating e-commerce channels. In India, government endorsement of homeopathy under national health programs has fortified institutional support and expanded rural outreach. China’s digital pharmacies and health apps are facilitating rapid consumer uptake, particularly among urban millennials seeking alternative approaches. Across Australia and Southeast Asia, integrative clinics are adopting hybrid treatment regimens that combine homeopathic therapies with conventional modalities, setting the stage for continued regional expansion.

This comprehensive research report examines key regions that drive the evolution of the Homeopathic Medicine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players and Strategic Moves Shaping the Competitive Landscape in Homeopathic Medicine Manufacturing and Distribution

Leading companies in the homeopathic medicine sector are differentiating themselves through innovation, strategic investments, and collaborative ventures. Established multinationals have been accelerating reformulation programs to enhance stability, reduce production times, and meet evolving regulatory requirements. Meanwhile, emerging players are carving out niches in personalized remedy development, leveraging digital platforms to offer bespoke homeopathic blends that align with individual patient profiles and symptom patterns.

Partnerships between ingredient specialists and clinical research organizations are driving product pipeline enrichment, with several firms entering co-development agreements to accelerate evidence-generation for new therapeutic indications. In addition, strategic acquisitions and joint ventures are reshaping the competitive landscape; leading market participants have broadened their distribution reach by merging with regional packagers and contract manufacturing organizations. This consolidation trend has also facilitated enhanced supply chain control and margin resilience. At the same time, collaboration with academic institutions and independent laboratories is fostering greater transparency around mechanism-of-action studies, thereby strengthening stakeholder confidence in homeopathic interventions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Homeopathic Medicine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. Nelson & Co. Limited

- Ainsworths Limited

- Allen Homoeo & Herbal Products Limited

- B. Jain Pharmaceuticals Private Limited

- Bakson Drugs & Pharmaceuticals Private Limited

- Biologische Heilmittel Heel GmbH

- Boiron S.A.

- Deutsche Homöopathie-Union DHU-Arzneimittel GmbH & Co. KG

- Dr. Reckeweg & Co. GmbH

- Dr. Willmar Schwabe GmbH & Co. KG

- Hahnemann Laboratories, Inc.

- Hevert-Arzneimittel GmbH & Co. KG

- Homeocan Inc.

- Medisynth Chemicals Private Limited

- PEKANA Naturheilmittel GmbH

- Powell Laboratories Private Limited

- SBL Private Limited

- Similia Homoeopathic Laboratory Private Limited

- Standard Homeopathic Company

- Wheezal Homeo Pharma Private Limited

Empowering Industry Leaders with Actionable Recommendations to Capitalize on Opportunities and Mitigate Risks in Homeopathic Medicine

To thrive amidst evolving market dynamics, industry leaders must embrace a series of targeted actions. First, diversifying the supplier base for key botanical and mineral inputs will mitigate exposure to tariff volatility and geopolitical disruptions. By establishing alternative sourcing corridors and forging long-term contracts with regional producers, companies can fortify supply continuity and cost predictability.

Next, investing in digital infrastructure-spanning direct-to-consumer platforms, telehealth integrations, and data-driven marketing analytics-will enhance customer engagement and retention. Concurrently, forming strategic alliances with integrative health networks and wellness chains can unlock new distribution touchpoints and bolster clinical adoption. Prioritizing regulatory compliance and proactive engagement with policy makers will also ensure streamlined product registration processes and minimize time-to-market hurdles. Lastly, advancing personalized homeopathic solutions through customer profiling and adaptive remedy development will position organizations to capture value in high-growth demographic segments, such as geriatric care and pediatric wellness.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity, Analytical Rigor, and Strategic Relevance in Market Analysis

This study employed a rigorous research methodology designed to deliver robust, actionable insights. Primary research included in-depth interviews with key opinion leaders, ranging from homeopathic practitioners and clinical researchers to supply chain executives and regulatory specialists. These qualitative engagements provided firsthand perspectives on formulation trends, market adoption barriers, and emerging therapeutic applications.

Secondary research encompassed a systematic review of publicly available data sources-including industry publications, academic journals, trade association reports, and government filings-to map historical trends and contextualize competitive movements. Data triangulation techniques were applied to reconcile information from diverse channels, ensuring high confidence in validity and consistency. Additionally, a detailed vendor scorecard was implemented to assess manufacturing capabilities, quality management systems, and distribution footprints. Finally, all findings were subjected to internal quality control processes, including peer reviews and cross-functional validation workshops, to uphold analytical integrity and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Homeopathic Medicine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Homeopathic Medicine Market, by Product Type

- Homeopathic Medicine Market, by Form

- Homeopathic Medicine Market, by Distribution Channel

- Homeopathic Medicine Market, by Application

- Homeopathic Medicine Market, by End User

- Homeopathic Medicine Market, by Region

- Homeopathic Medicine Market, by Group

- Homeopathic Medicine Market, by Country

- United States Homeopathic Medicine Market

- China Homeopathic Medicine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights That Synthesize Critical Findings and Forge a Path Forward for Stakeholders in the Homeopathic Medicine Arena

The insights presented herein underscore the multifaceted evolution of the homeopathic medicine sector. From shifting consumer preferences toward holistic wellness to the disruptive impact of emerging trade policies, the industry is poised at a strategic inflection point. Segmentation analyses have illuminated the critical importance of tailoring product portfolios to specific therapeutic applications, demographic cohorts, and distribution channels, while regional comparisons have showcased the diverse regulatory environments and growth trajectories across global markets.

Moreover, competitive benchmarking reveals that innovation in formulation science, supply chain resilience, and strategic partnerships will define market leadership. Stakeholders who proactively integrate these dimensions into their strategic roadmaps stand to capture disproportionate value as the sector continues to mature. By synthesizing these core findings, decision-makers can chart a clear path forward-balancing opportunity pursuit with risk mitigation-to realize sustainable growth in a dynamic and increasingly interconnected landscape.

Engage with Ketan Rohom to Acquire In-Depth Market Intelligence and Propel Your Homeopathic Medicine Strategy to the Next Level

If you are ready to fortify your strategic planning with comprehensive data and expert analysis, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can provide tailored insights on consumer behavior, competitive dynamics, and regulatory developments to help you navigate the evolving homeopathic medicine landscape with confidence. Secure a detailed discussion and learn how our authoritative research can accelerate your growth trajectory in this dynamic sector. Contact him today to explore customized report options designed to drive informed decision-making and sustainable competitive advantage.

- How big is the Homeopathic Medicine Market?

- What is the Homeopathic Medicine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?