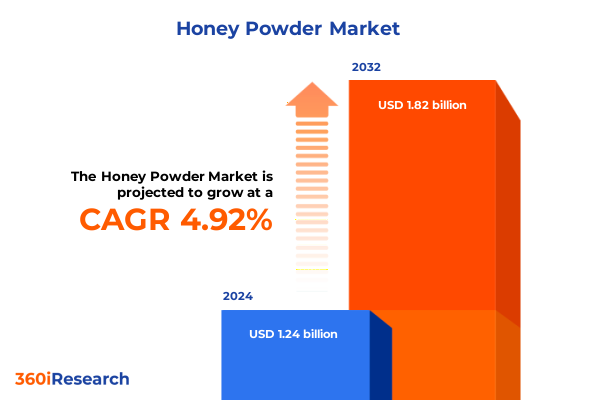

The Honey Powder Market size was estimated at USD 1.29 billion in 2025 and expected to reach USD 1.36 billion in 2026, at a CAGR of 4.97% to reach USD 1.82 billion by 2032.

Exploring the Transformative Rise of Honey Powder as a Premium Natural Sweetener with Extended Shelf Life and Formulation Benefits

Across the global food ingredient spectrum, honey powder has emerged as a highly versatile sweetening agent, delivering the flavor of traditional honey while offering extended shelf life and ease of formulation. Created through sophisticated dehydration processes that remove moisture while preserving nutritional and sensory qualities, honey powder appeals to formulators seeking clean-label ingredients that integrate seamlessly into dry mixes and powdered blends.

This introduction to honey powder highlights its growing importance, driven by escalating consumer demand for natural sweeteners amid heightened scrutiny of sugar intake. Simultaneously, manufacturers face significant production challenges, as the specialized equipment and expertise required for spray drying or vacuum dehydration translate into elevated capital and operational costs. In addition, fluctuations in raw honey prices-propelled by climate variability and the global decline in bee populations-have introduced volatility that reverberates throughout the honey powder supply chain.

Moreover, the interplay between tightening supply and rising operational expenses is exacerbated by increasing pollination service fees, which climbed to an average of $98.11 per colony in March 2025. These escalated costs underscore the complexity of securing a stable raw honey supply at competitive prices. Nevertheless, the inherent functional advantages and branding appeal of honey powder are motivating companies to invest in process optimization and alternative sourcing strategies, setting the stage for further innovation in this burgeoning segment.

Revolutionary Sustainability and Digital Traceability Shippings Are Redefining Honey Powder Supply Chains Globally

The honey powder landscape is undergoing profound transformation as digitalization and sustainability imperatives reshape every facet of the supply chain. Brands are rapidly adopting blockchain and IoT technologies to trace honey from hive to shelf, reinforcing authenticity and reducing the risk of adulteration. This integration of traceability tools not only strengthens quality control measures but also enhances consumer trust by offering transparent sourcing narratives that align with shifting preferences toward clean and verifiable ingredients.

Meanwhile, sustainability considerations are driving significant shifts in production and packaging. Leading companies are pioneering eco-friendly packaging solutions and lightweight materials that reduce waste and carbon footprints. At the same time, the soaring popularity of online retail channels has empowered smaller artisanal producers to reach new customers directly, disrupting traditional distribution models and accelerating the adoption of honey powder across niche and mainstream segments alike.

Analyzing the Cumulative Impact of 2025 US Universal and Reciprocal Tariffs on Honey Powder Imports and Domestic Supply Dynamics

In early 2025, the United States implemented a universal 10% tariff on all imports, including honey powder, effective April 5, 2025. This broad measure, part of a wider “reciprocal tariff” framework, immediately elevated landed costs for import-dependent manufacturers, prompting a strategic reassessment of procurement channels and pricing structures.

Subsequently, country-specific reciprocal tariffs were scheduled to take effect on April 9 but were paused pending review of market conditions. In parallel, anti-dumping duties enacted this period introduced additional levy rates ranging from 2.31% to 121.97% based on origin markets, further compounding cost pressures for importers. For example, duty rates on honey originating from Vietnam reached nearly 122%, significantly altering the competitive landscape. These measures collectively spurred an increase in domestic production investments as companies sought to mitigate exposure to rising duties and currency fluctuations.

Deriving Strategic Intelligence from Product Type, Packaging, End-User Industry and Distribution Channel Segmentation

The honey powder market can be strategically segmented by product type into conventional and organic variants, each driven by distinct consumer motivations. Conventional formats maintain momentum through broader price acceptance, while the organic category commands premium positioning by catering to health-conscious consumers seeking certified clean-label ingredients. This bifurcation informs R&D investment decisions and marketing nuances across the value chain.

Packaging innovations further differentiate offerings, as brands deploy bottles, jars, and flexible pouches to meet diverse handling and storage preferences across industrial and retail applications. Where rigid bottles and jars emphasize preservation and brand presence on shelves, pouches deliver compact convenience and reduced transportation footprint, aligning with sustainability goals.

On the demand side, end-user industries span the cosmetic and personal care sector, where honey powder’s humectant properties enhance formulations, to food and beverage applications, leveraging its sweetness in bakery, confectionery, and beverage mixes. The pharmaceutical and nutraceutical industry taps into honey powder’s functional and bioactive compounds for health-oriented supplements.

Lastly, distribution channels bifurcate into offline and online models, with traditional wholesale and specialty distributors maintaining strong ties to large-scale manufacturers, while e-commerce platforms unlock direct-to-consumer journeys and foster niche brand loyalty.

This comprehensive research report categorizes the Honey Powder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- End-User Industry

- Distribution Channel

Exploring How Regional Market Dynamics in the Americas EMEA and Asia-Pacific Are Shaping Honey Powder Growth Trajectories

Geographically, the Americas lead the global honey powder narrative, buoyed by robust food-processing infrastructures and a mature functional ingredients market. North American manufacturers are expanding capacity to serve both domestic and export markets, leveraging advanced processing hubs in the Midwest and Western regions to optimize logistics and meet stringent quality standards. At the same time, Latin American producers are capitalizing on localized honey varieties and attractive cost structures to supply neighboring markets.

In Europe, the Middle East and Africa region, regulatory rigor and consumer expectations around transparency and labeling drive premium positioning of honey powder. The European Union’s enhanced labeling directives, introduced in 2023, have compelled suppliers to adopt more detailed traceability protocols, elevating product confidence and shaping differentiated value propositions. Concurrently, Middle Eastern and African markets are experiencing rising demand for clean-label sweeteners within growing confectionery and personal care segments.

Asia-Pacific exhibits the fastest expansion, fueled by e-commerce platform proliferation and supportive trade policies. Notably, India’s extension of its Minimum Export Price program on honey through December 2025 and enforcement actions against origin fraud have underscored government commitment to quality standards, driving consolidation among exporters. Southeast Asian and Australasian markets likewise benefit from rising disposable incomes and health-oriented dietary shifts, propelling honey powder into mainstream culinary and wellness applications.

This comprehensive research report examines key regions that drive the evolution of the Honey Powder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Dominant Agribusiness Giants and Niche Innovators Elevating the Competitive Honey Powder Landscape

The competitive landscape of the honey powder market is anchored by established agribusiness leaders that combine scale, R&D prowess and distribution networks. Cargill and ADM are prominent, leveraging global processing capabilities to supply ingredient-grade honey powder across food, beverage and personal care sectors. Their extensive portfolios and strategic alliances enable them to adapt formulations and certifications at scale.

Complementing these giants are specialty ingredient providers like Agrana, Tate & Lyle and Ingredion, which differentiate through targeted product innovations such as high-solubility and organic-certified variants. These companies are deepening partnerships with large FMCG firms to co-develop customized blends that meet evolving formulation requirements.

At the same time, agile regional players like Norevo, Avebe and Woodland Foods are carving niche positions by emphasizing floral provenance, small-batch traceability and sustainable sourcing practices. These mid-sized suppliers often partner with contract manufacturers to integrate honey powder into premium skincare and nutraceutical applications, driving emergent use cases.

Finally, smaller direct-to-consumer brands-exemplified by Hoosier Hill Farm and Augason Farms-capitalize on e-commerce and specialty retail channels to offer value-priced, ready-to-use honey powder for home cooking and baking. Their consumer-facing strategies highlight convenience and affordability, broadening household adoption beyond traditional industrial use cases.

This comprehensive research report delivers an in-depth overview of the principal market players in the Honey Powder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Great American Spice Company

- Holy Hive Honey

- HOLYNATURAL.IN

- Honeyville, Inc.

- Hoosier Hill Farm

- Ishva

- Jeeva Organic Private Limited

- Mevive International

- Natural Sourcing, LLC

- Norevo GmbH

- Oaktown Spice Shop

- Ohly GmbH

- PURENSO

- Rare Tea Cellar

- Savory Spice Shop, LLC

- Shreena Enterprise

- SOS Chefs

- Specialty Products and Technology Inc.

- Spice Alliance, LLC

- Stover & Company

- The Honey Company

- Vedant Agro Foods

- VedaOils.us

- Viha Online

- Woodland Foods, Ltd.

- Wuhu Deli Foods Co.,Ltd.

Precision Recommendations for Industry Leaders to Navigate Trade Shifts and Unleash Honey Powder Market Potential

To thrive in the evolving honey powder market, industry leaders should prioritize investments in end-to-end traceability systems that leverage blockchain and IoT to authenticate product origin and streamline compliance with regulatory demands. By enhancing transparency, companies can command premium price points and bolster brand integrity while mitigating risks associated with fraudulent adulteration.

Concurrently, firms must diversify sourcing strategies to offset tariff-induced cost pressures. Building strategic alliances with domestic beekeepers and proximate regional suppliers can reduce dependency on high-duty import corridors. Employing tariff engineering tactics-such as bonded warehousing and tariff reclassification-can further optimize landed costs and preserve margin structures in volatile trade environments.

Product innovation should focus on sustainable packaging and multifunctional formats that align with both industrial formulators and direct-to-consumer preferences. Lightweight, recyclable pouches and barrier technologies minimize environmental impact, while hybrid ingredient blends infused with botanical extracts or probiotics can capture growing demand for differentiated wellness offerings.

Finally, companies should enhance omnichannel distribution strategies by strengthening partnerships with specialty distributors and digital marketplaces. Tailoring marketing and formulation to sector-specific needs-whether in confectionery, nutraceutical or personal care-will enable faster adoption and foster cross-sector collaborations that expand the application footprint of honey powder.

Outlining the Rigorous Multi-Source Methodology Combining Primary Interviews and Quantitative Trade Data Analysis

This research synthesizes a structured approach combining extensive secondary data reviews and targeted primary engagements. Secondary inputs include global trade databases, regulatory filings and peer-reviewed publications, which underpin a comprehensive understanding of production economics, tariff regimes and supply chain architectures.

Primary research comprised in-depth interviews with executive stakeholders across beekeeping cooperatives, ingredient manufacturers and consumer goods brands, supplemented by expert panel discussions. Quantitative data were triangulated through import–export statistics, customs datasets and company financial disclosures to ensure robust validation of market dynamics.

Analytical frameworks-such as Porter’s Five Forces, SWOT and PESTEL analyses-were applied to evaluate competitive intensity, growth drivers and geopolitical factors. Scenario modeling assessed the cumulative impact of tariff adjustments and raw material price volatilities, while segmentation matrices facilitated granular evaluation of product, channel and regional performance.

The combined methodology ensures that insights are both empirically grounded and strategically relevant, empowering stakeholders with actionable intelligence to steer decision-making in the honey powder sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Honey Powder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Honey Powder Market, by Product Type

- Honey Powder Market, by Packaging Type

- Honey Powder Market, by End-User Industry

- Honey Powder Market, by Distribution Channel

- Honey Powder Market, by Region

- Honey Powder Market, by Group

- Honey Powder Market, by Country

- United States Honey Powder Market

- China Honey Powder Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Strategic Imperatives and Growth Pathways to Guide Stakeholders Through the Honey Powder Market Ecosystem

The honey powder market stands at a pivotal crossroads, shaped by confluence of technological innovation, sustainability mandates and shifting trade policies. As digital traceability and eco-package solutions become table stakes, companies that adeptly integrate these elements will differentiate their offerings and resonate with increasingly discerning consumers.

Moreover, the recalibration of import tariffs and anti-dumping duties has underscored the imperative for diversified sourcing and agile supply chain strategies. Firms that pivot to domestic and regional partnerships while leveraging tariff engineering will secure cost advantages and fortify resilience against future policy shifts.

Segmentation by product type, packaging format, end-use industry and distribution channel reveals varied growth pockets-from organic-certified powders in nutraceuticals to flexible pouches in e-commerce channels-offering blueprints for targeted investment and collaboration.

By aligning strategic priorities with robust research insights, stakeholders can unlock sustainable value and innovation across the honey powder value chain, capitalizing on emerging consumer trends and navigating evolving market complexities.

Connect with Ketan Rohom to Acquire the Definitive Honey Powder Market Report and Propel Your Strategic Decisions

Ready to deepen your understanding of the honey powder market and gain a competitive edge? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to acquire the full, in-depth market research report. His expertise will guide you through detailed insights and tailored strategies that support your business goals in this rapidly evolving category.

- How big is the Honey Powder Market?

- What is the Honey Powder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?