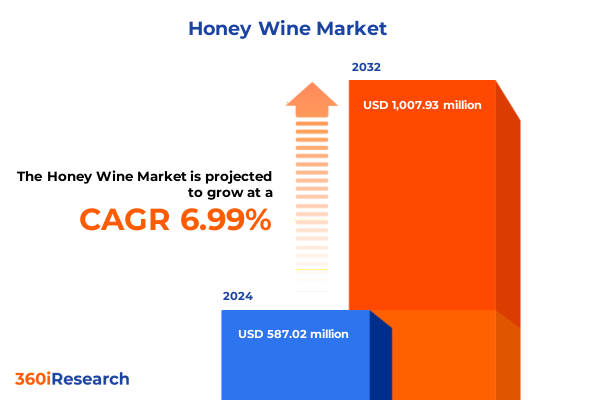

The Honey Wine Market size was estimated at USD 628.57 million in 2025 and expected to reach USD 674.70 million in 2026, at a CAGR of 6.97% to reach USD 1,007.93 million by 2032.

Exploring the Dynamic Trajectory of the Honey Wine Market as Consumer Tastes Shift Towards Authentic Craft and Health-Conscious Beverages

Honey wine, often referred to as mead, has transcended its historical origins to become a focal point of contemporary beverage innovation. While mead has long been celebrated for its cultural heritage, the past several years have witnessed a resurgence fueled by a combination of consumer curiosity and artisanal craftsmanship. Enthusiasts increasingly seek out authentic experiences, driving producers to revisit traditional fermentation methods while integrating modern quality controls. At the same time, the health and wellness movement has spotlighted honey’s natural antioxidant properties, positioning honey wine as a differentiated alternative within the alcoholic beverage landscape.

Concurrently, strategic investments in branding and storytelling have elevated the category’s appeal beyond niche circles. Producers are leveraging heritage narratives alongside sustainability commitments to forge deeper emotional connections with consumers. Digital marketing channels and social media influencers have amplified these efforts, enabling smaller producers to achieve national visibility more efficiently. As a result, honey wine has emerged not only as a craft novelty but also as a versatile beverage poised to capture broader market share in an environment defined by premiumization and experiential drinking.

Looking ahead, the honey wine market stands at a critical inflection point. The interplay between traditional authenticity, health-driven demand, and innovative marketing strategies will determine which players thrive. This introduction provides the foundational context for understanding the forces shaping the market’s evolution in 2025 and beyond.

Unraveling the Driving Forces Reshaping the Honey Wine Industry from Premiumization and Sustainability to Botanical Infusion Innovations

The honey wine landscape is undergoing transformative shifts driven by a confluence of premiumization, sustainability, and flavor innovation. Producers are increasingly investing in organic and single-origin honey sources to cater to discerning consumers who demand transparency and provenance. This has spurred partnerships with ethical beekeeping operations and accelerated the adoption of regenerative agricultural practices, reinforcing brand authenticity and environmental stewardship.

In parallel, packaging innovation has redefined convenience and gifting appeal. Trendsetters in the industry are experimenting with lightweight aluminum cans for on-the-go consumption, ornate gift packs for special occasions, and elegantly designed glass bottles that underscore premium positioning. These developments have not only diversified product portfolios but also enabled segmentation strategies that appeal to a wide range of occasions and price points.

Moreover, flavor diversification has evolved beyond traditional honey sweetness to encompass botanical and spice-infused variants. Fruit-forward flavor profiles such as berry and peach are resonating with Millennials, while herbal spiced expressions incorporating cinnamon and ginger are attracting adventurous consumers seeking novel taste experiences. These innovations are supported by refined fermentation techniques and precise alcohol content calibration, ensuring consistency and drinkability across diverse target audiences.

Ultimately, the industry’s landscape is being reshaped by these intersecting currents. The ability of producers to balance authenticity with innovation will define their competitive standing, making it essential to monitor emerging trends and consumer feedback to sustain growth in this dynamic marketplace.

Assessing the Ripple Effects of Recent U.S. Tariffs on Honey Wine Imports and Domestic Production Dynamics in the 2025 Regulatory Environment

In 2025, adjustments to U.S. tariff policy have introduced significant headwinds for both imported honey wine products and domestic producers reliant on foreign-sourced packaging materials. The imposition of a 10 percent duty on glass bottle imports and a 15 percent levy on gift pack assemblies has escalated landed costs, prompting importers to reevaluate supply chain structures. Meanwhile, tariffs on raw honey imports have increased by 8 percent, exacerbating raw material price volatility and compelling producers to secure long-term contracts or invest in domestic apiary partnerships.

These regulatory shifts have generated a ripple effect across pricing strategies and margin structures. Smaller craft producers have been particularly impacted, as they lack the scale to absorb higher costs and are facing pressure to pass incremental expenses onto price-sensitive consumers. Larger companies with diversified supplier networks have leveraged economies of scale to negotiate more favorable terms, thereby preserving competitive pricing and shielding their product portfolios from the most severe cost pressures.

Despite these challenges, the tariff-driven environment has incentivized domestic capacity expansion. Investment in local glass manufacturing and gift pack production facilities has gained traction, enabling select producers to mitigate exposure to import duties and reinforce supply chain resilience. Concurrently, strategic sourcing initiatives aimed at establishing hedged honey procurements have become commonplace, as industry players seek to stabilize input costs and minimize future tariff risks.

As a result, the regulatory landscape has not only introduced cost challenges but also catalyzed innovation in sourcing, production, and strategic collaboration. Stakeholders that proactively adapt to these changes are positioned to turn tariff pressures into opportunities for differentiation and long-term stability.

Decoding Consumer and Market Segmentation Patterns to Uncover Strategic Opportunities Across Ingredients Packaging Channels and Product Variations in the Honey Wine Industry

Insight into ingredient sourcing reveals a distinct bifurcation between conventional honey wine products and those labeled as organic. This differentiation underscores divergent consumer priorities: a segment that values cost efficiency contrasts with a cohort willing to invest in premium, certified offerings underpinned by environmental and wellness credentials. Transitioning between these streams demands careful calibration of supplier relationships and certification processes to ensure that organic claims are credible and traceable.

Packaging segmentation further amplifies the complexity of market engagement. Cans, available in 330 milliliter and 500 milliliter sizes, provide on-the-go portability and appeal to outdoor-oriented consumers, whereas gift packs-available in premium and standard presentations-are designed for celebratory occasions and gifting channels. Glass bottles, in both 375 milliliter and 750 milliliter formats, anchor the traditional premium segment and cater to consumers seeking an upscale drinking experience. Each packaging category necessitates tailored marketing approaches, production planning, and distribution strategies to align with distinct usage contexts.

Examining end-user behavior highlights a clear demarcation between Horeca establishments and household consumers. Hospitality venues offer opportunities for experiential marketing and premium tastings, while at-home consumption trends are influenced by direct-to-consumer platforms and subscription services. Optimizing channel partnerships across both spheres is essential to capture the full spectrum of demand.

Distribution dynamics distinguish off-trade channels-comprising liquor stores, online retail, and supermarket hypermarkets-from the on-trade arena of bars, hotels, and restaurants. Off-trade growth is propelled by e-commerce penetration and value-driven retail promotions, whereas on-trade expansion benefits from curated tasting events and menu integrations. Navigating these channels demands a nimble approach to pricing, promotional activities, and logistical coordination.

Alcohol content stratification-spanning high, low, and medium ranges, with the medium segment further delineated into 5–7 percent and 8–10 percent tiers-provides nuanced targeting opportunities for taste and consumption occasions. Flavor profiles extend across fruit flavored varieties such as apple, berry, and peach; herbal spiced expressions including cinnamon, ginger, and mixed spice; and original, unadulterated honey-centric presentations. Product types range from fortified and semi-sparkling to fully sparkling and still offerings, each invoking different sensory experiences. Finally, sweetness level segmentation into dry, semi-sweet, and sweet variants captures consumer preferences for palate intensity, shaping product formulation and labeling strategies. This multi-faceted segmentation framework serves as the foundation for precise market positioning and resource allocation to maximize reach and relevance.

This comprehensive research report categorizes the Honey Wine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Source

- Packaging

- End User

- Distribution Channel

- Alcohol Content

- Flavor

- Product Type

- Sweetness Level

Mapping Regional Growth Drivers and Market Nuances Across the Americas EMEA and Asia-Pacific to Illuminate Divergent Trends in the Global Honey Wine Landscape

In the Americas, the United States stands as the most mature honey wine market, underpinned by a robust network of craft meaderies and a well-established distributor landscape. Consumer fascination with artisanal and organic variants has driven rapid innovation, and e-commerce channels have become critical conduits for reaching geographically dispersed enthusiasts. Meanwhile, Canada’s smaller but growing scene emphasizes local honey sourcing, aligning with national sustainability trends and regional pride.

Europe, the Middle East, and Africa collectively exhibit diverse market profiles. In Western Europe, legacy meaderies in the United Kingdom and France enjoy a resurgence through tourism-driven retail channels, while Eastern European countries leverage honey wine as part of cultural heritage festivals. In the Middle East, premium honey wine aligns with luxury lifestyle segments, with boutique producers targeting high-net-worth consumers. African markets present nascent opportunities, where honey wine’s local raw material availability and informal distribution networks provide fertile ground for grassroots brand development.

Asia-Pacific stands out for its dual trajectory of rapid market expansion and evolving consumer palates. In China and Japan, rising disposable incomes and curiosity for new alcoholic beverages have accelerated honey wine adoption, particularly through premium gift packs and collaborations with hospitality brands. Australia and New Zealand benefit from strong beekeeping industries and export-oriented production, enabling local brands to penetrate neighboring markets. Moreover, Southeast Asian countries are embracing wellness-driven narratives, positioning honey wine as an alternative to traditional spirits in health-conscious segments.

These regional dynamics underscore the necessity of tailored market entry and expansion strategies. A nuanced understanding of local regulatory environments, cultural consumption patterns, and distribution infrastructures is paramount to harnessing growth potential across these heterogeneous territories.

This comprehensive research report examines key regions that drive the evolution of the Honey Wine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players in the Honey Wine Sector to Highlight Strategic Initiatives Shaping Competitive Advantages and Partnerships

A cadre of established producers and emerging disruptors is shaping the competitive terrain of honey wine. Leading the charge, Redstone Meadery has leveraged robust distribution partnerships and a diversified flavor portfolio to secure broad market visibility. Savage Honey Co. has emphasized organic certification and direct-to-consumer subscription models, cementing its reputation for innovation in flavor infusions and sustainable sourcing.

On the emerging front, Superstition Meadery has captured attention through collaborations with craft breweries, co-produced limited editions, and experiential tasting events that merge honey wine with beer culture. NapTown Meadworks, by contrast, has focused on upscale restaurant placements and high-profile mixology collaborations, positioning its products as versatile cocktail bases.

Strategic alliances and joint ventures are increasingly common, as exemplified by recent partnerships between boutique meaderies and specialty food brands to create honey wine-infused gourmet offerings. Investment flows from beverage conglomerates into regional craft producers underscore the sector’s growth potential, with acquisitions and minority stake purchases emerging as preferred expansion tactics.

While product innovation remains a critical differentiator, companies are also prioritizing brand storytelling, sustainability certifications, and digital engagement strategies. These combined initiatives are driving brand equity and influencing consumer loyalty, setting the stage for an evolving competitive hierarchy in which agility and authenticity are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Honey Wine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Brothers Drake Meadery

- Bunratty

- Charm City Meadworks

- Dansk Mjod A/S

- Etowah Meadery

- Four Fires Meadery

- Furious Meads

- Garagiste Meadery

- Gosnells London

- Heidrun Meadery

- Hierophant Meadery

- Hive Mind Mead & Brew Co

- Honey Pot Meadery

- Kinsale Mead Co

- Kuhnhenn Brewing Co LLC

- Lyme Bay Cider Co Ltd

- Marlobobo

- Martin Brothers Winery

- Medovina Meadery

- Moonlight Meadery

- Moonshine Meadery

- Nectar Creek

- Pips Meadery

- Queens Reward Meadery LLC

- Redstone Meadery

- Schramm's Mead

- Superstition Meadery

- The Honey Wine Company

- Wild Blossom Meadery & Winery

Strategic Imperatives for Honey Wine Producers to Capitalize on Consumer Trends Optimize Supply Chains and Navigate Regulatory Landscapes in 2025

Industry leaders must proactively refine their supply chains by securing long-term agreements with both conventional and organic honey suppliers, thereby safeguarding against price volatility and quality inconsistencies. Investing in domestic glass and packaging manufacturing can mitigate tariff-related cost pressures while enhancing responsiveness to demand fluctuations.

Marketing strategies should pivot toward storytelling frameworks that seamlessly integrate provenance narratives, sustainability credentials, and wellness benefits. Brands that amplify transparent beekeeper partnerships and highlight regenerative practices will resonate more effectively with eco-conscious demographics. Concurrently, diversifying packaging formats across cans, gift packs, and glass bottles allows portfolio optimization for distinct consumption occasions and distribution channels.

To capitalize on channel-specific dynamics, producers should deepen collaborations with key on-trade partners through co-branded events and experiential tasting activations. At the same time, enhancing direct-to-consumer e-commerce capabilities and subscription services will foster recurring revenue streams and facilitate data-driven consumer insights.

Finally, hedging strategies against tariff fluctuations and raw material cost volatility are essential. Engaging in futures contracts for honey procurement or exploring alternative sourcing geographies can provide cost stability. Embracing digital traceability tools will not only streamline supply chain transparency but also strengthen compliance with evolving regulatory requirements, ensuring sustainable growth in a complex market environment.

Elucidating the Comprehensive Research Framework Combining Primary Interviews Secondary Data Analysis and Market Triangulation to Validate Honey Wine Industry Insights

This analysis draws upon a multi-pronged research framework that combines primary and secondary sources to ensure robust market intelligence. Primary research included in-depth interviews with a cross-section of industry stakeholders, encompassing mead producers, distributors, and hospitality operators. These conversations provided qualitative insights into evolving consumer preferences, operational challenges, and strategic priorities.

Secondary research incorporated trade association reports, regulatory filings, and company disclosures, enabling comprehensive contextualization of market dynamics. Custom data sets from customs and tariff authorities were analyzed to quantify the 2025 impact of U.S. tariff adjustments on both raw honey and finished honey wine imports. These quantitative elements were triangulated against production and sales figures to validate trend interpretations.

Data synthesis employed both bottom-up and top-down approaches to reconcile supply-side production metrics with demand-side consumption patterns. Regional analyses were calibrated using macroeconomic indicators and demographic profiles to ensure localized relevance. Finally, an expert panel of trade analysts and academic researchers reviewed draft findings to affirm methodological rigor and mitigate potential biases.

This rigorous methodology underpins the credibility of the insights presented, offering decision-makers a transparent view of data provenance, analytical processes, and validation checkpoints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Honey Wine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Honey Wine Market, by Ingredient Source

- Honey Wine Market, by Packaging

- Honey Wine Market, by End User

- Honey Wine Market, by Distribution Channel

- Honey Wine Market, by Alcohol Content

- Honey Wine Market, by Flavor

- Honey Wine Market, by Product Type

- Honey Wine Market, by Sweetness Level

- Honey Wine Market, by Region

- Honey Wine Market, by Group

- Honey Wine Market, by Country

- United States Honey Wine Market

- China Honey Wine Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesis of Critical Findings Emphasizing Market Resilience Consumer Preferences Regulatory Challenges and Growth Pathways in the Evolving Honey Wine Sector

In an environment marked by evolving consumer preferences, regulatory complexities, and intensifying competition, the honey wine market exhibits both resilience and transformative potential. The resurgence of premium and organic variants underscores the segment’s ability to adapt to health and sustainability-driven demands, while packaging and flavor innovations continue to expand the category’s appeal across demographic cohorts.

Tariff-induced cost pressures have catalyzed strategic realignments in sourcing and production, prompting domestic capacity expansions and the adoption of hedging mechanisms. Segmentation insights reveal a landscape of nuanced consumer targeting, where ingredient origin, packaging format, distribution channel, alcohol content, flavor profile, product type, and sweetness level collectively inform go-to-market strategies.

Regional dynamics vary considerably, from the mature craft-driven markets of North America to the heritage-focused scenes in EMEA and the rapidly expanding opportunities in Asia-Pacific. Competitive analysis highlights the strategic importance of partnerships, brand authenticity, and digital engagement, while actionable recommendations emphasize supply chain resilience and consumer-centric marketing.

Together, these findings provide a comprehensive blueprint for stakeholders seeking to navigate the complexities of the honey wine industry in 2025. By aligning product portfolios with consumer demand, optimizing operational frameworks, and leveraging data-driven insights, market participants are well-positioned to capture growth opportunities and sustain competitive advantage.

Engage with Ketan Rohom to Access the Full Market Report and Unlock Actionable Insights Driving Growth and Innovation in the Honey Wine Industry 2025

Engaging with Ketan Rohom will unlock comprehensive perspectives drawn from rigorous analysis across consumer behavior, regulatory shifts, and competitive dynamics within the honey wine industry. By securing the full market research report, decision-makers gain access to in-depth breakdowns of segment-specific performance, tariff impact scenarios, and regionally tailored growth strategies. Personalized consultation sessions can further translate these insights into bespoke action plans, enabling organizations to refine product innovation roadmaps, optimize supply chain resilience, and accelerate market entry plans. Reach out to initiate a strategic dialogue and ensure your enterprise is positioned to capitalize on emerging opportunities and navigate industry challenges with confidence

- How big is the Honey Wine Market?

- What is the Honey Wine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?