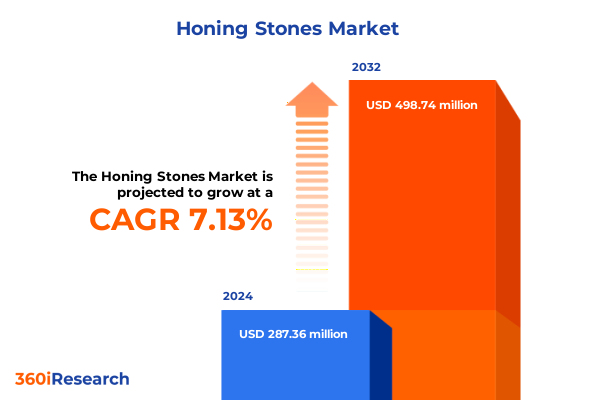

The Honing Stones Market size was estimated at USD 308.62 million in 2025 and expected to reach USD 330.72 million in 2026, at a CAGR of 7.09% to reach USD 498.74 million by 2032.

Setting the Stage for Honing Stones Industry Overview and Emerging Opportunities in Precision Surface Finishing Technologies

The honing stones sector serves as a cornerstone of precision surface finishing processes across industrial, automotive, aerospace, and professional tool applications, facilitating unparalleled flatness, parallelism, and surface quality. Over the past decade, honing stones have transcended their traditional roles by integrating advanced materials and manufacturing techniques that target microscopic tolerances. As component designs grow more complex and tolerance limits tighten, the demand for high-performance abrasive media becomes increasingly critical. Consequently, stakeholders across the value chain seek a deeper understanding of the technical fundamentals, evolving use cases, and market dynamics that define this specialized segment.

In addition to precision requirements, the honing stones industry is shaped by converging trends in automation, digital quality control, and sustainability. The integration of in-line metrology systems, for instance, has elevated process repeatability and reduced scrap rates, compelling abrasive manufacturers to innovate new formulations and grit structures. At the same time, pressure to adopt environmentally responsible materials and practices has prompted exploration of bio-based lubricants and closed-loop recycling schemes. These parallel imperatives-where precision meets performance and environmental stewardship-demand a comprehensive overview of current capabilities, emerging opportunities, and strategic imperatives.

To address this need, this executive summary distills the most salient insights from extensive primary interviews, industry surveys, plant visits, and secondary literature reviews. It outlines the key shifts redefining product portfolios, supply chain configurations, and regional growth trajectories. Moreover, it identifies critical segmentation dimensions and profiles leading companies driving innovation. By synthesizing these findings, the report equips decision-makers with a clear roadmap for navigating complex market forces and capitalizing on untapped growth levers.

Identifying the Pivotal Shifts Driving Radical Change in Honing Stone Applications and Value Chains Across Diverse Industrial Sectors

The honing stones landscape is undergoing transformative shifts driven by breakthroughs in material science, digital integration, and evolving end-user requirements. Ceramic, diamond, and whetstone substrates have benefited from advanced formulation techniques that enhance cutting action, grit retention, and thermal stability. Manufacturers are increasingly leveraging monocrystalline and polycrystalline diamond composites, which offer superior hardness uniformity and extended service life. These material innovations have expanded the application range from traditional engine cylinder finishes to high-precision components used in semiconductor and medical device production, thereby redefining the value proposition of honing processes.

Furthermore, the integration of Industry 4.0 technologies is reshaping operational models. Automated honing machines now incorporate real-time feedback loops enabled by acoustic emission sensors and machine-vision systems, significantly improving process control and reducing cycle times. As a result, capital equipment suppliers and abrasive manufacturers are collaborating more closely to deliver turnkey solutions that pair specialized honing stones with software-driven optimization protocols. This convergence of hardware and digital capabilities not only accelerates innovation cycles but also opens new service-based revenue streams focused on predictive maintenance and performance analytics.

Moreover, macroeconomic trends such as reshoring, nearshoring, and supply chain diversification have amplified the importance of local manufacturing resilience. End users are demanding shorter lead times and greater inventory transparency, spurring suppliers to adopt agile production strategies and regional distribution networks. These structural shifts underscore the essential balance between global sourcing efficiencies and on-demand responsiveness. Consequently, stakeholders must adapt their product development, logistics, and customer engagement models to remain competitive in an increasingly interconnected ecosystem.

Analyzing the Unfolding Impact of 2025 U.S. Tariff Adjustments on Honing Stone Imports with Implications for Production and Pricing Dynamics

In 2025, the United States implemented cumulative tariff adjustments that substantially affected the import economics of honing stones. Tariffs on select abrasive products rose from low single digits to mid-single digits under Section 301 measures targeting specialty industrial goods, resulting in immediate cost pressures for importers. These adjustments have disrupted traditional procurement strategies, compelling original equipment manufacturers and contract finishers to reassess supplier portfolios. Simultaneously, the increased duties have incentivized investments in domestic honing stone production capabilities, as companies seek to mitigate the impact of fluctuating trade policies on input costs.

Consequently, the rising cost of imported ceramic and diamond stones has led to a rebalancing of sourcing decisions, with greater emphasis on near-sourced and vertically integrated supply chains. Several leading abrasive producers have expedited capacity expansions in North America, repatriating certain manufacturing steps such as sintering and bonding. This shift, in turn, has enhanced responsiveness to customer quality specifications while reducing exposure to global shipping disruptions. However, these moves require significant capital deployment and in some cases have introduced scale inefficiencies that must be managed through process optimization and collaborative R&D initiatives.

Moreover, the tariff-induced cost escalations have trickled down to end users, prompting a reevaluation of process economics and tool maintenance schedules. Companies are now exploring alternative finishing methods, hybrid abrasive blends, and extended-life grit configurations to offset increased operating expenses. In this evolving context, the intersection of trade policy, raw material sourcing, and product innovation has never been more critical. Industry leaders must navigate these complexities by forging strategic partnerships, enhancing domestic production, and advancing technology roadmaps that deliver both cost efficiency and performance reliability.

Unlocking Segmentation Revelations by Product Type Material End User Sales Channel and Grit to Illuminate Market Nuances and Growth Patterns

Segmentation analysis reveals nuanced insights that can guide strategic investments and product development. The distinction between bench stones, combination stones, and hand stones captures the varying performance requirements and operational contexts across end users. Bench stones dominate high-volume industrial applications where consistency and throughput are paramount, while combination stones appeal to versatile job shops seeking both rough material removal and fine finishing in a single medium. Hand stones, in contrast, fulfill niche artisanal and precision manual operations, where ergonomics and tactile feedback are essential.

Material classification offers further clarity on competitive positioning and R&D focus. Ceramic stones deliver a balance of friability and thermal resilience ideal for heavy stock removal, whereas oilstones and whetstones have long served traditional manual sharpening needs. The diamond stone segment, subdivided into monocrystalline and polycrystalline variants, represents the cutting edge of abrasive longevity and cutting speed. Monocrystalline diamonds provide consistent protrusion and low friability, making them suitable for ultra-tight tolerances, whereas polycrystalline formulations offer cost-effective solutions for high-volume finishing operations.

End-user segmentation underscores diverse demand drivers. The consumer segment emphasizes affordability and ease of use, often bundled with sharpening kits for home workshops. Professional users value customization, product support, and integration with dedicated honing fixtures. Within industrial markets, the aerospace, automotive, and metal fabrication industries each exhibit distinct requirements: aerospace demands ultra-fine finishes and process traceability; automotive emphasizes cycle time reduction and cost consistency; metal fabrication prioritizes robustness and tool longevity.

Finally, sales channels vary from direct OEM partnerships to offline hardware and specialty stores, extending into online e-commerce platforms and manufacturer websites. Direct sales foster deep technical collaboration and bulk procurement efficiencies, while retail channels enhance market reach among smaller end-users. Digital channels have accelerated during the past two years, enabling real-time order tracking, user reviews, and virtual product demos. Grit size segmentation-spanning coarse through ultra fine-further informs product alignment with surface finish objectives, where coarser grits remove material rapidly and ultra fine grits achieve the smoothest finishes.

This comprehensive research report categorizes the Honing Stones market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Grit Size

- End User

- Sales Channel

Delineating Regional Market Nuances and Growth Drivers Across Americas Europe Middle East Africa and Asia-Pacific in the Honing Stones Domain

Regional dynamics in the honing stones market reflect diverse economic, regulatory, and industrial ecosystems. In the Americas, strong investment in automotive, aerospace, and general manufacturing drives adoption of both conventional oilstones and advanced diamond composites. Supply chain resilience has become a focal point, with domestic producers scaling up to meet demand and mitigate the effects of shipping disruptions. Across North and Latin America, there is growing interest in sustainable honing solutions, including water-based lubricants and reusable abrasive media, that align with evolving environmental regulations.

Europe, the Middle East & Africa presents a heterogeneous landscape. Western European nations benefit from well-established metallurgical clusters and precision machining hubs, spurring demand for ultra-fine and hybrid stones used in defense and medical device production. Regulatory emphasis on reducing carbon footprints has accelerated the adoption of closed-loop recycling systems for spent honing stones, creating an ecosystem where material reclamation and secondary markets are gaining traction. In the Middle East, infrastructure development and natural resource processing drive demand for robust honing solutions, while select African markets show early-stage growth as manufacturing capabilities expand.

Asia-Pacific remains the highest-growth region due to large-scale automotive, electronics, and machinery industries. Countries such as China, India, Japan, and South Korea are leading investments in next-generation abrasives, integrating advanced ceramics and diamond formulations to meet increasingly stringent product standards. Cross-border collaborations between local manufacturers and global material science leaders have accelerated technology transfer and localized production. Moreover, e-commerce penetration in the region has democratized access to specialized honing stones among small and medium-sized enterprises, fueling broader market adoption.

This comprehensive research report examines key regions that drive the evolution of the Honing Stones market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Strategies Collaborations and Innovations That Are Shaping the Future of Honing Stone Technologies Worldwide

The competitive landscape of honing stones is anchored by established abrasive specialists alongside emerging technology-driven entrants. Legacy companies leverage extensive process expertise and global distribution networks to maintain leadership in core product lines. These incumbents prioritize incremental material enhancements, operational excellence, and strategic alliances with OEMs to reinforce their market positions. In contrast, smaller agile players often focus on high-value niches, developing bespoke monocrystalline diamond stones optimized for ultra-precision applications in aerospace and medical device manufacturing.

Collaborative initiatives between abrasive producers and equipment manufacturers have gained prominence, enabling the development of integrated honing solutions that deliver hardware, software, and consumables in a unified package. Joint ventures and strategic partnerships are also on the rise, facilitating access to new geographic markets and advanced R&D capabilities. Furthermore, some companies are investing in digital platforms that offer customers end-to-end process monitoring, predictive maintenance, and performance benchmarking services, thereby transforming traditional product-centric business models into outcome-oriented offerings.

Mergers and acquisitions continue to shape the competitive terrain as firms seek to augment their material science portfolios and expand into adjacent markets. While consolidation drives scale efficiencies, it also raises questions about innovation velocity and customer choice. Observing these dynamics, industry players are evaluating the balance between organic growth through internal R&D and inorganic expansion via targeted acquisitions. The result is a dynamic ecosystem where collaboration and competition coexist, pushing the boundaries of what honing stones can achieve.

This comprehensive research report delivers an in-depth overview of the principal market players in the Honing Stones market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ATLANTIC GmbH

- Carborundum Universal Limited

- Compagnie de Saint-Gobain SA

- EHWA Diamond Ind Co Ltd

- Kemet International Limited

- Mirka Oy

- PFERD GmbH & Co. KG

- Radiac Abrasives, LLC

- Shandong Yanggu Huatai Abrasives Co., Ltd.

- Tyrolit Schleifmittelwerke Swarovski KG

- Weiler Abrasives, LLC

Formulating Actionable Strategic Recommendations to Propel Competitive Advantage and Operational Excellence in the Honing Stone Industry Landscape

To navigate the shifting landscape of honing stones, industry leaders should pursue a multi-pronged strategic approach that balances innovation, operational agility, and customer centricity. First, investing in advanced material R&D-particularly in diamond and ceramic composites-will yield next-generation products capable of meeting tighter tolerances and longer tool life requirements. Establishing collaborative research partnerships with universities and technology institutes can accelerate development timelines and spread technical risk across stakeholders.

Simultaneously, companies must strengthen supply chain resilience by diversifying sourcing footprints and building regional manufacturing capabilities. Nearshoring production nodes in key markets not only mitigates tariff exposure but also reduces lead times and supports local service and customization. Developing strategic inventory buffers for critical raw materials and finished stones will further enhance responsiveness to market fluctuations and geopolitical disruptions.

In parallel, embracing digital transformation is imperative. Integrating sensor-embedded honing fixtures and cloud-based analytics platforms enables predictive maintenance, process optimization, and value-added service offerings that differentiate suppliers from commodity providers. By delivering actionable insights on tool performance, process consistency, and lifecycle management, organizations can create deeper customer engagements and generate new recurring revenue streams.

Finally, targeted expansion into underserved segments and regions is crucial. Tailoring product portfolios to the specific needs of aerospace, automotive, metal fabrication, and consumer end users-as well as aligning distribution strategies across direct, retail, and online channels-ensures a more nuanced market approach. Leadership teams should continuously refine pricing models, technical support frameworks, and training programs to build loyalty and drive long-term partnerships.

Outlining a Robust Multi-Phase Research Methodology to Ensure Comprehensive Data Integrity and Insightful Analysis in Honing Stones Market Examination

This study leverages a rigorous multi-phase research methodology designed to capture comprehensive and reliable insights. Primary research comprised in-depth interviews with senior executives, process engineers, and purchasing managers across abrasive manufacturers, equipment OEMs, and end-use industries. These conversations provided firsthand perspectives on technology roadmaps, procurement challenges, and evolving operational requirements. Complementing primary interviews, on-site plant visits and field observations enabled direct assessment of honing equipment configurations and abrasive usage patterns.

Secondary research encompassed a broad spectrum of industry publications, trade association reports, technical papers, and regulatory documents. This body of literature informed the contextual analysis of raw material supply, manufacturing processes, and environmental compliance. Where necessary, data points from public company disclosures, government trade statistics, and patent databases were triangulated to ensure accuracy and validity.

Quantitative analysis included cross-segment and cross-regional comparisons of product adoption trends, valuation metrics, and channel dynamics. A standardized framework was applied to normalize disparate data sources, enabling meaningful benchmarking across product types, material classes, end-use verticals, sales channels, and grit sizes. Qualitative validation workshops with industry experts further refined interpretative insights and identified emerging themes.

Overall, this structured approach ensures that findings are underpinned by a blend of empirical evidence, expert judgment, and critical analysis. The resulting model provides a balanced perspective on both current market realities and future trajectories, equipping decision-makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Honing Stones market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Honing Stones Market, by Product Type

- Honing Stones Market, by Material

- Honing Stones Market, by Grit Size

- Honing Stones Market, by End User

- Honing Stones Market, by Sales Channel

- Honing Stones Market, by Region

- Honing Stones Market, by Group

- Honing Stones Market, by Country

- United States Honing Stones Market

- China Honing Stones Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Cohesive Conclusions That Synthesize Market Insights Technology Trends and Strategic Imperatives for the Honing Stones Sector

In synthesizing the insights from segmentation analysis, regional dynamics, tariff impacts, and competitive intelligence, several overarching themes emerge. Material innovation stands out as a pivotal driver, as the industry transitions toward advanced diamond and ceramic composites to meet escalating precision and durability requirements. Digital integration is likewise reshaping value propositions, with predictive analytics and sensor-enabled equipment enhancing process control and service differentiation.

Trade policy adjustments have underscored the importance of supply chain agility, prompting a strategic realignment toward regional manufacturing footprints and closer collaboration between abrasive producers and OEMs. Meanwhile, regional growth disparities highlight the need for tailored market approaches that factor in local industrial ecosystems, regulatory environments, and customer preferences. Leading companies balance these forces by combining organic R&D investment with targeted partnerships and platform expansions.

As the honing stones market continues to evolve, stakeholders must embrace an ecosystem mindset that transcends traditional product sales. Offering integrated hardware, consumable, and service solutions, backed by data-driven insights, will define the next frontier of competitive advantage. Ultimately, success will hinge on the ability to anticipate end-user demands, navigate trade complexities, and deliver consistent, sustainable performance improvements across a diverse array of applications.

Engaging With Associate Director Sales Marketing Ketan Rohom to Secure a Comprehensive Honing Stones Market Research Report and Unlock Critical Insights

To explore how your organization can harness the transformative insights outlined in this report, reach out today and engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep industry expertise and a keen understanding of the technical, commercial, and strategic factors influencing the honing stones market. Through a tailored consultation, Ketan will guide you through the most relevant findings, address your specific operational challenges, and outline the optimal pathways to translate data-driven insights into competitive advantage.

Partnering with Ketan means gaining access to a comprehensive market research report that delves into the nuanced shifts in product types, material innovations, end-user demand patterns, sales channel evolution, and grit size dynamics. You will receive actionable recommendations designed to enhance product development roadmaps, streamline supply chain resilience, and expand your market footprint in key regions. Ketan’s consultative approach ensures that you obtain clarity on policy implications, tariff impacts, and segmentation opportunities, enabling you to make informed decisions with confidence.

Take the next step toward unlocking the full potential of your honing stones business by scheduling a personalized briefing and demonstration of the core report. Connect with Ketan Rohom today and secure your organization’s position at the forefront of the surface finishing industry’s future.

- How big is the Honing Stones Market?

- What is the Honing Stones Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?