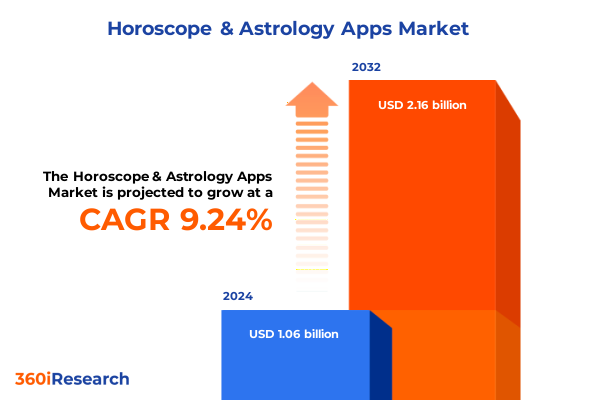

The Horoscope & Astrology Apps Market size was estimated at USD 1.16 billion in 2025 and expected to reach USD 1.26 billion in 2026, at a CAGR of 9.28% to reach USD 2.16 billion by 2032.

Emergence of Horoscope and Astrology Applications as Transformative Digital Wellness Tools Bridging Technology and Personalized Spirituality

In recent years, horoscope and astrology applications have transitioned from niche entertainment tools to integral components of many individuals’ personal wellness routines. Usage patterns have shifted from occasional fortune-telling to daily engagement, underscoring the role of these digital platforms in providing guidance, reassurance, and community. Approximately three in ten U.S. adults engage with astrology or tarot readings at least once per year, reflecting how deeply these practices have penetrated mainstream lifestyles.

Industry analyses report that the global astrology app market expanded rapidly, reaching an estimated valuation of $3.94 billion in 2024. This surge is largely driven by increasing smartphone penetration, growing interest in personalized spirituality, and the convenience of on-demand digital consultations, all of which underscore the transformative impact of digitalization on traditional esoteric services.

These developments are further amplified by Generation Z’s embrace of astrology as a means to find community and purpose. Apps like Co-Star achieved remarkable growth, ballooning from 7.5 million users in 2020 to 30 million in 2023, as concise, visually engaging astrological content on social platforms like TikTok and Instagram resonates deeply with younger demographics seeking meaning amid contemporary uncertainties.

How Innovations in AI, Augmented Reality, and Social Connectivity Are Redefining User Engagement Within the Horoscope and Astrology App Ecosystem

The horoscope and astrology application landscape has evolved dramatically due to the integration of advanced technologies, reshaping how users interact with celestial content. Artificial intelligence and machine learning algorithms now power hyper-personalized predictions, sifting through vast astrological data to deliver individualized insights in real time. These intelligent engines continuously refine their analyses based on user feedback, reinforcing engagement and driving higher retention rates.

Beyond predictive analytics, augmented reality and virtual reality features are creating immersive experiences, enabling users to visualize planetary alignments, navigate interactive astrological charts, and participate in virtual star-gazing sessions. These immersive layers deepen user involvement, transforming passive horoscope reading into an engaging experiential journey that resonates with digitally native audiences.

Astrology apps have transcended solitary readings by embedding social connectivity features that foster community engagement. Users can share daily affirmations, compare compatibility analyses with friends, and join live streams hosted by professional astrologers. This social dimension not only strengthens loyalty but also amplifies organic growth through peer recommendations and user-generated content.

Moreover, as the focus on mental health and holistic wellbeing intensifies, many astrology applications have incorporated mindfulness modules, guided meditation, and wellness tips alongside traditional readings. By positioning themselves as comprehensive self-care companions, these platforms bridge the gap between ancient wisdom and modern holistic health practices, appealing to users who seek both spiritual insight and practical coping strategies.

Evaluating the Ripple Effects of the 2025 United States Tariff Policies on Accessibility of Devices and Deployment of Astrology Applications

In 2025, the United States government enacted a series of tariff measures targeting semiconductors, microchips, and consumer electronics, imposing duties of up to 145 percent on goods originating from China. These directives, framed under reciprocal tariff policies, aim to incentivize domestic production but have also introduced significant cost pressures for import-dependent industries, including smartphone manufacturing.

These elevated tariffs have immediate downstream effects on smartphone pricing, with industry forecasts projecting unit cost increases ranging from 15 to 30 percent. Given that mobile devices serve as the primary gateway to astrology applications, any reduction in device affordability poses a risk to user acquisition and active engagement metrics across the sector.

In response to these trade barriers, electronics manufacturers have accelerated efforts to diversify their supply chains. Notably, Apple has ramped up iPhone assembly operations in India, achieving record production volumes during the first half of 2025 to mitigate exposure to U.S. import duties on Chinese-assembled devices. Such strategic relocations are critical for safeguarding device availability and stabilizing price points for end consumers.

Consequently, the reconfiguration of global production networks and fluctuating import costs may constrain the growth trajectory of mobile-first astrology platforms in the near term. Providers will need to monitor tariff developments closely and potentially adapt distribution strategies to ensure continued access to the devices that underpin their user base.

In-Depth Analysis of Service, Monetization, Platform, and Application Segmentation Revealing Diverse Opportunities in the Astrology Application Market

The astrology application market is scrutinized across a spectrum of service offerings that include core astrological readings, detailed birth chart and natal analysis, compatibility assessments, daily and extended horoscopes, and tarot reading modules. These service verticals enable providers to tailor experiences that meet diverse user needs, from general zodiac forecasts to in-depth life-path interpretations.

Within the core astrology services, specialized branches such as Chinese, Egyptian, Mayan, Tibetan, Vedic, and Western traditions cater to cultural preferences and heritage-based user segments. By integrating these varied astrological systems, applications can resonate more authentically with specific demographic cohorts seeking culturally rooted guidance. This multi-tradition approach broadens the addressable audience and strengthens user loyalty through targeted content alignment.

Monetization strategies in this sector range from one-time purchase models and pay-per-reading microtransactions to flexible subscription frameworks offering both annual and monthly plans. Subscription-based revenue structures have gained traction by delivering ongoing value and predictable revenue streams, enabling developers to invest in feature enhancement and customer support.

Platform segmentation further distinguishes between mobile and web-based applications, with mobile channels commanding the majority of downloads and active usage. Within mobile, native experiences optimized for Android and iOS ecosystems ensure broad device compatibility and seamless user interfaces, catering to the preferences of both Google Play and App Store audiences.

Finally, application-specific segmentation highlights use cases spanning career and finance planning, education and learning modules, event and date planning tools, health and wellness integrations, personalized guidance, relationship compatibility analysis, and spiritual growth workshops. These targeted domain features allow astrology apps to position themselves as multifaceted lifestyle platforms rather than singular horoscope readers.

This comprehensive research report categorizes the Horoscope & Astrology Apps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Monetization Model

- Platform

- Age Group

- Application

- End User

Strategic Regional Perspectives Highlighting Differentiated Consumer Behaviors and Market Dynamics Across the Americas, EMEA, and Asia-Pacific

North American markets, led by the United States, command a leading share of global astrology application usage owing to high levels of disposable income, sophisticated monetization maturity, and near-universal smartphone penetration. In September 2024 alone, Co-Star was the most downloaded astrology app in the U.S., illustrating the region’s robust appetite for digital spiritual services and premium subscription offerings.

Europe, Middle East, and Africa collectively represent a substantial growth region underpinned by strong multilingual support and a deep-rooted interest in Western astrological traditions. Western Europe exhibits stable adoption driven by wellness integration and premium app features, while the Middle East and Africa display emerging opportunities tied to rising internet connectivity and youth-driven demand for personalized readings.

Asia-Pacific offers unparalleled potential, accounting for nearly one-third of global market activity. Cultural affinity for astrology, particularly in India and Southeast Asia, combined with rapid smartphone adoption rates, drives significant download volumes and in-app spending. This region’s expansion is further buoyed by local language interfaces, increasing income levels, and a strong tradition of seeking celestial insight for life and career decisions.

This comprehensive research report examines key regions that drive the evolution of the Horoscope & Astrology Apps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of Leading Astrology Application Developers and Market Entrants Illustrating Competitive Strategies and Innovation Drivers in the Industry

Leading providers such as AstroTalk, Co-Star, GaneshaSpeaks, TimePassages, Susan Miller Astrology Zone, The Pattern, and Sanctuary dominate the competitive landscape, each differentiating through unique feature sets and content expertise. These companies exemplify the balance between technological innovation and domain authority that defines market leadership.

Co-Star, headquartered in New York, leverages social network integrations to deliver affirmation-driven daily horoscopes and community engagement tools, achieving over 151,000 downloads in September 2024. Nebula follows as a notable competitor, connecting users with a curated roster of professional astrologers for personalized consultations directly within the app interface.

Emerging entrants such as AstroSage have introduced generative AI platforms offering multilingual, on-demand astrological insights, while specialized firms deploy augmented reality celestial visualizations and AI-powered chatbots to deliver interactive user experiences. These innovations underscore a broader industry emphasis on blending technology with cultural nuance to captivate diverse audiences and foster sustained engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Horoscope & Astrology Apps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astro Future

- Astro-Vision Futuretech Pvt. Ltd.

- Astrodienst AG

- AstroGraph Software

- Astrolink Inc

- AstroMatrix LLC

- Astrotalk Services Private Limited

- AstroYogi Pvt Ltd

- Bodhi Inc

- Chani Nicholas Inc

- Chaturanga Inc

- Cosmic Insights LLC

- Co–Star, Inc.

- GaneshaSpeaks Services Pvt Ltd

- Horoscope.com Inc by Ingenio LLC.

- JPLoft Inc

- Moonly Tech GmbH

- OBRIO Limited

- OJAS Softech Pvt. Ltd.

- Prokerala by Ennexa Technologies Pvt. Ltd.

- Ruby Labs, Inc.

- Sanctuary

- Susan Miller’s Astrology Zone LLC

- Techugo Pvt Ltd

- The Pattern Inc

- Time Nomad

- TwinFlame Apps LLC

- YesCom Technology Co., Limited

- Yodha Pvt Ltd

Actionable Strategic Imperatives for Industry Stakeholders to Leverage Technological Advancements and Market Shifts in the Astrology App Sector

Industry leaders should prioritize investment in advanced AI and machine learning to deliver hyper-personalized predictions, as platforms equipped with intelligent analytics consistently demonstrate higher user retention and deeper engagement metrics. Leveraging predictive algorithms to tailor content in real time will distinguish top performers in a crowded marketplace.

Expanding regional language support and culturally custom content will unlock new growth pockets across EMEA and Asia-Pacific markets. Applications that integrate vernacular interfaces and honor localized astrological traditions are better positioned to resonate with users seeking authenticity and contextual relevance in their readings.

Reevaluating monetization strategies to balance accessible free features with premium subscription tiers and pay-per-reading options will enable companies to optimize revenue while accommodating diverse willingness-to-pay profiles. Seamless transitions between free and premium experiences can reduce friction and improve conversion rates for in-app purchases.

Monitoring geopolitical developments such as tariff policies and supply chain shifts is essential for mobile-first providers, ensuring device accessibility remains high even amid fluctuating import duties. Strategic partnerships with device manufacturers or alternative distribution channels can mitigate potential disruptions in user acquisition pipelines.

Strengthening community features and forging collaborations with recognized astrologers and spiritual influencers can enhance credibility and drive organic growth. Creating interactive events, expert-led webinars, and peer-to-peer discussion forums will foster deeper brand loyalty and amplify word-of-mouth referrals.

Comprehensive Research Methodology Outlining Rigorous Data Collection, Analysis, and Validation Approaches Employed in the Astrology App Market Study

This study employed comprehensive secondary research, analyzing published industry reports, credible news outlets, and proprietary databases to identify key market drivers, challenges, and emerging trends. Publicly available data from app analytics platforms and trade publications informed the quantification of user behavior and adoption rates.

Primary research comprised structured interviews with industry stakeholders, including application developers, professional astrologers, and end users. These discussions provided firsthand insights into feature preferences, pricing sensitivities, and expectations for future innovations, ensuring the findings are rooted in real-world perspectives.

Rigorous data triangulation and validation techniques were applied to reconcile information from multiple sources, minimizing bias and enhancing the reliability of projections. Segmentation and SWOT analyses were conducted to map market opportunities, competitive dynamics, and potential risks, offering a structured framework for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Horoscope & Astrology Apps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Horoscope & Astrology Apps Market, by Service Type

- Horoscope & Astrology Apps Market, by Monetization Model

- Horoscope & Astrology Apps Market, by Platform

- Horoscope & Astrology Apps Market, by Age Group

- Horoscope & Astrology Apps Market, by Application

- Horoscope & Astrology Apps Market, by End User

- Horoscope & Astrology Apps Market, by Region

- Horoscope & Astrology Apps Market, by Group

- Horoscope & Astrology Apps Market, by Country

- United States Horoscope & Astrology Apps Market

- China Horoscope & Astrology Apps Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings into a Cohesive Narrative Underscoring the Growth Potential and Strategic Imperatives of the Astrology Application Market

The horoscope and astrology app sector stands at a pivotal juncture, propelled by rapid technological innovation, evolving consumer behaviors, and expanding cultural adoption across key regions. As digital spiritual services continue to integrate into daily wellness routines, the landscape will reward platforms that successfully combine personalization, immersive user experiences, and authentic cultural resonance.

Companies that adeptly navigate shifting trade policies, diversify their supply chains, and invest in advanced analytics will secure competitive advantages. By fostering community connections, embracing localization, and refining monetization models, market leaders can unlock sustained growth and drive deeper engagement through 2025 and beyond.

Engaging Executive Invitation to Collaborate with Ketan Rohom for Exclusive Access to the Definitive Horoscope and Astrology App Market Research Report

For executives and decision-makers seeking to capitalize on these transformative trends, exclusive access to the full market research report offers actionable intelligence and strategic roadmaps.

Contact Associate Director, Sales & Marketing Ketan Rohom to secure your copy and gain a competitive edge in the dynamic horoscope and astrology applications landscape today.

- How big is the Horoscope & Astrology Apps Market?

- What is the Horoscope & Astrology Apps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?