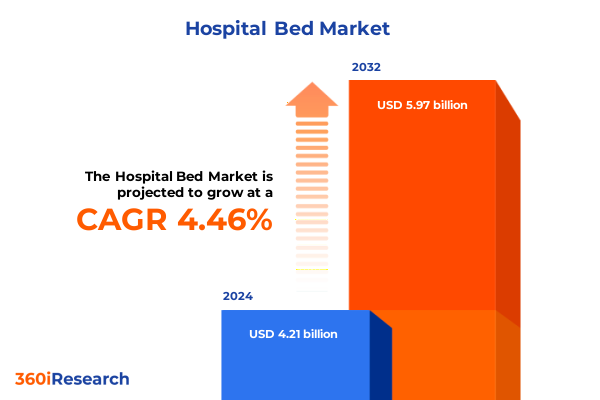

The Hospital Bed Market size was estimated at USD 4.38 billion in 2025 and expected to reach USD 4.58 billion in 2026, at a CAGR of 4.49% to reach USD 5.97 billion by 2032.

Exploring the foundational dynamics of hospital bed solutions optimized to support evolving patient care demands across varied medical environments

The evolution of hospital bed solutions has continued to accelerate in response to shifting patient needs, regulatory requirements, and the ongoing drive for improved clinical outcomes. Contemporary healthcare environments demand adaptable platforms that not only facilitate patient mobility and comfort but also integrate seamlessly with digital workflows and remote monitoring capabilities. Over recent years, hospital operators have prioritized the adoption of beds capable of supporting diverse care settings, from intensive care units to post-operative recovery wards, emphasizing enhanced ergonomics, infection control features, and compatibility with advanced therapeutic equipment.

With the convergence of demographic aging patterns and a heightened focus on patient-centric care models, hospital bed offerings have transcended their traditional roles, evolving into critical enablers of operational efficiency and clinical quality. Today’s solutions encompass a spectrum of mechanical and electronic functionalities, including precision positioning, pressure redistribution surfaces, and automated controls designed to minimize caregiver strain. As this introductory exploration highlights, the foundational dynamics of hospital bed technologies underpin broader efforts to redefine standards of care, improve health outcomes, and meet the dynamic requirements of varied medical environments.

Analyzing groundbreaking technological, policy and demographic shifts revolutionizing hospital bed deployment and reshaping care delivery paradigms globally

The hospital bed landscape has experienced transformative shifts driven by breakthroughs in smart technologies, policy reforms, and evolving patient demographics. As technology matures, fully-integrated bed systems now offer real-time analytics and connectivity with electronic health records, enabling predictive insights into patient mobility and risk factors. Moreover, the incorporation of advanced surfaces that adjust micro-pressure zones dynamically illustrates how innovation is reducing the incidence of pressure injuries and accelerating recovery protocols.

Parallel to these technological advancements, healthcare policies emphasizing value-based care have spurred demand for solutions that both optimize clinical outcomes and reduce total cost of care. Incentivized reimbursement models are encouraging providers to invest in beds that facilitate early patient mobilization and minimize length of stay. Demographically, the rise in chronic conditions and an expanding geriatric population have elevated the importance of beds tailored to long-term care and homecare contexts, thereby widening the industry’s scope beyond acute hospital settings. Collectively, these shifts have redefined market expectations, compelling manufacturers and providers to collaborate on developing versatile platforms that address emerging clinical and operational imperatives.

Assessing the comprehensive ramifications of newly introduced 2025 United States tariff measures on the hospital bed industry’s supply chains and competitive dynamics

The introduction of new United States tariffs in 2025 has exerted notable influence on the hospital bed sector, particularly across global supply chains and strategic sourcing approaches. Heightened duties on imported components and finished assemblies have prompted manufacturers to reassess their procurement footprints, leading to accelerated localization of machining, welding, and electronic assembly processes. In turn, this reconfiguration of supply networks has influenced lead times, with some producers adapting by establishing regional production hubs closer to end-use markets to mitigate tariff impacts and stabilize delivery schedules.

Consequently, healthcare equipment providers have been compelled to absorb incremental costs or realign pricing structures to maintain margin thresholds. Many have pursued cost-containment strategies through design standardization and modular architecture, ensuring that core platform components remain interchangeable even as assemblies shift geographically. Notably, some organizations have embraced strategic partnerships with domestic metal and electronics vendors to secure preferential terms and insulate against further policy volatility. Through these measures, industry stakeholders are navigating a recalibrated trade environment, striving to uphold quality and availability of critical beds while adapting to the cumulative ramifications of 2025 tariff measures.

Uncovering critical segmentation perspectives based on type, usage, material, end user and distribution channels enriching the hospital bed market analysis

Hospital bed market dynamics are enriched by a nuanced segmentation framework that reveals differentiated drivers, preferences, and strategic imperatives across distinct categories. Type-based analysis shows that fully-electric beds command attention for their advanced positioning controls and seamless integration with digital care ecosystems, while semi-electric platforms offer a balanced blend of functionality and cost-effective design. In parallel, manual beds remain indispensable in resource-constrained settings and transitional care units, where simplicity and reliability are paramount.

Contextualizing usage patterns underscores that acute care and critical care/ICU facilities prioritize beds equipped with comprehensive safety and monitoring functionalities, whereas homecare and long-term care segments emphasize portability, ease of maintenance, and patient comfort. Maternity and pediatric environments require bespoke configurations that support early mother-child bonding and accommodate size variability. Material composition further segments demand: aluminum frame beds attract purchasers through their lightweight, corrosion-resistant properties, whereas steel frame equivalents win favor for their robustness and cost efficiency.

End-user preferences also shape distribution channel strategies; hospitals and ambulatory surgical centers demonstrate a proclivity for direct procurements through established offline networks to ensure immediate service responsiveness, while nursing homes and home healthcare settings increasingly leverage online channels including eCommerce platforms and company websites for broadened choice and competitive pricing. This integrated view of type, usage, material, end user, and channel segmentation illuminates critical avenues for targeting product portfolios and value propositions.

This comprehensive research report categorizes the Hospital Bed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Usage

- Material

- End User

- Distribution Channel

Illuminating region specific trends and market maturation trajectories across the Americas, Europe Middle East Africa and Asia Pacific landscapes

Regional market landscapes expose unique adoption drivers and competitive contexts across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, large-scale hospital infrastructure modernization initiatives and government incentives for domestic manufacturing have accelerated uptake of advanced bed solutions. Meanwhile, providers in Latin America seek modular and scalable platforms to address fluctuating demand in both urban centers and remote clinics.

The Europe Middle East & Africa region presents a mosaic of maturity levels; Western European nations emphasize sustainability and digital interoperability, driving demand for energy-efficient electric beds connected to hospital information systems. In contrast, Middle Eastern markets are characterized by substantial capital investment in premium acute care facilities, which propels demand for cutting-edge ICU bed technologies. Sub-Saharan Africa continues to focus on durability and ease of maintenance, highlighting the role of manual bed variants in primary care settings.

Asia-Pacific stands out for its rapid healthcare infrastructure expansion and increasing aptitude for high-volume production among regional manufacturers. Countries such as China and India are leveraging economies of scale to produce competitively priced semi-electric beds, while Southeast Asian markets demonstrate a growing preference for homecare beds to support shifting care models. Together, these regional insights underscore the importance of localized strategies for product development, pricing, and distribution.

This comprehensive research report examines key regions that drive the evolution of the Hospital Bed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading hospital bed manufacturers and innovators driving advancement through strategic collaborations, technology integration and competitive differentiation

Leading hospital bed manufacturers have pursued diverse strategies to fortify their market positions and extend technological leadership. Many have forged strategic alliances with digital health providers to embed advanced sensor arrays and analytics platforms directly into bed frames, enabling predictive maintenance and patient fall prevention. Product roadmaps often feature incremental enhancements such as multi-functional side rails, motorized tilting mechanisms, and wireless control interfaces that improve safety and caregiver efficiency.

At the same time, companies are investing in regional manufacturing expansions and facility upgrades to localize production, reduce shipping lead times, and navigate evolving trade policies. Some have established dedicated research centers to explore novel materials such as antimicrobial coatings and next-generation pressure redistribution surfaces. Meanwhile, service innovation is gaining prominence: aftermarket support models now offer remote diagnostics, usage-based service contracts, and digital spare-parts ordering portals, reflecting a shift toward outcome-oriented commercial engagements.

Competitive differentiation also stems from tailored financing solutions and bundled offerings that combine bed systems with facility-wide digital integration services. By enhancing total cost of ownership transparency and aligning delivery timelines with capital expenditure budgets, these leading players are reinforcing customer loyalty and unlocking new sales channels in both public and private healthcare segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hospital Bed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Amico Corporation

- Anyang Top Medical Devices Co., Ltd.

- ARJO

- Baxter International Inc.

- Drive DeVilbiss Healthcare

- Gendron, Inc.

- Graham-field Health Products, Inc.

- Invacare Corporation

- Joerns Healthcare

- LINET Group SE

- Lojer Oy

- Malvestio Spa

- Medline Industries, LP

- Midmark Corporation

- Narang Medical Ltd.

- Paramount Bed Holdings Co., Ltd.

- PROMA REHA, s. r. o.

- Savaria Corporation

- Shree Hospital Equipment

- SonderCare

- Stiegelmeyer GmbH & Co. KG

- Stryker Corporation

- Umano Medical Inc.

Delivering actionable strategic recommendations for healthcare equipment executives to optimize product portfolios, streamline supply chains and accelerate innovation

Industry leaders can accelerate growth and resilience by adopting targeted product modularity that balances customization with standardized core components, thereby streamlining manufacturing workflows and reducing supply-chain complexity. Aligning design strategies with differentiated end-user needs-for instance, prioritizing lightweight aluminum frame beds for homecare and long-term care markets-will enhance customer satisfaction and unlock niche revenue streams.

Moreover, cultivating partnerships with regional suppliers and contract manufacturers can mitigate tariff exposure and improve responsiveness to local demand fluctuations. Healthcare equipment executives should also integrate digital analytics and remote monitoring capabilities into bed platforms to drive preventive maintenance programs and maximize asset utilization. Such value-added services foster recurring revenue models and strengthen customer relationships through data-driven insights.

Finally, leaders should evaluate omnichannel distribution strategies that blend traditional procurement channels with robust online platforms. By enabling configurator-based eCommerce experiences and responsive direct-sale operations, companies can cater to diverse procurement preferences across hospitals, ambulatory centers, and homecare settings. This multi-pronged approach will be essential to sustaining competitive edge and capitalizing on evolving care delivery paradigms.

Outlining rigorous research methodology combining primary interviews, secondary sources and triangulation techniques to ensure data reliability and insight accuracy

This research rigorously combines primary and secondary methodologies to ensure comprehensive coverage and data integrity. Primary engagements included in-depth interviews with senior procurement officers, clinical engineering managers, and key opinion leaders across hospitals, ambulatory surgery centers, and homecare providers. These discussions provided qualitative context on technology adoption drivers, service expectations, and regulatory influences shaping purchase decisions.

Secondary analysis encompassed a thorough review of industry publications, white papers, and peer-reviewed articles, complemented by an examination of patent filings, corporate financial disclosures, and thematic market intelligence reports. Data triangulation techniques were applied to reconcile insights from multiple sources, validate emerging trends, and identify potential divergences between projected and observed behaviors.

To enhance transparency and reproducibility, all data points were cross-referenced against proprietary vendor databases and anonymized procurement records. The underlying framework adheres to established research standards, incorporating iterative validation workshops with subject matter experts to refine key findings and ensure the robustness of strategic imperatives presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hospital Bed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hospital Bed Market, by Type

- Hospital Bed Market, by Usage

- Hospital Bed Market, by Material

- Hospital Bed Market, by End User

- Hospital Bed Market, by Distribution Channel

- Hospital Bed Market, by Region

- Hospital Bed Market, by Group

- Hospital Bed Market, by Country

- United States Hospital Bed Market

- China Hospital Bed Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing conclusive perspectives on the hospital bed market’s current state, strategic inflection points and implications for healthcare stakeholders moving forward

Drawing from the preceding analysis, the hospital bed market stands at a pivotal juncture defined by technological convergence, shifting trade policies, and evolving care delivery models. The interplay of smart bed functionalities, adaptive supply-chain strategies, and dynamic segmentation across type, usage, material, and end-user categories underscores a multifaceted landscape ripe with opportunity and complexity.

Regional variations further illuminate the necessity for localized approaches in product development, manufacturing footprint, and distribution architecture. Meanwhile, leading companies continue to differentiate through service innovation, strategic partnerships, and modular design philosophies that enhance both clinical outcomes and operational efficiency.

As the healthcare sector navigates pressures from demographic trends, regulatory changes, and cost-containment imperatives, stakeholders armed with rigorous insights and actionable recommendations will be best positioned to deliver safe, patient-centric, and economically sustainable bed solutions. This conclusion synthesizes core perspectives and highlights the strategic inflection points that will define market trajectories in the coming years.

Engagement opportunity to connect with the Associate Director of Sales and Marketing and acquire the comprehensive hospital bed market research report

We invite industry executives and healthcare procurement leaders to initiate a personalized consultation with Ketan Rohom, Associate Director of Sales & Marketing, to explore the comprehensive hospital bed market research report. During this tailored discussion, you will gain exclusive insight into the market’s defining characteristics, key growth drivers, and critical strategic imperatives that inform robust decision-making. Our dedicated team stands ready to address your specific questions, outline bespoke package options, and facilitate seamless access to the full dataset and analysis. By connecting directly with an expert who intimately understands both research rigour and commercial application, you can accelerate strategic planning, align with emerging market opportunities, and strengthen your competitive positioning. Reach out now to secure a detailed walkthrough of the report’s actionable intelligence and to receive customized pricing and delivery arrangements. Empower your organization with in-depth, authoritative data that drives real-world outcomes and sustains a leadership advantage in the evolving hospital bed landscape

- How big is the Hospital Bed Market?

- What is the Hospital Bed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?