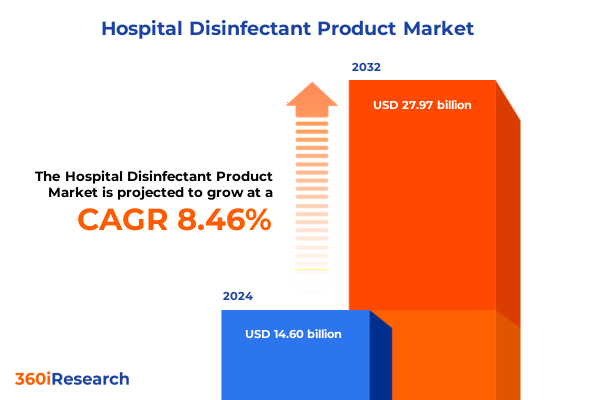

The Hospital Disinfectant Product Market size was estimated at USD 15.53 billion in 2025 and expected to reach USD 16.52 billion in 2026, at a CAGR of 8.76% to reach USD 27.97 billion by 2032.

Foundational Overview Highlighting the Critical Role of Advanced Hospital Disinfectant Solutions in Safeguarding Patient Safety and Healthcare Environments

Hospital disinfectant solutions have emerged as foundational pillars in the pursuit of healthcare excellence, serving as frontline defenses against pathogen transmission and infection outbreaks. In recent years, the criticality of these products has been reaffirmed by heightened global awareness of healthcare-associated infections and the imperative to protect vulnerable patient populations. This introductory overview situates readers within the dynamic ecosystem that underpins product development, regulatory oversight, and procurement decision-making in hospital settings.

Advancements in formulation science and product delivery systems have expanded the range of available options, enabling healthcare facilities to balance efficacy, safety, and operational convenience. As infection prevention goals have intensified, institutions have sought solutions that not only inactivate a broad spectrum of microorganisms but also integrate seamlessly with sterilization workflows, minimize surface dwell times, and reduce the risk of chemical exposure for personnel. Meanwhile, evolving guidelines from agencies such as the Environmental Protection Agency and the Centers for Disease Control and Prevention have continually raised the bar for performance validation, reinforcing the importance of rigorous laboratory testing and field-trial evidence.

Against this backdrop, the present analysis offers a clear lens through which stakeholders can understand emerging technologies, distribution channels, strategic partnerships, and competitive forces shaping the landscape. By grounding insights in real-world use cases, regulatory milestones, and operational priorities, this introduction sets the stage for a deeper exploration of transformative trends, economic variables, and actionable strategies in the hospital disinfectant domain.

Exploring Pivotal Transformations Reshaping Hospital Disinfection Protocols Through Technological Advances Regulatory Developments Infection Control Needs

The hospital disinfectant sector is undergoing transformative shifts that are redefining longstanding norms in infection control. At the forefront, digitalization has catalyzed the advent of Internet of Things-enabled disinfection devices, which allow for real-time monitoring of treatment cycles and chemical usage. These “smart” systems are gaining traction as healthcare administrators seek to bolster compliance, reduce manual errors, and generate audit trails for accreditation purposes.

Concurrently, innovation in active chemistries has given rise to greener, biodegradable compounds that align with sustainability mandates and lower cumulative environmental impact. This trend has been buoyed by commitments from healthcare networks to adopt eco-friendly procurement policies, which in turn incentivize manufacturers to invest in research and development focused on next-generation peroxide formulations and quaternary ammonium alternatives with reduced toxicity profiles.

Regulatory evolution is another pivotal catalyst, as agencies tighten efficacy thresholds and mandate broader pathogen-specific validation, including benchmarks for persistent viral and bacterial inactivation. Concurrent antimicrobial stewardship initiatives underscore the need to minimize the emergence of resistant strains by optimizing contact times and reducing over-application. Finally, the integration of ultraviolet-C and vaporized hydrogen peroxide technologies into hybrid disinfection protocols is reshaping facility workflows and opening new avenues for automation. Together, these converging forces are propelling the market toward higher safety standards, enhanced operational efficiency, and greener product footprints.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Supply Chains Procurement Costs and Budgets for Hospital Disinfection Solutions

In 2025, the cumulative impact of United States tariffs has created notable ripple effects throughout the hospital disinfectant supply chain, influencing raw material sourcing, pricing structures, and inventory management practices. Components such as hydrogen peroxide, peracetic acid, and quaternary ammonium compounds-many of which are imported or reliant on cross-border chemical intermediates-have experienced year-on-year cost escalations tied to tariff increases ranging from 10 to 25 percent. These added duties have reverberated through manufacturer margins and procurement budgets, prompting stakeholders to reevaluate supplier partnerships and near-sourcing strategies.

As a direct response, several leading producers have diversified their vendor base to include domestic suppliers and lower-tariff jurisdictions, thereby mitigating exposure to unpredictable trade policy fluctuations. In parallel, contract manufacturers are adopting automated blending operations that reduce manual handling and concentration variability, enabling more agile in-house formulation that can offset some of the duties incurred on finished goods. Healthcare purchasing teams have also adjusted stocking protocols, transitioning from just-in-time inventory models toward safety stock frameworks designed to absorb tariff-induced price volatility and supply delays.

Moreover, collective purchasing organizations and group purchasing alliances have leveraged volume commitments to negotiate waiver provisions or tiered pricing agreements that partially counterbalance the duty burden. These collaborative procurement mechanisms underscore the sector’s adaptability in the face of trade policy headwinds and exemplify how strategic sourcing, operational restructuring, and stakeholder coordination can preserve both supply continuity and fiscal discipline.

Unlocking Insights Across Hospital Disinfectant Frameworks to Reveal Trends in Product Type End User Application Sales Channel and Active Ingredient Selection

The hospital disinfectant market is best understood through a suite of complementary segmentation frameworks that illuminate distinct needs and opportunity pockets. When examining product types, disinfection devices coexist alongside chemical solutions, aerosol and non-aerosol sprays, and both dry and pre-moistened wipes. Among solutions, the choice between concentrate and ready-to-use formulations influences storage requirements, on-site dilution protocols, and overall cost efficiency.

End-user segmentation further clarifies demand patterns: ambulatory surgical centers, outpatient and specialty clinics, secondary hospitals, and tertiary hospitals each exhibit unique throughput volumes, regulatory expectations, and facility footprints that drive purchasing priorities. Clinics typically favor compact, rapid-action sprays and wipes to accommodate high patient turnover, whereas tertiary hospitals invest in automated sterilization devices capable of large-scale instrument and surface coverage.

Application segmentation underscores the importance of air, floor, instrument, and surface disinfection. Manual and automated instrument sterilization solutions offer discrete advantages in cycle time and process reproducibility, while the distinction between high-touch and low-touch surface protocols informs product selection and frequency of treatment. From an air quality standpoint, integrated disinfection devices employing ultraviolet-C or hydrogen peroxide vapor are increasingly deployed in critical care units.

Lastly, sales channel and active ingredient lenses provide further insight. Direct sales enable tailored technical support and cohesive contract management, whereas distributor networks-both local and national-ensure broad geographic reach. Online channels are beginning to capture incremental share through ease of replenishment and transparent pricing. In terms of chemistry, alcohols, chlorine compounds, hydrogen peroxide, peracetic acid, and quaternary ammonium compounds each present distinct efficacy spectra and material compatibility considerations, guiding procurement specialists toward optimal combinations for their institutional protocols.

This comprehensive research report categorizes the Hospital Disinfectant Product market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Active Ingredient

- Application

- End User

- Sales Channel

Dissecting Regional Dynamics in Hospital Disinfectant Demand and Distribution Across the Americas Europe Middle East & Africa and Asia-Pacific Landscapes

Regional dynamics play a crucial role in shaping hospital disinfectant demand, procurement strategies, and innovation pathways. Within the Americas, a concentration of large healthcare networks and regulatory harmonization efforts have driven widespread adoption of digital monitoring platforms and high-efficacy automated devices. In addition, environmental regulations in certain states have accelerated the shift toward low-toxicity chemistries and closed-loop systems designed to minimize chemical runoff.

Across Europe, the Middle East and Africa, regulatory diversity and varying levels of infrastructure development yield a spectrum of market maturity. Western European nations emphasize rigorous antimicrobial validation and sustainability certifications, while emerging markets in the Middle East leverage public-private partnerships to enhance infection control infrastructure. In Africa, donor-funded programs often prioritize portable, low-cost wipe and spray formats tailored for resource-constrained clinical settings.

In the Asia-Pacific region, fiscal stimulus measures in advanced economies have fueled investments in next-generation disinfection technologies, such as robotics integrated with ultraviolet-C and misting systems. Simultaneously, high population densities in certain urban centers underscore the need for scalable, rapid-action solutions. Diverse procurement models, including centralized government tenders and decentralized private hospital purchasing, shape the competitive landscape and highlight the importance of adaptable go-to-market approaches.

Taken together, these regional insights underscore the necessity of tailored strategies that account for localized regulations, infrastructure readiness, and procurement cultures. Manufacturers and distributors must finesse their product portfolios and service capabilities to resonate with the distinct requirements of each geography.

This comprehensive research report examines key regions that drive the evolution of the Hospital Disinfectant Product market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Innovation Drivers for Leading Hospital Disinfectant Manufacturers to Uncover Unique Strategic Differentiators

Leading hospital disinfectant manufacturers are deploying nuanced strategic initiatives to fortify their market positions and drive sustainable growth. Several have established innovation hubs that focus on next-generation chemistries and device automation, forging partnerships with academic institutions and clinical research organizations to validate performance against emerging pathogens. These efforts not only fortify product pipelines but also enhance brand credibility within infection prevention communities.

At the same time, purposeful investments in digital service offerings-such as remote performance monitoring and predictive maintenance alerts-are enabling suppliers to differentiate beyond traditional product portfolios. By leveraging real-time usage data, providers can anticipate demand fluctuations, optimize delivery schedules, and propose tailored training programs that reinforce compliance and facilitate continuous improvement.

Supply chain resilience has also emerged as a focal point, with top companies diversifying sourcing footprints and building regional manufacturing capacities to mitigate logistic disruptions and tariff impacts. Sustainability commitments further inform corporate strategy, driving the launch of packaging innovations that reduce plastic waste and align with circular economy principles. Moreover, high-profile joint ventures between global players and local distributors have accelerated market entry in high-growth regions, balancing global expertise with on-the-ground networks.

Collectively, these strategic imperatives underscore how market leaders are leveraging multimodal product development, data analytics, and supply chain optimization to advance both top-line growth and operational excellence in the hospital disinfectant landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hospital Disinfectant Product market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- B. Braun Melsungen AG

- Cantel Medical Corporation

- Colgate‑Palmolive Company

- Diversey Holdings Ltd.

- Ecolab Inc.

- GOJO Industries, Inc.

- Johnson & Johnson

- Kimberly‑Clark Corporation

- Medline Industries, Inc.

- Metrex Research, LLC

- Paul Hartmann AG

- Procter & Gamble Company

- Reckitt Benckiser Group plc

- S. C. Johnson & Son, Inc.

- Sealed Air Corporation

- Spartan Chemical Company, Inc.

- STERIS plc

- The Clorox Company

- Whiteley Corporation

- Zep Inc.

Strategic Action Steps for Industry Leaders to Capitalize on Emerging Hospital Disinfectant Trends Optimize Operational Efficiency and Drive Market Leadership

To navigate the evolving hospital disinfectant landscape effectively, industry leaders should prioritize strategic actions that align with emerging trends and operational imperatives. First, investing in advanced disinfection technologies-including IoT-enabled devices and hybrid chemistries-will position organizations to meet rising efficacy benchmarks and deliver enhanced data transparency. This approach ensures robust audit capabilities while optimizing cycle durations.

Simultaneously, fostering flexible supply chain architectures through dual sourcing agreements and near-shoring partnerships can mitigate tariff-driven cost pressures and reduce lead-time variability. Complementing this, the adoption of dynamic inventory models that balance just-in-time replenishment with strategic safety stocks will safeguard continuity in the face of trade policy and logistic uncertainties.

Stakeholders should also champion sustainability by integrating greener chemistries into procurement specifications and collaborating with suppliers on packaging innovations. Engaging cross-functional teams to develop standard operating procedures that emphasize minimal chemical overuse and waste reduction will drive both environmental goals and cost efficiencies. Further, leveraging data analytics platforms to monitor usage patterns and compliance metrics enables targeted training initiatives, thereby reinforcing protocol adherence and reducing human error.

Finally, establishing symbiotic relationships with academic centers and regulatory bodies ensures early insight into shifting guidelines and emerging pathogen threats. By proactively participating in research consortia and standard-setting forums, organizations can co-create solutions that anticipate market needs and solidify their position as leadership partners in infection control.

Comprehensive Research Methodology Using Data Sources Analytical Approaches Expert Interviews and Validation Processes for Hospital Disinfectant Market Analysis

The research underpinning this market analysis was structured to deliver comprehensive, reliable insights through a systematic methodology. Primary data was collected via expert interviews with infection prevention specialists, procurement directors, and regulatory authorities to capture frontline perspectives on usage patterns and unmet needs. These qualitative inputs were supplemented by quantitative surveys distributed to hospital administrators and facility managers across multiple regions to validate perception data and procurement criteria.

Secondary research included a thorough review of regulatory filings, patent databases, peer-reviewed journals, and government reports to track efficacy standards, chemical approvals, and trade policy developments. Trade association publications and white papers provided additional context on technological innovation trajectories and environmental guidelines. To ensure robustness, data sources were cross-referenced and triangulated, with conflicting insights reconciled through follow-up consultations.

Analytical approaches employed encompass trend mapping, scenario analysis, and competitive benchmarking. Cost-impact models were constructed to assess tariff influences on raw material flows and finished-goods pricing, while segmentation frameworks were applied to delineate distinct market pockets. Validation processes involved peer review sessions with independent consultants and expert panels, ensuring that interpretations remained objective and aligned with real-world experiences.

This multi-tiered methodology ensures that the findings and recommendations presented herein are grounded in both empirical evidence and industry expertise, offering stakeholders a precise, actionable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hospital Disinfectant Product market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hospital Disinfectant Product Market, by Product Type

- Hospital Disinfectant Product Market, by Active Ingredient

- Hospital Disinfectant Product Market, by Application

- Hospital Disinfectant Product Market, by End User

- Hospital Disinfectant Product Market, by Sales Channel

- Hospital Disinfectant Product Market, by Region

- Hospital Disinfectant Product Market, by Group

- Hospital Disinfectant Product Market, by Country

- United States Hospital Disinfectant Product Market

- China Hospital Disinfectant Product Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Summarizing Critical Findings Strategic Implications and Perspectives to Guide Stakeholder Decision-making in the Evolving Hospital Disinfectant Landscape

In closing, the hospital disinfectant sector is witnessing a confluence of technological, regulatory, and economic forces that are reshaping market dynamics and stakeholder priorities. Advancements in smart disinfection devices, eco-optimized chemistries, and automated workflows are elevating efficacy benchmarks and driving real-time compliance monitoring. Meanwhile, the 2025 tariff regime has underscored the strategic importance of resilient sourcing models and flexible procurement frameworks, prompting stakeholders to diversify supply chains and embrace collaborative purchasing mechanisms.

Segmentation insights reveal that product type, end-user setting, application modality, sales channel, and active ingredient selection each offer distinct paths to differentiation and value creation. Regional nuances further highlight the necessity for localized strategies that reflect regulatory diversity, infrastructure maturity, and cultural procurement preferences. Competitive analysis underscores that leading manufacturers are investing in digital services, strategic partnerships, and sustainability programs to capture incremental share and foster long-term brand loyalty.

Looking ahead, market participants must remain agile, continuously incorporating emerging scientific validation and policy developments into their operational roadmaps. By focusing on integrated technology adoption, supply chain adaptability, and targeted stakeholder engagement, organizations can not only navigate the current landscape but also anticipate future shifts in infection control. The insights contained within this report serve as a strategic compass, guiding decision-makers toward optimized outcomes and sustained competitive advantage.

Engage with Ketan Rohom Associate Director of Sales & Marketing to Secure Your Hospital Disinfectant Market Report and Drive Informed Investment Insights

For tailored insights and to secure your comprehensive hospital disinfectant market report, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the findings and strategic considerations. His seasoned expertise in translating market intelligence into actionable sales and marketing initiatives ensures you will maximize return on investment. Reach out to discuss customized licensing options, volume discounts, and supplementary advisory services that align with your objectives. Take the next step toward informed decision-making and strengthened competitive positioning by contacting Ketan Rohom today and transforming data-driven insights into growth opportunities.

- How big is the Hospital Disinfectant Product Market?

- What is the Hospital Disinfectant Product Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?