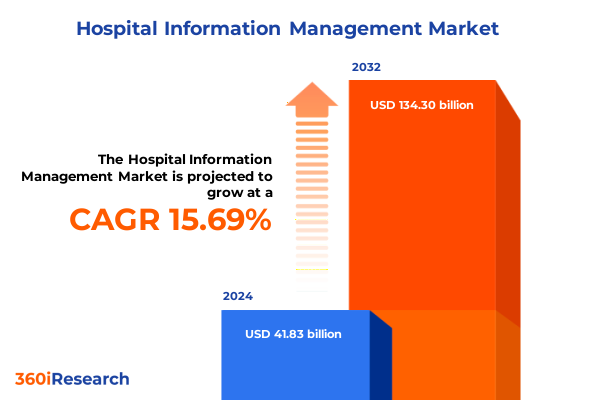

The Hospital Information Management Market size was estimated at USD 48.54 billion in 2025 and expected to reach USD 55.53 billion in 2026, at a CAGR of 15.64% to reach USD 134.30 billion by 2032.

Navigating the Evolving Digital Ecosystem of Hospital Information Management to Empower Data-Driven Clinical and Operational Excellence

Hospital information management has become the cornerstone of modern healthcare, driving the digitization of clinical workflows and administrative operations. As institutions strive to eliminate silos and harness the power of data, integrated platforms are transforming patient care, enabling providers to access real-time information across the continuum of care. This evolution reflects a broader industry imperative: the acceleration of digital transformation, which Deloitte has identified as the factor most likely to impact global health systems through 2025 and beyond, with nearly ninety percent of executives anticipating significant change in technology adoption and process redesign.

Moreover, the convergence of telehealth, mobile health applications, and remote monitoring solutions has further underscored the critical role of robust hospital information systems in supporting hybrid care models. These systems serve as the digital backbone for virtual visits, enabling seamless data exchange between patients and providers. According to industry analysis, virtual care platforms now integrate directly with electronic health records to ensure continuity and quality of care, highlighting the need for intuitive interfaces and interoperable architectures that can adapt to evolving clinical demands.

In this dynamic environment, stakeholders must recognize the multifaceted challenges inherent in deploying and optimizing hospital information management solutions. From aligning with regulatory frameworks to safeguarding patient privacy amidst increasing cyber threats, the path forward demands strategic foresight and disciplined execution. This executive summary brings together the latest trends, regulatory considerations, and market dynamics to equip decision-makers with the insights necessary to navigate this complex landscape and realize the full potential of digital health.

Unleashing Digital Transformation Through AI, Interoperability, and Adaptive Cybersecurity to Redefine Hospital Information Management

Hospitals today are at the forefront of a digital renaissance driven by advancements in artificial intelligence, interoperability standards, and adaptive cybersecurity frameworks. Leading health systems are embracing AI-driven clinical decision support tools that analyze patient history, laboratory results, and genomics to recommend personalized care pathways. Simultaneously, regulators and health consortia are reinforcing data exchange mandates under frameworks such as the Trusted Exchange Framework and Common Agreement, prompting providers to adopt FHIR-based APIs for seamless interoperability. These shifts are redefining how information flows between disparate systems and across care teams.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Hospital Information Systems through Cost, Supply Chain, and Strategic Shifts

The tariffs enacted by the United States in 2025 have introduced material cost pressures across the healthcare technology and device supply chains. Import duties on critical electronics, including servers, networking equipment, and semiconductor components, have prompted hospitals and vendors to reevaluate procurement strategies. Many institutions are transitioning select workloads to cloud-based platforms to mitigate hardware cost volatility, while on-premise upgrades are being deferred as organizations await clearer guidance on tariff schedules and exemption processes.

These duties have not only elevated capital expenditure budgets but also reshaped project timelines. According to a recent healthcare executive poll, ninety-one percent of provider IT leaders anticipate delays in digital transformation initiatives as budgets shift to cover increased operational expenses, with many deferring EHR modernization and AI-enabled upgrade cycles until tariff risks soften. At the same time, non–tariffed software services remain a relative bright spot, encouraging greater adoption of managed and professional services models to deliver clinical software updates and revenue cycle management enhancements without triggering additional duties.

In response, equipment manufacturers and technology partners are exploring near-shoring and regional distribution hubs to fortify supply chains. Industry analyses indicate that healthcare organizations forming strategic alliances for consolidated purchasing and stockpiling essential components can achieve continuity of care, despite broader market instability. As these tariff-related headwinds persist, healthcare leaders must balance cost containment with the imperative to maintain secure, compliant, and fully supported information infrastructures.

Unveiling Key Segmentation Insights Spanning Services, Software Modules, Deployment Models, End Users, and Hospital Types Driving System Adoption

The hospital information management market can be examined through multiple lenses to uncover nuanced growth drivers and service adoption patterns. The first view considers components, wherein service offerings bifurcate into managed and professional services, each delivering specialized consulting, customization, and support engagements. Alongside these services, software modules span core functionalities, encompassing billing and revenue cycle management, computerized provider order entry, clinical trial management, electronic health and medical records, laboratory information systems, and patient administration systems.

Another perspective centers on deployment mode, contrasting cloud-based solutions with on-premise installations. Cloud deployments offer rapid scalability, subscription-based cost models, and offloaded maintenance responsibilities, while on-premise models appeal to institutions seeking direct control over data sovereignty and infrastructural customization. Additionally, end-user segmentation illuminates demand across ambulatory surgery centers, clinics, diagnostic centers, and hospitals, each with unique requirements for clinical workflows, administrative integrations, and compliance reporting.

A final segmentation dimension addresses hospital type: general hospitals pursue broad-based interoperability and workflow optimization across multiple specialties, whereas specialty hospitals-cardiology, oncology, orthopedics, and pediatrics-prioritize niche clinical decision support, advanced imaging integrations, and specialized revenue cycle configurations. Together, these segmentation perspectives reveal a complex tapestry of organizational needs and solution capabilities that are shaping the evolution of hospital information management strategies.

This comprehensive research report categorizes the Hospital Information Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End User

- Hospital Type

Revealing Pivotal Regional Dynamics Shaping Hospital Information Management Adoption within Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in the adoption and evolution of hospital information management solutions. In the Americas, well-established regulatory frameworks, significant healthcare expenditure, and robust reimbursement models catalyze rapid uptake of cloud-enabled electronic health records and integrated revenue cycle management platforms. Providers in North America leverage mature vendor ecosystems to pursue interoperability initiatives, while Latin American markets are embracing telehealth extensions to bridge geographic and workforce constraints.

Across Europe, the Middle East and Africa, regulatory harmonization efforts-driven by standards like the European Health Data Space and data privacy frameworks such as GDPR-shape solution design and deployment. Western European health systems undertake large-scale legacy system replacements to achieve seamless data exchange, whereas emerging markets in the Middle East and Africa prioritize cost-effective, scalable platforms that support phased digital transformation roadmaps and foundational cybersecurity postures.

In the Asia-Pacific region, rapid economic growth and expanding healthcare budgets fuel the fastest adoption rates globally. Governments in India and China champion digital health initiatives, exemplified by nation-wide health ID programs and unified patient portals, while advanced markets such as Japan and Australia focus on integrating AI-powered analytics and precision medicine modules into their hospital information landscapes. These diverse regional forces underscore the importance of localized partnerships and regulatory alignment in driving successful implementations.

This comprehensive research report examines key regions that drive the evolution of the Hospital Information Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Initiatives and Innovative Strategies of Leading Hospital Information Management Vendors Driving Technological Competition and Evolution

Leading hospital information management vendors are executing distinct strategies to differentiate in a competitive landscape marked by accelerating digital transformation and rising customer expectations. Epic Systems continues to expand its fully integrated platform, showcasing generative AI–powered documentation, genomics integrations, and nationwide interoperability under TEFCA at major industry events, positioning itself as a one-stop solution for enterprise health networks. Oracle Health, formed through the Cerner acquisition, is embedding cloud-native AI capabilities within its EHR suite to automate administrative workflows and deliver advanced analytics, underscoring its long-term commitment to AI-augmented patient care.

Allscripts is diversifying its cloud portfolio with a new machine learning–driven EHR system, Avenel, and strategic partnerships for virtual assistants, while continuing to bolster revenue cycle and population health offerings with data-driven analytics modules. MEDITECH is emphasizing interoperability through its Expanse platform and the growing Traverse Exchange network, integrating ambient listening, AI-enhanced documentation, and patient engagement tools via its MEDITECH-as-a-Service cloud subscription model to streamline implementations and drive user adoption of advanced workflows. These vendor initiatives highlight the critical interplay of AI, cloud adaptability, and ecosystem integration in defining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hospital Information Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allscripts Healthcare, LLC

- athenahealth, Inc.

- Computer Programs and Systems, Inc.

- Dedalus S.p.A.

- eClinicalWorks, LLC

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- InterSystems Corporation

- Koninklijke Philips N.V.

- McKesson Corporation

- Medhost, LLC.

- Medical Information Technology, Inc.

- Netsmart Technologies, Inc.

- NextGen Healthcare, Inc.

- NTT DATA Corporation

- Optum, Inc.

- Oracle America, Inc.

- Siemens Healthineers AG

- WellSky Corporation

- Wipro Limited

Driving Innovation and Resilience through Actionable Recommendations Anchored in AI, Interoperability, Cloud Adaptation, Cybersecurity, and Policy Advocacy

Industry leaders should prioritize a balanced technology portfolio that blends on-premise control with cloud-native flexibility to mitigate geopolitical and tariff-induced supply chain disruptions. By strategically outsourcing routine infrastructure management to managed service providers, organizations can maintain focus on core clinical and operational priorities while guarding against hardware cost volatility driven by import levies.

Simultaneously, healthcare systems must accelerate their AI adoption roadmaps, embedding generative AI and predictive analytics into clinical workflows and administrative functions. Engaging with technology partners early to pilot AI-driven agents can yield efficiency gains and position providers to capture quality reimbursement incentives tied to value-based care.

Moreover, robust cybersecurity frameworks are non-negotiable. Organizations should adopt zero-trust architectures, multifactor authentication, and continuous monitoring to fortify defenses against increasingly sophisticated threats. Alignment with evolving regulatory requirements-such as enhanced security rule updates-ensures compliance and safeguards patient trust.

Finally, proactive advocacy for supply chain diversification and tariff exemptions is essential. By collaborating with industry associations and government bodies, healthcare stakeholders can influence policies that support affordable access to medical technologies and information systems, reinforcing resilience and continuity of care.

Outlining a Robust Research Methodology Combining Primary Interviews, Quantitative Surveys, Secondary Analysis, and Rigorous Data Validation Processes

Our research methodology integrates both primary and secondary approaches to deliver a comprehensive, unbiased market assessment. We conducted in-depth interviews with senior executives across a spectrum of healthcare providers, including hospital CIOs, clinical informatics leaders, and supply chain directors, capturing real-world perspectives on system selection, implementation challenges, and strategic priorities.

In parallel, we deployed quantitative surveys to a broader pool of health system IT professionals, gathering data on adoption rates, technology preferences, and budgetary considerations. Secondary research encompassed detailed analysis of public financial reports, regulatory filings, and vendor press releases to corroborate interview findings and ensure alignment with reported market activity.

Data triangulation techniques were applied to synthesize qualitative and quantitative inputs, enabling us to validate trends and identify emerging inflection points. Our team also monitored global policy developments and tariff announcements to contextualize cost and supply chain analyses. Rigorous data validation procedures, including consensus reviews by subject-matter experts, guarantee the accuracy and relevance of our insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hospital Information Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hospital Information Management Market, by Component

- Hospital Information Management Market, by Deployment Mode

- Hospital Information Management Market, by End User

- Hospital Information Management Market, by Hospital Type

- Hospital Information Management Market, by Region

- Hospital Information Management Market, by Group

- Hospital Information Management Market, by Country

- United States Hospital Information Management Market

- China Hospital Information Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding with Strategic Reflections on Key Insights, Emerging Opportunities, and Future Directions in Hospital Information Management

This executive summary has illuminated the critical transformations reshaping hospital information management, from tariff-driven supply chain realignments to AI-enabled clinical and administrative innovations. By segmenting the market across components, deployment modes, end users, and hospital types, we’ve revealed the nuanced drivers of adoption and the tailored strategies required to meet diverse organizational needs.

Regional analysis underscored the varying priorities across the Americas, Europe, the Middle East & Africa, and Asia-Pacific, highlighting the importance of localized compliance, interoperability standards, and digital transformation initiatives. Vendor profiling showcased how leading players-Epic Systems, Oracle Health, Allscripts, and MEDITECH-are leveraging AI, cloud services, and ecosystem partnerships to capture market share and drive technological evolution.

Actionable recommendations have been outlined to guide decision-makers in balancing cost, risk, and innovation. From investing in hybrid cloud architectures to championing cybersecurity enhancements and engaging in policy advocacy, these strategic imperatives are designed to future-proof hospital information systems and support the delivery of high-quality patient care. As the industry continues to evolve, stakeholders who align technology initiatives with regulatory developments and market dynamics will position themselves for sustainable success.

Connect with Ketan Rohom for Tailored Guidance and Exclusive Access to the Comprehensive Hospital Information Management Market Research Report

We invite you to explore our in-depth market research report on hospital information management systems and discover the strategic insights that can give your organization a competitive edge. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this comprehensive analysis can be tailored to your specific needs and objectives. Ketan brings extensive industry expertise and is committed to guiding you through the key findings, methodological rigor, and actionable recommendations contained within the report.

Connect with Ketan today to secure exclusive access to our latest research deliverables and gain the clarity needed to inform your next strategic move in hospital information management.

- How big is the Hospital Information Management Market?

- What is the Hospital Information Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?