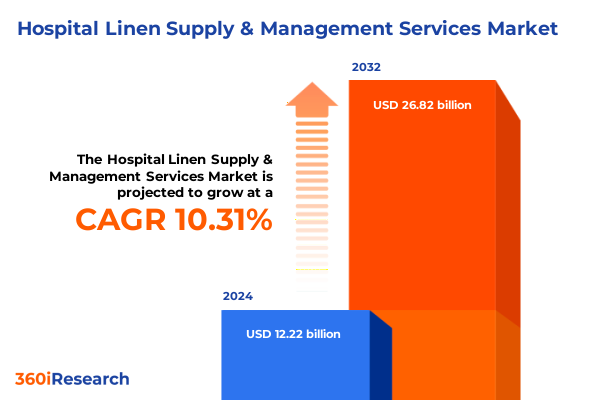

The Hospital Linen Supply & Management Services Market size was estimated at USD 13.40 billion in 2025 and expected to reach USD 14.70 billion in 2026, at a CAGR of 10.41% to reach USD 26.82 billion by 2032.

Understanding the Crucial Role of Hospital Linen Supply Management in Driving Quality Care Efficiency and Operational Sustainability

In the high‐stakes environment of modern healthcare, linen supply performs a pivotal function in maintaining hygiene, patient safety and brand reputation. Hospital linens are integral to patient comfort and infection control practices. Medical supply expenses collectively accounted for $146.9 billion in 2023, marking a $6.6 billion rise from the prior year; within this category, linens represent a critical subset that influences both operational budgets and compliance with stringent sanitary protocols. Healthcare administrators allocate a significant proportion of facility budgets to linen procurement and management, driving a continuous quest for cost‐effective, reliable solutions that enhance throughput while mitigating risk.

Against this backdrop, the hospital linen and laundry services sector stands at a crossroads defined by intensifying regulatory requirements, escalating labor and utility costs, and increasing stakeholder scrutiny over sustainability metrics. Evolving accreditation standards and heightened patient expectations demand resilient, innovative supply models that align with broader organizational objectives. Consequently, providers of linen management services are compelled to adopt advanced operational frameworks, integrate cutting‐edge technologies, and forge strategic partnerships that span the continuum of care. This report offers a comprehensive overview of these imperatives, setting the stage for a deeper exploration of market shifts and actionable strategies.

Exploring the Technological Environmental and Operational Transformations Reshaping How Linens Are Managed across Modern Healthcare Facilities

The landscape of hospital linen management has undergone a technological revolution characterized by the deployment of radio‐frequency identification (RFID), real‐time location systems (RTLS) and integrated IoT platforms. For instance, a leading 800‐bed institution in Brazil implemented a comprehensive RFID solution to track over 158,000 linen items, slashing inventory counting times by nearly 86 percent, curbing loss rates from four percent to under one percent, and achieving annual savings exceeding $300,000. Meanwhile, smart hospitals in Europe and North America are leveraging RFID‐enabled cabinets, robotic dispensing systems, and AI‐driven predictive analytics to automate replenishment, optimize utilization rates and streamline sterilization workflows. These innovations not only enhance supply chain transparency but also empower clinical staff to devote more time to patient‐centric activities.

In parallel, sustainability mandates and infection control protocols are reshaping operational priorities. Water reuse technologies, energy‐efficient drying processes and eco‐certified detergents have emerged as core differentiators, aligning linen management services with corporate environmental objectives and regulatory frameworks. Automation reduces linen handling, thus lowering cross‐contamination risks and bolstering compliance with stringent sterilization standards. Additionally, a shift toward outsourced, third‐party service models enables healthcare providers to access specialized expertise while retaining in‐house teams for critical functions. As the industry navigates rising labor costs and tariff pressures, these transformative shifts delineate a clear agenda for service excellence and resilience.

Examining the Far‐Reaching Consequences of 2025 U.S. Tariff Adjustments on Textiles and Their Implications for Hospital Linen Supply Chains

In 2025, the United States government enacted sweeping tariff adjustments under Section 301, targeting textile imports from key sourcing countries to bolster domestic industries and address perceived trade imbalances. Tariffs on Chinese‐made textile goods escalated to 54 percent, while products sourced from Vietnam now face a 46 percent levy, Pakistan 29 percent and India 26 percent. Moreover, discussions within the administration signaled the potential establishment of a 15 percent baseline tariff floor on all textile imports, which could push average effective rates beyond historical norms. These measures represent some of the most expansive trade actions implemented since the early twentieth century.

The cumulative impact of these tariff increases reverberates throughout hospital linen supply chains, yielding higher input costs for fabric, disposable gowns and ancillary items. Providers are compelled to reevaluate supplier portfolios, diversify to less‐expensive production bases and negotiate more aggressive contractual terms. The added duties have prompted a reassessment of nearshore and onshore options, yet domestic capacity constraints limit rapid scaling. As a result, many linen service organizations are recalibrating cost models, absorbing certain tariff effects while strategically reallocating resources to maintain competitive pricing and service continuity.

Revealing Strategic Perspectives on Service End User Distribution Ownership Material Fabric Application and Hygiene Segmentation Dynamics

A nuanced understanding of segmentation dimensions is indispensable for crafting differentiated service offerings in the hospital linen sector. Providers structure portfolios around service type distinctions, offering pure rental solutions that ensure on‐demand replenishment alongside comprehensive laundry services encompassing washing, finishing and high‐temperature sterilization. Clients span the continuum of care, from ambulatory surgical centers and outpatient clinics to large tertiary hospitals, each with distinct volume needs and compliance requirements. Distribution frameworks range from direct delivery models, which foster tighter control over inventory stewardship, to partnerships with specialized third‐party logistics operators that facilitate broader geographic coverage and scalability.

Ownership structures also vary, with some healthcare systems retaining in‐house linen management teams to maintain hands‐on quality oversight, while others outsource end‐to‐end operations to capitalize on provider expertise and cost efficiencies. Material choices-be they durable cotton, low‐cost polyester blends or advanced synthetic fibers-are aligned with performance attributes such as moisture‐wicking, microbial resistance and lifecycle costs. Linens are further categorized by fabric construction, spanning nonwoven disposables for critical containment scenarios and woven textiles for patient gowns, bed linens, tablecloths, napkins and towels. In surgical contexts, drapes and pack covers are meticulously engineered and often packaged as procedure packs, while hygiene preferences bifurcate disposable items designed for one‐time use versus reusable alternatives subject to rigorous sterilization.

This comprehensive research report categorizes the Hospital Linen Supply & Management Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Ownership

- Material

- Fabric

- Hygiene

- Application

- Distribution Channel

Uncovering Regional Nuances and Operational Variances across the Americas Europe Middle East & Africa and Asia Pacific Hospital Linen Markets

The Americas region, particularly the United States and Canada, remains at the forefront of technology adoption in hospital linen management, with early deployments of RFID‐enabled tracking systems and robotic dispensing units. Healthcare networks collaborate closely with linen service partners to integrate data platforms that provide end‐to‐end visibility of inventory status, facilitating rapid response to peak demand and emergency scenarios. Latin American markets, led by Brazil and Mexico, are increasingly investing in centralized laundry hubs that leverage automation to overcome labor constraints and improve compliance with evolving hygiene protocols.

In Europe, Middle East and Africa, stringent textile regulations and robust environmental policies have driven widespread implementation of green laundering practices, including water reprocessing and chemical management. Leading providers in Western Europe highlight sustainability credentials through certifications and circular economy initiatives that recycle textile fibers. Meanwhile, healthcare systems in the Gulf Cooperation Council and North Africa face unique challenges around extreme climate conditions and remote infrastructure, prompting a reliance on modular laundry units and public‐private partnerships.

The Asia‐Pacific region exhibits dynamic growth fueled by expanding hospital networks and rising demand for premium clinical textiles. Countries such as Japan and South Korea emphasize smart hospital programs that incorporate IoT sensor networks in linen carts and storage areas, while Southeast Asian nations explore dual sourcing strategies to mitigate tariff risks. Investment in hyper‐location aware applications has enabled throughput increases of up to 25x and a tenfold reduction in lost linens, underscoring the transformative power of integrated digital solutions in high‐volume settings.

This comprehensive research report examines key regions that drive the evolution of the Hospital Linen Supply & Management Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Leadership Demonstrated by Key Players in the Hospital Linen Supply and Management Sector

Cintas Corporation distinguishes itself through an extensive North American footprint that encompasses over 400 service centers and a robust logistics infrastructure, enabling it to deliver rapid replenishment and flexible rental programs across diverse care settings. The company’s emphasis on sustainability is evident in its textile recycling initiatives and water conservation targets, which resonate with healthcare executives focused on environmental stewardship. Similarly, Aramark has positioned itself at the intersection of technology and service design through its APLUS (Aramark Personal Linen Utilization System) program, which leverages RFID tracking to optimize surgical linen workflows, minimize waste and support compliance with infection prevention protocols.

European leader Elis (formerly Berendsen) has bolstered its market presence by integrating advanced textile technologies and launching sustainable product lines composed of recycled materials, reinforcing its commitment to circular healthcare models. Alsco, with a diversified portfolio spanning uniforms, linens and facility services, leverages proprietary detergents and proprietary finishing processes to enhance linen performance and extend textile lifecycles. Mission Linen Supply differentiates through customized service bundles and data‐driven analytics, enabling healthcare partners to tailor inventory levels and service cadences to specific unit workloads. Collectively, these organizations underscore the imperative of blending operational scale with niche innovation to maintain competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hospital Linen Supply & Management Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alsco Inc.

- AmeriPride Services Inc.

- Angelica Corporation

- Aramark

- Celtic Linen

- CleanCare

- Compass USA

- Ecotex Healthcare Linen Service Group

- Emes Textiles Pvt. Ltd.

- Healthcare Services Group, Inc.

- ImageFIRST Healthcare Laundry Specialists, Inc.

- Infiniti Medical Solutions

- Linen King, LLC

- Medline Industries, LP

- Mission Linen Supply

- Morgan Services, Inc.

- SAS Elis Services

- Synergy Health Managed Services Ltd.

- Tetsudo Linen Service

- Unitex Textile Rental Services, Inc.

- Venus Group

Presenting Targeted Actionable Recommendations to Empower Industry Leaders in Optimizing Efficiency Sustainability and Resilience in Linen Management

To remain competitive and resilient in the face of shifting regulatory environments and tariff headwinds, industry leaders should prioritize the deployment of integrated digital platforms that extend beyond basic inventory tracking. Embedding RFID and IoT sensors within linen assets is a foundational step, yet the greatest value emerges when these data streams are harmonized with analytics engines capable of forecasting usage patterns, identifying process bottlenecks and triggering automated replenishment actions. By establishing interoperable data ecosystems in collaboration with clinical informatics teams, providers can unlock actionable insights that drive both cost containment and service excellence.

Concurrently, organizations must pursue sustainability frameworks that encompass resource conservation, waste reduction and circular economy principles. This includes partnering with laundry operations that employ advanced water‐reclamation systems, leveraging eco‐certified detergents and integrating lifecycle management tools to track textile ownership and reclamation. In response to tariff-induced supply chain risks, diversification of raw material sources and exploration of nearshoring options can mitigate exposure to sudden duty escalations. Finally, cultivating a skilled workforce through targeted training in lean management methodologies and technology utilization ensures that human capital aligns with future operational paradigms.

Detailing a Robust Multi-Method Research Framework Combining Primary Interviews Secondary Data Sources and Analytical Models for Rigorous Insights

This analysis integrates a multi-method research framework to deliver rigorous, actionable insights. A comprehensive PESTEL assessment evaluates macroeconomic, political and regulatory drivers shaping the hospital linen landscape, while Porter’s Five Forces analysis delineates competitive pressures and bargaining dynamics across the value chain. Strategic company profiles draw upon in-depth secondary data, including corporate sustainability reports, technology adoption studies and industry association publications to capture the evolving commitments of key service providers.

Primary research comprised structured interviews with supply chain executives, clinical operations directors and laundry service managers across North America, Europe and Asia-Pacific to validate emerging trends and quantify operational efficiencies. These qualitative insights were augmented by quantitative data extraction from customs databases, trade publications and third-party logistics reports. The triangulation of diverse data streams ensures a balanced perspective that reflects both frontline operational realities and overarching market trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hospital Linen Supply & Management Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hospital Linen Supply & Management Services Market, by Service Type

- Hospital Linen Supply & Management Services Market, by Ownership

- Hospital Linen Supply & Management Services Market, by Material

- Hospital Linen Supply & Management Services Market, by Fabric

- Hospital Linen Supply & Management Services Market, by Hygiene

- Hospital Linen Supply & Management Services Market, by Application

- Hospital Linen Supply & Management Services Market, by Distribution Channel

- Hospital Linen Supply & Management Services Market, by Region

- Hospital Linen Supply & Management Services Market, by Group

- Hospital Linen Supply & Management Services Market, by Country

- United States Hospital Linen Supply & Management Services Market

- China Hospital Linen Supply & Management Services Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Strategic Imperatives that Define the Future Trajectory of Hospital Linen Supply Management Excellence

The hospital linen supply and management sector is experiencing a paradigm shift characterized by accelerated digital adoption, heightened sustainability imperatives and complex trade dynamics. RFID, IoT and AI-driven analytics are becoming indispensable tools for optimizing inventory accuracy and labor efficiency, while environmental stewardship initiatives reinforce brand reputation and compliance with regulatory mandates. At the same time, the introduction of substantial tariff adjustments in 2025 has underscored the necessity of supply chain diversification and strategic sourcing agility.

As healthcare organizations grapple with workforce constraints, facility expansion and evolving accreditation requirements, linen service providers must continue to innovate within segmented service portfolios and regional markets. Collaborative partnerships that integrate technology, sustainability expertise and operational consultancy will differentiate leaders from laggards. This synthesis of trends and strategic considerations sets the stage for actionable pathways that can elevate service quality, drive cost resilience and support the advancement of patient-centric care models.

Engage Directly with Ketan Rohom to Secure Expert Analysis and Acquire the Definitive Hospital Linen Supply Market Intelligence Report Today

Unlock the full breadth of research, encompassing detailed segmentation analyses, regional deep‐dives and proprietary insights into emerging tariff impacts by connecting directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Whether you seek a personalized briefing, bespoke data extracts or enterprise licensing for your organization’s strategic planning, Ketan stands ready to facilitate immediate access to the definitive hospital linen supply market intelligence report. Engage today to secure your competitive advantage and empower informed decision‐making in this rapidly evolving landscape.

- How big is the Hospital Linen Supply & Management Services Market?

- What is the Hospital Linen Supply & Management Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?