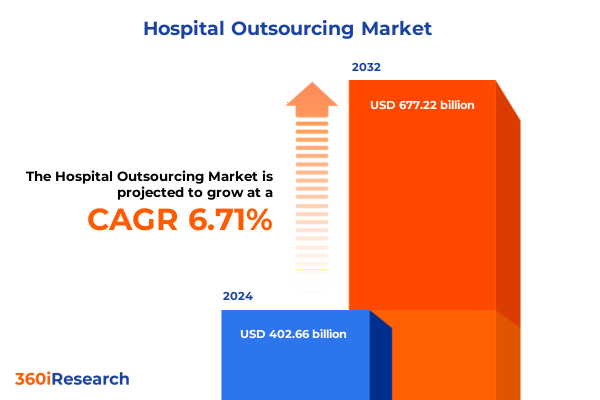

The Hospital Outsourcing Market size was estimated at USD 426.77 billion in 2025 and expected to reach USD 452.32 billion in 2026, at a CAGR of 6.81% to reach USD 677.22 billion by 2032.

Navigating the Complex Hospital Outsourcing Ecosystem to Enhance Operational Efficiencies and Patient Care While Reducing Costs

The complexity of modern hospital operations demands innovative outsourcing strategies that balance efficiency with clinical excellence. As healthcare systems confront tightening budgets, rising patient expectations, and evolving regulatory requirements, outsourcing non-core and specialized services emerges as a critical lever for sustaining quality care and operational resilience. This report serves as a foundational guide, providing stakeholders with a holistic understanding of the diverse service categories, contract structures, delivery modes, and provider models shaping the hospital outsourcing landscape.

Through a blend of industry expertise and empirical insights, this analysis elucidates how hospital executives can navigate the fragmented outsourcing ecosystem to unlock cost savings, drive process optimization, and maintain the highest standards of patient safety. By establishing this contextual framework, readers will gain clarity on the key drivers and constraints influencing outsourcing decisions, positioning their organizations to capitalize on market opportunities and proactively address emerging challenges.

Identifying Emerging Policy Technological and Workforce Trends Driving Fundamental Transformations in Hospital Outsourcing Landscapes

Hospital outsourcing is experiencing a paradigm shift driven by regulatory reforms, technological innovation, and workforce realignment. The introduction of value-based reimbursement models has propelled healthcare providers to seek external partners capable of delivering outcome-oriented services. Simultaneously, digital transformation initiatives, including the adoption of artificial intelligence, telehealth platforms, and predictive analytics, have redefined traditional service delivery paradigms.

Moreover, demographic changes and escalating labor costs have elevated the importance of scalable staffing solutions, prompting hospitals to collaborate with specialized outsourcing firms for clinical and nonclinical support. As these transformative forces converge, outsourcing strategies evolve from mere cost containment to strategic enablers of service differentiation and patient engagement. Stakeholders must therefore adopt a forward-looking mindset, aligning contractual frameworks and delivery capabilities with long-term organizational objectives.

Assessing the Multifaceted Impact of Newly Introduced United States Tariffs on Equipment Costs Supply Chains and Outsourcing Strategies in 2025

Recent tariff changes introduced by the United States government are reshaping cost structures and supply chain dynamics in the hospital outsourcing sector. Tariffs on Chinese-made semiconductors, solar cells, syringes, and needles have risen from 25% to 50%, while duties on batteries, face masks, medical gloves, critical minerals, permanent magnets, steel, and aluminum products have increased to 25% from previous rates of up to 7.5%. These measures stem from broader trade policy objectives aimed at incentivizing domestic production and enhancing supply chain resilience.

Industry surveys highlight the operational ramifications of these levies. Eighty-two percent of healthcare experts anticipate that tariff-related expenses will elevate hospital costs by at least 15% in the near term, and ninety-four percent of administrators signal plans to defer equipment upgrades to manage financial headwinds. Concurrently, procurement professionals report a 90% likelihood of sourcing disruptions and longer lead times as international manufacturing realigns. In response, outsourcing providers and hospital systems are reevaluating vendor portfolios, exploring alternative regional suppliers, and negotiating flexible contract models to mitigate tariff-induced volatility.

Unveiling Critical Segmentation Insights That Shape Outsourcing Strategies Based on Service Types Contract Models Delivery Modes Provider Types and Hospital Classifications

Insights derived from service type segmentation reveal nuanced adoption patterns across clinical and nonclinical domains. Clinical services such as laboratory operations, pharmacy management, radiology, and surgical support each necessitate distinct outsourcing approaches, while within each category sub-specializations demand tailored partnership models. Nonclinical functions, encompassing food services, housekeeping, human resources, and IT, similarly exhibit variable outsourcing maturity based on operational complexity and risk profiles.

Contract model segmentation demonstrates that fixed-price agreements appeal to organizations prioritizing budget certainty, whereas gain-sharing and risk-sharing arrangements align incentives around shared performance metrics. Time and materials contracts remain relevant for ad hoc or high-uncertainty engagements. Delivery mode segmentation underscores the growing prevalence of hybrid frameworks that combine onsite presence with remote support to optimize resource allocation. Provider type segmentation highlights a spectrum of options from captive centers and shared service centers to independent contractors and third-party specialists. Finally, hospital type segmentation shows that private, public, and specialty institutions each tailor outsourcing strategies to their unique governance, funding constraints, and patient demographics, resulting in differentiated demand for service offerings and engagement models.

This comprehensive research report categorizes the Hospital Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Contract Model

- Delivery Mode

- Provider Type

- Hospital Type

- Hospital Size

- End-User

Highlighting Regional Variations Across Americas Europe Middle East Africa and Asia Pacific Influencing Hospital Outsourcing Adoption and Market Dynamics

Regional dynamics exert a profound influence on hospital outsourcing practices across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, consolidation trends and the rise of integrated delivery networks facilitate large-scale outsourcing partnerships, with providers prioritizing end-to-end solutions to drive economies of scale. Europe Middle East and Africa markets, characterized by diverse regulatory environments and fragmented healthcare systems, demonstrate differentiated outsourcing adoption, with emphasis on compliance management and localized service delivery.

The Asia Pacific region, propelled by rapid urbanization and expanding middle-class populations, shows robust demand for outsourcing in clinical specialties and digital health services. Cross-border outsourcing hubs in India and Southeast Asia continue to attract nonclinical tasks such as IT support and revenue cycle management, leveraging cost arbitrage and skilled talent pools. These regional distinctions underscore the necessity for tailored market entry strategies and strategic alliances that align with local regulations, cultural considerations, and healthcare system maturity.

This comprehensive research report examines key regions that drive the evolution of the Hospital Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Industry Players and Strategic Collaborators Shaping the Competitive Hospital Outsourcing Ecosystem Across Multiple Service Verticals

Leading players in the hospital outsourcing ecosystem differentiate themselves through comprehensive service portfolios, technological integrations, and robust global footprints. Established facilities management firms extend their offerings to encompass specialized clinical support, while healthcare-focused outsourcing providers enhance capabilities through strategic acquisitions and technology partnerships. Several prominent companies have invested in digital platforms that integrate data from disparate systems, enabling real-time performance monitoring and predictive analytics.

These organizations also leverage deep clinical expertise to co-design workflows, ensuring that outsourced functions align seamlessly with in-house processes and quality standards. Collaboration between traditional outsourcing providers and emerging health-tech startups is driving innovative solutions, particularly in telemedicine enablement, AI-driven diagnostics, and remote monitoring services. The competitive landscape is further shaped by service level differentiation, with top providers offering tiered packages that range from basic compliance support to fully managed, end-to-end operational models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hospital Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Cognizant Technology Solutions Corporation

- Conduent Incorporated

- Evolent Health, Inc.

- Genpact Limited

- HCL Technologies Limited

- McKesson Corporation

- R1 RCM Inc.

- UnitedHealth Group Incorporated

- Wipro Limited

Actionable Strategic Recommendations for Hospital Executives and Outsourcing Providers to Capitalize on Efficiencies Technology and Regulatory Changes

Hospital executives must adopt a multi-faceted approach to outsourcing strategy that prioritizes agility, transparency, and shared accountability. First, developing robust governance frameworks with clearly defined KPIs and performance incentives will align organizational goals with provider deliverables. Engaging in joint risk-sharing arrangements can enable both parties to benefit from efficiency gains while sharing downside exposure.

Second, investing in digital integration and data exchange capabilities is imperative for monitoring outsourced operations and driving continuous improvement. Stakeholders should leverage cloud-based platforms and secure data repositories to facilitate real-time collaboration. Third, expanding local and regional supplier networks will mitigate concentration risks and enhance supply chain resilience. Finally, cultivating strategic partnerships with niche providers and health-tech innovators can accelerate the adoption of cutting-edge solutions, fostering a culture of innovation and ensuring sustained competitive advantage.

Detailing a Rigorous Multi Stage Research Methodology Incorporating Primary Interviews Secondary Data Analysis and Expert Validations to Ensure Robust Insights

This research employs a rigorous, phased methodology to ensure the validity and reliability of insights. The process began with an extensive secondary data review, encompassing industry reports, regulatory filings, peer-reviewed journals, and trade publications. This foundation was supplemented by primary research, involving in-depth interviews with hospital executives, outsourcing providers, industry analysts, and regulatory experts to capture diverse perspectives and real-world experiences.

Quantitative data were analyzed using statistical techniques to identify patterns and correlations across segmentation variables and regional markets. Scenario analysis was conducted to evaluate the impact of tariff changes, technological disruptions, and policy reforms on outsourcing strategies. Finally, all findings and hypotheses were validated through expert panel reviews, incorporating feedback loops to refine conclusions and ensure robustness against evolving market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hospital Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hospital Outsourcing Market, by Service Type

- Hospital Outsourcing Market, by Contract Model

- Hospital Outsourcing Market, by Delivery Mode

- Hospital Outsourcing Market, by Provider Type

- Hospital Outsourcing Market, by Hospital Type

- Hospital Outsourcing Market, by Hospital Size

- Hospital Outsourcing Market, by End-User

- Hospital Outsourcing Market, by Region

- Hospital Outsourcing Market, by Group

- Hospital Outsourcing Market, by Country

- United States Hospital Outsourcing Market

- China Hospital Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Drawing Conclusive Insights to Synthesize Key Findings Support Decision Making and Guide Strategic Moves in the Evolving Hospital Outsourcing Market

The findings of this report synthesize the interplay of regulatory shifts, economic pressures, and technological advancements shaping the hospital outsourcing market. By articulating key segmentation and regional insights, stakeholders are equipped to formulate targeted strategies that optimize resources, enhance service quality, and manage risk. The analysis underscores the importance of aligning contract models with organizational objectives and tailoring delivery modes to operational requirements.

Moreover, the evaluation of tariff impacts highlights the necessity for flexible supply chain strategies and diversified vendor ecosystems. As the competitive landscape evolves, the ability to forge strategic alliances with specialty providers and technology innovators will become increasingly critical. This executive summary encapsulates actionable insights designed to guide decision makers in steering their organizations toward sustainable growth, operational excellence, and enhanced patient outcomes.

Connect with Ketan Rohom to Unlock Actionable Intelligence and Acquire the Comprehensive Hospital Outsourcing Market Report for Strategic Advantage

Engaging with an experienced industry specialist can catalyze your strategic decision making and accelerate your path to actionable insights. Ketan Rohom, Associate Director of Sales & Marketing, offers personalized consultations to understand your specific research needs and guide you through the comprehensive hospital outsourcing market report. By partnering directly with Ketan, you gain priority access to in-depth analyses on cost optimization, service delivery innovations, and emerging regulatory landscapes.

Initiating a conversation with Ketan will ensure you receive tailored recommendations and relevant data extracts aligned to your organizational objectives. This collaboration enables you to leverage the full breadth of the report’s findings-transformative shifts, tariff impacts, segmentation nuances, and regional dynamics-into executable strategies. Contact Ketan today to secure your copy of the hospital outsourcing market research report and position your organization at the forefront of operational excellence and patient care enhancement.

- How big is the Hospital Outsourcing Market?

- What is the Hospital Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?