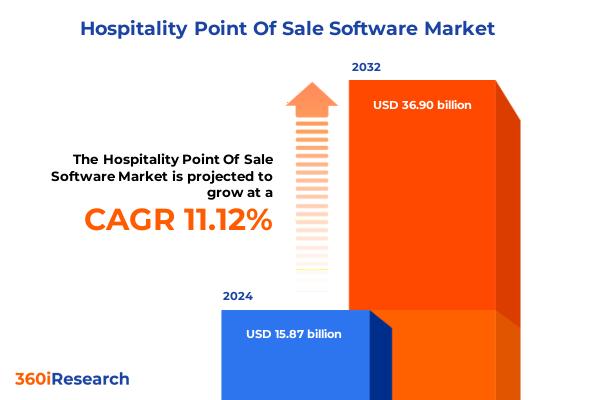

The Hospitality Point Of Sale Software Market size was estimated at USD 17.60 billion in 2025 and expected to reach USD 19.53 billion in 2026, at a CAGR of 11.15% to reach USD 36.90 billion by 2032.

Exploring the Role of Point Of Sale Solutions in Shaping Guest Experiences and Operational Agility Across the Hospitality Spectrum and Driving Revenue Growth

The hospitality industry is undergoing a rapid transformation, propelled by the convergence of technology and evolving guest expectations. At the heart of this evolution lies the point of sale software, a critical platform that not only facilitates transactions but also serves as the nerve center for operations, guest engagement, and data-driven decision making. From boutique luxury properties to high-volume limited-service chains, POS solutions have emerged as indispensable tools for delivering seamless experiences and amplifying revenue streams.

In an era where digital connectivity and personalized service have become non-negotiable, modern POS systems have transcended traditional cash register functions to become integrated ecosystems. They empower staff with real-time inventory visibility, enable mobile and contactless payments, and feed actionable insights into revenue management and loyalty programs. As the hospitality landscape grows increasingly competitive, the ability to harness point of sale software to deliver differentiated guest experiences and operational efficiencies is no longer a luxury but a strategic imperative.

Uncovering the Digital Transformation and Contactless Payment Revolution Redefining Hospitality Point Of Sale Software and Seamlessly Connecting Operations to Guest Engagement

The hospitality POS ecosystem is experiencing transformative shifts driven by digital innovation and evolving consumer behaviors. Cloud-based architectures have taken center stage, providing operators with scalability, remote management capabilities, and cost efficiencies that legacy on-premise systems cannot match. This evolution has been further accelerated by the necessity for contactless interfaces and mobile ordering solutions, which have redefined how guests interact with establishments from check-in to check-out.

Additionally, the integration of advanced analytics and artificial intelligence into POS solutions is enabling predictive staffing, dynamic pricing, and personalized promotions that resonate with today’s experience-driven travelers. Seamless API connectivity has allowed POS systems to become the central hub for an array of hospitality technologies, including property management systems, channel managers, and guest engagement platforms. As a result, service providers are increasingly focusing on open-architecture solutions that can adapt to rapidly changing market demands and integrate emerging functionalities without significant infrastructure overhauls.

Assessing the Far-Reaching Implications of United States 2025 Tariff Measures on Hospitality Point Of Sale Software Cost Structures and Supply Chain Resilience

The imposition of new United States tariffs in 2025 has generated a ripple effect across the global supply chain for point of sale hardware and related components. Many hospitality operators rely on peripherals such as tablets, payment terminals, and printers sourced from jurisdictions now subject to elevated duties. As a consequence, total cost of ownership calculations for POS implementations have shifted, prompting procurement teams to reevaluate vendor partnerships and contract terms.

In response to these pressures, software providers have intensified their focus on cloud-native deployments and remote device management solutions that minimize the need for frequent hardware refreshes. By decoupling software licensing from proprietary equipment purchases, vendors are enabling clients to pivot more quickly in reaction to tariff adjustments. At the same time, regional distribution agreements and localized assembly arrangements are being explored as strategies to mitigate long-term cost exposure and ensure supply chain resilience in the face of evolving trade policies.

Decoding In-Depth Market Segmentation Across Deployment Models Property Categories Enterprise Sizes Service Models and System Types in Hospitality POS

A nuanced view of the hospitality POS market emerges when examining deployment modalities, property categories, enterprise sizes, service models, and system architectures. Cloud-based solutions, whether via multi-tenant or single-tenant frameworks, are prized for rapid rollout and continuous updates, while on-premise offerings with managed hosting or self-hosted configurations remain relevant for operators prioritizing data sovereignty and offline functionality. Each approach aligns differently with organizations’ risk tolerances and IT governance policies.

Further segmentation by property category reveals that full-service hotels, whether located in airports or urban centers, demand POS solutions capable of handling high transaction volumes and complex banquet operations, whereas limited-service economy and midscale establishments prioritize streamlined workflows and cost-effective licensing models. Luxury segments, from boutique retreats to sprawling resort properties, seek bespoke integrations that elevate guest personalization through seamless back-of-house coordination and elevated guest-facing interfaces.

When considering enterprise size, large chains leverage enterprise-grade platforms with extensive customizability and centralized management consoles. Medium-sized groups balance sophistication with budget considerations, often adopting subscription-based licensing to align expenses with occupancy levels. Small enterprises favor turnkey standalone systems that provide core functionality without extensive training overhead. Finally, system type distinctions between integrated suites and standalone modules guide operators toward either all-in-one platforms or best-of-breed solutions, depending on their strategic emphasis on uniformity versus specialization.

This comprehensive research report categorizes the Hospitality Point Of Sale Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Property Category

- Service Model

- System Type

- Deployment Type

- Enterprise Size

- Organization Size

Illuminating Regional Demand Patterns and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Hospitality POS Markets

Regional dynamics significantly shape the adoption and evolution of point of sale software within the hospitality industry. In the Americas, widespread cloud adoption and a mature ecosystem of payment processors have accelerated the rollout of mobile ordering and digital payment capabilities. Operators in North America, in particular, are leveraging POS analytics to optimize labor scheduling and yield management across seasonal demand cycles.

In the Europe, Middle East, and Africa region, diverse regulatory environments and varying levels of digital infrastructure continue to influence POS strategies. While Western European markets drive demand for integrated loyalty programs and multi-currency support, Middle Eastern luxury resorts emphasize bespoke guest interface experiences. In contrast, parts of Africa are experiencing rapid uptake of cloud-based offerings as mobile network coverage expands, enabling hospitality operators to leapfrog traditional hardware constraints.

Across Asia Pacific, robust tourism growth and a thriving hospitality sector have spurred interest in advanced POS functionalities. Markets such as Southeast Asia are witnessing increased use of contactless QR code payments, while gateway markets like Australia and Japan focus on aligning POS platforms with sophisticated property management systems. Regional variation in consumer payment preferences has prompted vendors to invest in modular architectures that can easily incorporate new digital wallets and local payment methods.

This comprehensive research report examines key regions that drive the evolution of the Hospitality Point Of Sale Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Strategies Partnerships and Innovations Shaping the Competitive Landscape of Hospitality Point Of Sale Software

The competitive landscape for hospitality POS software is defined by a diverse mix of global incumbents, specialized regional providers, and innovative disruptors. Leading vendors emphasize strategic partnerships with hardware manufacturers and payment gateways to deliver turnkey solutions, while others focus on open-API ecosystems that empower third-party developers to extend platform capabilities rapidly.

Key players are also forging alliances with property management system providers and hotel management consultancies to offer bundled service packages that address end-to-end operational needs. In parallel, emerging companies are differentiating themselves through niche capabilities such as AI-driven upsell recommendations, automated inventory forecasting, and guest sentiment analysis. As market maturity deepens, collaborative co-innovation models between vendors and large hotel groups are becoming more prevalent, enabling rapid prototyping and deployment of bespoke functionalities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hospitality Point Of Sale Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilysys, Inc.

- Beijing Shiji Information Technology Co., Ltd.

- Block, Inc.

- Epos Now

- Fiserv, Inc.

- Foodics

- Global Payments Inc.

- Infor

- Lightspeed Commerce Inc.

- Mews Systems B.V.

- NCR Corporation

- Oracle Corporation

- PAR Technology Corporation

- Revel Systems, Inc.

- Shift4 Payments, Inc.

- SpotOn Transact, LLC

- Toast, Inc.

- TouchBistro Inc.

Charting a Strategic Roadmap for Industry Leaders to Leverage Emerging Technologies Optimize Operations and Enhance Guest Engagement in Hospitality POS

To capitalize on the shifting hospitality POS landscape, industry leaders should prioritize investments in flexible cloud infrastructures that support incremental feature rollouts without disruption to daily operations. Embracing modular architectures will allow organizations to incorporate emerging payment methods and guest engagement tools as they become mainstream, reducing time-to-value and enhancing guest satisfaction.

Furthermore, forging deeper integrations with property management and loyalty platforms will create unified guest profiles that drive personalized offers and streamline service delivery. Operators should also leverage advanced analytics capabilities within POS systems to refine staffing models, optimize menu performance, and dynamically adjust pricing strategies in real time. Finally, establishing regional supply agreements and exploring localized hardware partnerships can mitigate tariff impacts and safeguard against supply chain volatility, ensuring continuity of service and cost predictability.

Outlining a Robust Research Methodology Integrating Primary Engagements Secondary Analysis and Triangulation of Data Sources for Hospitality POS Insights

The research methodology underpinning this analysis combines primary engagements with industry stakeholders and comprehensive secondary analysis of publicly available data. Primary insights were collected through structured interviews with hospitality technology executives, feedback sessions with frontline operations managers, and interactive roundtables with vendor solution architects. This facilitated a deep understanding of real-world deployment challenges and prioritized feature requirements.

Secondary research involved systematic examination of vendor whitepapers, industry association reports, regulatory filings, and technology blogs to capture the latest product releases and partnership announcements. Data triangulation was employed to cross-verify facts, reconcile conflicting information, and identify emerging trends. The approach ensures that findings are grounded in both empirical evidence and expert judgment, providing a robust foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hospitality Point Of Sale Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hospitality Point Of Sale Software Market, by Property Category

- Hospitality Point Of Sale Software Market, by Service Model

- Hospitality Point Of Sale Software Market, by System Type

- Hospitality Point Of Sale Software Market, by Deployment Type

- Hospitality Point Of Sale Software Market, by Enterprise Size

- Hospitality Point Of Sale Software Market, by Organization Size

- Hospitality Point Of Sale Software Market, by Region

- Hospitality Point Of Sale Software Market, by Group

- Hospitality Point Of Sale Software Market, by Country

- United States Hospitality Point Of Sale Software Market

- China Hospitality Point Of Sale Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Future Imperatives for Stakeholders Navigating the Evolving Hospitality Point Of Sale Software Landscape

In summary, the hospitality point of sale software market is at a pivotal juncture, characterized by rapid digital transformation, evolving guest demands, and external pressures such as tariff realignments. Operators who strategically adopt cloud-native and modular POS platforms can unlock new avenues for personalized service delivery, operational efficiency, and revenue optimization.

By understanding the nuanced segmentation dynamics across deployment models, property types, enterprise scales, and service frameworks, stakeholders can tailor their technology strategies to align with specific business objectives. Coupled with region-specific insights and a clear view of competitive dynamics, this analysis equips decision makers to navigate market complexities and capitalize on growth opportunities with confidence.

Connect with Our Associate Director to Secure Comprehensive Hospitality Point Of Sale Software Insights and Propel Your Business Growth Today

If you’re ready to unlock the full potential of hospitality point of sale solutions and gain an unparalleled competitive edge, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan and the sales team are poised to guide you through the comprehensive research report, highlighting how the latest technological advancements and market trends can inform your strategic decisions and accelerate revenue growth.

Act now to secure your copy of the in-depth market intelligence report, featuring rigorous analysis of segmentation dynamics, regional demand, key industry players, and actionable recommendations. Ketan will assist you in tailoring the insights to your organizational needs, ensuring you capitalize on emerging opportunities and navigate industry challenges with confidence.

- How big is the Hospitality Point Of Sale Software Market?

- What is the Hospitality Point Of Sale Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?