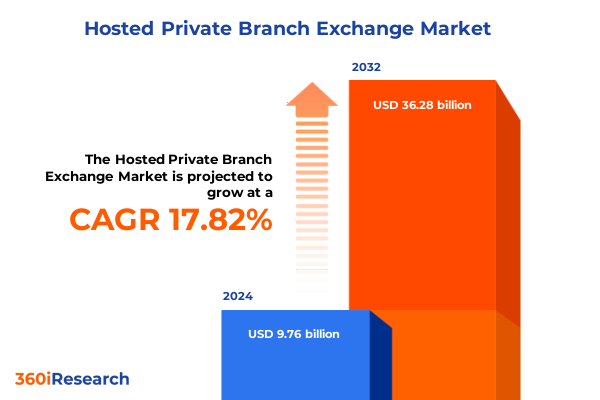

The Hosted Private Branch Exchange Market size was estimated at USD 11.39 billion in 2025 and expected to reach USD 13.30 billion in 2026, at a CAGR of 17.98% to reach USD 36.28 billion by 2032.

Exploring the Emergence and Strategic Importance of Hosted Private Branch Exchange Solutions in Today’s Dynamic Business Communication Ecosystem

Exploring the transformative potential of hosted private branch exchange solutions requires an understanding of their foundational role in modern enterprise communications. Hosted PBX systems decouple telephony infrastructure from on-premises constraints, enabling organizations to leverage cloud-based platforms for enhanced flexibility, scalability, and cost management. The convergence of voice, video, and collaboration tools into unified communication frameworks has accelerated adoption as businesses seek seamless, integrated experiences for employees and customers alike.

As digital transformation initiatives intensify, companies recognize that hosted PBX technology serves as a strategic enabler, supporting remote workforces and distributed operations with minimal capital expenditure. The abstraction of hardware maintenance responsibilities to service providers liberates internal IT resources, allowing teams to prioritize innovation over routine tasks. Moreover, the availability of hybrid models caters to enterprises balancing legacy system investments with cloud-native aspirations, ensuring a smooth migration trajectory.

In tandem with these drivers, evolving regulatory environments and heightened security concerns have elevated the importance of compliance-ready, encrypted voice services. Leading providers now offer end-to-end solutions that incorporate advanced authentication protocols and real-time threat detection, reinforcing trust and operational resilience. Together, these factors position hosted PBX as a compelling alternative to traditional telephony architectures and a cornerstone of next-generation communication strategies.

Revealing the Key Technological Advancements and Market Forces Redefining Hosted PBX Services Across Industries and Geographies

The hosted PBX landscape is undergoing profound shifts driven by rapid technological innovations and evolving customer demands. Cloud migration, once viewed as a future prospect, has become a default strategy as enterprises seek elastic capacity and software-driven agility. In parallel, the integration of artificial intelligence and machine learning into telephony systems is redefining user experiences by enabling intelligent call routing, sentiment analysis, and automated virtual assistants that optimize operational efficiency.

Another catalytic development is the proliferation of 5G and edge computing, which promises ultra-low latency and expanded connectivity for voice and collaboration services. These advancements are particularly impactful for industries that rely on real-time communication, such as healthcare and manufacturing, where remote diagnostics and IoT-enabled voice interactions are gaining traction. Additionally, the convergence of communication platforms with business applications through APIs has broadened the scope of hosted PBX offerings, transforming them into holistic productivity suites rather than standalone voice solutions.

As cyber threats become more sophisticated, providers are embedding zero-trust security frameworks and continuous monitoring capabilities within their architectures. This security-centric shift aligns with broader enterprise priorities around data privacy and regulatory compliance, reinforcing the value proposition of managed communication services. Collectively, these trends underscore a market in flux, driven by digital innovation, performance demands, and the imperative for resilient, future-ready infrastructures.

Analyzing the Multi-Dimensional Effects of United States 2025 Tariff Policies on Hosting Costs Supply Chains and Competitive Dynamics

United States tariff policies enacted in 2025 have introduced additional complexity to the hosted PBX supply chain, influencing hardware costs, vendor selection, and service pricing. Levies on telecommunications equipment imported from specific regions have compelled providers to reassess procurement strategies, sourcing critical components like gateways, routers, and IP phones from alternative manufacturing hubs. This shift has, in some cases, accelerated nearshoring efforts and partnerships with domestic original equipment manufacturers to mitigate exposure to elevated duties.

Beyond direct equipment pricing, tariffs have exerted a cascading effect on maintenance agreements and support contracts. Providers encountering higher capital outlays are recalibrating service-level agreements to preserve margins, which may translate into tiered support packages or extended delivery timelines. In response, some customers are gravitating toward software-centric solutions that reduce reliance on physical assets subject to import duties, elevating the importance of cloud-native PBX software and unified communications platforms.

Moreover, the unpredictability of tariff adjustments has underscored the value of flexible pricing models, prompting market participants to offer consumption-based or subscription structures that absorb cost fluctuations. These dynamic approaches enable organizations to align expenses with usage while shielding budgets from one-off tariff shocks. As industry stakeholders navigate the evolving policy landscape, agility in supply chain configuration and opaque cost coverage will distinguish market leaders from laggards.

Unlocking Strategic Growth Opportunities Through Comprehensive Deployment Component Organization Size Industry Vertical Pricing Model and End User Analyses

A nuanced examination of deployment modes reveals that hybrid cloud configurations are increasingly favored by organizations seeking both agility and control. Enterprises often retain on-premises infrastructure for sensitive voice traffic while extending capacity into public and private clouds to accommodate peak conferencing loads. This balanced approach reflects a drive to optimize total cost of ownership while maintaining regulatory and data sovereignty compliance.

In analyzing the component landscape, service offerings are diversifying beyond conventional hardware sales. While gateways and IP phones remain integral, there is a marked shift toward software solutions and value-added services. Providers bundle installation, maintenance, and ongoing support with PBX and unified communications software, creating comprehensive solutions that reduce implementation friction. This evolution underscores the importance of end-to-end lifecycle management in achieving high customer satisfaction.

When considering organizational size, small and medium enterprises are demonstrating accelerated uptake of hosted PBX services, driven by lower entry barriers and minimal upfront investment. Large enterprises continue to prioritize bespoke integrations and advanced feature sets, often negotiating custom agreements to align with existing IT roadmaps. The bifurcation of requirements calls for tailored strategies from vendors aiming to address the distinct needs of micro, small, medium, and large-scale customers.

Industry vertical analysis highlights diverse adoption rates and customization demands. Sectors such as financial services and healthcare are prioritizing compliance, encryption, and audit logging, whereas education and retail focus on scalable conference capabilities and omnichannel customer engagement. The variance in vertical-specific requirements reinforces the need for configurable platforms that can adapt to regulatory, performance, and user experience mandates.

Pricing model insights reveal a growing preference for subscription and pay-as-you-go structures that allow organizations to scale expenditure in line with usage patterns. This financial flexibility aligns with broader shifts toward operational expenditures over capital commitments. Finally, evaluating end-user segmentation, commercial deployments dominate early investments, yet nascent residential applications-fueled by remote work trends-are emerging as a secondary focus for select providers.

This comprehensive research report categorizes the Hosted Private Branch Exchange market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Pricing Model

- Organization Size

- Deployment Mode

- End User

Mapping the Divergent Trajectories of Hosted PBX Adoption and Innovation Across the Americas EMEA and Asia Pacific Economic Zones and Emerging Markets

Across the Americas, hosted PBX adoption is propelled by robust enterprise digital transformation programs and a mature cloud services ecosystem. North American organizations prioritize integrated collaboration suites with advanced analytics and AI-driven features, while Latin American markets exhibit a faster transition to cloud-based voice platforms as legacy infrastructure becomes increasingly obsolete. The region’s focus on scalability and innovation is driving vendors to localize data centers and partner with regional carriers to address latency and regulatory requirements.

In Europe, Middle East, and Africa, regulatory diversity and data protection mandates present both challenges and opportunities. Stringent privacy laws in the European Union have spurred demand for private cloud and on-premises hybrid solutions that ensure GDPR compliance, whereas emerging economies within the region are embracing public cloud deployments to leapfrog legacy systems. Service providers are capitalizing on this mix by offering region-specific data residency options and multilingual support, reinforcing their value in complex compliance landscapes.

The Asia-Pacific zone is distinguished by heterogeneous market maturity and rapid growth in emerging economies. Telecom incumbents in developed markets like Japan and Australia are migrating existing PBX clients toward managed cloud offerings, while Southeast Asian and South Asian enterprises adopt hosted solutions to modernize fragmented communication environments. Competitive pricing, mobile integration, and strategic partnerships with local system integrators are driving momentum, highlighting the region as a critical battleground for global and domestic providers alike.

This comprehensive research report examines key regions that drive the evolution of the Hosted Private Branch Exchange market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Positioning Technology Portfolios and Go-to-Market Approaches of Leading Providers in the Hosted PBX Ecosystem

Leading providers in the hosted PBX ecosystem are differentiating through a balanced mix of technological innovation and strategic partnerships. Market stalwarts with deep enterprise portfolios emphasize integrated unified communications suites, leveraging global support networks and carrier-grade infrastructure to appeal to multinational corporations. Meanwhile, agile pure-play vendors are capturing SMB segments with lean deployment models, rapid onboarding processes, and competitive tiered pricing structures designed for swift scalability.

Collaborations between hardware manufacturers and cloud service providers have produced optimized gateways and session border controllers certified for specific PBX platforms, enhancing security and performance benchmarks. These alliances underscore a broader industry trend toward ecosystem interoperability, as end users demand seamless connectivity with CRM systems, contact centers, and collaboration tools. Providers investing in open APIs and developer portals are positioning themselves as enablers of digital ecosystems rather than standalone telephony solutions.

In response to growing demand for managed services, select companies have expanded their offerings to include proactive monitoring, analytics dashboards, and co-managed support models. This evolution addresses customer pain points around system uptime and resource constraints, elevating the role of hosted PBX vendors as strategic partners rather than commodity suppliers. The competitive landscape is therefore defined by an interplay of product breadth, service quality, and the ability to anticipate evolving communication requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hosted Private Branch Exchange market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3CX

- 8x8, Inc.

- Amazon Web Services

- Atlantech Online Inc.

- Avaya Holdings Corp.

- AVOXI

- Cisco Systems, Inc.

- Dialpad

- Ecosmob

- Exotel Techcom Pvt. Ltd.

- Fuze, Inc.

- GoToConnect

- Microsoft Corporation

- Mitel Networks Corporation

- MyOperator

- Nextiva, Inc.

- REVE Cloud Telephony

- RingCentral, Inc.

- Ringover

- TeleCMI

- Vonage Inc.

- Zoom Video Communications, Inc.

Crafting Practical Strategic Roadmaps for Industry Leaders to Enhance Service Differentiation Operational Efficiency and Sustainable Growth in PBX Markets

Industry leaders aiming to fortify their positions in the hosted PBX market should prioritize investment in modular cloud architectures that accommodate hybrid and multi-cloud strategies. Emphasizing interoperability through standardized APIs will facilitate deeper integrations with business-critical applications and empower customers to tailor solutions for distinct workflow demands. By championing open standards, organizations can foster partner ecosystems that drive innovation and accelerate time-to-value for end users.

Enhancing cybersecurity offerings with continuous threat intelligence and zero-trust frameworks is paramount to building trust and compliance readiness. Providers should develop specialized bundles that integrate encrypted voice, real-time monitoring, and automated incident response to address heightened regulatory scrutiny. Investing in managed detection and response services will differentiate portfolios and attract security-conscious sectors such as finance and healthcare.

To optimize cost structures and align with customer budgetary cycles, vendors should expand flexible pricing schemes that combine subscription, per-user, and consumption-based models. This approach enables organizations of all sizes to adopt hosted PBX with minimal risk and predictable expenditure. Finally, emphasizing localized support and co-innovation workshops will deepen client relationships, while targeted marketing campaigns highlighting vertical-specific use cases will resonate across diverse industry segments.

Detailing the Comprehensive Mixed Method Research Framework Data Triangulation and Validation Processes Underpinning Insights into Hosted PBX Market Dynamics

This study employs a mixed-method research approach, integrating both qualitative and quantitative data to ensure a holistic understanding of the hosted PBX landscape. Primary research comprised in-depth interviews with C-level executives, IT infrastructure managers, and service providers across multiple regions. These expert discussions were complemented by a web-based survey to capture usage patterns, satisfaction metrics, and feature priorities among end users.

Secondary research underpinned the analysis by aggregating insights from industry publications, regulatory filings, technology white papers, and vendor collateral. Data triangulation techniques were applied to reconcile conflicting information, thereby enhancing the robustness and reliability of findings. Our methodology also incorporated competitive benchmarking, comparing vendor feature sets, service-level guarantees, and deployment architectures to identify best practices and market differentiators.

Validation of key insights was achieved through a series of advisory workshops with domain experts, ensuring that interpretations accurately reflect real-world conditions. Geographic coverage included mature markets in North America, evolving economies in the Asia-Pacific, and complex regulatory environments in Europe, Middle East, and Africa. This rigorous framework provides stakeholders with confidence that the conclusions drawn are both comprehensive and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hosted Private Branch Exchange market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hosted Private Branch Exchange Market, by Component

- Hosted Private Branch Exchange Market, by Pricing Model

- Hosted Private Branch Exchange Market, by Organization Size

- Hosted Private Branch Exchange Market, by Deployment Mode

- Hosted Private Branch Exchange Market, by End User

- Hosted Private Branch Exchange Market, by Region

- Hosted Private Branch Exchange Market, by Group

- Hosted Private Branch Exchange Market, by Country

- United States Hosted Private Branch Exchange Market

- China Hosted Private Branch Exchange Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Strategic Imperatives from the Hosted PBX Study to Guide Decision Makers Through Future Business Communication Challenges

The insights presented in this study illuminate the critical drivers reshaping the hosted PBX market, from cloud-native innovation to evolving security imperatives. As organizations seek to modernize communication infrastructures, the dual imperatives of agility and compliance have become central to value propositions. Segmentation analysis underscores that demand varies significantly across deployment modes, industry verticals, and organizational scales, requiring tailored approaches to product design and go-to-market strategies.

Regional landscapes further complicate the competitive equation, with the Americas prioritizing integrated analytics, EMEA navigating stringent data regulations, and Asia-Pacific balancing rapid adoption with localization needs. Leading vendors differentiate through ecosystem partnerships, open platforms, and managed service enhancements that address unique customer pain points. Amidst these dynamics, the ability to anticipate policy shifts-such as tariff adjustments-and absorb cost fluctuations through flexible pricing models remains a core competency for success.

As the market evolves, stakeholders must adopt strategic roadmaps that balance short-term operational efficiencies with long-term innovation roadmaps. Prioritizing hybrid architectures, bolstering security frameworks, and fostering partner ecosystems will be essential for capturing emerging opportunities. Ultimately, this study offers decision makers a clear framework for evaluating vendors, refining deployment strategies, and allocating resources to achieve sustainable growth within the hosted PBX domain.

Connect with Ketan Rohom to Secure Exclusive Hosted PBX Insights and Drive Strategic Value in Your Organization’s Next Communication Modernization Initiative

We invite you to partner with Ketan Rohom, whose deep expertise in market dynamics and strategic marketing can help you unlock unparalleled value from this comprehensive study. By engaging directly with our Associate Director of Sales & Marketing, you will gain personalized insights tailored to your organization’s communication modernization objectives. This direct collaboration ensures that you receive targeted recommendations and nuanced analyses aligned with your unique business priorities, equipping you to stay ahead in an increasingly competitive environment.

Purchasing the full report will grant you exclusive access to proprietary intelligence on deployment models, technology trends, pricing strategies, and competitive landscapes within the hosted PBX sector. Whether you are evaluating migration paths for hybrid cloud solutions, seeking to optimize total cost of ownership, or aiming to differentiate service offerings, Ketan Rohom is your dedicated resource for answering critical questions and guiding next steps. Act now to secure your copy of the report and initiate a consultative dialogue that will drive strategic decisions and foster sustainable growth.

Dont miss this opportunity to harness robust data, expert perspectives, and actionable roadmaps that have already empowered leading enterprises worldwide. Reach out to Ketan Rohom today to purchase the market research report and position your organization at the forefront of hosted communication innovation.

- How big is the Hosted Private Branch Exchange Market?

- What is the Hosted Private Branch Exchange Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?