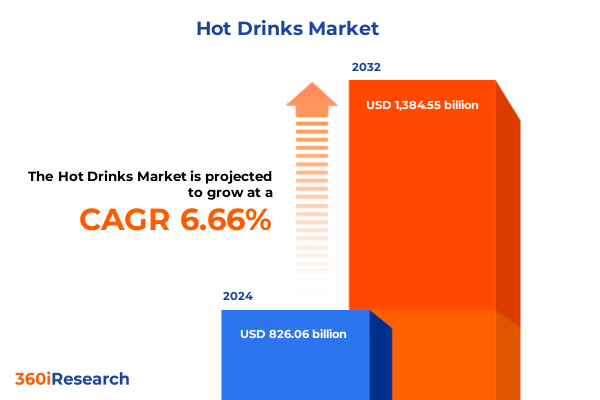

The Hot Drinks Market size was estimated at USD 880.75 billion in 2025 and expected to reach USD 935.68 billion in 2026, at a CAGR of 6.67% to reach USD 1,384.55 billion by 2032.

Examining Evolving Consumer Expectations Across Coffee Tea And Hot Chocolate Categories Reveals Opportunities Rooted In Innovation Sustainability And Experience

The contemporary hot drinks arena spans coffee, tea, and hot chocolate, each category evolving in response to shifting consumer palates and lifestyle demands. Consumers increasingly view these beverages as more than mere refreshments, seeking sensory experiences that align with personal values such as ethical sourcing, health benefits, and environmental stewardship. This paradigm shift has prompted brands to innovate across every facet of product development, from the introduction of single-origin pods and signature tea blends to plant-based formulations and functional ingredients designed to support wellness.

Moreover, the proliferation of digital channels continues to redefine convenience and accessibility. Mobile ordering platforms, subscription services, and virtual barista consultations have blurred the lines between at-home ritual and out-of-home indulgence. Concurrently, heightened interest in transparency and traceability has compelled suppliers to strengthen their supply chain narratives, emphasizing direct trade relationships and carbon footprint reduction initiatives. These dynamics converge to create unprecedented opportunities for differentiation.

Therefore, understanding the interplay of consumer behavior, technological disruption, and sustainability imperatives is essential for stakeholders aiming to seize new growth avenues. This executive summary distills critical developments across transformative shifts, policy impacts, segmentation nuances, and regional distinctions, offering a strategic compass for decision makers navigating the complex hot drinks landscape.

Highlighting How Digital Integration Sustainable Sourcing And Personalized Experiences Are Rapidly Transforming Consumer Engagement With Hot Beverages

Digital integration has emerged as a cornerstone of the hot drinks revolution, reshaping how consumers discover, purchase, and engage with their favorite beverages. Mobile applications and contactless payment systems have streamlined the ordering process, enabling customers to customize their coffee roast levels, select specialty tea infusions, or request enriched hot chocolate blends with unparalleled ease. This technological maturation has been bolstered by data analytics, which empowers brands to anticipate individual preferences and curate hyper-personalized recommendations.

Sustainable sourcing stands as another transformative trend, driving brands to redefine their partnerships with growers and cooperatives. Ethical procurement programs, fair wage guarantees, and regenerative farming practices are fast becoming non-negotiable elements of the value proposition. In turn, consumers are rewarding companies that embrace environmental and social responsibility by maintaining brand loyalty and advocating through digital channels.

Furthermore, personalization has extended beyond flavor profiles to encapsulate service models and packaging formats. Brands are experimenting with subscription-based offerings that deliver roasted whole bean coffee, single-serve capsules, or artisanal tea sachets directly to consumers’ doorsteps. As a result, the hot drinks industry is navigating a new frontier where digital connectivity, ecological mindfulness, and bespoke experiences coalesce to redefine longstanding rituals.

Analyzing the Escalating Influence of United States Tariff Adjustments on Import Costs Supply Chain Dynamics and Consumer Pricing in the Hot Drinks Sector

Recent adjustments to United States tariff policies in early 2025 have exerted cumulative pressure on import costs, compelling stakeholders to evaluate the resilience of their supply chains. Tariff escalations on certain specialty coffee roasts and premium tea blends have translated into higher landed expenses, prompting distributors and retailers to rethink sourcing geographies and negotiate more favorable freight contracts. These developments underscore the vulnerability inherent in overreliance on traditional supplier regions.

Moreover, the ripple effects of these levies extend to consumer-facing pricing, where cost increases have occasionally been passed along to end users. As a result, some brands have accelerated innovation in cost-optimization measures, such as blending strategies that integrate locally roasted beans or onshore manufacturing of select beverage ingredients. This strategic pivot not only mitigates tariff exposure but also resonates with consumers who favor products with transparent origin stories.

Consequently, the industry is witnessing a surge in collaborative alliances aimed at pooling procurement volumes and sharing logistics infrastructure. By investing in regional distribution hubs and exploring alternative trade agreements, hot drink stakeholders are endeavoring to fortify their operations against future tariff fluctuations. This evolving environment demands agility and foresight, especially for companies seeking to maintain margin integrity while preserving brand integrity.

Uncovering Deep Differentiation of Consumer Preferences Through Product Type Packaging Flavor Ingredient End User and Distribution Channel Perspectives

The hot drinks industry reveals its true complexity when viewed through multiple segmentation lenses that illuminate distinct consumer cohorts. Based on product type, distinctions among coffee, hot chocolate, and tea illustrate diverse preference archetypes: coffee aficionados gravitate toward ground roasted blends, instant formulations, or single-serve pods; chocolate enthusiasts explore mix, powdered, or ready-to-drink preparations; tea drinkers navigate black, green, herbal, oolong, and white varieties with equal passion.

Packaging type further refines the narrative, separating ground and instant powders from pods, ready-to-drink vessels, and roasted whole beans. Each format addresses different consumption occasions, whether it be a morning ritual requiring convenience or an immersive tasting experience demanding freshness.

In terms of end user, the market spans food service venues such as cafes, hotels, and restaurants, while simultaneously accommodating in-home indulgence and office-based coffee corners. Flavor personalization bifurcates the landscape into plain and flavored offerings, with the latter category embracing caramel, chocolate, spice, and vanilla infusions that cater to evolving taste preferences.

Ingredient selection emerges as a critical axis, dividing offerings into dairy-based and plant-based formulations; the latter subset leverages almond, oat, rice, and soy alternatives to align with broader dietary trends. Finally, distribution channels encompass both offline and online ecosystems. Offline channels include convenience stores, foodservice operators, specialty retail outlets, and supermarkets or hypermarkets, whereas online channels comprise direct-to-consumer sales and e-commerce platforms that capitalize on the growing appetite for digital convenience.

This comprehensive research report categorizes the Hot Drinks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Flavor

- Ingredient

- End User

- Distribution Channel

Mapping Nuanced Growth Trajectories Consumer Behaviors and Regulatory Influences Across Americas Europe Middle East Africa and Asia Pacific Hot Beverage Markets

Regional variations play a pivotal role in shaping the hot drinks landscape, each geography presenting unique catalysts and constraints. In the Americas, robust coffee culture coexists with burgeoning interest in specialty tea and plant-based hot chocolate alternatives. Consumer education programs and barista competitions elevate quality standards, fostering an ecosystem where artisanal roasters and premium tea suppliers coexist alongside global quick-service brands.

Transitioning to Europe Middle East and Africa, regulatory frameworks around sustainability reporting and packaging waste management have accelerated adoption of recyclable materials and compostable formats. Meanwhile, longstanding tea traditions in the UK and North Africa underpin significant demand for single-origin leaves and herbal infusions. Hospitality chains are collaborating with local growers to introduce regionally inspired menus that resonate with culturally rooted consumption habits.

In Asia Pacific, the hot drinks segment is characterized by rapid urbanization and a growing middle class that embraces both Western-style coffee culture and indigenous tea ceremonies. Innovation hubs in major metropolises are incubating new flavor hybrids that blend matcha, oolong, and cold brew techniques. Partnerships between beverage companies and regional e-commerce giants streamline last-mile delivery, reinforcing the primacy of convenience in densely populated markets.

These regional idiosyncrasies underscore the necessity of tailor-made strategies that address local preferences, regulatory landscapes, and competitive dynamics.

This comprehensive research report examines key regions that drive the evolution of the Hot Drinks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Innovations Marketing Alliances and Operational Efficiencies Delivered by Leading Global Brands and Emerging Players in the Hot Drinks Space

Industry incumbents and emerging disruptors are deploying an array of strategic initiatives to capture share in the highly fragmented hot drinks arena. Leading global brands invest heavily in product innovation, leveraging proprietary roasting techniques, novel tea infusion methods, and chef-curated flavor collaborations to differentiate their portfolios. At the same time, smaller specialty roasters and artisanal tea houses capitalize on hyper-local sourcing and direct-to-consumer channels to build authentic connections with niche audiences.

Collaborative partnerships have also become a hallmark of the competitive landscape. Coffee giants have aligned with technology firms to introduce smart brewing solutions that optimize extraction parameters and capture real-time consumer feedback. Similarly, tea producers partner with wellness brands to co-create functional blends infused with adaptogens and botanicals, addressing growing interest in holistic health.

Operational efficiencies remain a critical battleground, with companies streamlining their supply chains through vertical integration or shared logistics ventures. Investments in renewable energy at roasting facilities and tea packing plants highlight a collective commitment to carbon reduction, while packaging innovations reinforce the premium positioning of flagship products.

Overall, these strategic moves reflect an industry underway in a delicate balancing act between scale and authenticity, mass reach and personalized engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hot Drinks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Group Holdings, Ltd.

- Associated British Foods PLC

- Caffe Nero

- Celestial Seasonings, Inc.

- Costa Limited

- Danone SA

- Diageo PLC

- Dilmah Ceylon Tea Company PLC

- Dutch Bros

- JDE Peet's N.V.

- Keurig Dr Pepper Inc.

- Kirin Holdings

- Luigi Lavazza S.p.A.

- Mars, Incorporated

- Mondelēz International

- Nestlé S.A.

- PepsiCo Inc.

- Starbucks Corporation

- Suntory Beverage & Food Limited

- Tata Consumer Products Limited

- Tazo Tea Company

- The Coca-Cola Company

- The Kraft Heinz Company

- Tim Hortons

- Unilever PLC

Formulating Impactful Product Differentiation Partnership Initiatives and Operational Enhancements to Drive Sustainable Leadership in the Evolving Hot Drinks Ecosystem

Industry leaders should prioritize investments in digital infrastructure that facilitate seamless omnichannel experiences, ensuring consistency from in-app ordering to in-store fulfillment. Concurrently, enhancing sustainable sourcing practices through transparent supplier partnerships can bolster brand reputation and fortify consumer trust. By integrating blockchain tracking or certification verifications, organizations can substantiate their ethical credentials and convey tangible impact narratives.

Moreover, product diversification rooted in consumer insights will be paramount. Leaders are advised to expand their portfolios to include premium cold preparations, plant-based hot chocolate alternatives, and wellness-forward tea infusions that address immune support and stress relief. In this context, collaboration with ingredient specialists and flavor houses can expedite time-to-market and mitigate development risks.

Operationally, forging alliances with logistics providers to establish regional distribution centers can reduce tariff exposure and optimize freight costs. Additionally, embracing modular manufacturing solutions empowers agile response to shifting consumer demands and regulatory changes. These measures, when combined with targeted consumer education campaigns and loyalty-building initiatives, position companies to sustain growth in an increasingly competitive environment.

Outlining Integrated Qualitative And Quantitative Research Methods Data Collection Strategies And Analytical Models Underpinning Insights Into The Hot Drinks Industry

This research draws upon a layered methodology that merges both qualitative and quantitative approaches. Primary interviews were conducted with a cross-section of stakeholders, including beverage category managers, procurement specialists, retail executives, and supply chain consultants, to capture firsthand insights into emerging trends and operational challenges.

Secondary data was systematically gathered from industry publications, trade association reports, and government policy briefs, providing a robust contextual framework. A structured survey of frequent hot drink consumers supplemented these findings, enabling nuanced segmentation analysis across product types, packaging formats, distribution channels, and demographic cohorts.

Analytical models such as scenario planning and sensitivity analysis were employed to assess the potential impacts of tariff adjustments and supply chain disruptions. Data triangulation techniques ensured consistency between primary research inputs and publicly available datasets. Finally, validation workshops with expert panels refined the interpretations and identified strategic imperatives relevant to varied stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hot Drinks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hot Drinks Market, by Product Type

- Hot Drinks Market, by Packaging Type

- Hot Drinks Market, by Flavor

- Hot Drinks Market, by Ingredient

- Hot Drinks Market, by End User

- Hot Drinks Market, by Distribution Channel

- Hot Drinks Market, by Region

- Hot Drinks Market, by Group

- Hot Drinks Market, by Country

- United States Hot Drinks Market

- China Hot Drinks Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Key Discoveries Stakeholder Implications And Future Outlook To Illuminate Strategic Paths For Sustainable Expansion In The Hot Drinks Universe

The convergence of digital commerce, sustainable sourcing, and personalized offerings has ushered in a transformative era for hot beverages. Stakeholders who embrace technological enablers and ethical supply chain practices are most likely to capture discerning consumers seeking authenticity and convenience in equal measure. Meanwhile, tariff-driven cost pressures necessitate agile sourcing strategies and collaborative distribution frameworks.

Segment-specific insights highlight the importance of catering to diverse consumption occasions, whether through single-serve innovations, premium cold brew infusions, or plant-based hot chocolate alternatives. Regionally tailored approaches that align with local tastes and regulatory landscapes further amplify competitive advantage, while strategic alliances and operational efficiencies underpin margin resilience.

Looking ahead, companies that integrate consumer intelligence with flexible manufacturing and logistics capabilities will be best positioned to navigate evolving market dynamics. In this context, the ability to rapidly pilot new products, respond to policy shifts, and cultivate direct relationships with end users will emerge as critical differentiators. This comprehensive understanding of the hot drinks ecosystem empowers decision makers to chart clear paths toward sustainable expansion and enduring brand leadership.

Explore How Personalized Consultation Can Unlock Comprehensive Hot Drink Market Intelligence Tailored Strategies And Actionable Insights With Our Specialist

Engaging directly with Ketan Rohom, our Associate Director of Sales & Marketing, can provide the personalized guidance you need to leverage the comprehensive insights contained in this report. Through a tailored consultation, you can explore nuanced product and channel strategies, unpack the implications of recent tariff dynamics, and align your organization’s growth roadmap with emerging consumer trends. Reach out today to secure your copy of the full study and embark on a data-driven journey toward market leadership in the hot drinks space.

- How big is the Hot Drinks Market?

- What is the Hot Drinks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?