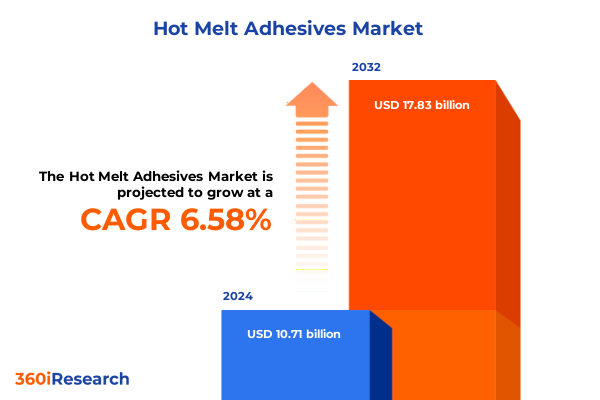

The Hot Melt Adhesives Market size was estimated at USD 11.42 billion in 2025 and expected to reach USD 12.10 billion in 2026, at a CAGR of 6.57% to reach USD 17.83 billion by 2032.

Discover the dynamic landscape of hot melt adhesives as they revolutionize automotive electronics packaging woodworking and sustainable manufacturing practices

Hot melt adhesives have emerged as indispensable enablers of manufacturing efficiency and product performance across a multitude of industries. Characterized by their rapid set times and solvent-free formulations these thermoplastic polymers offer precise bond strength while eliminating the environmental concerns associated with volatile organic compounds. From the seamless assembly of automotive interior components to the high-speed lamination processes in electronics and packaging manufacturing hot melt technologies have redefined production workflows by offering clean application methods reduced cycle times and robust end-use properties.

In response to accelerating innovation demands and sustainability targets manufacturers are continuously refining resin chemistries and dispensing systems to meet evolving performance specifications. The inherent versatility of hot melt adhesives enables formulators to optimize viscosity tack and shear strength parameters for specialized applications ranging from delicate bookbinding and hygiene products to heavy-duty woodworking and automotive under-the-hood assemblies. Moreover the ability to incorporate renewable feedstocks and recyclable formulations has positioned hot melt solutions at the forefront of eco-conscious material strategies in building and construction as well as textiles and apparel contexts.

As global supply chains evolve and end users require greater agility in production the hot melt adhesives sector stands at a transformative crossroad. Enhanced digital integration of dispensing equipment real-time process monitoring and predictive maintenance capabilities are coalescing to deliver unprecedented control over application consistency and downtime reduction. Against this dynamic backdrop this executive summary provides a concise yet comprehensive overview of the trends drivers and strategic imperatives shaping the next phase of hot melt adhesive innovation and adoption.

Emerging sustainability digitalization and bio-based technology trends are reshaping the hot melt adhesives landscape for future-ready manufacturing

Sustainability mandates and digital transformation initiatives are catalyzing a fundamental shift in hot melt adhesive development and deployment. In the electric vehicle battery segment for example the EU Battery Regulation introduced in 2023 requires 70 percent recyclability by 2030 prompting the creation of thermoplastic polyolefin adhesives that enable non-destructive disassembly at controlled temperatures and support battery reuse initiatives. At the same time major suppliers have introduced bio-based polyurethane formulations that reduce cradle-to-gate carbon footprints by more than thirty percent illustrating the commercial viability of renewable chemistries in high-performance applications.

Furthermore data-driven supply chain optimization is redefining inventory management and production scheduling for hot melt adhesive manufacturers. Real-time consumption tracking portals such as those implemented by leading electric vehicle OEMs now allow formulators to align raw material deliveries with production line output ensuring minimal downtime and reduced safety stock requirements. Meanwhile predictive maintenance platforms integrated with dispensing equipment deliver actionable insights on nozzle wear and heater performance preventing unplanned shutdowns and enhancing overall equipment effectiveness.

Lastly the convergence of smart adhesives and Internet of Things technologies is unlocking unprecedented opportunities for end users to monitor bond integrity in critical assemblies. Through embedded sensors and data analytics material scientists can now evaluate temperature humidity and load conditions in situ delivering predictive quality assurance for sectors like aerospace automotive and consumer electronics. Together these sustainability digitalization and performance-driven trends are reshaping the hot melt adhesives landscape to support next-generation manufacturing breakthroughs.

Unraveling the far-reaching cumulative impact of 2025 U S tariff measures on hot melt adhesives supply chains raw materials and pricing dynamics

The tariff measures introduced by the United States in early 2025 have exerted significant pressure on hot melt adhesive supply chains by increasing duties on key polymer precursors and specialty resins. Under these policies imports from Canada and Mexico face a twenty-five percent ad valorem levy while Chinese-origin shipments incur an additional ten percent duty as part of broader efforts to address trade imbalances through emergency powers. These adjustments have elevated landed costs for ethylene-vinyl acetate copolymers polyolefin adhesives and specialized polyurethane components integral to hot melt formulations.

Consequently adhesive manufacturers have been compelled to reconfigure sourcing strategies by diversifying procurement across low-tariff jurisdictions and negotiating multi-year contracts to stabilize input pricing. Many global suppliers have accelerated investments in regional production hubs within Europe and Asia-Pacific free trade zones enabling duty-free access to finished polymers while optimizing logistics expenses. Simultaneously contract formulators have tightened inventory buffers and adopted just-in-time delivery frameworks to safeguard production continuity amid tariff rate fluctuations.

Overall this cumulative tariff landscape underscores the imperative for agility and supply chain resilience in the hot melt adhesive sector. Companies that successfully blend local feedstock sourcing partnerships with strategic capacity expansions in permissive trade environments will be best positioned to mitigate duty impacts and maintain competitive pricing for end users navigating an increasingly complex global trade regime.

In-depth segmentation insights reveal how diverse applications industries technologies forms and channels shape positioning in the hot melt adhesives market

A nuanced understanding of market segmentation illuminates the diverse pathways through which hot melt adhesives generate value for end users. When examined by application the technology spans critical functions from automotive bonding and precision bookbinding to electronic package sealing hygiene product assembly and robust woodworking joints. In parallel an industry lens focused on end-use reveals high-volume demand driven by sectors such as building and construction where adhesives deliver long-lasting structural integrity alongside textiles and apparel applications characterized by stringent flexibility and comfort standards.

Technology segmentation further highlights two distinct formulation clusters. Reactive chemistries such as polyamide and polyurethane hot melts are prized for their superior heat resistance and chemical durability allowing displays and automotive facia to endure rigorous service environments. In contrast thermoplastic variants based on amorphous polyalphaolefin ethylene-vinyl acetate and polyolefin offer reworkable adhesion and rapid set times ideally suited for packaging lines and consumer goods assembly.

Physical form factors and distribution strategies also play pivotal roles in market accessibility and operational efficiency. Solid blocks granules or pellets support high-throughput extrusion and melt tank systems for large-scale industrial converters while sticks remain indispensable for manual handheld gun applications in light assembly contexts. Finally distribution channel dynamics encompassing direct sales distributors and rapidly growing online platforms shape how formulators engage with diverse customer segments by balancing technical service intensity with supply chain convenience.

This comprehensive research report categorizes the Hot Melt Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Form

- End-Use Industry

- Distribution Channel

Key regional insights illuminating how the Americas Europe Middle East Africa and Asia Pacific dynamics influence hot melt adhesive adoption and growth patterns

Regional landscapes continue to exert a profound influence on hot melt adhesive development adoption and supply chain configurations. In the Americas strong automotive and packaging sectors drive substantial demand with North American manufacturers investing heavily in domestic polymer capacities to mitigate cross-border tariff exposures while sustaining just-in-time delivery standards. Conversely Latin American markets are characterized by import reliance and emerging conversion facilities that cater to growing e-commerce and consumer goods segments.

In Europe Middle East and Africa regulatory frameworks and sustainability mandates have become key catalysts for formulation innovation. Stricter carbon emissions targets and circular economy objectives compel suppliers to integrate bio-based feedstocks and recyclable polymer blends across Western European production sites while Middle Eastern polymer producers leverage petrochemical integration to supply cost-competitive EVA and polyolefin resins. In sub-Saharan Africa nascent conversion capabilities are emerging as demand for cost-effective adhesives in building and consumer packaging expands.

Across the Asia-Pacific region a dynamic mix of mature and high-growth markets shapes the competitive environment. Northeast Asian economies benefit from advanced materials ecosystems and robust R&D collaborations that accelerate specialty hot melt developments for electronics and automotive. Simultaneously Southeast Asian manufacturing hubs are attracting regional polymer production investments to service expanding packaging and textiles sectors. Collectively these regional dynamics define a multifaceted growth landscape driven by both legacy industry strength and rapid capacity expansions in emerging economies.

This comprehensive research report examines key regions that drive the evolution of the Hot Melt Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical company insights uncover strategic initiatives innovations collaborations and competitive moves among leading hot melt adhesive producers globally

Leading companies in the hot melt adhesives market are deploying strategic initiatives that span price management capacity expansions technology collaborations and sustainability partnerships. For instance a global adhesives giant announced early 2025 price adjustments reflecting higher raw material and logistics costs in both the Americas and Europe a move that underscores the importance of transparent cost pass-through mechanisms in volatile macroeconomic conditions. Another specialty chemical leader followed suit by raising polymer emulsion and latex powder prices to align margin structures with input cost inflation trends.

In parallel technology partnerships are driving next-generation formulations and application systems. A major sealant and adhesive provider expanded its electric vehicle battery adhesives line in 2024 introducing bio-based polyurethane variants that cut cradle-to-gate emissions and improve end-of-life recyclability for battery pack bonding. Complementing this Henkel’s high-nickel battery pack adhesives have been validated through AI-powered simulation platforms in collaboration with premium automakers reducing physical testing cycles by more than half to accelerate product launches.

Investment in precision dispensing and automation also marks a critical focus area. Equipment manufacturers have rolled out advanced nozzle technologies and integrated sensors enabling real-time bond quality monitoring for high-speed packaging lines. Select battery pack and electronics assembly players have jointly developed custom dosing equipment with adhesive suppliers to achieve submillimeter bond line tolerances and minimize material waste. Thermal management adhesives specialists have likewise broadened product portfolios with two-component epoxy and polyurethane systems that deliver high thermal conductivity and structural strength essential for next-gen electronic and EV applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hot Melt Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adhesive Technologies, Inc.

- Aica Kogyo Co., Ltd.

- ALFA Klebstoffe AG

- Arkema Group

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- Bühnen GmbH & Co. KG

- DIC Corporation

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman Corporation

- ITW Dynatec

- Jowat SE

- KLEIBERIT SE & CO. KG KLEIBERIT SE & CO. KG

- Meridian Adhesives Group

- Palmetto Adhesives Company, Inc.

- Paramelt B.V. by Ter Group

- Sika AG

- Tex Year Industries Inc.

- The Dow Chemical Company

- Toyobo Co., Ltd.

Actionable recommendations for industry leaders to optimize supply chain resilience enhance sustainability and seize emerging hot melt adhesive opportunities

To navigate the complexities of evolving trade policies sustainability imperatives and technological shifts industry leaders must pursue a multi-pronged strategic agenda. First optimizing supply chain resilience is paramount by diversifying raw material sources across permissive trade zones establishing long-term procurement agreements and investing in local polymer production to buffer against duty fluctuations. By embedding real-time consumption analytics and predictive maintenance systems organizations can further reduce inventory risk and ensure production continuity.

Second embedding sustainability at the core of product development will be instrumental for long-term competitiveness. This involves accelerating the integration of bio-based feedstocks into polymer backbones prioritizing formulations that facilitate circularity and aligning R D efforts with emerging regulatory frameworks such as battery and packaging directives. Concurrently strengthening collaborations with material science research institutions and OEM sustainability teams can expedite the commercialization of renewable and recyclable hot melt technologies.

Finally embracing digitalization will unlock significant efficiency gains and quality improvements. Industry players should adopt smart dispensing platforms with embedded sensors, leverage AI-driven formulation design tools and implement end-to-end traceability solutions that link raw material provenance to finished-assembly performance. Together these actionable steps will empower leaders to seize new market opportunities enhance margins and reinforce their position in the next era of hot melt adhesive innovation.

Comprehensive research methodology outlining systematic data collection rigorous validation and analytical approaches driving hot melt adhesives insights

The insights presented in this executive summary are grounded in a rigorous research methodology that combines qualitative stakeholder interviews with quantitative data analytics and secondary source validation. Primary research encompassed in-depth discussions with R D scientists procurement heads and operational leaders across major adhesive producers and end-user industries to capture firsthand perspectives on market drivers challenges and technology trends.

Secondary data collection involved the systematic review of industry publications peer-reviewed journals and government trade reports to triangulate key tariff developments raw material cost movements and regulatory changes. Statistical modeling techniques were applied to trade flow datasets to assess the impact of duty adjustments on polymer import volumes and landed costs. Concurrently a detailed patent landscape analysis identified emerging hotspots in bio-based hot melt formulations and digital application technologies.

To ensure accuracy and impartiality all findings underwent multistage validation including cross-referencing supplier annual reports forum insights and proprietary databases. This combination of primary and secondary research alongside robust data triangulation underpins the reliability and relevance of the market insights contained herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hot Melt Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hot Melt Adhesives Market, by Technology

- Hot Melt Adhesives Market, by Form

- Hot Melt Adhesives Market, by End-Use Industry

- Hot Melt Adhesives Market, by Distribution Channel

- Hot Melt Adhesives Market, by Region

- Hot Melt Adhesives Market, by Group

- Hot Melt Adhesives Market, by Country

- United States Hot Melt Adhesives Market

- China Hot Melt Adhesives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Conclusion synthesizing key takeaways emerging trends and strategic imperatives shaping the global hot melt adhesives sector for informed decision-making

This executive summary has synthesized the principal trends, challenges and strategic imperatives that are defining the hot melt adhesives landscape in 2025. From sustainability-driven chemistries and digital supply chain frameworks to tariff-induced sourcing realignments and advanced application technologies the sector is undergoing multifaceted transformation. Key segmentation insights underscore the diverse requirements across applications end-use industries technologies physically manifested forms and distribution models that shape competitive differentiation.

Regional dynamics further enrich this picture revealing distinct growth drivers and supply chain configurations in the Americas Europe Middle East & Africa and Asia-Pacific. Meanwhile leading companies are advancing price management strategies technology partnerships and capacity expansions to position for long-term leadership. Collectively these insights illuminate a market where agility innovation and collaboration are critical success factors.

As industry participants chart their next moves they must balance near-term operational resilience with mid-term investment in sustainable and digital capabilities. By harnessing this comprehensive analysis, decision makers can formulate strategic roadmaps that capitalize on emerging opportunities enhance profitability and maintain a competitive edge in a rapidly evolving hot melt adhesives sector.

Take the next step toward strategic advantage by connecting with Ketan Rohom Associate Director of Sales Marketing to secure your adhesives market report

If you’re ready to transform your strategic outlook and gain unparalleled clarity on the hot melt adhesives market dynamics then don’t wait to unlock the full insights you need to stay ahead in a rapidly evolving industry. Reach out today to connect with Ketan Rohom Associate Director of Sales Marketing and explore tailored solutions for your organization Describe your unique requirements and he will guide you through the purchasing process to ensure you secure the adhesives market report that aligns precisely with your strategic ambitions

- How big is the Hot Melt Adhesives Market?

- What is the Hot Melt Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?