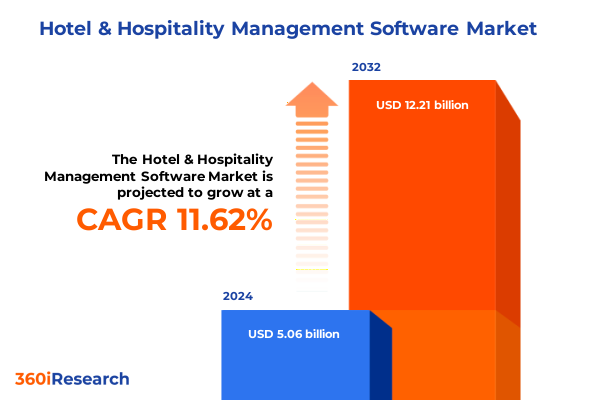

The Hotel & Hospitality Management Software Market size was estimated at USD 5.57 billion in 2025 and expected to reach USD 6.12 billion in 2026, at a CAGR of 11.87% to reach USD 12.21 billion by 2032.

Initializing an Executive Overview of the Hotel and Hospitality Management Software Industry Landscape and Strategic Imperatives Driving Innovation

In an industry where guest expectations evolve at unprecedented speed and technological innovation dictates competitive advantage, the hotel and hospitality software landscape demands a clear, strategic overview. This executive summary distills critical trends, operational challenges, and emerging opportunities to support informed decision-making by senior executives and IT leadership. By examining the interplay between digital transformation, evolving guest preferences, and shifting regulatory frameworks, this summary provides a cohesive narrative that highlights where investments in property management, revenue optimization, and guest engagement platforms can deliver the greatest return.

The narrative begins with an assessment of market drivers, including the accelerated adoption of cloud-based architectures and the imperative for seamless, omnichannel guest experiences. It then transitions into a detailed exploration of how tariff adjustments, segmentation dynamics, and regional variations are reshaping procurement strategies and technology roadmaps. By bridging qualitative insights from industry stakeholders with rigorous data validation, the report equips decision-makers with actionable guidance to navigate complexity, balance operational imperatives, and craft growth-oriented initiatives in the rapidly evolving hospitality technology ecosystem.

Exploring the Pivotal Technological Disruptions Operational Shifts and Emerging Guest Experience Transformations Reshaping Hospitality Management Software

The hotel technology domain has undergone profound transformation, pivoting from standalone modules to fully integrated platforms that leverage artificial intelligence, machine learning, and Internet of Things connectivity. These advances have shifted the industry’s focus from manual, siloed processes to predictive analytics and real-time automation. As contactless check-in and mobile concierge services become table stakes, software providers are embedding advanced personalization engines that tailor recommendations based on guest behavior, loyalty status, and contextual cues.

Meanwhile, sustainability considerations are influencing platform design, with leading solutions incorporating energy management and waste-reduction modules. This integration of environmental data into property management systems underscores a new era of responsible hospitality operations. Together, these technological and operational shifts are redefining guest expectations and compelling hoteliers to adopt agile, cloud-native architectures that can scale with evolving service models and support continuous innovation.

Assessing the Comprehensive Implications of Newly Imposed United States Tariffs on Hospitality Technology Procurement and Operational Cost Structures in 2025

In 2025, the United States implemented a series of tariffs targeting imported hardware components and on-premises infrastructure, with rates increasing costs by up to 15 percent for certain categories. As a result, hotels with legacy systems now face higher capital expenditures for server deployments and in-property networking upgrades. These additional costs have prompted many organizations to reevaluate total cost of ownership models and pursue alternative deployment modes.

Cloud-based platforms have largely been shielded from direct tariff impacts, enabling software vendors to maintain predictable pricing structures while offloading hardware procurement responsibilities. However, indirect effects have emerged as data center operators adjust service fees to offset increased equipment expenses. Software suppliers are responding by absorbing portions of the tariff-related cost increases, renegotiating vendor contracts, and introducing tiered support packages designed to mitigate financial burdens on their hospitality clients. Through collaborative vendor partnerships and strategic procurement frameworks, industry stakeholders are actively containing budgetary pressures while safeguarding system performance and guest service quality.

Deriving Actionable Segmentation Intelligence from Deployment Modes Component Types End User Categories Hotel Classifications Organizational Sizes and Pricing Models

The landscape of hospitality management software can be better understood by examining how different deployment modes cater to a variety of operational priorities. On-premises systems remain prevalent among hotels with stringent data residency requirements or legacy infrastructure commitments, while cloud solutions continue to gain ground for organizations seeking rapid scalability. Within the cloud segment, private clouds offer enhanced security controls favored by large enterprise chains, whereas public clouds deliver elastic capacity and cost efficiencies sought by independent properties.

Component-level insights reveal that reservation and channel management modules serve as the bedrock for guest acquisition, evolving to integrate online booking engines for streamlined multi-channel distribution. Customer relationship solutions are maturing to include dynamic guest profiling and loyalty management capabilities, enabling personalized offers and automated communications. Meanwhile, revenue management systems now blend pricing and yield management functions into unified platforms, harnessing real-time market data to optimize rate strategies across segments and channels.

End user segmentation underscores distinct requirements between chains and independents. Chain hotels leverage standardized deployments to achieve operational consistency and centralized control, whereas independent establishments prioritize modular solutions that can adapt to their unique brand identity. Resorts, whether beachfront or mountain-oriented, demand enhanced property management features to coordinate leisure amenities, activity bookings, and seasonal staffing models.

Variations in hotel classification and organizational size further shape software preferences, with luxury five-star and four-star properties gravitating toward comprehensive suites that integrate guest engagement, housekeeping, and facilities maintenance, while economy and midscale operations focus on core reservation and front-desk functionalities. Large enterprise chains are drawn to extensive licensing agreements with robust support frameworks, contrasting with SMEs that favor subscription-based models for predictable budgeting. Subscription offerings are available on both annual and monthly terms, whereas perpetual licenses may include one-time fees with optional maintenance services, catering to diverse financial planning approaches.

This comprehensive research report categorizes the Hotel & Hospitality Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Hotel Type

- Deployment Mode

- End User Type

- Organization Size

Unveiling Critical Regional Dynamics and Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Hospitality Technology Markets

Regional dynamics continue to play a pivotal role in shaping hospitality software adoption and innovation. In the Americas, widespread cloud acceptance has been driven by major national brands and independent operators alike, supported by substantial investment in data center expansions and broadband connectivity improvements. North American markets are at the forefront of embedding AI-driven guest personalization into frontline applications, while Latin American properties are increasingly leveraging mobile check-in and digital payment integrations to enhance guest experiences.

In Europe, the Middle East, and Africa, regulatory requirements around data privacy and sustainability reporting are steering platform enhancements, with enterprises seeking solutions that integrate GDPR and environmental compliance modules. The diverse economic landscapes within EMEA have fostered a demand for adaptable architectures, prompting providers to offer both localized on-premises installations and pan-regional cloud deployments.

Asia-Pacific markets exhibit some of the fastest growth trajectories, stimulated by booming tourism sectors in China, India, and Southeast Asia. Luxury beachfront resorts lead digital transformations with immersive guest experience platforms that interface with mobile wallets and in-resort IoT devices. Meanwhile, midscale hotels in urban hubs prioritize property management systems that streamline housekeeping, maintenance, and staffing coordination in high-occupancy environments.

This comprehensive research report examines key regions that drive the evolution of the Hotel & Hospitality Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscapes and Strategic Movements of Leading Hospitality Management Software Providers Driving Market Innovation and Adoption Trends

The competitive environment for hospitality management software is characterized by a blend of established technology conglomerates and agile startups. Major incumbents have accelerated platform enhancements through landmark acquisitions and strategic alliances, integrating payment, analytics, and IoT capabilities into comprehensive suites. At the same time, purpose-built cloud-native vendors are differentiating with open application programming interfaces, modular architectures, and streamlined onboarding processes that cater to independent hoteliers.

Innovation cycles have shortened as vendors race to deliver embedded AI modules for automated pricing, predictive maintenance, and intelligent housekeeping task assignment. Partnerships with fintech companies are enabling seamless, digital-first payments, while collaborations with loyalty networks and third-party booking platforms strengthen distribution reach. Through an emphasis on interoperability and developer-friendly tools, leading providers are fostering vibrant ecosystems that allow hotels to extend core platforms with niche solutions.

Emerging players are bringing fresh approaches to guest engagement by leveraging immersive technologies, chat-based interfaces, and hyper-personalized communication flows. The interplay between legacy system modernization and greenfield deployments continues to drive consolidation opportunities, compelling both global and regional players to refine their go-to-market strategies and reinforce customer success programs to retain and attract market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hotel & Hospitality Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amadeus IT Group S.A.

- Cloudbeds, Inc.

- eZee Technosys Pvt. Ltd.

- Guestline Limited

- Hotelogix India Pvt. Ltd.

- Infor, Inc.

- Mews Systems B.V.

- Northwind Canada Inc.

- Oracle Corporation

- Protel Hotelsoftware GmbH

- RMS Cloud Pty Ltd

- RoomRaccoon B.V.

- Shiji Information Technology Co., Ltd.

- StayNTouch, Inc.

- World Web Technologies Inc.

Empowering Industry Leaders with Targeted Strategies to Enhance Operational Efficiency Improve Guest Satisfaction and Capitalize on Emerging Hospitality Technology

To gain a competitive advantage, industry leaders must embrace a cloud-first approach that prioritizes agility, resilience, and seamless integration. Migrating core workloads to a secure cloud environment enables faster feature rollouts and reduces reliance on capital-intensive hardware refresh cycles. Implementing AI-driven guest profiling tools can unlock incremental revenue through tailored upsell offers and dynamic pricing, while machine-learning–based demand forecasting enhances resource allocation and labor planning.

Concurrent investment in cybersecurity frameworks is essential as digital touchpoints multiply across guest, back-office, and third-party systems. Conducting regular vulnerability assessments and adopting zero-trust architectures will safeguard both operational continuity and guest data privacy. Additionally, integrating sustainability metrics into property management and energy monitoring modules can support corporate environmental objectives and appeal to the growing segment of eco-conscious travelers.

Leaders should evaluate strategic partnerships with fintech providers to streamline mobile payments, loyalty currency tokenization, and contactless experiences. By designing modular, API-driven technology stacks, organizations can iterate service offerings rapidly and leverage best-in-class innovations from specialized vendors. Finally, aligning stakeholder incentives through a cross-functional Center of Excellence will ensure cohesive governance, drive user adoption, and maximize ROI on technology investments.

Detailing the Rigorous Research Methodology Combining Qualitative and Quantitative Analyses Primary Stakeholder Engagement and Data Validation Processes

This research leverages a multi-faceted methodology that integrates qualitative and quantitative analyses to ensure comprehensive and reliable insights. Primary data were gathered through in-depth interviews with senior IT executives, revenue managers, and operations directors at leading hotel chains, boutique properties, and resort destinations. These conversations illuminated critical pain points, adoption drivers, and future technology roadmaps.

Concurrently, a broad-based survey was administered to a representative sample of hoteliers across regions and segments, capturing standardized metrics related to deployment preferences, functionality usage, and vendor satisfaction. Secondary sources including vendor whitepapers, industry conference materials, and public financial disclosures were systematically reviewed to supplement primary findings. All data points were triangulated through cross-validation techniques to enhance accuracy, with discrepancies reconciled via follow-up consultations.

Analytical frameworks such as SWOT and Porter’s Five Forces were applied to contextualize competitive positioning and market dynamics. Statistical analyses, including regression modeling and cluster segmentation, provided granular validation of thematic trends. Throughout the process, stringent data governance protocols were maintained to ensure confidentiality and integrity of contributor inputs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hotel & Hospitality Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hotel & Hospitality Management Software Market, by Component Type

- Hotel & Hospitality Management Software Market, by Hotel Type

- Hotel & Hospitality Management Software Market, by Deployment Mode

- Hotel & Hospitality Management Software Market, by End User Type

- Hotel & Hospitality Management Software Market, by Organization Size

- Hotel & Hospitality Management Software Market, by Region

- Hotel & Hospitality Management Software Market, by Group

- Hotel & Hospitality Management Software Market, by Country

- United States Hotel & Hospitality Management Software Market

- China Hotel & Hospitality Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Insights Emphasizing Strategic Takeaways on Operational Excellence Technological Advancement and Sustainable Growth in Hospitality Management

In summary, the hospitality management software landscape is at a transformative crossroads, shaped by evolving guest expectations, regulatory complexities, and technological breakthroughs. Enterprises that harness cloud-native architectures, embed AI-driven personalization, and integrate sustainability considerations into their operations are best positioned to deliver exceptional guest experiences while driving operational efficiencies.

The tariff-induced adjustments in procurement strategies underscore the importance of flexible deployment models and strategic vendor partnerships. Segmentation insights reveal that a one-size-fits-all approach is untenable, as diverse property types and organizational scales demand tailored solutions. Regional dynamics further emphasize the need for localized offerings that comply with regulatory frameworks and cultural preferences.

Ultimately, the imperative for industry leaders is to adopt a holistic approach that aligns technology investments with business goals, fosters innovation ecosystems, and cultivates agile operational models. This report provides the actionable intelligence necessary to navigate the evolving landscape and achieve sustainable growth.

Take Action Today to Secure Comprehensive Hospitality Software Market Insights and Connect with Ketan Rohom for Tailored Strategies and Research Report Access

To explore the comprehensive insights covered in this report and gain a competitive edge in optimizing technology investments for your hospitality operations, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, Ketan will collaborate with your leadership team to align the research findings with your strategic objectives and tailor actionable blueprints that address your unique challenges. Engaging with Ketan will ensure you receive a customized consultation, enabling expedited access to the full report and supplementary data sets. Don’t miss the opportunity to leverage this vital intelligence in driving innovation and operational excellence within your organization

- How big is the Hotel & Hospitality Management Software Market?

- What is the Hotel & Hospitality Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?