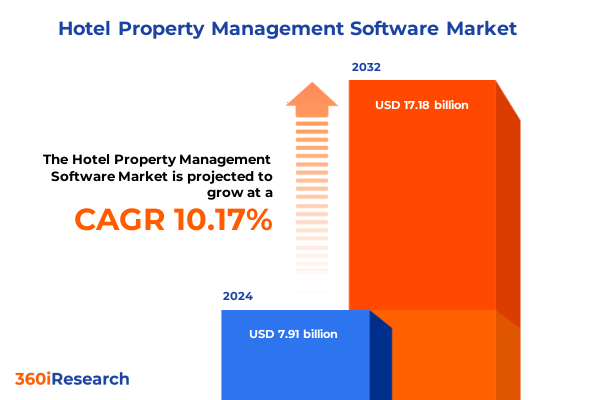

The Hotel Property Management Software Market size was estimated at USD 8.71 billion in 2025 and expected to reach USD 9.59 billion in 2026, at a CAGR of 10.17% to reach USD 17.18 billion by 2032.

Discover the Emerging Dynamics and Strategic Imperatives That Are Shaping Innovation and Operational Efficiency in Hotel Property Management Software Ecosystems

In an era marked by rapid digital transformation, the hotel property management software landscape has evolved from simple reservation systems into comprehensive, cloud-based ecosystems built to meet complex operational demands. Leading technology providers are integrating advanced analytics, artificial intelligence, and seamless channel connectivity to empower hoteliers to optimize revenue, deliver personalized guest experiences, and streamline back-office functions. Against this backdrop, stakeholders across the hospitality value chain are redefining strategic priorities, balancing the need for innovation with cost efficiencies and regulatory compliance.

Strong competition among software vendors has catalyzed a wave of feature-rich platforms that unify modules such as booking engines, revenue management, and restaurant point of sale into single interfaces. As hoteliers increasingly adopt unified, cloud-native solutions, the emphasis has shifted toward mobile accessibility, API-driven interoperability, and data security. Market participants are no longer content with basic property accounting; they seek predictive forecasting, real-time performance dashboards, and machine-learning-driven guest personalization. This heightened demand underscores the urgency for comprehensive analysis of emerging trends, competitive dynamics, and strategic imperatives guiding the next phase of technological adoption in the industry.

Unveiling the Transformative Technological and Consumer Behavior Shifts Redefining the Landscape of Hotel Property Management Software

Hotel property management software is undergoing a transformative evolution driven by converging forces of technology, consumer expectations, and operational complexity. On the technology front, artificial intelligence and machine learning have unlocked powerful revenue optimization tools that dynamically adjust pricing based on real-time demand signals. These advancements are complemented by integrated mobile applications that empower staff to manage reservations, process check-ins, and resolve guest issues from handheld devices, reducing reliance on fixed workstations.

Meanwhile, shifting consumer behaviors-shaped by the ease of online booking platforms and heightened expectations for personalized experiences-are compelling hoteliers to adopt sophisticated guest-profile management systems. Seamless integration with alternative accommodation providers and lifestyle-focused offerings has blurred the lines between traditional hotels and emerging hospitality formats. As a result, property management solutions are evolving beyond standalone modules into fully connected ecosystems that span the guest journey from pre-arrival communication to post-stay feedback. Transitioning toward open-API frameworks, vendors are forging partnerships with channel managers, loyalty platforms, and digital concierge services, ensuring that hoteliers remain agile in a rapidly converging marketplace.

Analyzing the Comprehensive Cumulative Impact of 2025 United States Tariffs on Technology Costs, Software Adoption, and Regional Infrastructure Strategies

Since the introduction of new tariffs by the United States in early 2025, the hospitality technology sector has felt ripple effects across hardware procurement, software licensing, and operational upgrades. Import duties imposed on network hardware, point-of-sale terminals, and IoT devices have driven up upfront costs, prompting many providers to increase license fees or adjust subscription pricing models. To mitigate these pressures, vendors are accelerating the transition to cloud-native architectures that reduce reliance on on-premises infrastructure, shifting the capital expenditure burden toward more flexible operating expense structures.

Cumulative impacts of these trade measures have also spurred a strategic pivot by global providers toward local development hubs. By establishing regional data centers and forging partnerships with U.S.-based hardware assemblers, software firms are circumventing tariff constraints while delivering on stringent data sovereignty and latency requirements. Additionally, hoteliers are recalibrating their procurement strategies to account for potential cost fluctuations, negotiating multiyear agreements to lock in pricing and exploring modular software deployments that isolate tariff-sensitive components. These adaptive approaches underscore the sector’s resilience and its capacity to innovate in response to evolving policy environments.

Delving into Multi-Dimensional Segmentation Perspectives That Illuminate Diverse Market Needs Across Functions, Accommodation Types, Subscription Models, Software Variants, Deployment Modes, and End Users

A multi-dimensional segmentation framework reveals the nuanced demands and growth levers across the hotel property management software space. When examined by core operational functions-spanning booking engines, channel management, lease oversight, property accounting, inspection protocols, restaurant point of sale, revenue management, and room reservation-hoteliers prioritize integrated workflows that minimize manual interventions and centralize data streams. This functional lens underscores the importance of interoperability and real-time analytics in driving operational excellence.

Looking at accommodation types, the software landscape caters to homestay offerings, full-service hotels and resorts, lifestyle villages, marinas, mobile home parks, motels and lodges, park and campground operations, and serviced apartments. Providers serving the hotel and resort segment further differentiate their solutions for chain properties, large urban hotels, mid-scale establishments, boutique venues, and ultra-luxury resorts, ensuring feature sets align with diverse scale and service models. These distinctions highlight the importance of configurable platforms that can flex to varied service levels.

Subscription preferences also delineate market segments, with perpetual licensing appealing to established enterprises seeking capex certainty, while subscription-based models resonate with emerging operators desiring scalable, pay-as-you-grow structures. Meanwhile, the choice between integrated suites and standalone systems speaks to organizational maturity: integrated systems offer unified data models and minimal integration overhead, whereas standalone solutions allow targeted investments in specific modules.

Deployment considerations further segment the market into cloud-hosted environments, prized for rapid rollouts and remote accessibility, and on-premises installations, valued for direct control and compliance. Finally, end-user profiles-ranging from independent boutique hotels to metropolitan business hotels and sprawling resorts and spas-shape feature requirements around guest personalization, group booking management, and amenity integration.

This comprehensive research report categorizes the Hotel Property Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Function

- Type

- Subscription Model

- Software Type

- Deployment

- End User

Exploring Regional Dynamics and Distinct Demand Drivers Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Hotel Technology Ecosystems

Regional dynamics in the hotel property management software market reveal distinct adoption patterns and growth drivers. In the Americas, a mature hospitality sector is fueling demand for advanced revenue management modules, mobile-first guest engagement tools, and seamless connectivity with global distribution systems. Operators in North America are early adopters of machine-learning-driven forecasting and voice-enabled service applications, while Latin American properties are prioritizing cloud deployments to bypass local infrastructure constraints and reduce total cost of ownership.

Europe, Middle East, and Africa present a complex tapestry of regulatory environments and hospitality formats. European operators emphasize stringent data privacy controls and GDPR-compliant frameworks, leading vendors to integrate robust encryption and privacy-by-design methodologies. In the Middle East, large integrated resorts demand end-to-end solutions that link room reservations with event management and loyalty ecosystems. Conversely, emerging markets across Africa are leveraging on-cloud offerings to leapfrog legacy IT investments and scale rapidly in response to tourism growth.

In the Asia-Pacific region, exponential growth in domestic and international travel has spurred investments in omnichannel booking platforms, multi-language support, and mobile wallet integrations. Cloud-native property management systems are gaining traction in Southeast Asian markets, where limited on-premises infrastructure makes hosted solutions more viable. China and India, with their massive domestic markets, are home to both established global vendors and vibrant local startups vying for market share, intensifying competition and driving continuous innovation in user interfaces, payment gateways, and AI-enabled service bots.

This comprehensive research report examines key regions that drive the evolution of the Hotel Property Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators, Strategic Collaborations, and Disruptive Entrants Shaping the Competitive Landscape of Hotel Property Management Software

Competitive dynamics among leading hotel property management software vendors are defined by a mix of innovation, strategic partnerships, and market consolidation. Established enterprise providers are reinforcing their market strongholds by enhancing cloud-native capabilities, embedding advanced analytics, and expanding their partner networks to include channel management, distribution, and loyalty platforms. Meanwhile, emerging challengers are differentiating through user-centric design, rapid implementation cycles, and open-API architectures that facilitate seamless integration with third-party applications.

Strategic acquisitions have also reshaped the landscape, with major players absorbing niche technology firms to broaden functionality in revenue optimization, guest experience, and back-office automation. At the same time, partnerships between global vendors and regional system integrators are enabling localized service delivery, data residency compliance, and on-the-ground support. This dual strategy of organic innovation and targeted M&A underscores the industry’s drive to offer end-to-end solutions that meet the evolving needs of hoteliers, from boutique operators to international chains.

Looking ahead, differentiation will hinge on agility-vendors that can rapidly incorporate emerging technologies such as augmented reality for virtual site inspections, blockchain for secure loyalty programs, and predictive maintenance for IoT-enabled assets will set new benchmarks. Additionally, those who commit to transparent pricing models and open-source interoperability standards will earn trust among operators navigating complex technology portfolios and tariff-driven cost pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hotel Property Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilysys, Inc.

- AltexSoft Inc

- ASSD GmbH

- Atulyam Hotelline Solutions Pvt. Ltd

- AxisRooms Travel Distribution Pvt. Ltd.

- Care Internet Services B.V.

- Cisco Systems, Inc.

- Clock Software Ltd.

- Cloudbeds

- eZee Technosys Pvt. Ltd by Yanolja

- FCS Computer Systems

- Finner PMS

- GraceSoft, Inc.

- Hallisoft

- hoteliga international Sp. z o.o.

- Hotelogix India Pvt. Ltd

- HotelTime Solutions a.s.

- Huawei Technologies Co. Ltd.

- IDS Next Business Solutions Pvt. Ltd.

- Infor by Koch Industries, Inc.

- innRoad Hotel Management Software

- International Business Machines Corporation

- IRIS Software Systems Ltd.

- Johnson Controls International PLC

- Kipsu, Inc

- Lodgify

- Mews Systems B.V

- Nobeds

- OpenKey, Inc

- Oracle Corporation

- PROTEL Computer Inc.

- ResNexus

- Revinate

- Revpar Guru Inc.

- RMS Cloud

- RoomKeyPMS

- RoomRaccoon

- Salesforce, Inc.

- SAP SE

- Shiji Group

- Sirvoy Limited

- SiteMinder Limited

- Stayntouch Inc.

- ThinkReservations

- Valsoft Corporation

- WebRezPro

- Yanolja Co., Ltd.

Strategic Actionable Recommendations for Industry Leaders to Accelerate Adoption, Enhance Customer Experiences, and Strengthen Competitive Advantage

To thrive amid technological disruption and evolving market dynamics, industry leaders must embrace a forward-looking strategy that balances innovation with operational pragmatism. First, investing in cloud-native architectures and microservices will enhance scalability and facilitate incremental feature rollouts without the need for large-scale infrastructure upgrades. This modular approach allows rapid response to changing guest expectations and regulatory requirements while controlling total cost of ownership.

Second, embedding advanced analytics and machine learning directly into core property management modules will unlock deeper insights into occupancy patterns, ancillary revenue opportunities, and guest sentiment. Decision-makers should prioritize platforms that offer pre-configured analytics dashboards and intuitive data visualization, reducing reliance on specialized IT staff and expediting time to value. Additionally, integrating cybersecurity frameworks from the outset-such as zero-trust access controls and continuous vulnerability scanning-will mitigate risk and ensure compliance with data privacy regulations across regions.

Third, forming strategic alliances with channel managers, digital concierge providers, and loyalty program operators will amplify guest engagement capabilities and streamline distribution. By fostering an open-API ecosystem, vendors can enable hoteliers to craft differentiated guest journeys while capitalizing on best-in-class technologies. Finally, addressing tariff-induced cost fluctuations through flexible subscription models or regionally distributed infrastructure will future-proof operations. Leaders who implement these strategic imperatives will position themselves to capture market share and deliver unrivaled guest experiences.

Outlining a Robust Research Methodology That Integrates Primary Executive Insights, Comprehensive Secondary Data, and Rigorous Triangulation Procedures

This report employs a multi-phased research methodology that ensures comprehensive coverage of the hotel property management software market. Primary insights were gathered through in-depth interviews with hospitality executives, IT directors, software vendors, and regional distribution partners. These qualitative discussions illuminated real-world challenges, adoption drivers, and decision criteria influencing platform selection across different property types and geographies.

Secondary research encompassed a systematic review of corporate filings, industry white papers, regulatory documentation, and technology patent databases. This desk-based analysis provided market context, tracked historical tariff changes, and identified emerging technology trends. Additionally, vendor product literature and technical specifications were examined to map feature sets against segmentation criteria.

To validate findings and ensure accuracy, a rigorous triangulation process was employed, cross-referencing primary feedback, secondary data, and publicly available benchmarks. Statistical and trend-analysis techniques were applied to qualitative and quantitative insights, ensuring that thematic conclusions reflect both industry executive sentiment and observable market behaviors. Quality checks, including peer reviews and consistency assessments, were integrated at every stage of the research process, culminating in the actionable recommendations presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hotel Property Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hotel Property Management Software Market, by Function

- Hotel Property Management Software Market, by Type

- Hotel Property Management Software Market, by Subscription Model

- Hotel Property Management Software Market, by Software Type

- Hotel Property Management Software Market, by Deployment

- Hotel Property Management Software Market, by End User

- Hotel Property Management Software Market, by Region

- Hotel Property Management Software Market, by Group

- Hotel Property Management Software Market, by Country

- United States Hotel Property Management Software Market

- China Hotel Property Management Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Future Investments and Innovation Trajectories in Hotel Property Management Software

The evolution of hotel property management software has reached an inflection point where the convergence of advanced technologies, shifting consumer demands, and regulatory complexities creates both challenges and opportunities. Market segmentation reveals that operational functions, property types, delivery models, and geographic nuances collectively shape solution requirements, underscoring the importance of configurable, interoperable platforms. At the same time, external factors such as new United States tariffs have accelerated cloud adoption and driven strategic adjustments in infrastructure investment.

Competitive dynamics highlight a bifurcation between established enterprises reinforcing cloud capabilities and nimble entrants prioritizing user-centric design and rapid deployment. In this context, industry leaders must adopt agile deployment models, integrate analytics and cybersecurity by design, and foster open-API ecosystems to sustain innovation. By aligning segmentation insights with regional demand characteristics and tariff-resilient strategies, hoteliers can optimize lifecycle costs and deliver differentiated guest experiences.

As the landscape continues to evolve, stakeholders equipped with a clear understanding of the transformative shifts, competitive landscape, and actionable recommendations will be best positioned to drive growth and maintain leadership in an increasingly technology-driven hospitality sector.

Engaging with Ketan Rohom to Unlock In-Depth Industry Intelligence and Drive Strategic Growth Through a Customized Market Research Report

To obtain this comprehensive market research report and unlock deep industry insights tailored to your strategic needs, reach out to Ketan Rohom, Associate Director, Sales & Marketing. By partnering with an expert familiar with the latest trends, regulatory impacts, segmentation nuances, and competitive dynamics, you’ll gain a critical edge in navigating the evolving hotel property management software landscape. Secure your copy today to benefit from actionable recommendations, in-depth company profiles, and a rigorous research methodology designed to support data-driven decision-making. Let our findings guide your next move and empower your organization to seize emerging opportunities with confidence

- How big is the Hotel Property Management Software Market?

- What is the Hotel Property Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?