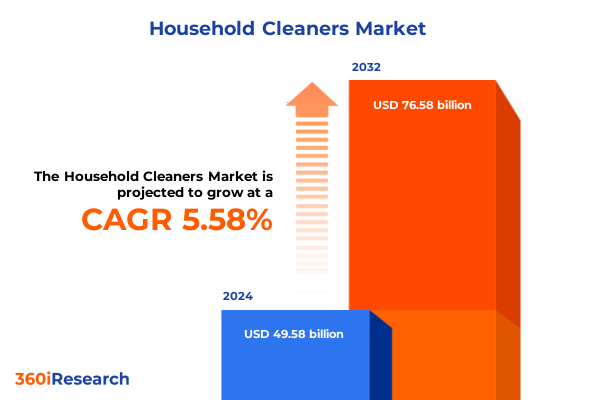

The Household Cleaners Market size was estimated at USD 52.39 billion in 2025 and expected to reach USD 55.03 billion in 2026, at a CAGR of 5.57% to reach USD 76.58 billion by 2032.

Exploring the Dynamic World of Household Cleaners and Unveiling Key Market Forces Shaping Future Industry Trajectories Reshape Global Demand Dynamics

The household cleaning solutions market is undergoing a period of rapid transformation driven by evolving consumer behaviors, environmental imperatives, and technological progress. As busy households and professional facilities alike seek products that deliver superior efficacy without compromising safety or sustainability, leading manufacturers are innovating across formulations, delivery formats, and service models to meet these complex demands. From concentrated enzyme-based detergents to app-enabled smart dispensers, the range of offerings has expanded far beyond traditional soap and water, reshaping the very definition of what a “clean” environment entails.

This dynamic environment has given rise to a more informed and discerning end user. Consumers are now scrutinizing ingredient lists for allergen-free and biobased claims, while facilities managers evaluate total cost of ownership across diverse product categories. In response, manufacturers have accelerated the integration of digital tools and data analytics to optimize supply chains, enhance product performance, and engage customers through targeted messaging.

At the same time, regulatory frameworks around single-use plastics, volatile organic compounds (VOCs), and ecological toxicity are tightening, propelling a shift toward refillable packaging, plant-based surfactants, and closed-loop lifecycle management. As a result, companies that once competed primarily on price and brand recognition now find themselves navigating a multidimensional battleground that spans sustainability credentials, digital engagement, and formulation science. Transitional strategies are essential, as incumbents and new entrants alike strive to align product portfolios with the powerful currents of consumer, environmental, and regulatory change.

Examining the Unprecedented Transformative Shifts Redefining Consumer Preferences and Technological Innovations in the Household Cleaning Ecosystem and Sustainability Imperatives Driving Market Evolution

Over the past five years, the household cleaning sector has witnessed transformative shifts that extend far beyond incremental product improvements. Consumer preferences have migrated toward multifunctional formulations capable of tackling grease, odors, and pathogens in a single application, catalyzing the rise of hybrid chemistries founded on enzymatic and antimicrobial technologies. These innovations reflect a growing emphasis on convenience, with time-pressed households and commercial facilities seeking products that accelerate cleaning routines without sacrificing effectiveness.

Concurrently, sustainability imperatives have moved from the periphery to the core of corporate strategies. New standards for biodegradability, microplastic reduction, and recyclable packaging have incentivized manufacturers to redesign supply chains and collaborate with material scientists. Advanced recycling initiatives-such as chemical depolymerization of rinse-off plastics-are gaining traction, underscoring the sector’s commitment to circular economy principles.

Digital integration has also become a cornerstone of market evolution. IoT-enabled dispensers and smart home platforms now provide real-time consumption data, enabling users to optimize dosage, reduce waste, and anticipate reorder cycles. In parallel, direct-to-consumer subscription models are proliferating, offering curated product assortments delivered on a recurring basis. This shift from mass retail to personalized digital engagement is reshaping not only how products are marketed, but how they are formulated and distributed, presenting both opportunity and challenge for legacy players and agile newcomers alike.

Analyzing the Cumulative Impact of 2025 U.S. Tariff Policies on Supply Chain Dynamics Cost Structures and Competitive Positioning in Cleaning Solutions

The implementation of new U.S. tariff policies in early 2025 has exerted a noteworthy influence on the cost structures and supply chain dynamics of imported raw materials used in household cleaners. Key ingredients such as specialty surfactants, antimicrobial agents, and performance-enhancing additives sourced from certain regions have seen incremental duties applied, prompting domestic and global manufacturers to reassess sourcing strategies. In many cases, firms have initiated dual-sourcing arrangements or intensified partnerships with domestic chemical producers to mitigate exposure to tariff volatility.

These shifts have reverberated across competitive positioning as well. Companies with established domestic production capabilities have leveraged scale advantages to absorb cost increases, while those heavily reliant on single-source imports have experienced margin compression or have passed incremental costs onto end users. Such dynamics have accelerated discussions around nearshoring and on-shore capacity expansion, as stakeholders seek to balance resilience with cost containment in an uncertain trade environment.

Looking forward, the cumulative impact of 2025 tariff measures is likely to catalyze further regional realignment of supply networks. As manufacturers explore alternative feedstocks-such as biosurfactants derived from agricultural byproducts-the interplay between tariffs and innovation is poised to shape product portfolios. Moreover, evolving trade negotiations and potential reciprocal measures from partner nations may introduce additional complexity, reinforcing the need for agile procurement teams and continuous scenario planning.

Uncovering Critical Segmentation Insights Spanning Product Type Form Sales Channel End User and Packaging Type to Illuminate Customer-Centric Market Nuances

A nuanced understanding of household cleaners emerges when the market landscape is examined across key segmentation dimensions without relying on simple bullet lists. First, analyzing product type reveals distinct pathways for air freshener, all-purpose cleaner, dishwashing detergent, floor cleaner, glass cleaner, laundry detergent, and toilet bowl cleaner offerings. Each category faces unique drivers-from fragrance sustainability in air fresheners to enzyme efficacy in laundry detergents-necessitating tailored R&D and marketing approaches. In parallel, form segmentation highlights diverging demand for aerosol, gel, liquid, powder, and wipes, with liquid presentations further delineated into concentrated and ready-to-use formats. Concentrates are winning favor among eco-conscious users seeking reduced packaging waste, while ready-to-use solutions emphasize convenience and immediate performance.

Shifting to sales channel, the dichotomy between offline and online retail has become increasingly pronounced. Traditional brick-and-mortar distributors continue to serve users who prefer in-store evaluation and bulk purchases, whereas the online domain-encompassing both direct-to-consumer websites and e-commerce platforms-caters to those seeking curated assortments, subscription services, and digital product education. Meanwhile, the end user dimension distinguishes between commercial and residential demand patterns, with commercial segments prioritizing bulk efficiency and regulated compliance, and residential consumers emphasizing lifestyle alignment and multisurface versatility. Finally, packaging type segmentation across bottles, boxes, pouches sachets, and spray cans shapes shelf impact and user convenience. Innovative pouches and sachets are resonating with environmentally aware buyers due to their low carbon footprint, while traditional bottles and spray cans maintain strong brand visibility in retail environments. By synthesizing these five lenses, businesses can identify white-space opportunities and optimize portfolio strategies for maximal market resonance.

This comprehensive research report categorizes the Household Cleaners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Packaging Type

- Sales Channel

- End User

Mapping Regional Performance and Strategic Nuances Across Americas Europe Middle East Africa and Asia-Pacific to Guide Targeted Market Engagement

Regional analysis of the household cleaners market underscores significant variation in consumer expectations, regulatory landscapes, and competitive dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, sustainability claims such as plant-derived surfactants and eco-friendly packaging have become baseline requirements, particularly in North America where high consumer environmental awareness drives premium pricing for green-certified products. Latin American markets, by contrast, are characterized by cost sensitivity balanced against growing demand for fragrance-focused air fresheners and price-effective multipurpose cleaners. Economic volatility in certain countries has elevated the importance of value-oriented SKUs and down-trading strategies.

Turning to Europe Middle East & Africa, the landscape is fragmented by divergent regulatory regimes and cultural preferences. Western Europe leads with stringent VOC restrictions and circular economy mandates, prompting extensive use of refill stations and lightweight packaging. In contrast, many Middle Eastern and African markets are in earlier stages of adopting sustainability criteria, although urbanization and rising disposable incomes are fueling demand for premium formulations. Across the region, international multinationals are collaborating with local partners to navigate complex import regulations and establish distribution networks that can respond rapidly to short-cycle trends.

In Asia-Pacific, rapid urban growth and expanding middle classes are driving broad-based expansion in household cleaning categories. China and India represent particularly dynamic arenas, where digital channels and mobile commerce dominate new product introductions, and where local players compete vigorously on price, flavor profiles, and multifunctionality. Meanwhile, Southeast Asian countries are experimenting with subscription models and concentrated formats to address logistics challenges and reduce environmental impact. By tailoring approaches to each region’s regulatory, cultural, and infrastructural context, manufacturers can optimize resource allocation and accelerate market entry cadences.

This comprehensive research report examines key regions that drive the evolution of the Household Cleaners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Strategic Alliances Product Innovations and Competitive Tactics Shaping the Global Household Cleaners Market Landscape

Industry leaders across the household cleaning sector are distinguished by their capacity to integrate innovation, brand equity, and distribution excellence. Procter & Gamble continues to leverage its deep R&D pipeline to launch multifunctional product lines such as enzyme-boosted detergents that address both stain removal and fabric care concerns, while utilizing its extensive retail partnerships to maintain shelf prominence. SC Johnson has doubled down on sustainability, expanding its portfolio of citrus-based degreasers and pioneering refillable gel concentrate systems to align with circular economy objectives. Unilever has positioned itself at the intersection of digital marketing and green branding, deploying targeted social media campaigns and transparent ingredient sourcing metrics to engage eco-aware consumers in Europe and North America.

Reckitt Benckiser has emphasized strategic acquisitions to bolster its antimicrobial and surface sanitization capabilities, integrating new technologies from niche innovators into marquee brands. Clorox has concurrently accelerated its private label partnerships and in-house innovation labs to deliver cost-competitive heavy-duty cleaners tailored for professional and consumer segments alike. Across these and other leading players, strategic alliances with packaging specialists and technology startups have become common, enabling rapid prototyping of novel container formats and IoT-enabled dispensing systems. By continuously refining brand portfolios, optimizing channel mixes, and embracing sustainability metrics, these companies are setting the standard for competitive differentiation in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Household Cleaners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway

- Bombril

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Dabur India Ltd

- Ecolab

- Essity

- Godrej Consumer Products Ltd

- Goodmaid Chemicals Corporation

- Henkel AG & Co. KGaA

- Hindustan Unilever Ltd

- Jyothy Labs Ltd

- Kao Corporation

- McBride PLC

- Newell Brands

- Nirma

- Reckitt Benckiser Group PLC

- S. C. Johnson & Son Inc.

- SC Johnson Professional

- Sofidel

- The Clorox Company

- The Procter & Gamble Company

- Unilever PLC

Providing Strategic and Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Positioning in Household Cleaning

Industry leaders should prioritize a multidimensional strategy that combines product innovation with operational resilience and customer-centric engagement. First, embedding sustainability at the core of formulation and packaging design can drive brand loyalty and preempt future regulatory mandates; this includes investing in renewable feedstocks, expanding refill offerings, and adopting closed-loop recycling partnerships. Second, strengthening supply chain flexibility through nearshoring or regional distribution hubs can mitigate the impact of emerging tariffs and geopolitical disruptions, while dual-sourcing critical inputs ensures continuity in the face of logistical bottlenecks.

Moreover, digital transformation must extend beyond e-commerce storefronts to encompass smart dispensing solutions, data-driven personalization, and integrated loyalty programs. By capturing usage data and leveraging predictive analytics, companies can offer tailored replenishment services, optimize inventory levels, and reduce customer churn. In parallel, partnerships with technology providers enable the development of subscription models that balance product variety with cost predictability, fostering recurring revenue streams.

Finally, fostering collaboration with regulatory bodies and industry associations is essential to shape feasible sustainability standards and streamline compliance processes. Engaging directly with policymakers on circular economy frameworks can yield early insights into upcoming legislative shifts, allowing businesses to adapt proactively. Collectively, these actionable recommendations empower industry leaders to navigate uncertainty, capitalize on emerging opportunities, and reinforce market leadership in the household cleaning domain.

Detailing Rigorous Research Methodology Embracing Data Collection Analysis Validation and Expert Insights to Ensure Comprehensive Market Intelligence

This report’s conclusions and insights are underpinned by a rigorous methodology combining primary and secondary research. Primary data collection involved in-depth interviews with senior executives, R&D specialists, and procurement managers across leading household cleaning companies, ensuring a firsthand understanding of strategic priorities and operational challenges. Complementing these qualitative insights, structured surveys were conducted with distributors and end users in key regions to quantify usage patterns, purchase drivers, and unmet needs.

Secondary research encompassed extensive review of corporate filings, patent databases, regulatory documents, and industry association publications, enabling triangulation of market developments and validation of emerging trends. Sales channel performance data were sourced from leading retail analytics firms and cross-reconciled with manufacturer shipment figures to ensure consistency. Advanced analytical frameworks, including SWOT analysis, PESTLE evaluation, and Porter’s Five Forces, were applied to assess competitive intensity, regulatory pressures, and macroeconomic influences.

Finally, all data were subjected to a thorough quality assurance process, with multiple rounds of validation by our in-house subject matter experts to guarantee accuracy, relevance, and consistency. This robust approach delivers a comprehensive, data-backed foundation for strategic decision-making and enables stakeholders to navigate the complex landscape of the household cleaning market with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Household Cleaners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Household Cleaners Market, by Product Type

- Household Cleaners Market, by Form

- Household Cleaners Market, by Packaging Type

- Household Cleaners Market, by Sales Channel

- Household Cleaners Market, by End User

- Household Cleaners Market, by Region

- Household Cleaners Market, by Group

- Household Cleaners Market, by Country

- United States Household Cleaners Market

- China Household Cleaners Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Comprehensive Conclusions on Industry Dynamics and Strategic Imperatives to Equip Stakeholders with Clarity for Future Decision-Making in Household Cleaners

The household cleaning market stands at a crossroads where sustainability ambitions, digital engagement, and resilient supply chains converge to shape the next phase of competitive advantage. Across product types and forms, companies must navigate nuanced consumer demands for safety, convenience, and environmental responsibility, while maintaining agility in an evolving tariff and regulatory environment. Regional variations in preference and policy underscore the importance of tailored strategies, as success in one geography may not translate seamlessly to another.

Leading players demonstrate that robust R&D, strategic partnerships, and data-driven decision-making are indispensable for capturing emergent growth pockets. Moreover, the integration of circular economy principles and smart technology solutions offers a pathway to differentiation that resonates with both consumers and business buyers. As the industry moves forward, those organizations that can align operational resilience with customer-centric innovation will be best positioned to drive sustainable growth and adapt to the shifting contours of the global household cleaners landscape.

Engage with Associate Director Ketan Rohom to Secure In-Depth Market Research and Empower Your Strategic Decision-Making in Household Cleaning Innovations

To access the comprehensive insights and in-depth analysis contained in the full household cleaners market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He stands ready to guide you through tailored licensing options, address any specific questions about report scope, and ensure your organization secures the strategic intelligence needed to stay ahead in this competitive landscape. Engage directly to explore volume discounts, customized add-ons, and expedited delivery so your team can act swiftly on market opportunities.

- How big is the Household Cleaners Market?

- What is the Household Cleaners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?