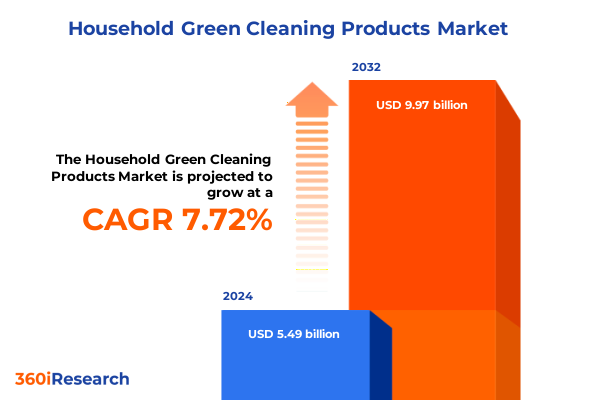

The Household Green Cleaning Products Market size was estimated at USD 5.93 billion in 2025 and expected to reach USD 6.33 billion in 2026, at a CAGR of 7.70% to reach USD 9.97 billion by 2032.

Unveiling the Dynamic Evolution of Household Green Cleaning Products as Consumer Demand and Sustainability Imperatives Reshape the Market Landscape

The surge in consumer awareness around indoor air pollution and endocrine disruptors has propelled green cleaning from a niche choice to a mainstream expectation. With growing concerns over conventional household cleaners containing volatile organic compounds (VOCs), quaternary ammonium compounds, and microplastics, an increasing number of individuals are opting for safer alternatives that prioritize human health and environmental stewardship.

Despite the United States lacking a precautionary principle comparable to that of the European Union, regulatory frameworks such as the EPA’s Safer Choice program and voluntary certification schemes have begun to shape product development and marketing claims. Nonetheless, gaps remain in transparency and ingredient disclosure, driving consumers to seek third-party verification and greater clarity around formula composition.

In response to these dynamics, manufacturers and emerging brands are accelerating innovation across ingredients and delivery systems. From enzyme-powered formulations to concentrated pods and refillable containers, market incumbents and disruptors alike are investing heavily in research and development. This wave of transformation underscores a fundamental shift: performance can no longer come at the cost of safety or sustainability.

Exploring Groundbreaking Transformative Shifts Accelerating Innovation Sustainability and Consumer Engagement Trends Within the Green Cleaning Industry

Across the green cleaning sector, zero-waste packaging has emerged as one of the most influential trends reshaping product design and consumer engagement. Brands are replacing single-use plastic bottles with reusable containers and concentrated refills, thereby cutting down shipping emissions and packaging waste. This model not only appeals to environmentally conscious consumers but also drives cost efficiencies through reduced material usage and logistics optimization.

Simultaneously, the rise of plant-based and enzyme-driven formulations is redefining performance expectations. Leveraging citrus oils, protein-cleaving enzymes, and botanically derived surfactants, these products deliver grease-cutting efficacy on par with traditional cleaners while maintaining biodegradability. The shift toward natural actives is reinforced by consumer preferences for non-irritating scents and allergen-free ingredients, making these formulations particularly attractive for families and pet owners.

In parallel, microbial and probiotic cleaners are gaining traction for their ability to break down organic matter over extended periods. By applying beneficial bacteria that continue to neutralize grime and odors for days after use, products such as Unilever’s recently introduced probiotic spray are redefining the concept of deep cleaning. This long-lasting approach not only enhances user convenience but also contributes to balanced microbiomes in built environments, aligning with broader wellness trends.

Driving further transformation, the integration of smart cleaning technologies-ranging from robot-assisted vacuums with HEPA-grade filtration to app-enabled dosing systems-enables precise application of green formulas, minimizing waste and optimizing resource consumption. These digitally connected tools provide real-time feedback on air quality, surface hygiene, and product usage, empowering consumers to maintain healthier homes while conserving water and energy.

Assessing the Comprehensive Cumulative Impacts of Recent United States Tariffs on the Economics Supply Chains and Pricing Dynamics in the Green Cleaning Sector

In recent months, the United States has implemented a series of tariffs targeting imports from major trading partners, extending higher duties to chemical inputs, packaging materials, and cleaning equipment. These measures, announced under reciprocal tariff policies, have compounded existing Section 232 levies on steel and aluminum, resulting in elevated costs for manufacturers reliant on global supply chains.

As a direct consequence, ingredient suppliers have raised prices on imported surfactants, enzymes, and botanical extracts-key components in green cleaning formulations. Packaging producers, facing higher raw-material expenses for plastics and metals, have also increased charges for refill pouches and spray nozzles. Ultimately, these added costs cascade through the value chain, pressuring brands to decide between price adjustments, margin compression, or reformulating with domestically sourced alternatives.

Manufacturers of household cleaning products, including industry leaders such as Procter & Gamble, have responded by shifting production footprints, renegotiating supplier contracts, and emphasizing premium product lines. P&G’s strategy to offset tariff-induced cost burdens includes elevated price points for innovation-driven offerings and enhanced product performance claims. While this approach aims to preserve profitability, it risks alienating value-seeking consumers facing broader economic uncertainty.

Consumer behavior has also adapted to the tariff environment, with purchasers stockpiling staple green cleaners ahead of anticipated price hikes. This trend underscores the essential nature of cleaning products, compelling brands and retailers to develop flexible pricing models, subscription programs, and loyalty incentives to maintain engagement and mitigate the impact on household budgets.

Illuminating Key Segmentation Insights Uncovering Product Ingredient Form and Sales Channel Dynamics Fueling Diversity and Growth in Green Cleaning Markets

The green cleaning market exhibits extensive differentiation by product type, encompassing versatile all-purpose cleaners and specialized solutions such as bathroom and floor products, glass care formulations, dishwashing liquids, and laundry detergents. Each category addresses distinct use cases, surface requirements, and consumer expectations, driving targeted innovation and branding strategies aimed at optimizing efficacy and user experience.

Beyond product function, ingredient-type segmentation reveals a balance between enzymatic blends that leverage protein-digesting catalysts and plant-based or essential oil-based formulas known for their antibacterial and aromatic properties. Mineral-based compounds, often featuring baking soda or citric acid, further complement this landscape by offering abrasive yet eco-friendly scrubbing capabilities, satisfying a broad spectrum of cleaning challenges.

Formulation format plays a pivotal role, ranging from concentrated liquids designed for refill systems to ready-to-use sprays, powders, and pre-moistened wipes. This diversity in delivery mechanisms reflects evolving consumer preferences for convenience, portability, and waste reduction, as well as the practical demands of different cleaning scenarios.

Sales channels augment market complexity, with traditional offline outlets-spanning convenience stores, hypermarkets, supermarkets, and specialty retail-coexisting alongside online platforms including e-commerce marketplaces and manufacturer websites. This omnichannel environment enables brands to craft differentiated experiences, capitalize on direct-to-consumer engagement, and harness data-driven personalization while maintaining visibility across physical retail landscapes.

This comprehensive research report categorizes the Household Green Cleaning Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Form

- Sales Channel

Revealing Critical Regional Dynamics and Growth Drivers Shaping Demand Preferences and Sustainability Adoption Across Americas EMEA and Asia Pacific

In the Americas, heightened consumer awareness and robust environmental advocacy have fueled demand for green cleaning products, prompting both established and emerging brands to expand distribution via retail giants and digital platforms. The region’s mature market exhibits strong receptivity to refillable packaging models and subscription-based offerings, driven by environmentally conscious urban populations seeking convenience and transparency.

Across Europe Middle East and Africa, stringent regulatory frameworks and comprehensive eco-labeling standards have placed sustainability at the forefront of product development. Consumers in EMEA increasingly rely on certifications such as the EU Ecolabel and national green seals when selecting cleaning solutions. This demand for verified environmental performance has catalyzed R&D investments and elevated transparency expectations among manufacturers and retailers.

In the Asia Pacific region, rapid urbanization and rising disposable incomes are accelerating adoption of plant-based and low-chemical cleaning alternatives. Countries such as Australia, Japan, and South Korea lead in premium segment growth, while emerging economies in Southeast Asia and India demonstrate strong potential for entry-level green offerings. E-commerce and mobile shopping channels play a critical role in reaching digitally savvy consumers, supporting localized product adaptations and agile marketing strategies.

This comprehensive research report examines key regions that drive the evolution of the Household Green Cleaning Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Innovation Initiatives of Leading Players Driving Competitive Advantage and Sustainability in the Green Cleaning Industry

Unilever has taken a pioneering role by introducing probiotic-infused cleaning sprays that harness beneficial bacteria to extend post-application efficacy. This focus on functional innovation combined with strategic influencer marketing underscores the company’s commitment to sensory appeal and long-term performance, reinforcing its leadership in the green hydration of homecare products.

Procter & Gamble’s elevated pricing strategy for advanced cleaning solutions illustrates how major players are leveraging premiumization to offset increased input costs. By prioritizing product enhancements and consumer education, P&G aims to capture higher margins while reinforcing brand prestige in a competitive environment.

Small and medium-sized enterprises are redefining market dynamics through targeted niche offerings, agile distribution, and rapid innovation cycles. These companies frequently collaborate with certification bodies to differentiate their portfolio based on ingredient transparency and sustainable packaging, compelling larger incumbents to adopt similar practices to maintain market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Household Green Cleaning Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AspenClean

- Attitude Living Inc.

- Better Life LLC

- Blueland Inc.

- Branch Basics LLC

- Clean Cult

- Dr. Bronner's Magic Soaps

- Earth Friendly Products LLC

- Ecover

- Greenshield Organic LLC

- Grove Collaborative Inc.

- J.R. Watkins & Company

- Meliora Cleaning Products LLC

- Method Products Inc.

- Puracy LLC

- Reckitt Benckiser Group PLC

- SC Johnson & Son Inc.

- Seventh Generation Inc.

- The Bon Ami Company

- The Caldrea Company

- The Clorox Company

- The Honest Company Inc.

- The Procter & Gamble Company

Empowering Industry Leaders with Actionable Strategic Recommendations to Drive Innovation Sustainability and Market Leadership in Green Cleaning

To solidify leadership in the green cleaning landscape, companies should prioritize end-to-end transparency by adopting clear labeling practices and third-party certifications. Such measures will build consumer trust and reduce skepticism around greenwashing claims.

Strategic partnerships with ingredient innovators and packaging specialists can accelerate the development of next-generation formulations and refill systems. Collaboration across the value chain will be instrumental in optimizing cost structures and enhancing product differentiation.

Investing in localized manufacturing and flexible supply-chain networks will mitigate tariff exposure and reduce logistics bottlenecks. This approach not only safeguards margin stability but also aligns with growing consumer preferences for locally sourced and responsibly produced goods.

Leveraging digital tools-ranging from AI-driven demand forecasting to personalized mobile applications-can enhance consumer engagement and refine inventory management. By harnessing real-time data insights, organizations can tailor promotions and streamline operations, delivering higher value to end users.

Detailing a Robust Mixed Methods Research Methodology Combining Primary Expert Interviews and Secondary Data Analysis for Rigorous Market Insights

The research methodology underpinning this report combines primary qualitative interviews with senior R&D executives, procurement managers, and sustainability specialists across leading cleaning manufacturers. These conversations provided nuanced insights into strategic priorities, product development roadmaps, and supply-chain adaptations.

Complementing primary insights, extensive secondary data analysis was conducted, encompassing peer-reviewed journals, regulatory filings, industry association publications, and reputable news sources. Data triangulation and cross-validation techniques were applied to ensure accuracy and reliability of findings.

Market segmentation and trend identification leveraged both quantitative shipment data and proprietary demand modeling. Rigorous data cleaning and consistency checks were performed to eliminate anomalies and ensure the robustness of insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Household Green Cleaning Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Household Green Cleaning Products Market, by Product Type

- Household Green Cleaning Products Market, by Ingredient Type

- Household Green Cleaning Products Market, by Form

- Household Green Cleaning Products Market, by Sales Channel

- Household Green Cleaning Products Market, by Region

- Household Green Cleaning Products Market, by Group

- Household Green Cleaning Products Market, by Country

- United States Household Green Cleaning Products Market

- China Household Green Cleaning Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings and Strategic Imperatives to Navigate the Future Landscape of Household Green Cleaning Markets with Confidence

The household green cleaning market stands at a pivotal juncture, driven by converging forces of regulatory evolution, consumer health consciousness, and sustainability imperatives. As tariffs reshape cost structures, the most resilient companies will be those that embrace transparency, agile supply-chain strategies, and continuous innovation.

By synthesizing segmentation dynamics, regional growth patterns, and competitive initiatives, this report equips stakeholders with a holistic understanding of market opportunities and risks. Forward-thinking organizations will leverage these insights to optimize their product portfolios, enhance consumer engagement, and secure long-term competitive advantage.

Ultimately, the path forward demands an integrated approach that balances performance, safety, and environmental responsibility. Leaders who navigate this complexity with strategic clarity will emerge as champions in the rapidly evolving green cleaning landscape.

Seize the Opportunity to Elevate Your Strategy with the In-Depth Market Research Report by Connecting with Ketan Rohom for Exclusive Purchase Access

To explore the full depth of market dynamics, competitive positioning, and strategic opportunities in the rapidly evolving household green cleaning sector, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage with an expert who can guide you through the detailed analyses, proprietary data insights, and tailored recommendations contained in the comprehensive market research report. By reaching out, you will gain exclusive access to actionable intelligence designed to inform your decision-making, refine your go-to-market strategies, and drive sustainable growth for your business.

- How big is the Household Green Cleaning Products Market?

- What is the Household Green Cleaning Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?