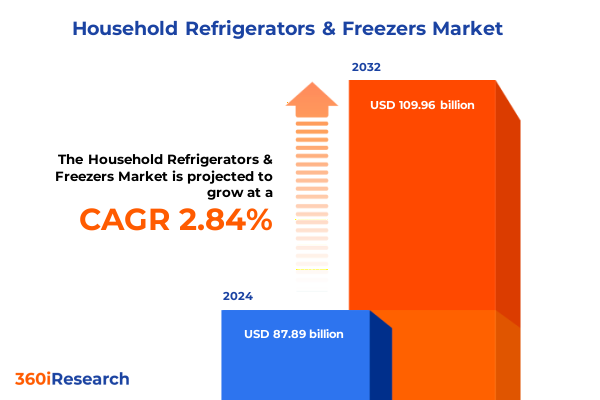

The Household Refrigerators & Freezers Market size was estimated at USD 89.86 billion in 2025 and expected to reach USD 91.88 billion in 2026, at a CAGR of 2.92% to reach USD 109.96 billion by 2032.

Understanding the Rapid Evolution of the Household Refrigerators and Freezers Market Amid Innovation, Sustainability, and Shifting Consumer Expectations

Understanding the landscape of household refrigerators and freezers is essential for industry stakeholders navigating an era of rapid innovation, evolving consumer priorities, and shifting regulatory environments. The introduction of advanced cooling technologies, coupled with heightened attention to energy efficiency and environmental sustainability, has redefined product expectations and competitive benchmarks. As consumer lifestyles become increasingly oriented toward convenience, smart connectivity, and health-conscious design, manufacturers and retailers must adapt strategies to align with new usage patterns and stringent regulatory requirements.

In this context, the competitive terrain for refrigerators and freezers is marked by intensifying investment in digital features such as Wi-Fi integration, predictive diagnostics, and customizable settings that optimize energy consumption. At the same time, government mandates on energy performance-driven by both domestic policies and international agreements-are accelerating the retirement of legacy models and prompting supply-chain realignments. These converging forces set the stage for a market that demands agility in product development, responsiveness to consumer insights, and proactive engagement with emerging regulations. This introduction lays the groundwork for a deeper exploration of transformative shifts, tariff dynamics, segmentation strategies, and actionable imperatives essential to thriving in this evolving domain.

Unveiling the Pivotal Technological, Consumer Behavior, and Sustainability Shifts Reshaping the Appliance Sector and Redefining Market Dynamics

The household refrigeration sector is experiencing a paradigm shift fueled by the convergence of digital technology, evolving consumer priorities, and sustainability imperatives. Manufacturers are embedding artificial intelligence in cooling systems to predict maintenance needs and regulate temperature zones, thereby enhancing operational efficiency and extending product lifespan. Meanwhile, consumers are gravitating toward models that offer bespoke features-ranging from customizable humidity controls to integrated food-waste management solutions-reflecting a broader trend toward personalization in home appliances.

Concurrently, environmental regulations are driving the adoption of low-global-warming-potential refrigerants and mandating stricter energy-consumption targets. This regulatory momentum has catalyzed partnerships between appliance makers, refrigerant developers, and energy utilities to accelerate research and commercialization of next-generation refrigerants and compressor technologies. In addition, supply-chain resilience has emerged as a critical focus, with companies diversifying sourcing strategies to mitigate geopolitical risks and ensure continuity of raw-material supply. Together, these technological, regulatory, and consumer behavior shifts are reshaping the competitive landscape, creating both challenges and unprecedented opportunities for differentiation.

Assessing the Far Reaching Consequences of Recent United States Tariff Actions on Household Refrigeration and Freezer Supply Chains and Pricing Pressures

In 2025, the United States significantly expanded Section 232 tariffs to include a range of household appliances, imposing duties on the steel and aluminum content of imported refrigerators, freezer-units, and related devices. Beginning June 23, 2025, combined refrigerator-freezers, chest and upright freezers, dryers, and cooking appliances were subject to a 50% derivative tariff assessed exclusively on the metal content of each unit, marking a notable escalation under the national-security authority of Section 232.

The sudden increase in input costs has been passed directly through distribution channels, with dealers reporting average retail price hikes between 5% and 10% shortly after implementation. Appliance Loft disclosed that units arriving post-tariff were already priced higher than pre-tariff inventory, while major manufacturers such as LG and BSH Home Appliances confirmed targeted price adjustments, safeguarding margin profiles amid rising steel prices.

On the legal front, the U.S. Court of International Trade invalidated broad IEEPA-based tariff orders in late May 2025, ruling that the executive branch exceeded statutory authority, though Section 232 duties remain in force pending appeal. This legal uncertainty continues to weigh on importers and distributors, complicating cost forecasts and inventory planning.

These tariff measures, coupled with broader protectionist policies that have lifted average effective duties to the highest level since 1910, are exerting upward pressure on consumer prices and prompting supply-chain reconfigurations. Companies are revisiting sourcing strategies, exploring localized production, and accelerating investments in alternative materials and process optimizations to mitigate the impact of sustained trade barriers.

Unlocking Profound Consumer and Product Segmentation Dynamics Illuminates Opportunities Within the Household Refrigerators and Freezers Market

Consumer and product segmentation analysis reveals nuanced preferences and purchasing behavior across the refrigeration market. When examining appliance type, traditional single-door refrigerators remain prevalent in budget-conscious segments, whereas the growing demand for convenience and upscale design is driving interest in French-door and side-by-side configurations. Chest freezers continue to serve bulk-storage needs, while upright freezers gain traction among urban consumers seeking space-efficient solutions. Technology preferences are defined by the direct-cool segment’s cost-effective appeal, contrasted with frost-free models that align with low-maintenance expectations and health-focused lifestyles.

Capacity considerations further distinguish consumer groups: compact units under 200 liters find a niche in ancillary or secondary applications such as offices and small apartments, whereas mid-range models between 200 and 600 liters strike a balance between family functionality and energy performance. High-capacity units exceeding 600 liters serve large households and specialized consumer segments seeking integrated food-storage management. Compressor type also shapes decision criteria; inverter compressors are increasingly favored for their superior energy efficiency and reduced noise profile, while single-compressor variants remain standard among entry-level models. Dual-compressor systems command a premium, offering independent freezer and refrigerator temperature control for food-quality preservation.

Distribution channels interplay with these segments, as offline retailers such as hypermarkets and specialty stores leverage experiential showrooms to demonstrate advanced features, while e-commerce platforms and manufacturer websites capitalize on digital marketing and data-driven consumer targeting. This multi-channel dynamic underscores the need for omnichannel strategies that seamlessly integrate in-store experiences with online configurators, virtual product tours, and data-backed after-sales support.

This comprehensive research report categorizes the Household Refrigerators & Freezers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Compressor Type

- Technology

- Capacity

- Distribution Channel

- Appliance Type

Examining Divergent Regional Patterns in Demand, Innovation, and Trade for Household Refrigerators and Freezers Across Major Global Markets

Regional market characteristics expose distinct growth drivers and strategic considerations. In the Americas, consumer demand is underpinned by a strong inclination toward large-capacity French-door refrigerators and smart-enabled freezers, supported by high disposable incomes and expanding home-remodeling trends. Government incentives for energy-efficient appliances, coupled with strict regulatory standards on refrigerants, further stimulate product upgrades and replacement cycles.

In Europe, Middle East, and Africa, sustainability regulations and urban living patterns shape segment evolution. European consumers increasingly prioritize eco-friendly designs and low-global-warming-potential refrigerants, while Middle Eastern markets value high-throughput cooling performance to accommodate bulk food storage in hot climates. In Africa, rising urbanization and modern retail expansion present greenfield opportunities, with demand emerging for compact, energy-efficient units that address intermittent electrical supply.

Across Asia-Pacific, rapid urbanization and rising middle-class aspirations fuel growth in advanced refrigeration segments, particularly inverter-compressor and frost-free technologies. Localization of manufacturing in Southeast Asia and China has created supply-chain hubs, enabling price competitiveness for both domestic integrated brands and export-oriented producers. Regional trade agreements and tariff harmonization efforts are further reducing barriers, enabling faster product launches and tailored innovations to meet diverse climate and cultural preferences.

This comprehensive research report examines key regions that drive the evolution of the Household Refrigerators & Freezers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Moves, Innovation Portfolios, and Collaborative Initiatives Among Leading Players in the Refrigerators and Freezers Industry

Leading companies in the refrigeration arena are sharpening competitive edges through targeted innovation and strategic collaborations. Global giants have increased R&D investment in IoT-enabled controls that support predictive maintenance and energy management platforms. Partnerships with software providers and data analytics firms are facilitating the rollout of subscription-based maintenance services and remote performance monitoring.

At the same time, differentiated product portfolios are emerging through acquisitions and joint ventures. Certain manufacturers have formed alliances with compressor specialists to co-develop variable-speed systems that lower energy consumption by up to 30 percent. Others are engaging with component suppliers to secure long-term access to eco-friendly refrigerants, ensuring compliance with evolving environmental mandates.

To bolster distribution, key players are embracing omnichannel retail strategies. Brick-and-mortar presences are being enhanced with digital showrooms and interactive displays, while direct-to-consumer channels are leveraged to collect consumer usage data, enabling rapid iteration of product features. These integrated approaches not only expand market reach but also reinforce brand loyalty through personalized customer experiences and consistent after-sales engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Household Refrigerators & Freezers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arçelik A.Ş.

- Aucma Co. Ltd.

- Blue Star Limited

- BSH Home Appliances Group

- Craig Industries, Inc.

- Danby Products Ltd.

- Electrolux AB

- Fisher & Paykel Appliances Holdings Limited

- Godrej & Boyce Manufacturing Company Limited

- Haier Group Corporation

- Hisense Group Co., Ltd.

- Hitachi, Ltd.

- Honeywell International Inc.

- LG Corporation

- Liebherr Hausgeräte GmbH

- Midea Group Co., Ltd.

- Miele & Cie. KG.

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Siemens AG

- Sub-Zero Group, Inc.

- Summit Appliance, LLC

- Viking Range, LLC by Middleby Corporation

- Whirlpool Corporation

Actionable Strategic Imperatives for Industry Leaders to Navigate Tariff Challenges, Accelerate Innovation, and Enhance Competitive Advantage

Industry leaders must adopt multifaceted strategies to navigate ongoing tariff pressures and capitalize on emerging consumer trends. First, supply-chain resilience should be strengthened by diversifying raw-material sources and exploring nearshoring opportunities, reducing reliance on high‐tariff imports. Next, accelerated product innovation must align with consumer demand for energyefficient technologies and smart integrations, providing clear value propositions that justify premium pricing.

Leveraging omnichannel marketing and sales models will enhance customer engagement, with datadriven personalization enabling more effective targeting and retention. Investing in digital platforms for virtual demonstrations, predictive maintenance services, and mobile‐enabled user interfaces can differentiate offerings and deepen consumer relationships. Concurrently, forging partnerships with energy utilities and government agencies to codevelop rebate programs and eco-label certifications will amplify market adoption of sustainable models.

Finally, ongoing scenario planning and active engagement with trade policymakers are critical to anticipate regulatory shifts. By establishing crossfunctional task forces that monitor legal developments, companies can adapt procurement and pricing strategies proactively, mitigating risks while capturing opportunities presented by shifting trade landscapes.

Delving into Rigorous Primary and Secondary Research Methodologies That Ensure Robust Insights and High Quality Validation for Market Analysis

Our research methodology combines primary and secondary approaches designed to yield robust, validated insights. Primary research involved structured interviews with senior executives across major appliance manufacturers, distributors, and retailers, complemented by qualitative discussions with industry analysts and subject-matter experts. In parallel, an extensive consumer survey was executed to capture end-user preferences regarding technology adoption, energy-efficiency awareness, and channel usage behaviors.

Secondary research drew upon a comprehensive review of publicly available sources, including government tariff notices, regulatory filings, patent databases, technical white papers, and industry trade publications. Additional analysis of corporate financial disclosures and investor presentations provided context on capital allocation toward R&D, manufacturing footprints, and regional expansion plans.

Data triangulation techniques were employed to cross-validate findings across multiple sources, ensuring consistency and reliability. Rigorous data quality checks, including outlier analysis and peer review by research directors, guarantee that the insights reflect real-world dynamics. This methodology supports an authoritative assessment of market developments and underpins the strategic recommendations articulated herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Household Refrigerators & Freezers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Household Refrigerators & Freezers Market, by Compressor Type

- Household Refrigerators & Freezers Market, by Technology

- Household Refrigerators & Freezers Market, by Capacity

- Household Refrigerators & Freezers Market, by Distribution Channel

- Household Refrigerators & Freezers Market, by Appliance Type

- Household Refrigerators & Freezers Market, by Region

- Household Refrigerators & Freezers Market, by Group

- Household Refrigerators & Freezers Market, by Country

- United States Household Refrigerators & Freezers Market

- China Household Refrigerators & Freezers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on Market Evolution, Tariff Impacts, and Strategic Imperatives Guiding Future Growth Trajectories for Household Refrigerators and Freezers

The collective findings underscore a market in transition, driven by technological innovation, evolving consumer expectations, and regulatory momentum toward sustainability. Tariff escalations in 2025 have introduced new cost structures that are reshaping supply-chain strategies and influencing pricing dynamics. In response, segmentation analysis highlights clear opportunities across appliance types, technologies, and capacity tiers, while regional insights reveal differentiated adoption patterns and growth catalysts.

Leading companies are responding with integrated innovation roadmaps, strategic partnerships, and omnichannel distribution frameworks that enhance agility and customer engagement. The imperative for resilient procurement, data-driven personalization, and proactive policy engagement has never been more critical. As the market continues to evolve, stakeholders that align technology development with consumer priorities, regulatory requirements, and global trade conditions will unlock the greatest competitive advantages and drive long-term value creation.

Seize the Opportunity to Gain In-Depth Market Intelligence and Strategic Guidance for Refrigeration Industry Success by Connecting with Ketan Rohom

Leverage exclusive insights and comprehensive analysis to stay ahead in an increasingly complex refrigeration market. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, and secure the definitive report that arms you with strategic intelligence tailored to your business needs. Elevate your decision-making process with data-driven perspectives on technology trends, tariff impacts, and competitive benchmarks. Don’t miss the opportunity to transform market challenges into growth pathways-connect with Ketan Rohom today and unlock the full potential of your refrigeration and freezer product strategies.

- How big is the Household Refrigerators & Freezers Market?

- What is the Household Refrigerators & Freezers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?