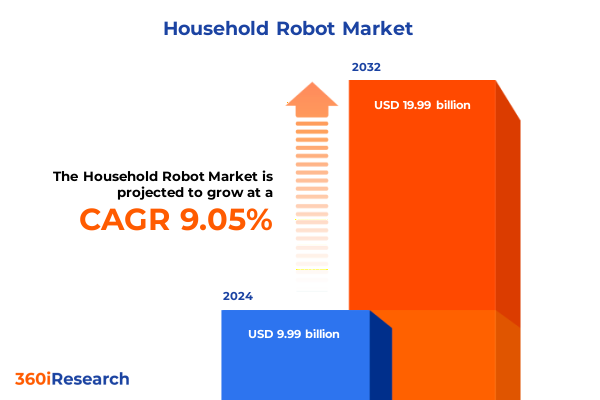

The Household Robot Market size was estimated at USD 10.83 billion in 2025 and expected to reach USD 11.76 billion in 2026, at a CAGR of 9.15% to reach USD 19.99 billion by 2032.

Revolutionary Fusion of Autonomy Intelligence and Consumer Expectations Transforming Domestic Chore Automation

The household robotics landscape is undergoing a profound transformation, driven by rapidly advancing autonomous technologies and shifting consumer expectations. Modern consumers seek more than mere convenience; they demand intelligent systems capable of adapting to unique home environments and seamlessly integrating with existing smart ecosystems. Consequently, manufacturers and technology providers are accelerating their efforts to embed artificial intelligence, machine learning, and sophisticated sensor arrays into everyday devices. This fusion of autonomy and usability is redefining mundane chores-such as vacuuming, mopping, lawn mowing, and window cleaning-into dynamic interactions that enhance quality of life.

Moreover, this convergence of robotics and connectivity is supported by robust interplay among hardware, software, and cloud platforms. As a result, household robots are no longer isolated devices but integral nodes within the broader Internet of Things. They collaborate with voice-activated assistants, smart thermostats, security systems, and mobile applications to deliver context-aware and user-friendly experiences. In turn, stakeholders across manufacturing, retail, and service sectors are recalibrating their strategies to harness these synergies and meet the accelerating demand for personalized and intelligent home automation.

Deep Technological, Connectivity, and Sustainability Shifts Are Redefining How Intelligent Domestic Robots Deliver Value

In recent years, multiple transformative shifts have reshaped how household robots are conceived, designed, and deployed. The first shift emerges from the relentless advancement of artificial intelligence models that enable more precise navigation and obstacle detection. These intelligent navigation frameworks leverage simultaneous localization and mapping capabilities, granting robots an unprecedented level of spatial awareness within complex home layouts. Consequently, performance metrics such as cleaning efficiency and error reduction have improved dramatically.

Simultaneously, the advent of 5G and enhanced Wi-Fi standards has accelerated the second shift toward ubiquitous connectivity. Household robots can now exchange data with cloud-based analytics engines in real time, receiving over-the-air updates, diagnostic feedback, and performance optimizations. This continuous pipeline of remote enhancements prolongs device lifecycles and fosters a new paradigm of service-based revenue models.

Finally, evolving consumer preferences are catalyzing a third transformation centered on sustainability and eco-conscious design. Manufacturers are responding by integrating modular components to facilitate repairability and minimize electronic waste. At the same time, power-efficient actuators and sensors reduce energy consumption, aligning product roadmaps with global environmental objectives. These converging shifts underscore the emergence of a consumer-centric era in household robotics, where adaptability, connectivity, and sustainability coalesce.

Evolving Tariff Regulations Are Reshaping Supply Chain Resilience and Domestic Sourcing Strategies for Home Robot Manufacturers

United States tariffs introduced in early 2025 have contributed a new dimension of complexity to the household robot supply chain. The phased imposition of duties on imported hardware components, including cameras, actuators, and specialized sensors, has elevated the cost of critical subsystems. As a result, original equipment manufacturers have faced pressure to reevaluate sourcing strategies, accelerate domestic supplier partnerships, or explore alternative component technologies. This trend is particularly evident in the actuator and vision sensor segments, where heightened duties have spurred intensified negotiation with domestic suppliers to mitigate margin erosion.

In parallel, software licensing and cloud-service tariffs have influenced the structuring of service agreements, prompting providers to reconfigure fee schedules to accommodate the cost uptick. Consequently, companies are increasingly favoring vertically integrated platforms, bundling hardware and software within unified procurement frameworks to shield end customers from abrupt price adjustments. Moreover, the tariff landscape has catalyzed innovation in component design, with research teams exploring more cost-effective power systems and refined motion sensors that rely on fewer imported parts.

Collectively, these measures underscore a strategic pivot in the United States household robot market. Supply chain resilience, domestic manufacturing partnerships, and adaptable design architectures have become critical levers for maintaining competitiveness amid an evolving tariff environment.

Granular Insights Reveal How Component Architecture, Product Types, Connectivity, End Users, and Distribution Channels Define Competitive Dynamics

Component analysis reveals that hardware remains at the core of household robot differentiation, with advanced actuators and high-resolution cameras commanding particular attention. Yet, software continues to unlock new frontiers in user experience, as navigation modules based on SLAM algorithms and robust speech recognition engines transform robots from mere endpoints into interactive companions. Delving deeper, sensor systems that encompass motion, proximity, and vision capabilities serve as critical enablers for precise movement and obstacle avoidance, while power systems determine endurance and operational reliability.

When examining product types, vacuum cleaning robots maintain widespread consumer adoption for their established performance, but emerging categories such as lawn mowing and pool cleaning robots are expanding market boundaries. Mopping robots that integrate liquid management and UV-based sterilization are gaining traction among health-oriented households, while window cleaning variants are leveraging advanced suction and motion control to deliver streak-free results on vertical surfaces.

Connectivity preferences also shape user engagement models, with Wi-Fi solutions dominating urban deployments due to ubiquitous home broadband, whereas Bluetooth and Zigbee find niche applications in smart-home integrations. Cellular-connected units cater to remote property management scenarios, particularly for second-home maintenance. End-user segmentation highlights divergent requirements: single-family homeowners prioritize multi-functional robots with extensive coverage, whereas apartment dwellers favor compact, agile units engineered for tight spaces. Distribution channels vary accordingly, as direct sales and manufacturer websites offer customization options, while hypermarkets and online retailers facilitate widespread accessibility across consumer segments.

This comprehensive research report categorizes the Household Robot market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Product Type

- Connectivity

- End User

- Distribution Channel

Diverse Regional Dynamics from the Americas to Asia-Pacific Drive Distinct Household Robot Adoption Patterns and Innovation Priorities

In the Americas, heightened interest in smart home ecosystems is fueling adoption, particularly within suburban and affluent urban communities. Early adopters in the United States and Canada are gravitating toward multifunctional robots that integrate cleaning, security, and remote monitoring capabilities. Meanwhile, research hubs in Brazil and Mexico are fostering local startups that specialize in cost-effective architectures tailored to regional infrastructure constraints.

Across Europe, Middle East & Africa, diverse regulatory frameworks and varying household densities present unique opportunities and challenges. Northern European markets emphasize eco-friendly power systems and repairable hardware, aligning with stringent environmental directives. In contrast, Middle Eastern regions showcase demand for high-durability robots capable of operating in extreme temperature conditions, while African urban centers seek affordable modular designs supported by local service initiatives.

The Asia-Pacific corridor represents the most dynamic frontier, driven by aggressive technology investments in China, Japan, South Korea, and emerging Southeast Asian markets. Manufacturers in these regions are advancing AI-powered platforms with advanced SLAM navigation and real-time voice interaction, aiming to capture both domestic and export markets. Additionally, regional supply chain clusters in East Asia continue to influence global component pricing, underscoring the strategic interplay between production hubs and end-user demand.

This comprehensive research report examines key regions that drive the evolution of the Household Robot market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Spotlighting Collaborative Alliances, R&D Acceleration, and Service-Integrated Business Models Shaping the Market

The competitive landscape features a mix of established electronics giants and agile robotics specialists. Industry frontrunners leverage economies of scale to integrate cutting-edge sensors and processors into intelligent cleaning platforms, while startups differentiate through niche applications and bespoke service models. Corporate alliances with cloud and AI service providers are becoming more commonplace, facilitating the rollout of advanced voice recognition, gesture interfaces, and context-aware automation.

Technology leaders are focusing R&D investments on deep learning frameworks that enhance obstacle prediction and adaptive behavior. At the same time, key players are scaling production capacities by forging strategic partnerships with contract manufacturers in low-cost regions to balance quality and affordability. In addition, collaborations between robotics firms and home service providers are gaining momentum, enabling subscription-based maintenance, performance analytics, and remote diagnostics.

This evolving ecosystem underscores the importance of strategic agility. Firms that can synthesize hardware innovation, software intelligence, and service excellence will be best positioned to capture emerging segments, from health-centric disinfection robots to modular platforms that interface with broader smart home networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Household Robot market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfred Kärcher SE & Co. KG

- Amano Corporation

- ASUSTeK Computer Inc.

- Avidbots Corp.

- Beijing Roborock Technology Co., Ltd.

- BISSELL Inc.

- Bobsweep Inc.

- Cleanfix Reinigungssysteme AG

- CYBERDYNE Inc.

- Diversey, Inc. by Solenis LLC

- Dyson Limited

- Ecovacs Robotics Co., Ltd.

- Eureka Forbes Limited

- Friendly Robots Company

- Haier Group Corporation

- Honda Motor Co., Ltd.

- iRobot Corporation

- LEGO System A/S

- LG Corporation

- lubluelu

- Makita Corporation

- Maytronics Ltd.

- Miele

- Miko Robot

- Panasonic Holdings Corporation

- Peppermint Robotics

- Preferred Networks, Inc.

Strategic Imperatives for Manufacturers Emphasizing Modular Innovation, Domestic Partnerships, and Platform-Driven Service Models

To thrive in this rapidly evolving environment, industry leaders must adopt a multifaceted strategic approach. First, investing in modular design architectures will enable quicker iteration cycles and facilitate component upgrades as technology evolves. This design philosophy reduces time-to-market for new features and supports circular economy principles through component reuse and repairability. Next, forging strategic alliances with domestic component suppliers can mitigate tariff pressures and strengthen supply chain resilience, ensuring consistent production even amid fluctuating trade regulations.

Moreover, embracing a platform-based software strategy that centralizes data analytics and remote update capabilities will differentiate offerings through continuous performance enhancements. By integrating advanced SLAM navigation and speech recognition services, companies can elevate the end-user experience, foster customer loyalty, and unlock recurring revenue streams through subscription-based feature packs. Parallel to these initiatives, targeted collaborations with home service providers can expand aftermarket support and deliver comprehensive maintenance bundles, reinforcing long-term customer engagement.

Finally, a heightened focus on user education and community building-through digital tutorials, dedicated forums, and interactive apps-will empower consumers to maximize device utility and provide valuable feedback loops for iterative product improvements. Together, these actionable measures will position leaders to navigate market complexities and capitalize on the accelerating demand for intelligent household robotics.

Comprehensive Research Framework Integrating Primary Stakeholder Interviews and Secondary Benchmarking to Ensure Rigorous Market Insights

This report is grounded in a rigorous research framework that integrates both primary and secondary data sources. The primary phase included in-depth interviews with key industry stakeholders, including robotics engineers, supply chain executives, and end-user focus groups across diverse household segments. These qualitative insights were complemented by surveys conducted with technology adopters to capture real-world usage patterns, satisfaction drivers, and unmet needs.

On the secondary front, the analysis leveraged white papers, patent filings, regulatory documents, and academic journals to map the technological trajectory of sensor integration, autonomous navigation algorithms, and energy management systems. Competitive benchmarking exercises were undertaken to evaluate product portfolios, distribution strategies, and service offerings of leading players. In addition, a cross-validation process triangulated findings by reconciling discrepancies between qualitative feedback and documented industry benchmarks.

Throughout the research process, methodological rigor was maintained by ensuring representative geographic sampling, transparent data collection protocols, and systematic analysis frameworks. This holistic approach guarantees that the insights presented are both actionable and reflective of the current state of the household robot market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Household Robot market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Household Robot Market, by Component

- Household Robot Market, by Product Type

- Household Robot Market, by Connectivity

- Household Robot Market, by End User

- Household Robot Market, by Distribution Channel

- Household Robot Market, by Region

- Household Robot Market, by Group

- Household Robot Market, by Country

- United States Household Robot Market

- China Household Robot Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Critical Conclusion Emphasizing the Synergy of Hardware, Software, Connectivity, and Supply Chain Agility Shaping the Future of Domestic Robotics

In an era defined by rapid technological convergence and changing consumer lifestyles, household robots have emerged as pivotal enablers of home automation. The interplay between advanced hardware components and intelligent software platforms continues to elevate operational capabilities, while connectivity innovations facilitate seamless integration into broader smart home ecosystems. At the same time, evolving tariff landscapes underscore the need for supply chain agility and domestic manufacturing partnerships to maintain competitive cost structures.

Looking ahead, the capacity to balance modular design, continuous software enhancement, and robust service ecosystems will determine market leadership. Organizations that successfully navigate these dimensions will capture opportunities in established cleaning segments and capitalize on emerging demand for specialized applications, including sterilization, surveillance, and multi-tasking platforms. Ultimately, the household robot sector is poised for sustained evolution, driven by consumer expectations for personalized, autonomous, and eco-friendly home solutions.

Secure a Personalized Briefing with the Associate Director of Sales & Marketing to Propel Your Household Robot Strategy and Drive Informed Growth

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure this comprehensive household robot market research report. This personalized consultation offers you an in-depth walkthrough of the key findings, segmentation insights, and strategic recommendations crafted for industry decision-makers. By partnering with Ketan Rohom, you gain exclusive access to expert perspectives on component-level analysis, product type evolution, connectivity trends, end-user behavior, and distribution channel dynamics. Don’t miss the opportunity to leverage these actionable insights to optimize your market approach, shape your innovation pipeline, and stay ahead in the rapidly evolving household robotics landscape. Contact Ketan today to arrange your customized briefing and take the first step toward informed strategic growth.

- How big is the Household Robot Market?

- What is the Household Robot Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?