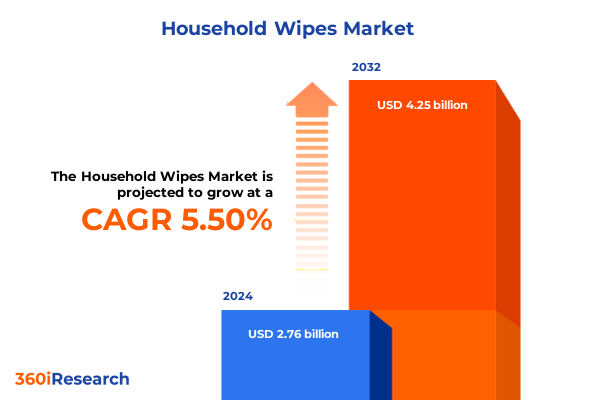

The Household Wipes Market size was estimated at USD 2.89 billion in 2025 and expected to reach USD 3.02 billion in 2026, at a CAGR of 5.64% to reach USD 4.25 billion by 2032.

Comprehensive Overview of the Household Wipes Market and Its Strategic Importance in Modern Consumer Hygiene and Cleaning Practices Across Channels

Household wipes have transformed from a simple convenience item into a critical component of modern consumer hygiene and cleaning routines. Their ability to deliver rapid, on-the-go sanitation has fuelled widespread adoption across homes, healthcare facilities, hospitality venues, and retail environments. As lifestyles have accelerated and health awareness has intensified, these versatile products have become synonymous with efficiency and peace of mind, rendering them indispensable in daily life. The robust demand trajectory observed in recent years underscores the importance of understanding the multifaceted factors that drive this dynamic market segment.

Against a backdrop of evolving consumer preferences and technological advancements, manufacturers and distributors are continuously innovating to differentiate their offerings. From enhancing formulation efficacy and skin-friendly additives to integrating eco-friendly materials and smart packaging features, the competitive landscape reflects a relentless pursuit of excellence. This report’s introduction establishes the foundation for a comprehensive exploration of market drivers, challenges, and strategic imperatives that define the household wipes sector.

The ensuing sections shed light on transformative shifts, regulatory influences, segmentation nuances, and regional variations that collectively shape market behavior. Through meticulous research and analysis, this summary distills critical insights designed to inform investment decisions, product development strategies, and go-to-market approaches. By framing the current environment and projecting the implications of emerging trends, the introduction primes decision-makers to grasp the core dynamics at play.

Ultimately, this overview lays the groundwork for actionable intelligence, equipping stakeholders with the clarity needed to navigate market complexities and capitalize on growth opportunities. By setting the stage with a holistic context, readers can confidently progress through the detailed examinations that follow.

Identifying Pivotal Transformations Shaping the Household Wipes Market Including Sustainability, Digital Commerce Evolution, and Consumer Health Priorities

The household wipes market landscape is undergoing profound change as sustainability, digital commerce, and health-consciousness converge to redefine norms. Increasing regulatory scrutiny and environmental advocacy are compelling manufacturers to explore biodegradable fibers and recyclable packaging solutions. Consequently, research and development initiatives are prioritizing plant-based substrates, low-impact production methods, and closed-loop recycling partnerships. This shift underscores a collective commitment to minimizing ecological footprints while maintaining high performance standards, signaling a watershed moment for product innovation.

Simultaneously, the rapid ascent of e-commerce platforms has disrupted traditional retail channels. Direct-to-consumer models and subscription services are reshaping purchasing behaviors, driving brands to invest in omnichannel strategies that integrate personalized marketing, digital loyalty programs, and real-time inventory management. As a result, companies must navigate complex distribution ecosystems, balancing brick-and-mortar presence with the agility required to capture online market share.

Additionally, consumer health priorities have intensified following global public health events, elevating expectations around disinfectant efficacy and skin compatibility. Formulation breakthroughs-such as incorporating antiviral agents and hypoallergenic preservatives-are becoming critical differentiators. Meanwhile, packaging innovations like resealable pouches and clean-touch technologies enhance user convenience and perceived safety, further influencing adoption patterns.

Taken together, these transformative shifts create a dynamic marketplace in which continuous adaptation is imperative. Understanding how these forces interplay will enable stakeholders to anticipate future requirements, tailor offerings, and sustain competitive advantage in an environment characterized by rapid evolution.

Assessing the Comprehensive Implications of 2025 United States Tariffs on Raw Materials and Finished Goods within the Household Wipes Supply Chain

The introduction of new tariff measures by the United States in early 2025 has exerted significant pressure on the household wipes supply chain, prompting a comprehensive reassessment of sourcing and cost structures. By imposing higher duties on a range of imported raw materials-particularly nonwoven fabrics derived from polyester and polypropylene-or finished consumer packs, these policies have accelerated cost pass-through considerations across the value chain. Suppliers are now evaluating alternative manufacturing hubs and negotiating revised contractual terms to mitigate margin erosion and maintain price competitiveness.

In response, several leading producers have diversified their supplier base, shifting procurement toward regions with preferential trade agreements or domestic capacity. This strategic pivot aims to buffer against volatility while preserving product quality and consistency. At the same time, some manufacturers have absorbed a portion of the additional duty burden to prevent substantial retail price increases that could dampen demand elasticity among cost-sensitive consumer segments.

Furthermore, the tariff environment is catalyzing local production investments, as firms seek to enhance vertical integration and reduce exposure to cross-border duties. Capital expenditures are being channeled into expanding domestic nonwoven fabrication facilities, bolstered by policymakers’ incentives to strengthen localized manufacturing capabilities. Over the long term, these adaptations may yield more resilient supply networks, enabling quicker responsiveness to demand fluctuations.

While the immediate impact of the tariff changes has been an uptick in production costs and renegotiations across procurement and distribution agreements, the evolving landscape underscores the strategic imperative for supply chain agility and diversified sourcing. Stakeholders must continue to monitor policy developments and refine contingency plans to safeguard profitability in an increasingly complex trade environment.

Unlocking Segmentation Perspectives Revealing How Distribution Channels, Product Types, Packaging Modes, End Users, and Material Choices Drive Market Dynamics

Insights derived from segmentation analysis reveal nuanced preferences that inform targeted go-to-market strategies. Distribution channels exhibit distinct performance dynamics: convenience retailers serve consumers seeking rapid replenishment and single-use formats, while drugstore environments emphasize specialty offerings, including sensitive-skin formulations and cosmetic wipes infused with premium ingredients. E-commerce, however, is driving bulk purchasing trends and subscription-based consumption, enabling brands to leverage tiered pricing and personalized bundles. Meanwhile, supermarkets and hypermarkets maintain their position as high-volume corridors, where in-store promotions and private label assortments influence large-scale household purchases.

Product type segmentation further underscores differential demand patterns. Baby wipes continue to represent a stalwart category, underpinned by steady birth rates and parental preference for gentle, dermatologically tested solutions. Cosmetic wipes reflect the growing intersection of skincare and convenience, propelled by influencer-driven beauty routines and multifunctional formulations. Disinfecting wipes, having attained ubiquitous use during heightened health awareness periods, are now adapting toward broader spectrum antimicrobial claims and eco-conscious residue profiles. Surface cleaning wipes complement these categories by targeting hard surfaces and specialized applications, from kitchen counters to electronic screens.

Packaging type preferences convey evolving consumer expectations. Buckets and canisters offer institutional durability suited to commercial and high-traffic environments, while refill and resealable packs cater to sustainability-minded households by reducing plastic waste. Tube packaging is carving out a niche among cosmetic and personal care lines, valued for its portability and measured dispensing. Each packaging format aligns with distinct usage occasions and brand positioning imperatives.

End-user segmentation highlights divergent requirements between residential consumers, who prioritize convenience and affordability, and commercial operators in healthcare and hospitality settings, where regulatory compliance, large-scale consumption, and traceability are paramount. Material composition analysis indicates that blends offer a compelling balance of cost efficiency and functional performance, whereas monomaterial options like polyester, polypropylene, and viscose appeal to applications demanding specific absorbency or softness characteristics. These segmentation insights collectively illuminate paths for tailored product development and channel-specific engagement.

This comprehensive research report categorizes the Household Wipes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Material Type

- End User

- Distribution Channel

Examining Regional Differentiators Influencing Household Wipes Adoption Across Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics in the Americas underscore the maturity of the household wipes sector, particularly in the United States where consumer awareness of hygiene remains elevated. Retailers in North America have refined merchandising strategies to highlight value-added benefits such as antimicrobial efficacy and eco-certified practices. Latin American markets are experiencing incremental growth driven by rising urbanization, expanding modern trade networks, and increasing penetration of branded offerings, though price sensitivity continues to influence adoption rates.

Across Europe, the Middle East, and Africa, a tapestry of regulatory frameworks and consumer attitudes shapes market performance. Western European countries are championing stringent environmental standards, prompting brands to pursue compostable substrates and reduced chemical footprints. Regulatory developments in the Middle East have spurred demand for halal-certified wipes, while the African segment is witnessing nascent growth facilitated by improved distribution infrastructure and urban population expansion. Collectively, these regional nuances require stakeholders to customize formulations and value propositions in accordance with local expectations and compliance requirements.

In the Asia-Pacific region, the household wipes market is characterized by rapid expansion fueled by rising disposable incomes, increasing health awareness, and accelerating adoption of modern retail formats. China leads the growth trajectory, with manufacturers investing heavily in innovation clusters and digital marketing campaigns. Southeast Asian markets demonstrate varied consumption patterns, where premium segments are gaining traction alongside value offerings tailored for high-volume family usage. India’s market is emerging as a significant frontier, propelled by rural outreach programs and e-commerce penetration.

Understanding these geographical differentiators enables market participants to refine their strategic priorities, calibrate supply chain logistics, and optimize product portfolios for each region’s unique demand drivers. By recognizing local idiosyncrasies, companies can secure sustainable growth and reinforce competitive positioning across global markets.

This comprehensive research report examines key regions that drive the evolution of the Household Wipes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements of Leading Players Defining Competitive Trajectories and Innovation Frontiers in the Household Wipes Arena

In the competitive arena, leading consumer products conglomerates are spearheading innovation through strategic mergers, technology investments, and cross-industry partnerships. Major players such as Procter & Gamble have intensified their focus on advanced formulations and premium branding, launching specialized wipes lines that leverage unique active ingredients and patented delivery systems. Similarly, Kimberly-Clark has reinforced its market stronghold by expanding capacity in key regions and streamlining its product portfolio to emphasize high-margin segments.

New entrants and niche specialists are also making noteworthy inroads by targeting underserved subcategories. Agile companies capitalizing on clean-label trends and small-batch production emphasize transparency in material sourcing and eco-certified credentials. These emerging brands often harness e-commerce platforms and direct feedback loops to iterate product features rapidly, challenging traditional incumbents to accelerate their innovation cycles. Strategic alliances with textile manufacturers and chemical suppliers are becoming more prevalent, ensuring access to next-generation nonwoven substrates and proprietary disinfectant compounds.

Distribution partnerships play a pivotal role in market outreach. Several established firms have secured exclusive agreements with major retail chains to develop co-branded offerings and tailor assortment strategies. Simultaneously, digital-first companies are forging alliances with logistics providers to optimize last-mile delivery, ensuring subscription-based replenishment services meet rigorous performance benchmarks. This convergence of supply chain excellence and brand differentiation is setting new performance standards for the industry.

By analyzing these company-level strategies-ranging from capacity expansion and portfolio optimization to collaboration with upstream innovators-industry stakeholders can identify potential opportunities for joint ventures, competitive benchmarking, and strategic acquisitions. Recognizing the diverse approaches adopted by leading actors is essential for crafting counterstrategies and positioning one’s offerings effectively within an increasingly crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Household Wipes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Amway Corporation

- Clorox Company

- Codi Group BV

- Colgate-Palmolive Company

- Diamond Wipes International, Inc.

- Embuer Health Pvt. Ltd.

- Essity AB

- Godrej Consumer Products Limited

- GOJO Industries, Inc.

- Jiaxing Hongjie Commodity Co., Ltd.

- Kao Corporation

- Kimberly-Clark Corporation

- Medline Industries, LP.

- Nice-Pak Products, Inc.

- Professional Disposables International, Inc.

- Reckitt Benckiser Group PLC

- Rockline Industries Ltd.

- S. C. Johnson & Son, Inc.

- The Procter & Gamble Company

- Unilever PLC

- Weiman Products, LLC

- WipesPlus by CFS Brands, LLC

- Yessor Wipes

Formulating Actionable Strategies for Industry Leadership to Accelerate Growth, Enhance Sustainability, and Strengthen Resilience in the Household Wipes Sector

Industry leaders can drive sustained growth by prioritizing investment in next-generation materials and eco-friendly processes. By accelerating the development of biodegradable nonwoven fabrics and leveraging partnerships with sustainable textile innovators, companies can meet evolving regulatory mandates and resonate with environmentally conscious consumers. In parallel, streamlining the packaging lifecycle through refillable pouches and reduced plastic content will reinforce brand credibility and align with emerging circular economy imperatives.

Enhancing digital engagement must be integral to growth strategies, as e-commerce continues to capture market share. Establishing robust direct-to-consumer platforms with personalized subscription models will enable companies to secure recurring revenue streams and gather real-time consumer insights. Integrating advanced analytics into these channels can drive targeted promotions and forecast consumption patterns more accurately, allowing for optimized inventory management and promotional planning.

Operational resilience requires diversification of supply chain footings. By cultivating relationships with multiple suppliers across geographies-particularly in regions offering favorable trade terms-organizations can mitigate tariff exposure and safeguard against disruptions. Concurrently, exploring vertical integration opportunities in nonwoven production may yield cost efficiencies and strengthen quality control.

Finally, cultivating an innovation-oriented culture, anchored by cross-functional teams and agile development frameworks, will expedite product-to-market cycles. By fostering close collaboration between R&D, marketing, and operations, decision-makers can swiftly respond to shifting consumer preferences and emerging public health requirements. These actionable strategies will empower market participants to consolidate their leadership positions and seize new avenues of expansion in the rapidly evolving household wipes sector.

Detailing a Robust Research Framework Combining Primary Expertise, Secondary Data Integration, and Methodical Validation for Household Wipes Market Analysis

The foundation of this analysis rests on a comprehensive research framework combining both primary expertise and secondary data integration. Primary research encompassed in-depth interviews with senior executives from leading manufacturers, procurement specialists in distribution channels, and procurement officers within healthcare and hospitality institutions. These discussions illuminated real-world operational challenges, tariff management tactics, and innovation roadmaps, ensuring that the findings reflect industry practitioners’ firsthand experiences.

Secondary research involved exhaustive examination of publicly available sources, including trade association publications, regulatory filings, and company financial disclosures. Data triangulation methodologies were applied to reconcile discrepancies and validate emerging narratives. Additionally, retail audit data and e-commerce analytics provided quantitative insights into channel performance and consumer purchasing behaviors, while nonwoven substrate suppliers contributed technical specifications and pricing indices.

Analytical rigor was maintained through systematic cross-referencing of regional import–export statistics, tariff schedules, and sustainability certification databases. Scenario analysis was conducted to assess the potential financial impact of policy shifts, and sensitivity testing evaluated the robustness of strategic recommendations under varying market conditions. Quality assurance procedures, including peer review by market research specialists and regulatory experts, ensured objectivity and accuracy throughout the report.

By blending qualitative insights with quantitative evidence, this methodology delivers a balanced perspective on the household wipes market. Stakeholders can rely on the robustness of these methods to support strategic planning, resource allocation, and risk management decisions in an environment of persistent change.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Household Wipes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Household Wipes Market, by Product Type

- Household Wipes Market, by Packaging Type

- Household Wipes Market, by Material Type

- Household Wipes Market, by End User

- Household Wipes Market, by Distribution Channel

- Household Wipes Market, by Region

- Household Wipes Market, by Group

- Household Wipes Market, by Country

- United States Household Wipes Market

- China Household Wipes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Insights Highlighting Key Findings, Emerging Opportunities, and Strategic Imperatives Shaping the Future of the Household Wipes Market Landscape

This executive summary has distilled the essential insights driving the household wipes sector, from overarching market dynamics to nuanced segmentation and regional distinctions. By elucidating the transformative shifts in sustainability, digital commerce, and consumer health imperatives, the analysis highlights how manufacturers and distributors must adapt to maintain relevance in a competitive landscape. The examination of the United States tariffs unveiled the strategic recalibrations necessary to navigate cost pressures and fortify supply chain resilience.

Segmentation insights underscored the importance of tailoring offerings to distinct distribution channels, product types, packaging forms, end users, and material compositions. These granular perspectives empower decision-makers to refine product development and channel strategies, aligning portfolios with evolving consumer and institutional requirements. Regional analysis further reinforced the imperative to customize approaches for the Americas, EMEA, and Asia-Pacific markets, each characterized by unique regulatory, cultural, and economic drivers.

Strategic company-level evaluations showcased how leading players are leveraging innovation, partnerships, and supply chain agility to sustain growth. Actionable recommendations emphasized the need for sustainable material investments, digital engagement enhancements, and diversified sourcing models to thrive in a rapidly changing environment. The rigorous research methodology, blending primary interviews and secondary data triangulation, underpins the credibility of these findings and recommendations.

As market participants navigate these complexities, the conclusion serves as a call to integrate these insights into strategic planning and operational execution. By doing so, organizations can position themselves to capitalize on emerging opportunities and secure a competitive edge in the evolving household wipes market.

Engage with Associate Director Ketan Rohom to Acquire Personalized Access to the Complete Household Wipes Market Research Report and Unlock Strategic Advantages

To secure your competitive edge and gain comprehensive insights into the household wipes market, reach out to Associate Director Ketan Rohom for personalized guidance on acquiring the full research report. Ketan brings deep industry expertise and a keen understanding of emerging market dynamics to help you navigate complex trends and identify growth opportunities tailored to your strategic objectives. By partnering directly with Ketan, you can explore customized data packages, delve into specific regional analyses, and access exclusive interviews with key industry stakeholders. Whether you require in-depth benchmarking, comparative intelligence on leading players, or detailed segmentation breakdowns, this engagement ensures you receive actionable and relevant intelligence aligned with your decision-making needs. Contact Ketan today to discuss your unique requirements and take the first step toward leveraging data-driven insights that will shape your success in the evolving household wipes landscape.

- How big is the Household Wipes Market?

- What is the Household Wipes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?