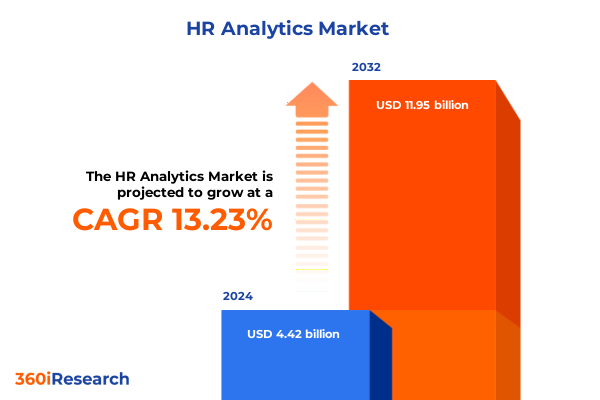

The HR Analytics Market size was estimated at USD 2.90 billion in 2025 and expected to reach USD 3.10 billion in 2026, at a CAGR of 8.34% to reach USD 5.08 billion by 2032.

Discover how cutting-edge HR analytics platforms are revolutionizing talent management and driving next-generation workforce performance

In today’s rapidly evolving business environment, organizations are under intense pressure to optimize their human capital and achieve strategic objectives with greater efficiency. This executive summary distills the critical landscape of HR analytics, demonstrating how data-driven insights are reshaping decision-making across talent acquisition, performance management, and workforce optimization. Grounded in the latest methodologies and technological advancements, the overview sets the stage for a deeper exploration of the market dynamics influencing HR leaders and decision-makers.

Drawing upon primary research, expert interviews, and real-world case studies, this report illuminates the core trends and emerging opportunities within HR analytics. It provides a snapshot of how leaders are leveraging advanced software and services to not only measure workforce performance but also predict future talent needs and mitigate retention risks. As organizations strive for agility, this introduction frames the strategic imperatives and contextualizes the transformative potential of intelligent analytics platforms.

Uncover the rapid evolution from basic reporting to advanced AI-driven HR analytics solutions reshaping workforce strategy

The HR analytics landscape has undergone a seismic shift, fueled by the convergence of artificial intelligence, machine learning, and cloud computing. Leaders have moved beyond traditional descriptive reporting toward prescriptive and predictive insights that can anticipate attrition, recommend individualized learning pathways, and optimize talent deployment. This shift is underpinned by the proliferation of workforce analytics software that integrates seamlessly with core HR systems and external talent marketplaces.

Concurrently, service providers have expanded their portfolios to include consulting engagements aimed at designing end-to-end analytics roadmaps and integration services that ensure data quality and governance. Organizations are demonstrating a growing appetite for managed support and continuous feedback platforms that deliver real-time performance insights. As a result, the lines between software solutions and professional services have blurred, creating an ecosystem where analytics adoption is accelerated through turnkey offerings and collaborative partnerships.

Explore how evolving U.S. tariff policies in 2025 are reshaping procurement tactics and deployment preferences in HR analytics

In 2025, United States tariff policies have exerted a clear influence on the procurement strategies of organizations adopting HR analytics technologies. Recent levies on imported hardware components prompted many enterprises to reconsider their capital expenditure patterns, driving a shift toward cloud-based solutions that minimize reliance on on-premises infrastructure. This trend has accelerated demand for subscription-based models and software-as-a-service offerings that bypass upfront hardware investments.

Furthermore, tariffs have introduced complexity into global vendor selection processes, prompting many U.S.-based organizations to prioritize domestic software and consulting partners. As a result, local service providers have expanded capabilities and scaled operations to meet surging demand, while multinational vendors have adapted by establishing regional data centers and adjusting pricing structures. The net effect has been a renewed emphasis on flexible deployment models and modular service engagements that can withstand the uncertainties of trade policy.

Gain nuanced segmentation insights unveiling component, deployment, enterprise scale, and vertical-specific HR analytics landscapes

A critical driver of market segmentation arises from the study of key components, revealing a bifurcation between services and software. Consulting, integration, and support services have become instrumental in guiding organizations through complex analytics deployments, ensuring that solution roadmaps are aligned with strategic objectives. On the software front, four primary categories-learning management, performance management, talent management, and workforce analytics software-have emerged as foundational pillars for comprehensive talent ecosystems. Within learning management, the balance between classroom training and e-learning modalities underscores organizations’ dual focus on experiential and digital learning pathways. Meanwhile, performance management solutions span appraisal management and continuous feedback capabilities, catering to both traditional evaluation cycles and ongoing coaching models. The talent management segment further subdivides into recruitment management and talent acquisition platforms, reflecting the distinctive needs of sourcing, candidate experience, and employer branding. Finally, workforce analytics solutions have evolved to encompass descriptive analytics for historical insights, predictive analytics to forecast turnover or skill gaps, and prescriptive analytics that recommend targeted interventions.

Deployment models represent another axis of differentiation, with cloud and on-premises options each offering unique value propositions. Cloud deployments provide scalability, rapid time-to-value, and reduced capital outlay, while on-premises installations appeal to organizations with stringent data control and compliance mandates. Enterprise size further modulates buying approaches: large enterprises often favor integrated, customized analytics suites supported by global service networks, whereas small and medium enterprises prioritize turnkey, out-of-the-box solutions that can be rapidly adopted without significant IT overhead.

Vertical-driven segmentation reveals distinctive requirements across BFSI, healthcare, IT and telecom, manufacturing, and retail sectors. Within banking and insurance subsectors, preferences diverge between commercial banking’s emphasis on performance dashboards and investment banking’s focus on talent mobility. Life insurance and non-life insurance providers leverage analytics for risk management and agent productivity optimization. Healthcare organizations, including clinics and hospitals, demand compliance-centric analytics that can tie workforce efficiency to patient outcomes. IT services and telecom providers harness analytics to manage highly fluid project-based staffing, while manufacturers in automotive and electronics deploy analytics to align workforce skills with production cycles. Retail enterprises, whether brick-and-mortar or e-commerce, seek to optimize labor scheduling and customer-facing staff performance through real-time workforce intelligence.

This comprehensive research report categorizes the HR Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Enterprise Size

- Deployment Model

- Vertical

Unveil region-specific HR analytics dynamics driven by regulatory, cultural, and technological factors across global markets

Regional variations in HR analytics adoption reflect distinct market maturity, regulatory landscapes, and cultural attitudes toward data-driven decision-making. In the Americas, organizations are leading the charge with robust cloud adoption, fueled by advanced digital infrastructures and a competitive talent marketplace. North American enterprises demonstrate strong investment in AI-driven predictive analytics, while Latin American firms are rapidly embracing cloud-based learning management to bridge skills gaps and support distributed workforces.

Europe, the Middle East, and Africa exhibit a more heterogeneous landscape, influenced by data privacy regulations and varying levels of cloud readiness. GDPR-driven compliance requirements have steered many European organizations toward hybrid deployments that balance on-premises control with cloud agility. In the Middle East, government-led digital transformation initiatives are catalyzing investment in performance and talent management platforms. African markets, though nascent, are showing promise in mobile-first workforce analytics tailored to emerging economies.

Asia-Pacific stands out for its dynamic growth and technological innovation, with regional powerhouses driving adoption across multiple verticals. In Southeast Asia, cloud-based talent management platforms are propelling rapid skill development programs, particularly within IT and telecom sectors. Australasian enterprises are at the forefront of prescriptive analytics, utilizing sophisticated workforce models to anticipate labor shortages. Across key markets such as China, Japan, and India, a growing cadre of homegrown vendors is competing alongside global players, offering localized language support and compliance alignment.

This comprehensive research report examines key regions that drive the evolution of the HR Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze how top HR analytics providers blend technological innovation with strategic services to set industry benchmarks

Leading players in the HR analytics space have differentiated through innovative technology roadmaps, strategic partnerships, and service excellence. Many have expanded beyond core offerings to deliver integrated talent suites that unify learning, performance, recruitment, and advanced analytics within a single platform. Partnerships with AI research labs and cloud hyperscalers have enabled faster feature rollouts and enhanced predictive modeling capabilities. In addition, several vendors have invested in robust marketplace ecosystems, offering prebuilt connectors, analytics accelerators, and industry-specific templates that expedite deployment.

On the services side, consultancies have developed specialized HR analytics practice areas, staffed by data scientists and organizational psychologists, to deliver bespoke analytics strategies. This trend highlights the growing recognition that technology alone is insufficient without change management and analytics literacy initiatives. As clients seek end-to-end accountability, vendors offering managed services, data governance frameworks, and continuous optimization programs are gaining significant traction. These differentiating strategies underscore the competitive imperative to blend technological depth with domain expertise to deliver tangible business outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the HR Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADP, LLC

- Alteryx, Inc.

- Anaplan, Inc.

- Cornerstone OnDemand, Inc.

- Degreed, Inc.

- Eightfold AI, Inc.

- HCM Analytics, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- PeopleSoft, LLC

- Planday A/S

- SAP SE

- SAS Institute Inc.

- Tableau Software, LLC

- UKG, Inc.

- Visier, Inc.

- Workday, Inc.

- Workforce Software, Inc.

- Zoho Corporation Pvt. Ltd.

Empower leadership with strategic steps to drive analytics adoption and cultivate a data-centric HR culture for sustainable impact

Industry leaders aiming to maximize the value of HR analytics should begin by establishing clear business objectives tied to talent outcomes, ensuring that investments are aligned with overarching organizational goals. To achieve this, executives must foster cross-functional collaboration between HR, IT, and business units, promoting shared ownership of data assets and analytics initiatives. Creating centers of excellence that drive best practices in data governance, analytics methodologies, and change management can help institutionalize a culture of insights-driven decision-making.

Leaders should prioritize scalable and modular platforms that can evolve with emerging needs, balancing initial deployments with strategic roadmaps for advanced AI and machine learning capabilities. Embracing agile implementation methodologies and pilot programs can accelerate time-to-value and surface early learning. Furthermore, investing in workforce analytics training and upskilling programs will empower HR teams to interpret data and derive actionable recommendations, reinforcing the shift from reactive reporting to proactive workforce planning. Finally, ongoing vendor performance reviews and ecosystem partnerships will ensure continuous innovation and alignment with evolving market demands.

Understand the robust multi-phased research approach blending primary interviews, surveys, and rigorous data validation processes

This research has been conducted through a multi-phased methodology combining primary and secondary data sources to ensure comprehensive coverage and rigorous validation. Initially, a detailed review of industry publications, regulatory filings, and publicly available financial statements provided baseline context regarding market developments and vendor standings. This secondary data was complemented by qualitative interviews with over 25 HR executives, technology vendors, and independent consultants to capture firsthand perspectives on adoption drivers, challenges, and future priorities.

Quantitative surveys were deployed across a balanced mix of enterprise sizes and industry verticals to quantify adoption rates, deployment preferences, and service utilization patterns. Data triangulation techniques were applied to cross-verify survey findings against secondary benchmarks, enabling the identification of significant trends and anomalies. Statistical analysis tools and predictive modeling frameworks were then leveraged to refine insights, particularly in forecasting the impact of tariff shifts and evolving deployment models. Finally, all findings underwent a comprehensive review by an advisory panel of industry subject-matter experts to ensure accuracy, relevance, and actionability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HR Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HR Analytics Market, by Component

- HR Analytics Market, by Enterprise Size

- HR Analytics Market, by Deployment Model

- HR Analytics Market, by Vertical

- HR Analytics Market, by Region

- HR Analytics Market, by Group

- HR Analytics Market, by Country

- United States HR Analytics Market

- China HR Analytics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesize overarching insights linking technological, economic, and organizational forces shaping the future of HR analytics

The convergence of advanced analytics technologies, evolving service models, and shifting regulatory landscapes is ushering in a new era of strategic HR decision-making. As organizations navigate the complexities of talent management in an increasingly dynamic environment, the insights presented in this executive summary offer a roadmap for leveraging data to drive workforce agility, performance optimization, and future readiness. From the nuanced impacts of U.S. tariff policies to the differentiated demands of global regions and verticals, the need for a holistic and adaptable analytics strategy has never been more critical.

By synthesizing segmentation nuances, regional variations, and competitive differentiators, this report equips decision-makers with the clarity and confidence to invest in platforms and services that align with their unique operational contexts. The path forward entails not only adopting cutting-edge technologies but also cultivating the organizational capabilities and cultural mindsets necessary to translate analytics into sustained business value.

Seize exclusive access to transformative HR analytics insights by connecting with Ketan Rohom to secure your comprehensive market research today

We invite you to explore the full depth of this comprehensive executive report and uncover the pivotal strategies that will redefine your organizational approach to HR analytics. By partnering directly with Ketan Rohom (Associate Director, Sales & Marketing), you will gain exclusive access to an extensive landscape of insights, in-depth analyses, and actionable frameworks tailored to elevate talent management and workforce performance. Engage now to secure a competitive edge and drive transformative outcomes across your enterprise’s most critical HR functions. Reach out today to acquire your copy of the full report and catalyze data-driven growth and innovation within your organization.

- How big is the HR Analytics Market?

- What is the HR Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?