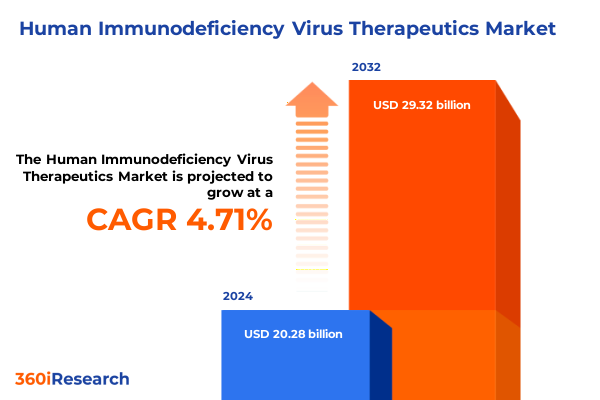

The Human Immunodeficiency Virus Therapeutics Market size was estimated at USD 21.23 billion in 2025 and expected to reach USD 22.23 billion in 2026, at a CAGR of 4.71% to reach USD 29.32 billion by 2032.

Harnessing Breakthrough Scientific Advances and Strategic Initiatives to Navigate the Rapid Evolution of the Human Immunodeficiency Virus Therapeutics Landscape

The landscape of Human Immunodeficiency Virus therapeutics has undergone a profound transformation driven by scientific breakthroughs and evolving patient needs. Over the past decade, the field has witnessed an acceleration in novel drug classes and combination regimens that have redefined standards of care for individuals living with HIV. Concurrent advances in treatment delivery and formulation science have enabled more patient-centric approaches, fostering adherence and improving outcomes across diverse populations.

As global health priorities increasingly emphasize both long-term viral suppression and quality of life, industry stakeholders are aligning research investments with strategies that address resistance profiles, co-infections, and comorbidity management. Moreover, the integration of real-world evidence and robust clinical data into regulatory pathways has expedited access to next-generation therapies. This evolving paradigm underscores the critical intersection of innovation and strategic positioning, challenging companies to balance portfolio optimization with agility in response to competitive and regulatory pressures.

Against this backdrop, a detailed exploration of emerging pipeline assets, therapy optimization trends, and patient segmentation dynamics is essential. By illuminating key drivers and barriers, this analysis aims to equip decision-makers with the insights needed to navigate a rapidly advancing HIV therapeutics market.

Embracing Next-Generation Therapeutics and Digital Innovations That Are Driving Transformative Shifts in HIV Treatment Paradigms and Patient Outcomes

The HIV therapeutics arena is witnessing transformative shifts as new modalities and digital innovations converge to reshape treatment paradigms. Notably, long-acting therapies have emerged as a game-changing approach, reducing dosing frequency and enhancing patient adherence. At the same time, the maturation of gene-editing and immunotherapeutic strategies promises potential functional cures, ushering in a fundamentally different long-term vision for disease management.

Parallel to therapeutic advances, digital health solutions are increasingly embedded across the care continuum. Telemedicine platforms, remote monitoring tools, and mobile adherence apps offer real-time patient engagement and data-driven decision support. These technologies not only augment clinical trial design but also facilitate personalized treatment adjustments, aligning with the shift toward precision medicine and holistic patient care.

Furthermore, artificial intelligence and machine learning are being leveraged to accelerate drug discovery, optimize dosing regimens, and predict resistance patterns. As organizations embrace these capabilities, collaborative ecosystems spanning biotech innovators, academic research centers, and technology partners are becoming the cornerstone of next-generation HIV therapies. Such collaborative frameworks signal a departure from traditional siloed models, emphasizing co-development and integrated value chains.

Analyzing the Comprehensive Effects of 2025 United States Tariff Policies on HIV Therapeutics Supply Chains and Cost Structures

A sweeping 10 percent global tariff on almost all imports into the United States took effect in April 2025, capturing critical components such as active pharmaceutical ingredients and diagnostic equipment essential to HIV drug manufacturing and delivery. This broad trade measure has generated immediate cost pressures across supply chains, compelling companies to reassess sourcing strategies and defensive inventory policies to maintain continuity of care amid heightened input costs.

Further compounding these dynamics, the U.S. administration imposed differentiated duties of 25 percent on foundational APIs from China and 20 percent on those sourced from India, two leading suppliers to the generic and branded drug sectors. These targeted levies have had an unmistakable inflationary impact on production costs, particularly for antiretroviral agents reliant on bulk‐sourced intermediates. In response, several manufacturers have announced supply diversification initiatives and exploratory talks to accelerate domestic API manufacturing, though such transitions pose multi‐quarter lead times and regulatory hurdles.

The potential extension of at least 25 percent tariffs on finished pharmaceutical products also carries the risk of contravening exemptive provisions under the World Trade Organization’s 1994 Pharmaceutical Agreement. Industry authorities warn that these higher duties could trigger pronounced disruptions in global supply networks, heighten inventory imbalances, and exacerbate existing drug shortage vulnerabilities. As tariffs escalate, the imperative to secure resilient logistics partnerships and engage in tariff mitigation strategies becomes increasingly urgent.

Critically, generic antiretroviral manufacturers, already operating on narrow profit margins, face heightened vulnerability to import penalties. According to industry leaders, unforeseeable tariff fluctuations may precipitate production discontinuations and supply gaps, with patient access imperiled in the short term. While the long-term objective of reshoring pharmaceutical manufacturing aims to enhance national security and control, the immediate consequence is a potential slow-down in R&D investment as firms refocus capital on supply chain reengineering rather than innovation pipelines.

Uncovering Strategic Insights Through Multidimensional Segmentation Perspectives That Drive Competitive HIV Therapeutics Market Dynamics

The HIV therapeutics market is explored through multiple segmentation lenses, each revealing distinct insights into treatment adoption and competitive dynamics. When viewed by drug class, integrase strand transfer inhibitors have emerged as cornerstone agents, with compounds such as Bictegravir and Dolutegravir demonstrating robust efficacy and tolerability, while entry inhibitors like Maraviroc offer critical salvage options in resistant cases. This granularity underscores how targeted therapies shape formulary decisions and lifecycle management strategies.

Considering regimen type, the rise of single tablet regimens has fundamentally influenced patient adherence profiles and prescribing trends, streamlining complex antiretroviral combinations into cohesive, once-daily dosing. Conversely, multi tablet regimens maintain relevance for tailored therapy across resistance landscapes and drug-drug interaction scenarios. This duality highlights the necessity for portfolio agility in aligning with diverse clinical needs.

Exploring therapy line segmentation illuminates the evolving pathway of care, where first-line therapies prioritize high-barrier agents to forestall resistance, while salvage therapy options remain indispensable for treatment-experienced patients. Second-line interventions further reflect a continuum of care that demands sustained innovation and life cycle extensions. These therapy line distinctions drive strategic allocation of R&D resources and commercial focus.

Lastly, mode of administration, patient type, and distribution channel perspectives reveal additional layers of market nuance. Injectable formulations introduce long-acting paradigms that disrupt daily dosing conventions, adult and pediatric populations warrant differentiated safety and efficacy considerations, and channel diversification across hospital, online, and retail pharmacies influences market access strategies. Taken together, these multidimensional segmentation insights are instrumental for shaping targeted product launches and investment priorities.

This comprehensive research report categorizes the Human Immunodeficiency Virus Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Regimen Type

- Therapy Line

- Mode Of Administration

- Patient Type

- Distribution Channel

Illuminating Regional Market Drivers and Growth Opportunities Across the Americas, EMEA, and Asia-Pacific That Shape the Global HIV Therapeutics Landscape

Disparate regional dynamics are instrumental in shaping the global trajectory of HIV therapeutics, with each geography presenting unique drivers and constraints. In the Americas, a mature healthcare infrastructure and established reimbursement frameworks support rapid uptake of innovative regimens. Market participants frequently engage in value-based contracting to mitigate cost pressures and align outcomes incentives with payers. This environment fosters competition among leading manufacturers to secure formulary placement and drive real-world evidence generation to substantiate long-term benefits.

In Europe, the Middle East, and Africa, pricing and reimbursement landscapes vary significantly. Western European markets often adhere to stringent health technology assessment protocols that emphasize cost-effectiveness, prompting companies to demonstrate robust pharmacoeconomic profiles. Meanwhile, emerging economies in Eastern Europe, the Middle East, and Africa grapple with access disparities and supply chain limitations, driving demand for generics and incentivizing public-private partnerships to expand diagnostic and treatment capabilities in underserved communities.

Asia-Pacific territories exhibit dynamic growth underpinned by high disease burden in certain countries, evolving regulatory frameworks, and a growing emphasis on domestic pharmaceutical manufacturing. Market access pathways in nations such as India and China have been streamlined to expedite generic approvals, while regional hubs for clinical research attract global trial investments. Governments are increasingly focused on enhancing healthcare coverage through national insurance schemes, generating both opportunities and challenges for global players seeking to penetrate diversified markets.

Collectively, these regional insights highlight the importance of tailoring commercial strategies to local policy frameworks, patient demographics, and competitive landscapes, ensuring that innovation reaches those most in need.

This comprehensive research report examines key regions that drive the evolution of the Human Immunodeficiency Virus Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances That Are Driving Competitive Advantage and Breakthroughs in HIV Therapeutics Development

Leading organizations in the HIV therapeutics space are forging differentiated paths through strategic investments, collaborative agreements, and robust clinical pipelines. Gilead Sciences continues to leverage its legacy of protease inhibitors while advancing novel integrase inhibitors and long-acting agents to extend its market leadership. Concurrently, ViiV Healthcare, with a focus on combination regimens and patient support services, has cemented its reputation for addressing unmet needs in both naïve and treatment-experienced populations.

Traditional pharmaceutical powerhouses such as Merck and Johnson & Johnson are deepening their footprints through partnerships with biotech innovators, driving early-stage research in antibody-based therapies and immunomodulatory approaches. These alliances not only diversify risk but also accelerate the translation of breakthrough science into clinical candidates. At the same time, emerging biotechs specializing in gene editing and therapeutic vaccines have captured attention through high-value licensing agreements, underscoring the competitive imperative to tap into novel modalities.

In parallel, contract manufacturing organizations and specialized service providers are elevating their role by offering integrated solutions spanning formulation development, CMC optimization, and commercial supply. This ecosystem synergy reduces time to market and allows originators to concentrate on core R&D and commercialization efforts. Across the competitive landscape, strategic M&A activity and licensing collaborations remain key levers for augmenting portfolios and securing technology platforms that support next-generation HIV treatment paradigms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Human Immunodeficiency Virus Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aspen Pharmacare Holdings Limited

- Aurobindo Pharma Limited

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Cipla Limited

- Genentech, Inc.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Hetero Labs Limited

- Janssen Pharmaceutica NV

- Merck & Co., Inc.

- Pfizer Inc.

- Shionogi & Co., Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- ViiV Healthcare Limited

- Zydus Lifesciences Limited

Implementing Actionable Strategies to Enhance Resilience, Innovation, and Market Position for HIV Therapeutics Stakeholders

Industry leaders can enhance resilience and capture growth by adopting a multi-pronged approach that balances supply chain fortification, patient engagement, and innovation acceleration. Strengthening supplier diversification across geographies and investing in contingency manufacturing sites will mitigate tariff-driven disruptions while preserving product continuity and quality benchmarks. Simultaneously, leveraging digital patient support tools and real-world data platforms can elevate adherence, inform clinical decision making, and generate valuable outcomes evidence for payers and regulators.

To sustain a competitive edge, organizations should pursue strategic partnerships with biotech firms specializing in novel modalities such as long-acting injectables and gene therapies, thereby enriching portfolios with differentiated assets. Co-development arrangements and licensing agreements offer a pragmatic path to share R&D risk while expediting time to market. In parallel, embedding advanced analytics into commercial operations-from forecasting demand to optimizing pricing strategies-will enable more agile responses to shifting payer requirements and market trends.

Finally, prioritizing equitable access by directing initiatives toward pediatric populations and resource-constrained regions will strengthen corporate social responsibility profiles and unlock untapped patient segments. By aligning product development and market access strategies with global health imperatives, industry stakeholders will not only drive sustainable growth but also make a meaningful impact on the lives of people living with HIV worldwide.

Detailing Rigorous Research Methodologies Underpinning In-Depth Analysis of the HIV Therapeutics Market for Informed Decision-Making

The research underpinning this analysis integrates a robust blend of primary and secondary data collection methods to ensure depth and credibility. Primary research activities included in-depth interviews with key opinion leaders, clinicians, and industry executives to capture qualitative insights on clinical practices, pipeline developments, and access challenges. Detailed questionnaires and validation workshops complemented these discussions, enabling triangulation of diverse viewpoints and identifying emerging trends in real time.

Secondary research entailed a systematic review of scientific literature, regulatory filings, company disclosures, and patent databases to map therapeutic innovations and competitive landscapes. Proprietary databases were also leveraged to track clinical trial activities, approval timelines, and legal proceedings affecting market dynamics. Market intelligence was further enriched by data from governmental agencies, health authority publications, and global health observatories to contextualize epidemiological and reimbursement frameworks across regions.

Rigorous data validation protocols, including cross-referencing multiple information sources and reconciling discrepancies through follow-up queries, ensured the report’s accuracy and relevance. All segmentation logic, from drug class to distribution channel, was applied consistently to guarantee comparability and actionable clarity. This methodological rigor provides a solid foundation for strategic decision making and supports confident navigation of the rapidly evolving HIV therapeutics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Human Immunodeficiency Virus Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Human Immunodeficiency Virus Therapeutics Market, by Drug Class

- Human Immunodeficiency Virus Therapeutics Market, by Regimen Type

- Human Immunodeficiency Virus Therapeutics Market, by Therapy Line

- Human Immunodeficiency Virus Therapeutics Market, by Mode Of Administration

- Human Immunodeficiency Virus Therapeutics Market, by Patient Type

- Human Immunodeficiency Virus Therapeutics Market, by Distribution Channel

- Human Immunodeficiency Virus Therapeutics Market, by Region

- Human Immunodeficiency Virus Therapeutics Market, by Group

- Human Immunodeficiency Virus Therapeutics Market, by Country

- United States Human Immunodeficiency Virus Therapeutics Market

- China Human Immunodeficiency Virus Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Imperatives That Define the Future Trajectory, Opportunities, and Challenges of HIV Therapeutics Innovation

Collectively, the insights presented underscore a dynamic environment where patient-centric innovation, supply chain resilience, and strategic collaborations are pivotal. Breakthrough drug classes and digital health integrations have redefined therapeutic paradigms, while trade policy shifts and tariff measures necessitate agile operational frameworks. Segmentation analysis illuminates differentiated demands across drug classes, regimens, and patient demographics, reinforcing the value of tailored market strategies.

Regionally, nuanced approaches that align with reimbursement landscapes and infrastructure capabilities will determine the pace of innovation uptake and access equity. Leading companies and emerging biotechs are competing on multiple fronts-ranging from long-acting injectables to gene-based therapies-underscoring the importance of diversified portfolios and synergistic partnerships. To thrive in this competitive terrain, stakeholders must embed advanced analytics, real-world evidence, and digital engagement into their core playbooks.

As the HIV therapeutics market continues to evolve, embracing a holistic, patient-first approach while safeguarding supply chains and fostering collaborative ecosystems will be fundamental to achieving sustainable growth and improved health outcomes. These strategic imperatives define the roadmap for future success in combating the global HIV epidemic.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Insights and Secure Your Definitive HIV Therapeutics Market Research Report

I appreciate your interest in gaining a comprehensive understanding of the Human Immunodeficiency Virus Therapeutics market. To secure the full-depth analysis, detailed segmentation insights, and strategic guidance tailored to your organization’s needs, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will walk you through the report’s strengths, customize a package that aligns with your research objectives, and facilitate a seamless acquisition process. Engage now to elevate your decision-making with definitive market intelligence and actionable foresight in HIV therapeutics.

- How big is the Human Immunodeficiency Virus Therapeutics Market?

- What is the Human Immunodeficiency Virus Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?