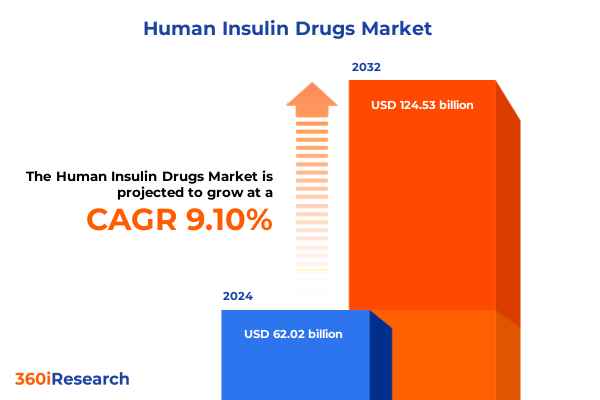

The Human Insulin Drugs Market size was estimated at USD 67.59 billion in 2025 and expected to reach USD 73.66 billion in 2026, at a CAGR of 9.12% to reach USD 124.53 billion by 2032.

Shaping the Future of Human Insulin Therapy with Comprehensive Insights into Current Market Dynamics, Patient Needs, and Therapeutic Innovations

The therapeutic landscape of human insulin has undergone remarkable evolution, tracing its roots from the pioneering discovery of pancreatic extracts in the early twentieth century to the advent of highly refined formulations that remain indispensable to diabetes management. As clinicians and patients navigate the complexities of chronic glycemic control, the relevance of human insulin endures amid the proliferation of analogs and biosimilars. Today’s stakeholders demand not only safety and efficacy but also cost-effectiveness and ease of use to enhance adherence and outcomes. By setting the stage with a concise overview of historical milestones, clinical imperatives, and the shifting regulatory environment, this introduction delineates the intricate web of forces shaping the current insulin market.

Moving beyond mere chronicle, this section underscores the importance of understanding the human insulin segment as a dynamic interplay of innovation, patient preference, and health economics. What emerges is a holistic foundation that informs the subsequent exploration of transformative market shifts, the ripple effects of trade policies, and the granular segmentation that defines opportunity spaces. This narrative provides decision-makers with a contextual framework, illuminating why human insulin retains both therapeutic significance and commercial vitality within the broader diabetes care continuum.

Navigating the Transformative Shifts in Human Insulin Drug Development from Biosimilars to Patient-Centric Delivery Innovations

Significant paradigm shifts have redefined the human insulin sector in recent years. The accelerated development of biosimilar human insulin products has injected competitive pressures, compelling established manufacturers to refine cost structures and differentiate through value-added services. Concurrently, patient-centric delivery solutions have gained traction, with prefilled pens and reusable devices designed to simplify administration and minimize dosing errors. Regulators, in response to safety and quality concerns, have implemented more stringent standards, driving companies to invest in robust manufacturing processes and traceability systems to ensure compliance and market access.

Parallel to these product and regulatory developments, digital health integration is reshaping patient engagement. Remote monitoring platforms and smart pen technologies now deliver real-time adherence data, enabling healthcare professionals to tailor regimens and intervene proactively. This convergence of therapeutics and information technology heralds a new era in which human insulin management transcends the confines of traditional supply channels. As a result, stakeholders are recalibrating strategies to harness data-driven insights, emphasizing end-to-end patient support and ecosystem-based offerings over standalone pharmaceutical solutions.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Human Insulin Supply Chains, Pricing Strategies, and Access Dynamics

The onset of new tariff structures affecting medical products in the United States during 2025 has introduced fresh challenges for manufacturers and importers of human insulin. Heightened duties on specific therapeutic categories have incrementally raised landed costs, prompting supply chain stakeholders to reassess vendor selection, inventory management, and pricing strategies. Multinational producers, reliant on cross-border raw material sourcing and contract manufacturing in lower-cost jurisdictions, have felt the direct impact of these levies on their cost-of-goods-sold, compelling some to accelerate efforts to localize production and establish domestic fill-finish operations.

In response to tariff-induced cost pressures, leading organizations have diversified procurement channels, negotiating preferential terms with alternative suppliers and exploring long-term off-take agreements to stabilize input prices. Moreover, the evolving trade regime has catalyzed collaborative initiatives among industry consortia and patient advocacy groups to lobby for tariff relief on essential biologics, positioning human insulin as a critical resource in public health. These collective actions, in turn, have spurred dialogue within policymaking circles regarding duty exemptions and harmonized trade classifications that could mitigate the financial burden on healthcare systems.

While the full financial impact of these policy changes continues to unfold, early indicators suggest that innovative supply chain realignments and proactive stakeholder engagement are key to preserving affordability and continuity of access. Clinicians and institutions are likewise adapting reimbursement models to accommodate marginal cost shifts without compromising patient care. By examining the cumulative influence of U.S. tariffs, this section illuminates the strategic imperatives for resilient operations and value delivery within the human insulin market.

Delving into Layered Market Segmentation Reveals Product, Administration, Distribution, End User, and Dosage Nuances Driving Competitive Tactics

A nuanced understanding of market segmentation reveals multiple pathways for differentiation and growth. Within the realm of product types, conventional NPH human insulin remains a mainstay for basal glycemic control, while premixed formulations deliver predetermined ratios of rapid-acting and intermediate-acting insulin, catering to patients seeking simplified dosing schedules. The 50/50 ratio suits individuals requiring balanced basal and prandial coverage, whereas 70/30 and 75/25 mixes provide adjusted kinetics for varying meal patterns. Meanwhile, regular human insulin retains its clinical relevance in acute glycemic management settings.

Diverse administration routes further segment the market opportunity. Cartridges interface with reusable pen devices, offering durability for chronic therapy users, whereas disposable prefilled pens combine convenience with dose accuracy. Reusable pens provide an eco-friendlier alternative by accommodating replaceable insulin cartridges. Vials and syringes, cherished for their cost-effectiveness and flexibility in titration, continue to serve patients with highly individualized dosing requirements.

Distribution channels shape product accessibility and patient experience. Hospital pharmacies represent critical procurement hubs for inpatient and acute care, while retail pharmacies deliver community-level availability. The burgeoning online pharmacy sector is transforming prescription fulfillment through home delivery services and digital platforms.

End users span clinics where professionals oversee titration regimens, home care scenarios emphasizing self-administration, and hospital environments requiring rapid, in-route adjustments during acute episodes. Dosage strength defines therapeutic intensity; U100 typically addresses most chronic insulin needs, whereas U500 caters to individuals with markedly higher insulin resistance or advanced disease, reducing injection volume and enhancing compliance.

This comprehensive research report categorizes the Human Insulin Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Administration Route

- Distribution Channel

- End User

- Dosage Strength

Uncovering Regional Differentiators in the Americas, Europe-Middle East-Africa, and Asia-Pacific That Shape Human Insulin Accessibility and Adoption

Geographic insights underscore distinct regional trajectories influenced by healthcare infrastructure, regulatory frameworks, and patient demographics. In the Americas, robust insurance coverage in certain jurisdictions coexists with cost-containment pressures, fostering demand for affordable biosimilars alongside established human insulin brands. Latin American markets demonstrate heterogeneity in reimbursement environments, leading to tiered adoption rates and emphasizing the need for flexible distribution models.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts within the European Union contrast with variable approval pathways in Middle Eastern and African nations. This divergence shapes market entry sequences and local partnership strategies. Reimbursement negotiations in Western Europe often hinge on rigorous health technology assessments, while emerging economies in the region present both pricing sensitivity and growth potential for manufacturers who can navigate diverse policy landscapes.

In Asia-Pacific, expanding healthcare infrastructure and rising prevalence of type 2 diabetes drive sustained human insulin demand. Urbanization trends and expanding out-of-pocket segments encourage manufacturers to tailor product portfolios to meet both cost-sensitive public health programs and premium patient cohorts seeking advanced delivery devices. Regional trade agreements and local manufacturing incentives further influence market dynamics, prompting strategic alliances between global and indigenous players to secure logistic efficiencies and regulatory footholds.

This comprehensive research report examines key regions that drive the evolution of the Human Insulin Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Their Strategic Moves in Formulation Innovation, Device Partnerships, and Patient Support Ecosystems

Major pharmaceutical companies anchor the human insulin market through integrated portfolios spanning traditional formulations and next-generation delivery platforms. Established multinational giants leverage global manufacturing networks to optimize scale efficiencies, while selectively introducing biosimilar counterparts to protect brand franchises and defend market share. Companies with robust R&D pipelines are exploring formulation enhancements to prolong stability at varying temperature thresholds and expand patient-friendly administration options.

Specialized bioscience firms, having secured regulatory approvals for follow-on human insulin products, employ targeted pricing strategies and distribution alliances to penetrate cost-sensitive markets. Strategic collaborations between device manufacturers and insulin producers have yielded co-branded offerings that streamline end-user training and support adherence programs. Meanwhile, emerging biotechs focus on niche formulations such as high-concentration U500 insulin, addressing unmet needs among patients with severe insulin resistance.

Competitive differentiation increasingly hinges on service ecosystems rather than pure pharmaceutical performance. Companies are investing in digital adherence tools, telemedicine partnerships, and education initiatives to fortify patient loyalty and enhance therapeutic outcomes. By monitoring these strategic approaches, stakeholders can anticipate sources of innovation and identify optimal collaboration opportunities within the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Human Insulin Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca PLC

- Biocon Limited

- Bioton S.A.

- Bristol‑Myers Squibb Company

- C.H. Boehringer Sohn AG & Co. KG

- Celltrion, Inc.

- Dr. Reddy's Laboratories Limited

- Eli Lilly and Company

- Exir Pharmaceutical Co., Ltd.

- Gan & Lee Pharmaceuticals Co., Ltd.

- Lupin Limited

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Novo Nordisk A/S

- Sanofi S.A.

- Sedico Pharmaceuticals Co.

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Tonghua Dongbao Pharmaceutical Co., Ltd.

- Torrent Pharmaceuticals Limited

- United Laboratories International Holdings Limited

- Wockhardt Limited

- Ypsomed AG

Implementing Holistic Strategies in Manufacturing, Digital Integration, and Market Access to Cement Leadership in the Insulin Landscape

Stakeholders seeking leadership positions must adopt a multifaceted approach that spans product, process, and patient engagement. Investing in advanced manufacturing technologies and localized fill-finish capabilities will mitigate tariff-related cost volatility and fortify supply chain resilience. Simultaneously, expanding device portfolios to include both disposable and reusable pen systems can capture diverse patient preferences and drive adherence.

Collaborative partnerships with digital health solution providers offer another vector for differentiation, enabling real-time monitoring and proactive diabetes management. Tailoring educational programs to caregivers, clinicians, and patients will strengthen brand trust and encourage optimal regimen adherence. To address regional access disparities, companies should engage early with health authorities to secure inclusion in reimbursement formularies and design flexible pricing frameworks that align with local economic conditions.

Finally, a rigorous focus on sustainability - encompassing eco-friendly device design and reduced packaging waste - will resonate with institutional purchasers and end users. By executing on these recommendations, industry leaders can reinforce competitive positioning, deliver tangible value to patients, and navigate an increasingly complex regulatory and economic terrain.

Outlining a Hybrid Research Framework Combining Primary Expert Interviews, Secondary Data Synthesis, and Geospatial Analysis for Rigorous Insights

The research methodology integrates a blend of qualitative and quantitative approaches to deliver comprehensive market insights. Primary data collection involved in-depth interviews with endocrinologists, supply chain managers, payers, and patient advocacy representatives to capture real-world perspectives on treatment protocols, access barriers, and future needs. These interviews were structured around defined discussion guides to ensure comparability across geographic markets and stakeholder categories.

Secondary research synthesized peer-reviewed clinical studies, regulatory filings, health technology assessment reports, and pharmaceutical company disclosures to establish a robust factual foundation. Cross-validation techniques were applied to reconcile discrepancies between differing data sources and maintain analytical rigor. Market segmentation was derived from systematic categorization of product pipelines, administration modalities, distribution infrastructures, end-user environments, and dosage formulations.

Geospatial analysis utilized public health data sets and regional trade statistics to map demand patterns and cross-border supply flows. Expert panels provided validation of preliminary findings, refining assumptions and enhancing the applicability of insights. This hybrid methodology ensures that the report offers both depth and breadth, equipping decision-makers with actionable intelligence grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Human Insulin Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Human Insulin Drugs Market, by Product Type

- Human Insulin Drugs Market, by Administration Route

- Human Insulin Drugs Market, by Distribution Channel

- Human Insulin Drugs Market, by End User

- Human Insulin Drugs Market, by Dosage Strength

- Human Insulin Drugs Market, by Region

- Human Insulin Drugs Market, by Group

- Human Insulin Drugs Market, by Country

- United States Human Insulin Drugs Market

- China Human Insulin Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Market Dynamics, Regional Variances, and Strategic Imperatives to Illuminate a Path Forward in Human Insulin Therapy

The human insulin market stands at a pivotal juncture, marked by converging forces of innovation, economic pressures, and evolving patient expectations. Biosimilar entrants and digital health integrations are transforming competitive dynamics, while tariff-driven cost considerations underscore the imperative for supply chain agility. Regional nuances in regulatory, reimbursement, and demographic factors demand finely tuned strategies that balance global scale with local relevance.

For decision-makers, the imperative is clear: success will hinge on the ability to orchestrate manufacturing excellence, device innovation, digital solution partnerships, and market access acumen into a coherent value proposition. The insights and recommendations presented throughout this report serve as a strategic compass, guiding stakeholders toward resilient growth paths and meaningful patient outcomes. By aligning organizational capabilities with the detailed segmentation and regional analysis, companies can capitalize on emerging opportunities and navigate the complexities of the evolving human insulin landscape.

Engage with Our Associate Director to Unlock Exclusive Human Insulin Market Insights and Drive Strategic Growth Initiatives

To secure an authoritative edge in the human insulin drugs market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a tailored discussion that will align the comprehensive insights from our report with your strategic priorities, enabling optimized planning, investment decisions, and competitive differentiation. Connect with Ketan today to explore bespoke research deliverables, in-depth data analysis, and actionable intelligence designed to drive your organization’s growth within this dynamic therapeutic segment.

- How big is the Human Insulin Drugs Market?

- What is the Human Insulin Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?