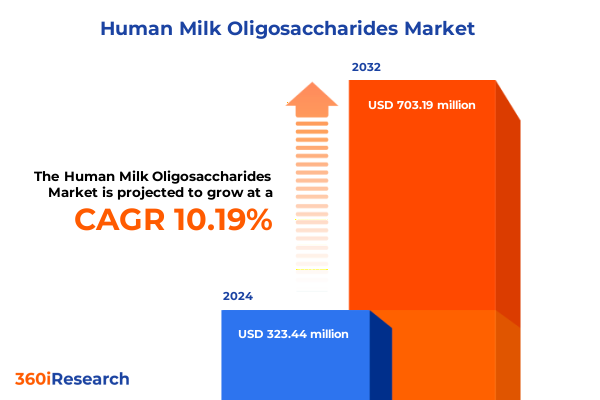

The Human Milk Oligosaccharides Market size was estimated at USD 351.13 million in 2025 and expected to reach USD 383.29 million in 2026, at a CAGR of 10.42% to reach USD 703.18 million by 2032.

Unveiling How Human Milk Oligosaccharides Are Catalyzing a Paradigm Shift in Nutritional Science and Infant Gut Health Worldwide

Human milk oligosaccharides (HMOs) represent a revolutionary class of complex carbohydrates integral to the immunological and gut health benefits of breast milk. Over the past decade, scientific inquiry has unveiled their selective prebiotic functions, demonstrating how they nurture beneficial microbiota while inhibiting pathogenic colonization. This has elevated HMOs from a niche research topic to a cornerstone of modern nutritional science, driving applications that extend far beyond infant health. As demand for bioactive compounds intensifies, HMOs have emerged as a compelling subject for formulators targeting advanced nutritional solutions.

With increasing clarity on molecular structures and functions, the industry is witnessing a transition from theoretical understanding to practical applications. These developments are underpinned by interdisciplinary collaborations among academic institutions, clinical research centers, and biotechnology enterprises. Such synergy has accelerated the pace of discovery, enabling manufacturers to integrate HMOs into diverse matrices, from fortified formulas to functional beverages. The resulting landscape is one of both opportunity and complexity: stakeholders must navigate emerging regulatory frameworks and scale novel synthesis technologies. This introduction sets the stage for a comprehensive exploration of the shifts, challenges, and strategic imperatives defining the HMO market today.

Emerging Technological Breakthroughs and Regulatory Milestones Are Reshaping the Competitive Landscape of Human Milk Oligigosaccharide Development

The human milk oligosaccharide sector is experiencing transformative shifts driven by cutting-edge synthesis techniques and evolving regulatory attitudes. Pioneering advancements in enzymatic catalysis and microbial fermentation now enable commercial-scale production of structurally diverse HMO analogues, overcoming previous limitations associated with low natural abundance. Concurrently, the refinement of chemocatalytic pathways has boosted yield consistency, reducing reliance on extraction from bovine or human lactation sources. These technological leaps have not only enhanced product purity but have also expanded the potential molecular repertoire available to formulators.

Beyond manufacturing innovations, regulatory agencies are progressively defining HMO-specific guidelines, paving the way for clearer market pathways. The codification of safety assessments and novel ingredient approvals in key jurisdictions underscores a maturation of the sector, fostering greater confidence among investors and product developers. Market participants are also capitalizing on cross-industry collaborations, leveraging shared platforms to streamline clinical validation and expedite consumer adoption. Consequently, the competitive terrain is intensifying, with early movers establishing proprietary platforms and strategic partnerships to secure technology licenses. This confluence of technological breakthroughs and regulatory clarity marks a pivotal moment in the HMO evolution, setting the foundation for sustained growth and diversification.

Assessing the Ramifications of Layered United States Tariff Measures on Human Milk Oligosaccharide Supply Chains and Industry Viability in 2025

United States tariff policies in 2025 have introduced layered duties on key raw materials and finished HMO products, exerting downward pressure on traditional import channels. Many manufacturers reliant on international suppliers are now confronting elevated landed costs, driving supply chain recalibration. In response, enterprises are exploring alternative sourcing strategies, such as establishing local fermentation facilities or securing tariff exemption certifications under specialized trade provisions. While these approaches mitigate cost escalations, they also necessitate significant capital outlays and timeline adjustments for facility certification and technology transfer.

The cumulative effect of these tariffs extends beyond procurement economics to influence market pricing and competitive positioning. Companies with vertically integrated production capabilities are better insulated from duty fluctuations, enabling them to maintain more stable pricing for end users. Conversely, stakeholders lacking upstream integration are compelled to pass on increased costs to consumers or absorb margin compression. The resulting realignment has prompted strategic alliances, as smaller players seek collaborative ventures to share production assets and access duty-reduced inputs. As the tariff landscape continues to evolve, agility in supply chain design and proactive engagement with trade authorities will be critical for preserving market viability.

Revealing Actionable Insights from Application, Source, Product Form, and Distribution Channel Segmentation in the Human Milk Oligosaccharide Market Spectrum

In examining market segmentation, application-focused demand reveals distinct usage patterns across diversified portfolios. Adult nutrition developers are integrating HMOs into dietary supplements, offering gut health benefits to mature demographics, while functional food and beverage producers emphasize prebiotic claims in sports nutrition formulations. Veterinary nutrition companies are incorporating these oligosaccharides into animal feed additives to enhance gut integrity in livestock, and pet food brands are responding to owner preferences for digestive wellness in companion animals. Within clinical nutrition, hospitals are deploying HMO-enriched tube feeding solutions to support patients with compromised gastrointestinal function, demonstrating the ingredient’s therapeutic versatility. The infant nutrition segment remains the sector’s flagship application, where breast milk fortifiers and infant formulas enriched with specific oligosaccharide profiles mimic natural compositions to support early-life immune development. Simultaneously, the pharmaceutical arena is exploring drug delivery matrices and potential therapeutic adjuvants, leveraging HMO’s molecular interactions to improve bioavailability and targeted effects.

Turning to source-based insights, chemical synthesis continues to underpin certain uniform oligosaccharide variants, but enzymatic synthesis methods are rapidly maturing, with both chemically catalyzed systems and β-galactosidase approaches offering scalable, high-purity outputs. Extraction from bovine milk remains a transitional process, while novel human lactation-derived techniques are carving niche applications in precision nutrition. Microbial fermentation, particularly E. coli and yeast derived platforms, is unlocking greater structural diversity, positioning manufacturers to tailor HMO profiles with unprecedented specificity.

Regarding product forms, liquid concentrates and ready-to-use solutions cater to ease-of-application use cases in hospitals and functional beverage sectors, whereas powder formats-available as free-flowing and granular presentations-serve supplement producers seeking stability and dosage flexibility. Syrup-based offerings, differentiated by high and low concentrate compositions, facilitate incorporation into flavor-centric products and specialized dosing regimens.

Finally, distribution channel dynamics reveal that traditional pharmacies, specialty stores, and supermarkets or hypermarkets remain critical for consumer trust and professional advocacy, while brand websites and third-party e-commerce platforms are capturing digitally native buyers through direct-to-consumer models and subscription frameworks. This multifaceted segmentation narrative underscores the necessity for tailored go-to-market strategies aligned with each discrete channel’s operational and regulatory requirements.

This comprehensive research report categorizes the Human Milk Oligosaccharides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Product Form

- Application

- Distribution Channel

Comparative Regional Dynamics Highlighting Distinct Growth Drivers, Regulatory Variances, and Market Adoption across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics in the Americas illustrate a market environment shaped by robust clinical research infrastructures and strategic policy support for ingredient innovation. United States-based manufacturers benefit from advanced fermentation technology clusters and a regulatory framework that increasingly recognizes HMO safety profiles, facilitating expedited novel food notifications. Latin American markets, while nascent, are demonstrating heightened interest in HMO-enriched infant formula, driven by rising birth rates and expanding middle-class healthcare spending.

In Europe, the Middle East, and Africa, regulatory harmonization efforts are underway to align novel ingredient protocols, creating a more cohesive landscape for cross-border product approvals. European bioprocessing hubs continue to lead in enzymatic synthesis patents, while Gulf countries are investing in bio-manufacturing capabilities to reduce import dependencies and bolster local nutraceutical portfolios. Africa’s engagement remains focused on capacity building, with pilot projects exploring bovine milk extraction and fermentation technology transfers to address regional nutritional deficiencies.

The Asia-Pacific region stands out for its dynamic consumer demand and extensive production networks. Countries such as China and India have rapidly expanded microbial fermentation capacity, leveraging cost advantages to serve domestic and export markets. Regulatory bodies in the Asia-Pacific are progressively updating novel food frameworks, creating clearer pathways for HMO-enriched formula approvals. Japan and Australia maintain high safety standards, driving quality benchmarks that influence global supply chain certifications. Across these diverse regions, competitive advantage hinges on the ability to navigate regulatory variances, adapt production models to local cost structures, and engage stakeholders through targeted educational initiatives.

This comprehensive research report examines key regions that drive the evolution of the Human Milk Oligosaccharides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Positioning, Innovation Trajectories, and Collaborative Networks of Leading Organizations Advancing Human Milk Oligosaccharide Commercialization

Leading organizations in the human milk oligosaccharide sphere are distinguishing themselves through integrated innovation pipelines and strategic collaborations. Biotechnology firms are partnering with academic consortia to accelerate enzyme discovery, enhancing yields for chemoenzymatic production platforms. Concurrently, ingredient suppliers are pursuing joint ventures with contract manufacturers to scale microbial fermentation capacity, ensuring consistent supply under evolving quality standards. These alliances not only mitigate capital intensity but also foster shared risk and knowledge exchange.

Manufacturers with end-to-end capabilities, encompassing research, production, and distribution, are particularly adept at capturing emerging market opportunities. Their investments in proprietary downstream purification technologies yield high-purity oligosaccharide isolates, meeting stringent regulatory and customer specifications. On the other hand, specialized biotech start-ups are carving niches by focusing on rare or highly specific HMO structures, appealing to premium segments and clinical trial partners. Pharmaceutical companies are exploring co-development agreements to integrate HMOs as excipients, leveraging the molecules’ functional attributes to enhance drug stability and targeted release.

Overall, the competitive landscape is characterized by collaborative ecosystems, where intellectual property licensing, technology sharing, and co-investment models accelerate time-to-market. This mosaic of partnerships underscores the dual imperatives of technological leadership and operational scalability, which together define the success parameters for major players in the HMO domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Human Milk Oligosaccharides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arla Foods Ingredients Group P/S

- BASF SE

- Chr. Hansen Holding A/S

- Dextra Laboratories Ltd.

- DuPont Nutrition & Biosciences

- Elicityl S.A.

- FrieslandCampina Kievit B.V.

- Glycom A/S

- Glycom A/S

- Glycosyn LLC

- Inbiose NV

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Jennewein Biotechnologie GmbH

- Jennewein Biotechnologie GmbH

- Koninklijke DSM N.V.

- KYOWA HAKKO BIO CO., LTD.

- Morinaga Milk Industry Co., Ltd.

- Nestlé S.A.

Strategic Imperatives for Industry Leaders to Enhance Competitive Advantage through Innovation, Diversification, and Regulatory Engagement in Oligosaccharide Markets

Industry leaders should prioritize the expansion of local manufacturing footprints to circumvent tariff-induced cost pressures while achieving closer proximity to key consumer markets. Establishing modular fermentation facilities that leverage advanced bioreactor designs can enable rapid capacity scaling and flexible production of diverse oligosaccharide profiles. Equally critical is the deepening of relationships with regulatory bodies through proactive safety dossier submissions and participation in industry working groups, fostering an anticipatory dialogue to shape emerging compliance frameworks.

Portfolio diversification must remain at the forefront of strategic agendas. Leaders are advised to broaden their application matrix beyond traditional infant nutrition, tapping into adult digestive health, clinical nutrition support, and therapeutic delivery opportunities. Cultivating cross-sector partnerships-particularly with pharmaceutical and veterinary nutrition stakeholders-can unlock novel use cases and revenue streams. Concurrently, investments in digital direct-to-consumer channels will enhance brand visibility and data-driven consumer insights, essential for targeted marketing and ongoing product optimization.

Finally, to maintain a sustainable innovation pipeline, organizations should embed open innovation practices, inviting external researchers and technology providers to contribute novel HMO structures and processing methodologies. By codifying collaborative IP frameworks, industry players can share R&D risks while retaining commercialization rights. Collectively, these actionable imperatives will equip leaders to navigate complex trade environments, expedite product launches, and sustain competitive advantage in the evolving human milk oligosaccharide landscape.

Detailing a Rigorous Mixed-Method Research Framework Integrating Primary Expert Consultations and Secondary Data Synthesis to Ensure Analytical Robustness

This research integrates a mixed-method approach, commencing with a comprehensive secondary analysis of peer-reviewed journals, patent databases, and publicly accessible regulatory filings to establish a foundational understanding of technological and policy developments. Data synthesis encompassed qualitative insights from regulatory guidance documents and quantitative trend analyses of production capacity disclosures. To validate these findings, a series of structured interviews was conducted with thought leaders spanning academic researchers, manufacturing executives, and supply chain specialists.

Primary data collection involved in-depth conversations with senior R&D managers, procurement directors, and clinical nutritionists, elucidating nuanced perspectives on innovation bottlenecks and market adoption drivers. Triangulation of these interview insights with secondary data ensured robustness, while thematic coding techniques highlighted recurring patterns and emergent themes. Geographic representation was carefully considered, with participant selection across North America, Europe, and Asia-Pacific to capture regional variances in regulatory approaches and consumer preferences.

Finally, a peer review process engaged external experts to critique interim findings, refine analytical frameworks, and ensure methodological transparency. Through this iterative validation cycle, the research outcomes presented herein offer a high degree of credibility, supporting strategic decision-making in the dynamic human milk oligosaccharide domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Human Milk Oligosaccharides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Human Milk Oligosaccharides Market, by Source

- Human Milk Oligosaccharides Market, by Product Form

- Human Milk Oligosaccharides Market, by Application

- Human Milk Oligosaccharides Market, by Distribution Channel

- Human Milk Oligosaccharides Market, by Region

- Human Milk Oligosaccharides Market, by Group

- Human Milk Oligosaccharides Market, by Country

- United States Human Milk Oligosaccharides Market

- China Human Milk Oligosaccharides Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Core Findings to Illuminate Future Prospects, Address Industry Constraints, and Chart a Visionary Path for Human Milk Oligosaccharide Advancement

The convergence of advanced synthesis techniques, evolving regulatory clarity, and strategic market segmentation has established human milk oligosaccharides as a transformative ingredient platform. Key findings reveal that diversified production pathways, from enzymatic catalysis to microbial fermentation, are essential to meeting the burgeoning complexity of application-specific requirements. Meanwhile, cumulative tariff measures in the United States underscore the necessity for supply chain resilience and localized manufacturing investments.

Segmentation analysis highlights the expansive reach of HMOs across adult, animal, clinical, infant, and pharmaceutical domains, each with unique formulation and go-to-market dynamics. Regional insights further emphasize that success will depend on navigating distinct regulatory landscapes and consumer demand profiles in the Americas, EMEA, and Asia-Pacific. Competitive analysis underscores the critical role of collaborative ecosystems, where technology sharing and joint ventures accelerate time-to-market and foster sustainable innovation.

Collectively, these insights chart a clear pathway forward: organizations that couple technological leadership with agile operational models and proactive regulatory engagement will be best positioned to capture the multidimensional growth opportunities presented by human milk oligosaccharides. As the market continues to mature, stakeholders must remain vigilant, adaptive, and collaborative to fully realize the promise of this dynamic ingredient class.

Connect with Ketan Rohom to Capitalize on Comprehensive Human Milk Oligosaccharide Market Intelligence and Advance Strategic Decision-Making Immediately

Engaging directly with Ketan Rohom opens the door to a partnership grounded in deep market expertise and actionable insights. As Associate Director of Sales & Marketing, he stands ready to guide your strategic planning process, ensuring you leverage the full spectrum of data-driven findings and trend analyses presented in this report. By initiating a conversation, you gain access to tailored support, customized briefing sessions, and exclusive deliverables that align with your organizational goals. Beyond report procurement, this collaboration facilitates ongoing dialogue regarding emerging opportunities and evolving best practices in the human milk oligosaccharides domain.

Taking the next step is seamless. Reach out to schedule a comprehensive consultation that will unpack the strategic implications of each insight, from segmentation nuances to tariff impacts and regional dynamics. Armed with this tailored guidance, you can refine product pipelines, optimize supply chain strategies, and position your enterprise at the forefront of innovation. Don’t let decision-making gaps delay your competitive advantage; Ketan’s expertise will ensure you capitalize on the market’s transformative potential. Initiate your engagement today and secure an information edge that drives sustainable growth and maximizes ROI in the expanding human milk oligosaccharides market.

- How big is the Human Milk Oligosaccharides Market?

- What is the Human Milk Oligosaccharides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?