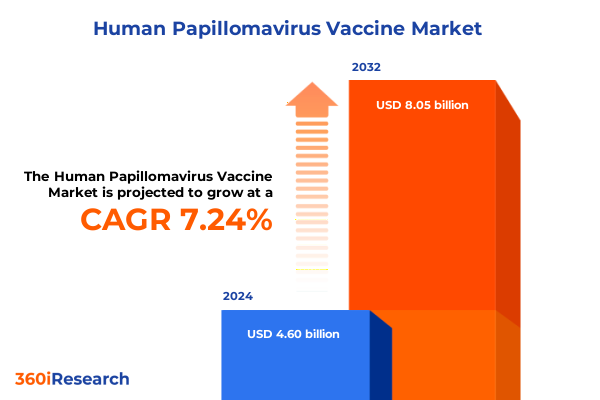

The Human Papillomavirus Vaccine Market size was estimated at USD 4.93 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 7.26% to reach USD 8.05 billion by 2032.

Bridging Prevention and Public Health: Exploring the Transformative Journey of HPV Vaccination in Cancer Prevention and Healthcare Innovation

Human papillomavirus (HPV) remains one of the most pervasive viral infections worldwide, directly implicated in nearly all cervical cancer cases and a growing number of oropharyngeal and other anogenital malignancies. Each year, HPV contributes to approximately 660,000 new cases of cervical cancer globally, with more than 95 percent of those cases linked to high-risk HPV strains 16 and 18. Because of its prevalence and oncogenic potential, HPV poses a critical public health challenge, demanding robust vaccination initiatives and sustained investment from both public and private stakeholders. In the United States, coverage trends reveal that while over three quarters of adolescents had initiated vaccination by 2023, only 61 percent were up to date on the full series, leaving significant gaps in population protection and highlighting the need for enhanced outreach and education.

The evolution of HPV vaccines from the original bivalent formulations targeting HPV types 16 and 18 to quadrivalent and, most recently, nine-valent options has markedly expanded the spectrum of protection. Today’s vaccines are proven to prevent not only cervical precancerous lesions but also vulvar, vaginal, anal, penile, and oropharyngeal cancers linked to multiple HPV types. These scientific advancements, coupled with global initiatives such as the World Health Organization’s call to vaccinate 90 percent of girls by age 15, form the cornerstone of a cohesive strategy aimed at cervical cancer elimination by 2030. As stakeholders gather an increasingly complex array of clinical and real-world evidence, the interplay of epidemiological data, vaccine technology, and immunization policy will determine the next phase of progress against HPV-related disease.

How Single-Dose Strategies, mRNA Advances, and Expanded Indications Are Redefining the HPV Vaccine Landscape Worldwide

Recent breakthroughs in HPV vaccination underscore a paradigm shift in how immunization programs are designed and delivered. In October 2024, the World Health Organization added a fourth HPV vaccine, Cecolin®, to its prequalified list for use in a single-dose schedule, validating off-label data that demonstrated efficacy comparable to traditional multi-dose regimens. This endorsement has already enabled 57 countries to adopt single-dose schedules as of September 2024, reaching an additional 6 million girls with life-saving protection in 2023 alone. Concurrently, Merck has engaged with regulatory agencies to evaluate potential single-dose regimens for its nine-valent Gardasil 9 vaccine, asserting that any transition away from the established two- or three-dose schedules must be grounded in robust, non-inferiority data and comprehensive efficacy profiles across genders, including extended efficacy data in men.

Moreover, population-level policies are evolving to extend HPV vaccine recommendations across broader age ranges and male populations. New research from the American Society of Clinical Oncology demonstrates that immunizing young males not only mitigates anal and oropharyngeal cancers but also contributes to herd immunity, reinforcing the value of gender-neutral vaccination policies. Advances in vaccine technology, including exploratory work on mRNA-based and therapeutic HPV vaccine candidates, promise to enhance immunogenicity and adapt dosing schedules, potentially ushering in a new era of precision-tailored HPV prophylaxis. These converging trends in dosing flexibility, population expansion, and technological innovation are fundamentally redefining the global HPV vaccine landscape.

Evaluating the Cumulative Impact of 2025 U.S. Tariff Measures on HPV Vaccine Production, Supply Chains, and Distribution Dynamics

The 2025 policy environment in the United States has introduced significant tariff measures that reverberate across the HPV vaccine supply chain. The imposition of 20–25 percent duties on active pharmaceutical ingredients (APIs) sourced from China and India, the primary producers of bulk vaccine intermediates, has directly increased the cost base for vaccine manufacturing facilities operating in North America. Simultaneously, new 15 percent tariffs on medical packaging, including glass vials and cold-chain insulation materials, have escalated downstream validation costs and extended lead times for final product release. These cumulative cost pressures are compelling major vaccine producers to reassess their sourcing strategies and accelerate diversification of supply networks to mitigate exposure to imported inputs.

Beyond these global tariff adjustments, Section 301 measures targeting Chinese imports have intensified duties on critical medical devices integral to vaccination campaigns. Syringes and needles, essential for vaccine administration, now attract duties as high as 100 percent, while medical gloves and disposable facemasks face 50 percent tariffs beginning January 2025. The aggregated effect of these policies is manifest in stretched procurement schedules, inventory shortages, and upward pressure on per-dose costs-factors that threaten to widen access gaps in underserved communities. In response, several multinational pharmaceutical companies have announced multi-billion-dollar investments in U.S. manufacturing capacity, signaling a strategic pivot toward onshore production to circumvent tariff risks and ensure stable vaccine supplies amid evolving trade dynamics.

Unlocking Strategic Insights Through Vaccine Type, End User, Distribution, Age, and Gender Segmentation in the HPV Vaccine Market

Analyzing the market through a vaccine type lens reveals distinct adoption curves and procurement strategies among stakeholders. The established quadrivalent formulations continue to dominate entry-level programs in many emerging markets due to legacy infrastructure, while nine-valent vaccines are increasingly incorporated into national immunization schedules in advanced economies, driven by the desire for broader oncogenic HPV coverage. Bivalent vaccines retain footholds in several low- and middle-income countries, leveraged for their cost-effectiveness and simplified antigen profile.

Diversity in end-user settings, such as clinics, hospitals, and public health centers, shapes distribution priorities and education outreach. Hospital systems often lead with comprehensive adolescent and adult dosing programs, whereas clinics and public health centers play a critical role in catch-up campaigns and school-based initiatives. Across distribution channels, hospital pharmacies remain central to initial rollouts and specialty immunization services, while retail and online pharmacies have emerged as pivotal access points for adult populations seeking convenience. Age segmentation further underscores the need for differentiated messaging: programs targeting the 9-14 age cohort emphasize foundational immunity prior to viral exposure, whereas strategies for the 15-26 and older demographics focus on completing series schedules and looser catch-up protocols. Gender segmentation informs tailored communication tactics that address unique perceptions and barriers, ensuring that both female and male cohorts are engaged with appropriate risk and benefit narratives.

This comprehensive research report categorizes the Human Papillomavirus Vaccine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Age Group

- Gender

- End User

- Distribution Channel

Exploring Distinct HPV Vaccine Adoption Patterns, Policy Drivers, and Coverage Trends Across the Americas, EMEA, and Asia-Pacific Regions

'The Americas' market environment reflects robust public-private collaboration to elevate HPV vaccine uptake, underpinned by policy mandates in several U.S. states and provincial programs in Canada. Adolescent vaccination rates plateaued at roughly 61 percent up-to-date status in 2023, prompting federal and state agencies to intensify school-based initiatives and leverage Medicaid outreach to close immunity gaps. Stakeholder engagement across community health centers and private health systems has been essential to address disparities in coverage between urban and rural populations.

In 'Europe, Middle East & Africa', diverse health infrastructure and funding mechanisms yield a mosaic of uptake patterns. Western European nations have integrated nine-valent vaccines into publicly funded schedules, achieving coverage rates exceeding 70 percent among pre-teens. In contrast, access in parts of the Middle East and Africa remains constrained by financing challenges and supply limitations, although Gavi-supported programs and single-dose adoption are expanding immunization footprints in under-served regions.

The 'Asia-Pacific' region is emerging as a dynamic growth driver following the approval of domestic high-valent vaccines such as Cecolin®9 in China. Regulatory clearance by the National Medical Products Administration on June 5, 2025, for a locally developed nine-valent vaccine has catalyzed national manufacturing scale-up and price competition, setting new benchmarks for regional self-sufficiency and supply resiliency. Meanwhile, Australia and parts of Southeast Asia continue to modernize immunization infrastructures, integrating digital registries and catch-up strategies to expand cohort coverage beyond early adolescence.

This comprehensive research report examines key regions that drive the evolution of the Human Papillomavirus Vaccine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major HPV Vaccine Manufacturers: Market Strategies, Portfolio Innovations, and Competitive Dynamics Shaping the Industry

Merck & Co. remains the leading commercial innovator with its nine-valent Gardasil 9 vaccine, which holds broad global approvals and a robust real-world safety record. Despite ongoing regulatory discussions regarding reduced dosing regimens, Merck maintains that existing two- and three-dose schedules must prevail until comprehensive non-inferiority data are available to satisfy stringent FDA and European regulators. The company’s continued investment in post-licensure studies and epidemiological surveillance underpins its position as a market anchor for HPV immunization programs.

GlaxoSmithKline, the manufacturer of Cervarix, has restructured its pipeline priorities, discontinuing a candidate therapeutic HPV vaccine from phase 2 studies due to anticipated lack of best-in-class potential. At the same time, Cervarix usage has declined in favor of quadrivalent and nine-valent options, and GSK has consolidated its resources toward other priority vaccines that align with strategic growth imperatives.

Xiamen Innovax Biotech has distinguished itself through the development of Cecolin®9, China’s first domestically produced nine-valent HPV vaccine. NMPA approval in June 2025 positions Innovax as the second manufacturer globally with full high-valent production capabilities, poised to leverage cost efficiencies and WHO single-dose prequalification to expand access in multiple low- and middle-income markets. This strategic entry disrupts established procurement channels and introduces new competitive dynamics through differentiated pricing and supply reliability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Human Papillomavirus Vaccine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca plc

- Beijing Wantai Biological Pharmacy Enterprise Co., Ltd

- Bharat Biotech International Ltd

- Biological E. Limited

- CSPC Pharmaceutical Group Ltd

- Dynavax Technologies Corporation

- Emergent BioSolutions Inc.

- GlaxoSmithKline plc

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novavax, Inc.

- Pfizer Inc.

- Sanofi S.A.

- Serum Institute of India Ltd

- Shenzhen Kangtai Biological Products Co., Ltd

- Sinovac Biotech Ltd

- Walvax Biotechnology Co., Ltd

- Xiamen Innovax Biotech Co., Ltd

- Yuxi Zerun Biotechnology Co., Ltd

- Zydus Lifesciences Ltd

Actionable Strategies for Industry Leaders to Enhance HPV Vaccine Access, Optimize Supply Chains, and Drive Public Health Impact

Industry leaders should engage proactively with global health authorities to secure label expansions and off-label dosing endorsements for single-dose schedules, leveraging emerging efficacy data to expedite public health approvals and reduce logistical burdens. Establishing multi-stakeholder working groups can streamline evidence generation and standardize regulatory pathways across jurisdictions, minimizing delays in program rollouts.

To mitigate tariff-driven cost pressures, organizations must diversify their supplier base, explore near-shoring of critical API and packaging production, and invest in integrated manufacturing networks. Collaborations with government partners and incentives for domestic capacity expansion will be essential to sustain affordable supply chains in a high-tariff environment.

Furthermore, targeted communication strategies that harness segmentation insights should be deployed to address coverage gaps across age, gender, and end-user settings. Tailored digital engagement platforms and school-based outreach campaigns can enhance uptake among adolescents, while specialized initiatives aimed at adult catch-up cohorts and male populations will optimize herd immunity and long-term cancer prevention goals.

Comprehensive Research Methodology Outline: Integrating Primary Interviews, Secondary Data, and Segmentation Analysis for HPV Vaccine Market Insights

Our research integrates comprehensive secondary data analysis, leveraging peer-reviewed journals, official regulatory releases, and global health organization publications to establish foundational market insights. We complemented this with primary research, conducting one-on-one interviews with key opinion leaders, supply chain experts, and immunization program directors to validate findings and capture nuanced operational perspectives.

Segmentation frameworks were constructed around vaccine type, end-user channel, distribution model, age group, and gender divisions, enabling granular assessment of market dynamics. Data triangulation methodologies merged quantitative input from national immunization coverage surveys with qualitative feedback from stakeholder consultations, ensuring robustness and reliability of insights.

Throughout the study, we employed iterative validation processes, cross-referencing real-world uptake data against evolving policy landscapes to maintain alignment with current developments. This hybrid approach facilitated the generation of actionable recommendations, grounded in both empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Human Papillomavirus Vaccine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Human Papillomavirus Vaccine Market, by Vaccine Type

- Human Papillomavirus Vaccine Market, by Age Group

- Human Papillomavirus Vaccine Market, by Gender

- Human Papillomavirus Vaccine Market, by End User

- Human Papillomavirus Vaccine Market, by Distribution Channel

- Human Papillomavirus Vaccine Market, by Region

- Human Papillomavirus Vaccine Market, by Group

- Human Papillomavirus Vaccine Market, by Country

- United States Human Papillomavirus Vaccine Market

- China Human Papillomavirus Vaccine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on the Strategic Imperatives and Future Pathways in Advancing HPV Vaccination Efforts Globally

The HPV vaccine ecosystem stands at a pivotal juncture, propelled by dosing innovations, policy shifts, and evolving competitive landscapes. Single-dose prequalification and expanded valency options have laid the groundwork for more inclusive, cost-effective immunization strategies, while tariff dynamics and supply chain challenges underscore the importance of diversified production networks.

Looking ahead, success will hinge on the ability of stakeholders to synchronize evidence generation with regulatory advocacy, operational resilience with strategic investments, and segmentation-tailored outreach with equitable access goals. By harmonizing these imperatives, the industry can accelerate progress toward the global elimination of HPV-related cancers, safeguard public health gains, and foster sustainable market growth.

Connect with Ketan Rohom to Unlock Exclusive HPV Vaccine Market Research and Tailored Strategic Insights

For personalized insights and to explore how our comprehensive analysis can support your strategic goals in the HPV vaccine sector, connect with Ketan Rohom, Associate Director of Sales & Marketing. With extensive expertise in vaccine market dynamics and tailored go-to-market strategies, Ketan can guide you through our robust research findings and help align your objectives with actionable intelligence. Reach out directly to arrange a detailed briefing and gain exclusive access to our in-depth market research report.

- How big is the Human Papillomavirus Vaccine Market?

- What is the Human Papillomavirus Vaccine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?