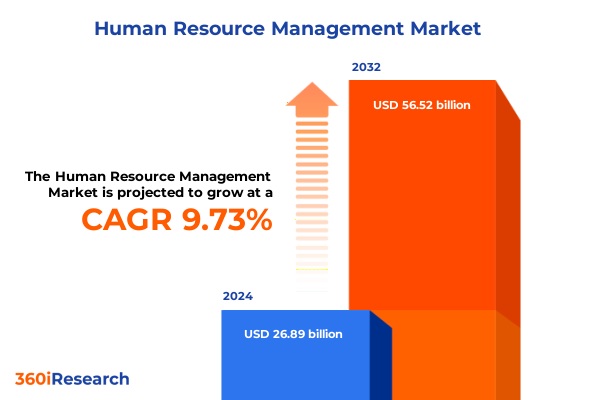

The Human Resource Management Market size was estimated at USD 29.37 billion in 2025 and expected to reach USD 32.08 billion in 2026, at a CAGR of 9.80% to reach USD 56.52 billion by 2032.

Human Resource Management is undergoing profound evolution driven by digital innovation, workforce expectations, and global economic imperatives

Human resource management today reflects a convergence of technological breakthroughs, changing workforce expectations, and evolving global economic conditions. Organizations are called to reimagine traditional HR functions, embracing digital platforms that enable seamless employee experiences from recruitment and onboarding through performance management and career development. Against this backdrop, human capital strategies must align with broader business imperatives to foster agility, resilience, and sustainable growth.

As enterprises navigate this dynamic landscape, the integration of data analytics, artificial intelligence, and automated workflows emerges as a critical enabler of strategic decision-making. By harnessing these capabilities, HR leaders can deliver personalized experiences at scale, anticipate talent needs, and cultivate a culture of continuous learning. Moreover, the shift toward hybrid work models and distributed teams demands new approaches to engagement, collaboration, and organizational design.

Looking ahead, the successful organizations will be those that not only adopt emerging technologies but also embed inclusive practices and purpose-driven initiatives into their HR frameworks. By balancing digital innovation with human-centric values, HR departments can elevate their role from administrative support to strategic growth partners.

Organizations are embracing transformative shifts in HR strategies through AI integration, employee-centric models, and agile workforce design in response to market demands

Organizations are undertaking transformative shifts in human resource practices to remain competitive in an increasingly complex environment. Leaders are prioritizing the implementation of artificial intelligence to streamline talent acquisition, elevate learning and development, and automate routine administrative tasks. Such AI-enabled tools not only reduce time-to-hire but also enhance candidate and employee experiences by delivering tailored insights and recommendations in real time.

Concurrently, the emphasis on employee-centric models has intensified. Companies are reengineering benefits, performance management, and career pathing to reflect workforce preferences for flexibility, wellbeing support, and purposeful work. This focus has encouraged the adoption of agile methodologies within HR, characterized by rapid iteration of policies, continuous feedback loops, and cross-functional collaboration to address emerging challenges swiftly.

Moreover, the rise of the contingent workforce and gig economy has prompted HR teams to expand their scope beyond full-time employees. They are developing new engagement and compliance strategies for temporary, contract, and freelance talent. Such initiatives require robust partner ecosystems and sophisticated workforce planning capabilities to ensure organizational agility and maintain regulatory adherence across geographies.

Analysis of how 2025 United States import tariffs continue to reshape labor markets, talent acquisition costs, and organizational workforce planning across industries

The imposition of broad import tariffs by the United States administration in early 2025 has had a material effect on labor markets and organizational cost structures. Recent bilateral deals with key Asian partners introduced tariffs up to 19 percent on selected imports, prompting concerns among U.S. manufacturers reliant on imported components for supply chain continuity and production planning. In response, many organizations accelerated capital expenditures ahead of these measures but subsequently encountered a slowdown in equipment spending, as core capital goods orders dipped by 0.7 percent in June, reflecting heightened policy uncertainty and elevated input costs.

Economic forecasts have adjusted downward amid this environment of increased trade barriers. The Organisation for Economic Co-operation and Development notes that U.S. GDP growth is projected to decelerate to 2.2 percent in 2025, a decline from prior expectations, driven in part by raised tariffs with Canada and Mexico that add 25 percentage points to most merchandise imports as of April. These developments translate into upward pressure on consumer prices and wage negotiations, influencing compensation strategies across industries.

Sector-specific analyses highlight that manufacturing and mining firms face the highest average effective tariff rates-ranging from 18 to 22 percent-compelling CFOs to diversify supply chains and explore alternative domestic suppliers to mitigate cost disruptions. As companies adapt, human resource leaders must factor in these changes by recalibrating talent acquisition budgets, adjusting benefits frameworks to offset inflationary impacts, and revising workforce plans to address potential shifts in production footprints.

Deep segmentation insights reveal tailored HR approaches across service software deployment organization size application and industry dimensions for strategic advantages

A nuanced segmentation framework reveals how human resource solutions must be tailored to align with specific organizational needs and market contexts. When considering component offerings, service models encompass integration and deployment capabilities, ongoing support and maintenance provisions, as well as specialized training and consulting engagements. Complementing these services, software platforms deliver specialized modules spanning core HR administration, employee collaboration and engagement tools, recruitment and applicant tracking systems, robust talent management solutions, and sophisticated workforce planning and analytics functionalities.

Deployment preferences further differentiate market requirements, with cloud-based implementations appealing to organizations seeking scalability, reduced infrastructure overhead, and rapid feature updates, while on-premise configurations remain relevant for enterprises prioritizing data sovereignty and bespoke customization. In parallel, organization size influences solution complexity; large enterprises often require fully integrated suites capable of handling global payroll and compliance at scale, whereas small and medium enterprises favor modular solutions that provide core functionalities without excess complexity.

Applications for HR technology span compliance and risk management protocols, onboarding experiences including employee training pathways, payroll administration and benefits coordination, performance management intertwined with employee engagement initiatives, and targeted recruitment and talent acquisition processes. Finally, sector-specific requirements underscore the importance of industry-aligned solutions, from regulatory-driven frameworks in banking, financial services, and insurance to adaptable scheduling and workforce management in healthcare, and technology-driven analytics in IT and telecommunications. By mapping these segmentation dimensions against organizational priorities, HR leaders can select and deploy solutions that deliver maximum strategic value.

This comprehensive research report categorizes the Human Resource Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Organization size

- Application

- Industry

Regional HR dynamics in the Americas Europe Middle East Africa and Asia Pacific unveil unique talent challenges cultural diversities and economic drivers shaping workforce strategies

Regional HR dynamics manifest distinct challenges and opportunities across the Americas. In North America, organizations continue to invest in digital HR platforms that facilitate remote work, enhanced wellbeing benefits, and data-driven talent analytics. Latin American markets, by contrast, emphasize workforce reskilling programs and social dialogue initiatives to address evolving labor regulations and talent retention pressures.

Within Europe, Middle East, and Africa, regulatory complexity drives demand for compliance-first HR solutions. The European Union’s evolving data protection and employment legislation requires platforms capable of navigating GDPR provisions and cross-border labor laws. Middle Eastern enterprises focus on nationalization mandates and localization strategies, while African markets are embracing mobile-centric learning and talent marketplaces to bridge geographic and infrastructural gaps.

Asia-Pacific presents a diverse human resource mosaic, encompassing advanced markets like Japan and Australia that prioritize predictive analytics and talent mobility, alongside emerging economies in Southeast Asia where fundamental workforce digitization and multilingual support take precedence. In all these regions, cultural nuance and economic volatility necessitate flexible HR architectures that can scale and adapt to shifting geopolitical and macroeconomic conditions.

This comprehensive research report examines key regions that drive the evolution of the Human Resource Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key companies in the HR domain are leveraging innovation strategic partnerships and customer-centric solutions to gain competitive advantage in an evolving market environment

Leading HR technology providers are driving the competitive landscape through continuous innovation and strategic partnerships. Workday, for example, has unveiled its next generation of AI-powered Illuminate Agents designed to accelerate hiring workflows, enhance frontline worker experiences, and streamline financial and HR operations. These agents leverage responsible AI principles to deliver tailored insights, automate contract workflows, and enable self-service capabilities that boost productivity across diverse organizational functions. This agentic AI framework underscores Workday’s commitment to integrating intelligence with human oversight.

Oracle has similarly expanded its AI agent portfolio within its Fusion Cloud Human Capital Management suite. The new role-based agents automate end-to-end HR tasks, from career planning guidance and performance goal setting to onboarding assistance and contract analysis. By embedding these agents directly into core workflows, Oracle empowers HR leaders to optimize administrative processes and enhance the overall employee experience through contextual AI recommendations.

Furthermore, Oracle Cloud Infrastructure’s integration with xAI’s Grok 3 model exemplifies the trend toward multi-vendor AI ecosystems, offering enterprises access to advanced natural language capabilities within a secure cloud environment. This partnership enables organizations to employ third-party AI models alongside proprietary solutions, thus providing unparalleled flexibility in designing AI-driven HR applications that align with corporate security and compliance requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Human Resource Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- ADP, Inc.

- BambooHR, Inc.

- Bullhorn, Inc.

- Cegid Group

- ClearCompany, Inc.

- Cornerstone Galaxy

- Dayforce, Inc.,

- Gusto, Inc.

- iCIMS, Inc.

- Infor, Inc.

- Insperity Services, L.P.

- International Business Machines Corporation

- Jobvite, Inc.

- Lever by Employ Inc.

- Namely, Inc.

- Oracle Corporation

- Paycom Software, Inc.

- Paycor, Inc.

- Paylocity Corporation

- Rippling, Inc.

- SAP SE

- TriNet Group, Inc.

- UKG Inc.

- Workday, Inc.

- WorkForce Software, LLC

- Zoho Corporation

Actionable recommendations equip industry leaders with strategies to optimize talent management foster employee engagement and navigate shifting regulatory and economic landscapes

Industry leaders should prioritize the adoption of integrated AI capabilities that complement existing HR infrastructures, ensuring that automation initiatives are aligned with organizational goals and compliance standards. By conducting pilot programs with focused use cases, HR teams can validate the efficacy of AI agents in real-world scenarios before scaling deployments across the enterprise.

To foster a culture of continuous improvement, leaders must invest in upskilling HR professionals on data literacy and AI governance. Equipping teams with the knowledge to interpret analytics outputs and manage algorithmic bias will strengthen decision-making processes and build stakeholder trust. Collaboration between HR, IT, and legal departments is essential to establish robust data privacy frameworks that uphold regulatory requirements and safeguard employee information.

Moreover, embracing workforce segmentation and regional customization enables tailored talent strategies that resonate with local labor markets and cultural contexts. Organizations should refine their vendor evaluation criteria to include flexibility in deployment models-cloud or on-premise-and alignment with industry-specific compliance mandates. Finally, continuous monitoring of macroeconomic indicators, such as tariff impacts and labor market trends, will allow HR leaders to proactively adjust compensation models and workforce plans, preserving agility in times of economic uncertainty.

Rigorous mixed-methods research methodology combines quantitative analysis qualitative interviews and validation protocols to ensure robust and actionable HR market insights

This research employs a mixed-methods approach combining quantitative surveys, financial and operational data analysis, and qualitative interviews with senior HR executives across key global regions. Data collection was conducted over a six-month period to capture evolving trends and ensure time-relevant insights. The quantitative component includes structured surveys distributed to more than 300 HR leaders, focusing on technology adoption, workforce planning, and talent management metrics.

Complementing these surveys, financial and operational datasets were aggregated from reputable industry bodies and regulatory filings to assess macroeconomic influences, such as tariff impacts, capital expenditure patterns, and sectoral investment decisions. The qualitative strand comprises in-depth interviews with experts in HR technology, labor economics, and organizational behavior, providing contextual nuance to the quantitative findings.

To validate the robustness of insights, triangulation techniques were applied, cross-referencing survey results with third-party data sources and interview narratives. This ensured consistency and mitigated potential biases. Ethical considerations, including anonymization of participant identities and adherence to data protection regulations, underpinned the research design, reinforcing the credibility and applicability of the recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Human Resource Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Human Resource Management Market, by Component

- Human Resource Management Market, by Deployment

- Human Resource Management Market, by Organization size

- Human Resource Management Market, by Application

- Human Resource Management Market, by Industry

- Human Resource Management Market, by Region

- Human Resource Management Market, by Group

- Human Resource Management Market, by Country

- United States Human Resource Management Market

- China Human Resource Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Conclusion and strategic imperatives outline the roadmap for HR transformation emphasizing resilience agility and value creation in a rapidly changing global context

The intersection of digital innovation, shifting workforce expectations, and global economic forces underscores the need for HR functions to evolve from transactional service providers to strategic growth enablers. By embedding AI-driven automation and advanced analytics into core HR processes, organizations can enhance talent acquisition efficiency, personalize employee experiences, and optimize resource allocation across functions.

Regional and industry-specific variations highlight the importance of customized solutions that address local compliance, cultural, and economic contexts. Organizations that adopt a segmentation-driven approach will be better equipped to align HR strategies with business priorities, ensuring sustained competitive advantage. Moreover, proactive management of macroeconomic factors-such as import tariffs-will enable HR leaders to anticipate cost pressures and recalibrate workforce planning accordingly.

Ultimately, the successful HR organizations of the future will balance technological prowess with a people-centric ethos. Through continuous learning, agile methodologies, and collaborative governance frameworks, HR teams can navigate uncertainty and drive enduring value. The insights presented herein provide a strategic roadmap for achieving this transformation, empowering decision-makers to lead their organizations toward greater resilience and performance in a rapidly changing world.

Connect with Ketan Rohom Associate Director Sales and Marketing to access the comprehensive human resource management market research report and drive informed decisions

To explore the full breadth of these insights and leverage robust market intelligence tailored to your strategic needs, reach out to Ketan Rohom at Associate Director, Sales & Marketing. He stands ready to guide you through the comprehensive human resource management market research report, ensuring you obtain the data and analysis needed to make confident, impactful decisions. Engage directly to arrange a personalized consultation and secure early access to proprietary findings that can drive your organization’s talent strategies forward.

- How big is the Human Resource Management Market?

- What is the Human Resource Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?