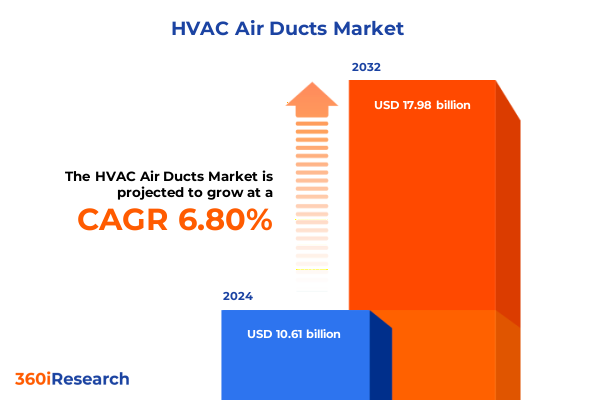

The HVAC Air Ducts Market size was estimated at USD 11.33 billion in 2025 and expected to reach USD 12.10 billion in 2026, at a CAGR of 6.81% to reach USD 17.98 billion by 2032.

Setting the Stage for HVAC Air Duct Market Exploration as Industry Embraces Energy Efficiency, Technological Advancement, and Shifting Regulatory Mandates

The HVAC air duct sector sits at a pivotal intersection of energy management and indoor environmental quality. Duct leakage can result in the loss of up to thirty percent of conditioned airflow, a phenomenon that not only compromises comfort but also escalates operational costs and strains system lifecycle sustainability. Industry standards such as ASHRAE 90.1 demonstrate that rigorous duct sealing and proper system design can yield energy savings of nearly thirty percent compared to non-compliant configurations

Emerging digitalization trends are reshaping the very fabric of ductwork solutions. Smart air ducts equipped with sensors for temperature, humidity, airflow, and particulate monitoring now offer remote diagnostics and predictive maintenance capabilities, reducing unplanned downtime and optimizing energy usage. These connected systems empower facility managers to fine-tune performance in real time, aligning operational efficiency with occupant comfort

Regulatory imperatives are also driving modernization across both new construction and retrofit applications. The revised Energy Performance of Buildings Directive in the European Union mandates stricter performance criteria for ductwork, while the U.S. Department of Energy continues to emphasize duct sealing best practices to enhance indoor air quality and lower energy waste. Such measures are heightening demand for advanced duct materials and installation techniques that meet evolving codes and sustainability objectives

Embracing Next-Generation HVAC Air Duct Innovations Driven by Smart Connectivity, Sustainable Materials, and Evolving Workforce Dynamics

The integration of Internet of Things connectivity into ductwork has ushered in a new era of system intelligence. By embedding sensors and actuators within duct panels, manufacturers now deliver real-time data on airflow patterns, temperature gradients, and humidity levels. Building operators can leverage analytics platforms to predict maintenance needs, optimize ventilation rates, and minimize energy consumption, marking a significant departure from reactive maintenance models

Sustainability has become a centerpiece of material innovation in the duct market. Partnerships such as the October 2024 collaboration between Lindab and Tata Steel to supply green steel demonstrate how advanced materials can reduce thermal loss and support circular economy objectives. Composite and recycled materials are being engineered to deliver superior insulation properties, corrosion resistance, and lightweight construction, accelerating adoption in eco-conscious projects

Augmented reality tools are transforming both installation and service workflows, guiding technicians through complex layouts with step-by-step, on-site visual overlays. At the same time, evolving workforce dynamics present challenges and opportunities: the projected shortage of HVAC technicians by 2025 has prompted industry stakeholders to invest heavily in apprenticeship and training initiatives that equip the next generation of professionals with digital and sustainability skill sets

Navigating the Complexities of 2025 U.S. Tariff Adjustments and Their Far-Reaching Effects on HVAC Air Duct Manufacturing, Costs, and Supply Chains

In early 2025, U.S. policymakers enacted layered tariff measures that directly affect HVAC duct manufacturing. Imports of duct components and raw materials from China now carry a twenty percent surcharge, while steel and aluminum inputs remain subject to a twenty-five percent levy. Concurrently, goods meeting USMCA origin rules are exempt from these duties, providing relief for compliant Mexican and Canadian producers and reshaping procurement strategies across North America

The cumulative cost pressures are substantial. Industry analysts forecast price increases as manufacturers absorb higher input costs for metal headers, mounting hardware, and specialized fittings. These expenses are being passed through the supply chain, with equipment and installation charges potentially rising by up to forty percent. At the same time, supply chain disruptions have emerged as a critical concern, as increased customs scrutiny and shifting sourcing protocols extend lead times for critical components such as heat exchangers and control panels

To mitigate these impacts, leading contractors and OEMs are diversifying supplier bases, seeking alternative domestic steel mills, and accelerating the adoption of USMCA-sourced metal stock. Strategic stockpiling of pre-tariff inventories and collaborative forecasting with key suppliers are also being employed to buffer short-term volatility and maintain project schedules.

Unlocking Multifaceted Perspectives on HVAC Air Duct Performance Through Shape, End-Use, Insulation, Material Type, and Application Lenses

Analyzing the market through shape configurations reveals distinct performance and installation attributes. Oval profiles offer streamlined airflow ideal for low-ceiling spaces, while rectangular systems strike a balance between structural rigidity and cross-sectional area. Round ducts, prized for their minimal surface area relative to volume, consistently deliver superior pressure characteristics, underscoring the link between geometry and system efficiency.

The end-use dimension distinguishes new installation frameworks from replacement and retrofit scenarios. In new construction, duct systems can be architecturally integrated, enabling optimal routing and seamless insulation. Conversely, retrofit projects must grapple with existing spatial constraints and prioritize minimal disruption, driving demand for flexible liners and pre-insulated panels that simplify upgrades without sacrificing performance.

Insulation status further refines market perspectives, as insulated ducts reduce thermal bridging and condensation risks, particularly in unconditioned attics or mechanical rooms. Non-insulated configurations, however, remain prevalent in conditioned ceiling cavities where energy losses are inherently controlled by the building envelope.

Material typologies span aluminum, fiberboard, flexible, PVC, and sheet metal. Within the sheet metal category, galvanized steel and stainless steel grades cater to applications demanding enhanced corrosion resistance or hygienic compliance. This layered taxonomy informs product positioning across industrial, commercial, and residential applications.

Segmenting by application unveils the necessity of tailored solutions: expansive commercial campuses demand robust, modular trunk systems, industrial facilities prioritize chemical-resistant ducts, and residential installations emphasize ease of assembly and minimal acoustic impact.

This comprehensive research report categorizes the HVAC Air Ducts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Shape

- Insulation

- Type

- End Use

- Application

Assessing HVAC Air Duct Market Dynamics Across Americas, Europe-Middle East-Africa, and Asia-Pacific Geographies Under Varied Regulatory and Economic Contexts

In the Americas, stringent energy codes such as California’s Title 24 have driven widespread adoption of aerodynamically optimized rectangular ducts to curb fan energy use and cut HVAC energy consumption by double-digit percentages. Meanwhile, tariff-driven cost pressures are prompting many U.S. contractors to explore local steel mills and USMCA-exempt supply chains to maintain competitive pricing and project timelines

Across Europe, the revised Energy Performance of Buildings Directive has elevated indoor air quality requirements and digital monitoring mandates, positioning smart duct systems integrated with CO₂ and humidity sensors as core components of zero-emission building standards. Manufacturers are responding with advanced composites and flexible ductwork that reconcile enhanced insulation, reduced leakage, and compliance with EPBD performance thresholds

Asia-Pacific remains the fastest-growing regional market, fueled by rapid urbanization and industrial expansion in China, India, and Southeast Asia. Government incentives for green buildings and large-scale infrastructure projects are driving demand for insulated and pre-insulated ducts, while geothermal heat pump integration is creating new opportunities for specialized ducting solutions that leverage stable ground temperatures for year-round comfort control

This comprehensive research report examines key regions that drive the evolution of the HVAC Air Ducts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Technological Advancements of Leading HVAC Air Duct Manufacturers Shaping Global Market Competitiveness

Johnson Controls recently unveiled a commercial air duct solution line featuring advanced polymeric insulation and modular connectors designed to accelerate installation schedules and enhance thermal performance. By combining these features with proprietary sealing systems that meet the highest industry leakage standards, the company underscores its commitment to energy efficiency and rapid deployment in large-scale retrofit projects

Carrier has expanded its modular duct portfolio through partnerships that introduce pre-fabricated assemblies with integrated sensors, enabling real-time performance monitoring and predictive maintenance alerts. This aligns with the broader industry shift toward smart duct ecosystems that deliver enhanced occupant comfort while minimizing lifecycle costs

Other leading players such as Daikin, Lennox, and FabricAir are differentiating through sustainability credentials. Daikin’s eco-duct initiative promotes recycled material use, while Lennox’s sensor-embedded duct systems link directly to its iComfort platform. FabricAir has brought textile-based air dispersion solutions to market, offering low-velocity, even air distribution and notable weight savings compared to rigid configurations

This comprehensive research report delivers an in-depth overview of the principal market players in the HVAC Air Ducts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Daikin Industries, Ltd.

- Ductmate Industries, Inc.

- Duro Dyne, Inc.

- FläktGroup Holding AB

- Greenheck Fan Corporation

- Hart & Cooley, Inc.

- Honeywell International Inc.

- iangsu Buna Technology Development Co., Ltd.

- Jiangsu Sulong Eco‑Technologies Co., Ltd.

- Johnson Controls International plc

- Lennox International Inc.

- Lindab International AB

- Nordfab Ductwork Systems, Inc.

- Nortek Air Solutions, LLC

- Prihoda a.s.

- Qingdao Aedis Fiber Duct Co., Ltd.

- Ruskin Company

- SetDuct

- Shandong Zhongnan Kelai Air‑conditioning Equipment Co., Ltd.

- Shanghai Xuanyuan Air‑Conditioning Equipments Co., Ltd.

- Titeflex Corporation

- Trane Technologies plc

- Waves Aircon Pvt. Ltd.

- Winduct

- Wuhan Aiweisi Ventilation Equipment Co., Ltd.

- Zinger Sheet Metal Co.

Implementing Strategic Frameworks for HVAC Air Duct Industry Leaders to Optimize Supply Chains, Embrace Innovation, and Enhance Regulatory Compliance

To navigate tariff-driven cost volatility, industry leaders should expand domestic sourcing partnerships and leverage USMCA exemptions to secure stable steel and aluminum inputs. Collaborative supply chain agreements can buffer against sudden policy changes, enabling contractors to maintain service levels and protect margin structures

Investing in smart duct systems with integrated IoT and predictive analytics will deliver operational efficiencies and reduce long-term maintenance expenditures. Early adopters of these technologies can offer performance-based service models, fostering recurring revenue streams tied to system uptime and energy savings

Finally, aligning product development with evolving building codes-such as the EPBD and emerging zero-emission building mandates-will position providers as preferred partners in sustainability-focused construction. Emphasizing recyclable materials, airtight installation techniques, and digital readiness will ensure compliance and appeal to environmentally conscious stakeholders

Detailing Comprehensive Research Methodology Employing Primary Interviews, Secondary Data Analysis, and Rigorous Validation for Credible Market Insights

This report integrates insights from extensive primary research, including in-depth interviews with senior executives, product engineers, and facility managers across leading HVAC manufacturers and contracting firms. These conversations elucidated real-world challenges in transport logistics, installation workflows, and client expectations in both retrofit and greenfield contexts.

Secondary research drew upon public filings, regulatory databases, technical standards from ASHRAE and the U.S. Department of Energy, and credible industry news sources to capture the latest technological, regulatory, and market developments. Specialized databases provided overviews of tariff schedules, material pricing trends, and region-specific adoption rates.

All data points and qualitative findings were validated through triangulation methods, cross-referencing multiple independent sources to ensure consistency. Rigorous quality controls were applied at each stage, from data collection to final synthesis, guaranteeing the integrity and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HVAC Air Ducts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HVAC Air Ducts Market, by Shape

- HVAC Air Ducts Market, by Insulation

- HVAC Air Ducts Market, by Type

- HVAC Air Ducts Market, by End Use

- HVAC Air Ducts Market, by Application

- HVAC Air Ducts Market, by Region

- HVAC Air Ducts Market, by Group

- HVAC Air Ducts Market, by Country

- United States HVAC Air Ducts Market

- China HVAC Air Ducts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Converging Insights on the Future Trajectory of the HVAC Air Duct Market Amid Technological Evolution, Regulatory Shifts, and Sustainability Imperatives

The HVAC air duct landscape is undergoing a profound transformation, driven by convergence of energy efficiency imperatives, digital integration, and regulatory stringency. Shape differentiation, installation context, and material specifications all play critical roles in matching system design to performance objectives.

Concurrently, tariff fluctuations and global policy shifts are reshaping supply chain strategies, incentivizing nearshoring and collaborative sourcing agreements. Leaders who proactively align procurement and R&D efforts with these external pressures will secure competitive advantages in cost management and market responsiveness.

Ultimately, the path forward resides in harmonizing state-of-the-art duct innovations-ranging from smart sensor networks to sustainable composites-with emerging code requirements and project delivery models. This multi-dimensional approach will define success in a market where occupant comfort, energy stewardship, and cost containment are more interconnected than ever.

Reach Out to Ketan Rohom to Secure the Full HVAC Air Duct Market Research Report and Empower Data-Driven Strategic Decision-Making

If you’re ready to deepen your understanding of market dynamics and gain actionable intelligence tailored to your business goals, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through the report’s comprehensive insights, answer any questions, and facilitate access to proprietary data that will empower your strategic decisions. Reach out today to secure full access to the detailed HVAC Air Ducts market research and stay ahead in a rapidly evolving industry.

- How big is the HVAC Air Ducts Market?

- What is the HVAC Air Ducts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?